National News

Gold rockets to record high again amid tariff war and USD sinks to 35-month low: AUGMONT BULLION REPORT

COMEX Gold’s active month contract closed 7% higher at $3254, marking the highest weekly percentage increase since March 27, 2020. Prices are up $270, or 9%, during the last four sessions, and year-to-date they are up $593, or 22.5%.

Last week, the United States substantially boosted duties on Chinese imports, adding a new 125% