By Invitation

Insights into the Gold & Bullion market

Over the past two years, gold prices have been underpinned by strong physical demand from China and central banks. However, investor flow, and specifically retail-focused ETF building, resident- its easing cycle on September 18, the Fed projected 50 basis points of rate reduction by year's end and a full percentage point of decreases the following year.

During times of global instability and low interest rates, gold is typically favoured as an

investment. The U.S. presidential election on November 5th may possibly lead to a further

increase in gold prices, as investors may seek safe-haven assets due to possible volatility in

the markets.

Global Factors Impacting the Gold Rally

Gold has been the best-performing asset class in 2024, rising around 30% in international

markets and 22% in domestic markets with prices surpassing the $2700/oz (~ Rs 76400)

mark. The global central banks’ ongoing gold purchases, the US Federal Reserve’s rate cuts,

the geopolitical unpredictability of the world’s markets, the slowdown in the Chinese

economy, and the recent monetary stimulus measures taken by the Chinese central banks

are all responsible for the strong performance.

1) Central Bank Buying

This year’s central bank gold demand is probably being influenced by the gold price

increase, but the long-term pattern of net purchasing is still in place. Total gold holdings

added by central banks around the world from January to July is around 520 tonnes. Turkey,

India and Poland have been the top buyers, while the Philippines and Thailand are the net

sellers.

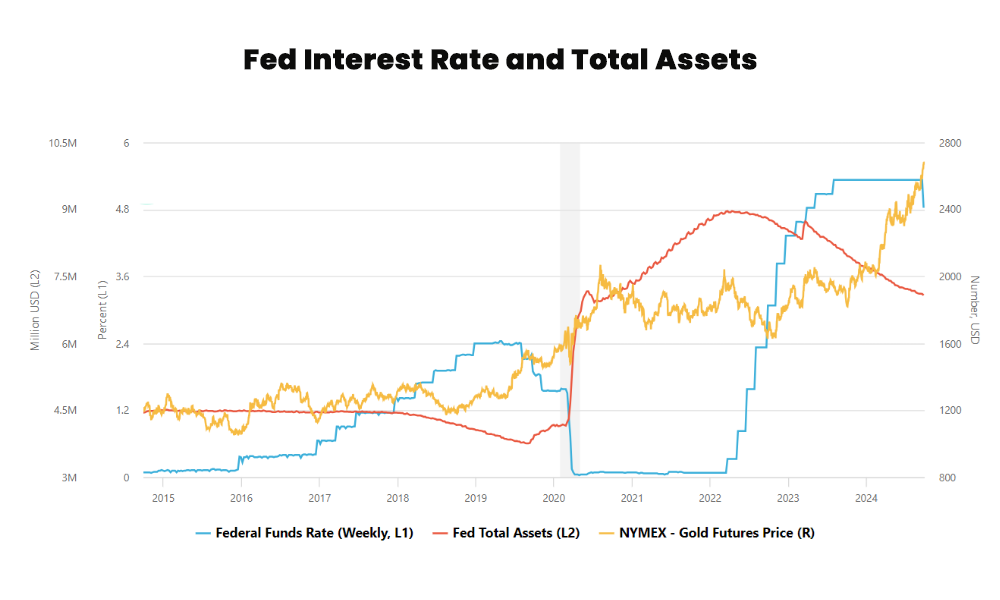

2) FED rate cut cycle

Even if inflation is still high, gold is still in a favourable position as the Federal Reserve

cuts interest rates to support a contracting labour market. After a 50-bps rate cut and a

warning that rates may drop to 3% by 2026. It’s evident that the Fed is relaxing, which is

good news for yellow metal. With central banks all over the globe starting to lower

interest rates, gold is still the primary hedge against currency devaluation on a

worldwide scale.

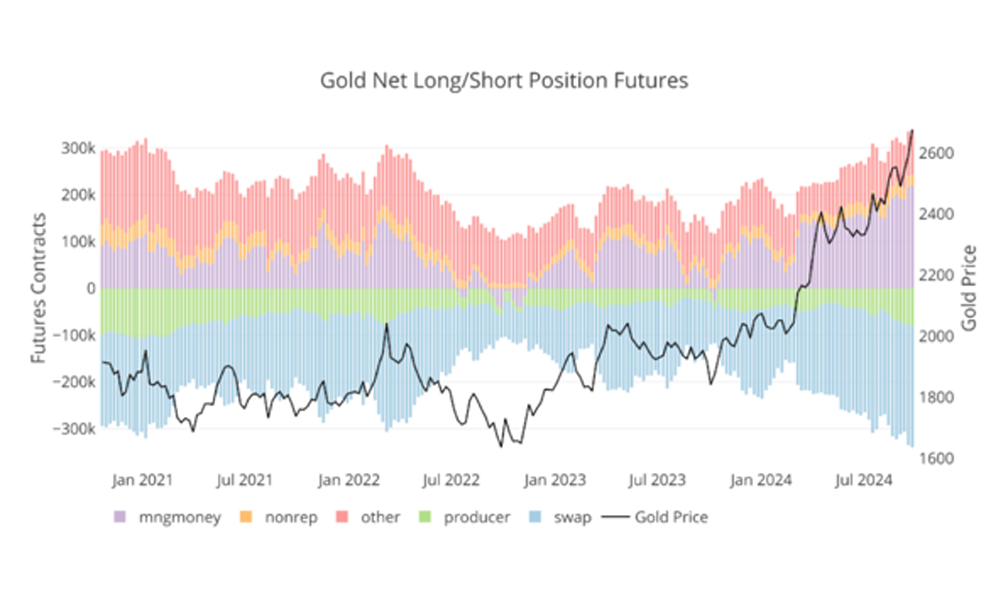

3) Gold CFTC positioning

Due to the ongoing rate-cut cycle by the Federal Reserve, geopolitical worries in the Middle

East, and expectations of increased festival demand in India, investors are still building long

positions in gold. U.S. traders have lately entered the speculative phase headed by China,

with futures long holdings at a nearly four-year high (315,000 contracts), producing a

market that is mostly unaffected by normal drivers.

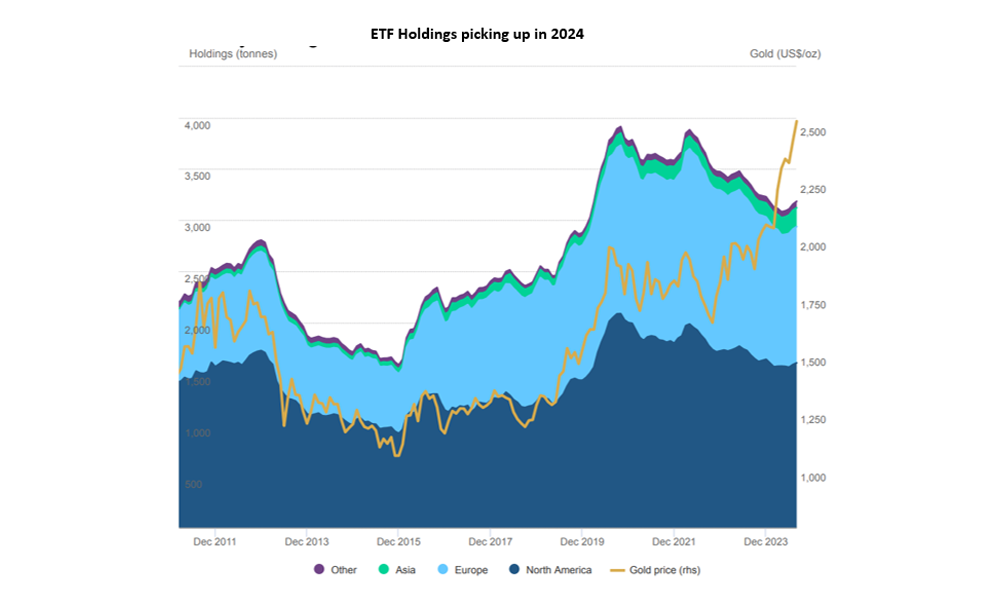

4) ETF Holdings

Four months in a row, there have been inflows into global gold ETFs: all regions had positive

flows, with Western funds leading the way. The y-t-d losses for global gold ETFs further

decreased to $1bn as a result of nonstop inflows between May and August. Additionally, the

2024 holdings reduction has been reduced to 44t. In the meantime, during the first eight

months of 2024, the total AUM increased by 20%. Asia has seen the most inflows this year

($3.5 billion), while the leading outflows are from North America (-$1.5 billion) and Europe

(-$3.4 billion)

5) Dollar index

The Dollar Index has slipped below the highly crucial psychological milestone of the 100

mark as the US Dollar’s role as the major global reserve currency is being threatened. The

combination of better risk sentiment and lowered Fed rate expectations is fundamentally

unfavourable. Since gold doesn’t generate interest, cuts in interest rates contribute to a

declining value of the US dollar, which in turn makes the non-yielding metal more appealing.

The dollar index’s negative relationship with gold keeps the yellow metal maintained at high

levels.

6) Gold Silver ratio

The gold-silver ratio dropped to its lowest levels since July during the last week of

September, when gold started to approach $2700 and silver momentarily overtook a 10-

year high of over $33. At this point, the gold-to-silver ratio is 84 to 1. The beginning of a

silver rally that would see white metal surpass its more costly counterpart would be

confirmed by a sustained decline in the gold-silver ratio.

Domestic Factors Supporting Gold

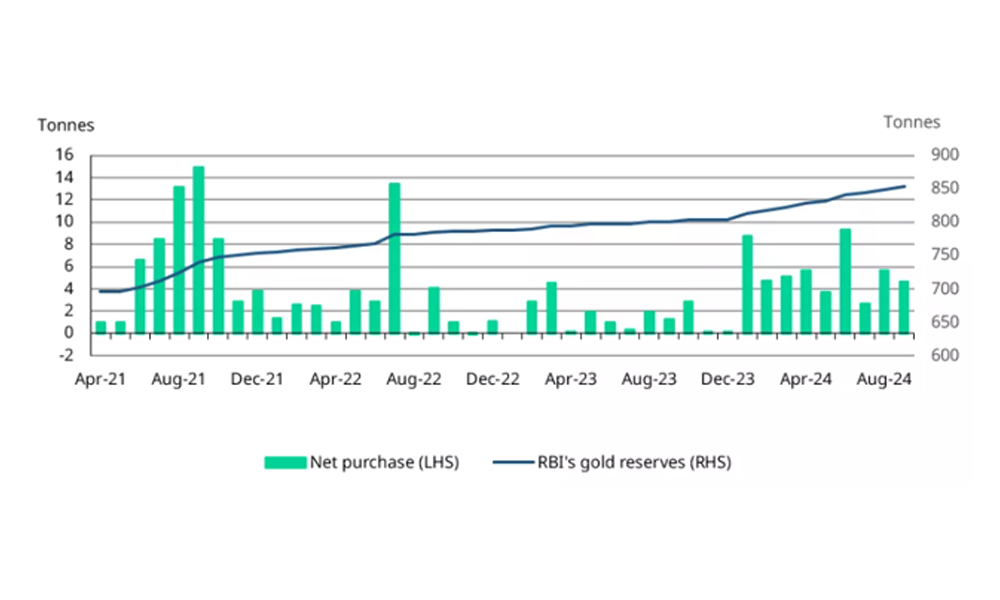

1) RBI Gold reserves

The Reserve Bank of India’s appetite for gold remains high, as indicated by its recent

acquisitions. Over the first eight months of the year, the RBI has acquired a total of 50

tonnes of gold, with acquisitions in each month. Up from 7.5% a year ago, the RBI’s gold

reserves have now reached a record 853.6 tonnes or 9% of its total foreign reserves.

2) India Gold Imports

The Union Budget’s announcement of the reduction in import duties and the modifications

to the long-term capital gains for gold ETFs has contributed to the rise in gold imports into

India. Between January and August, gold imports increased by 30% year over year to almost

485 tons, valued at US$32 billion.

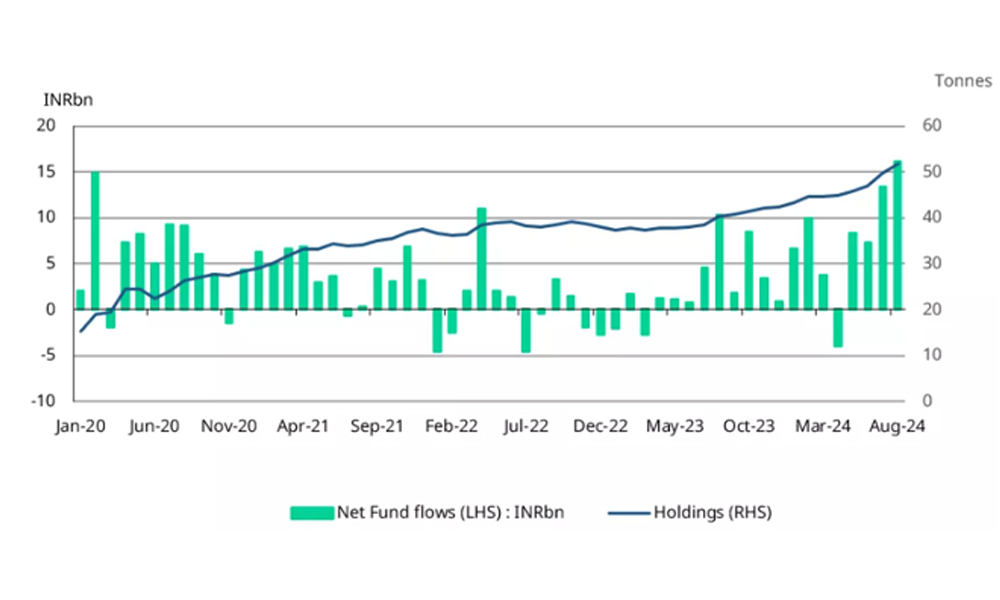

3) Gold ETF Holdings

Investor interest in Indian gold ETF has surged since the end of July. According to AMFI data,

net inflows into Indian gold ETFs have reached Rs 61 billion (~$735 million) thus far in 2024,

a considerable rise of over Rs 15 billion during the same period in the previous year.

Together, these funds have added 9.5tn of gold this year, increasing their total holdings to

51.8tn, a 29% year-over-year rise.

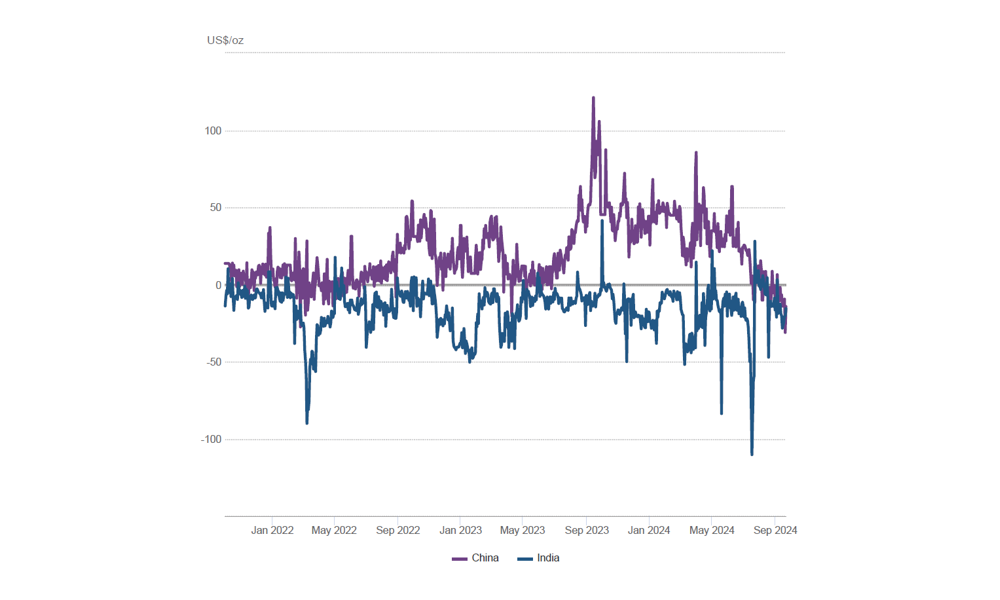

4) Gold Premium/Discount

The gap between domestic and international gold prices has narrowed as a result of rising

global prices and increased supply from increased imports. Domestic gold prices have been

trading either at a modest discount to or in line with international prices in recent weeks,

despite the normalizing but still robust demand.

Diwali Outlook

Overall, with continued global economic uncertainty, gold is expected to retain its appeal

as a hedge against inflation and market volatility. Investors may adopt a “buy on dips”

strategy as the metal is likely to see periodic fluctuations, but the long-term outlook

remains bullish through for next 5-6 months and prices are expected to touch $3000 (~Rs

84000).

Having said that, currently gold prices are in the overbought zone, so we might see a

consolidation phase and a retracement with support at $2575 (~Rs 73000) and resistance

being the next psychological level of $2750 (~Rs 78000) in the next one month.

By Invitation

A fun, practical New Year note for jewellery business owners

Wishing You a Healthier, Happier & Wiser 2026 – By Shivaram A

A new year arrives with a new set of—what else—New Year resolutions. And 2026 is no different.

Resolution makers, beware. Research says nearly 80% of New Year resolutions collapse by mid-February. There’s even a name for it: the second Friday of January is officially called Quitters’ Day.

So, here’s the uncomfortable question: Do you want 2026 to be any different, or should we just block your calendar till Quitters’ Day?

If your answer is a serious yes, then it boils down to two things:

- What exactly do you want?

- How badly do you want it?

Because let’s be honest intentions are cheap. Discipline is expensive.

If you’re still reading, congratulations. You haven’t quit yet.

Most business resolutions sound familiar: higher sales, higher profits (or much higher profits), more stores, more customers. And yes—higher gold and silver prices too. On that one, we have very little control… though prayers are always welcome!

But for 2026, let’s look beyond only business numbers and focus on three areas that quietly decide your long-term success.

1. A Healthier You in 2026

A typical day before 2025 (you may recognise this): Late wake-up. Late breakfast. Reaching the store by 11 am—or noon on a “busy” day. Vendor meetings. Lunch at 3 pm. Evening snacks at 6 pm. Endless cups of chai. Store closes at 9 pm. Dinner at 10:30 pm. Netflix or phone scrolling. Sleep well past midnight.

Not everything applies—but enough of it does to make you uncomfortable.

The result? Low energy, rising health reports, and a body that protests quietly… until it doesn’t.

Resolution for a Healthier 2026

Start with a complete health check-up. Think of it as your personal P&L statement—it shows your condition on one specific day.

Identify what I like to call “golden furniture” in the body—parts that have stopped moving but still occupy space.

Then act:

- Better food (not fancy diets)

- Regular movement (not heroic gym resolutions)

- Better sleep (yes, even for business owners)

Warning: Change will be uncomfortable. But so is ignoring the problem.

Set SMART health goals—Specific, Measurable, Achievable, Realistic, Time-bound.

2. A Happier You in 2026

Let’s admit it—becoming happier has rarely featured on a jeweller’s resolution list.

Resolution for a Happier 2026

Make happiness intentional, not accidental.

Start with something simple: one family dinner or friends’ meal every week.

According to the World Happiness Report (based on over 1,50,000 people), those who regularly eat with others report:

- Higher life satisfaction

- More positive emotions

- Fewer negative emotions

One strict rule: phones stay away. If the phone joins the table, happiness leaves early.

3. A Wiser You in 2026

You’ve built a successful business. The numbers prove it. Experience, instinct, and industry knowledge have served you well.

But the world is shifting—fast.

AI. Agentic AI. AI Agents. (And yes, everyone is still figuring out the difference.)

People deep in this space believe AI may have a bigger impact than the internet itself.

The real question is not whether AI will affect jewellery retail—but whether you’ll learn early or catch up late.

For traditional business owners, the willingness to learn and apply new tools is the new unfair advantage.

A Simple 2026 Resolution Action Plan

| Action Area | Example | Final Status – 31.12.2026 |

| Healthier | 30 minutes movement daily | Achieved / Not Achieved |

| Happier | Weekly family dinner | Achieved / Not Achieved |

| Wiser | One AI implementation | Achieved / Not Achieved |

No overthinking. No complex dashboards. Just honest tracking.

Ready to make 2026 different?

If you want help converting good intentions into clear action plans—for health, happiness, or business wisdom—I’m happy to help you think it through.

Let’s ensure you’re still on track after Quitters’ Day.

Here’s wishing you a Healthier, Happier & Wiser 2026.

Call or WhatsApp on 90360 36524

Email: RetailGurukul.com

Jb Exclusive : Digital View

-

International News5 hours ago

International News5 hours agoTanishq USA & Bibhu Mohapatra Unveil ‘She Is the Balance’ at Manhattan for Fall 2026

-

National News4 hours ago

National News4 hours agoGJEPC & Mumbai Customs Host Session on Hand-Carried Jewellery Exports

-

DiamondBuzz6 hours ago

DiamondBuzz6 hours agoStructural challenges continue to weigh on the diamond sector:ICRA

-

GlamBuzz7 hours ago

GlamBuzz7 hours agoDua Lipa Stuns in Bulgari’s Rare Black Diamond Necklace at Berlin Premiere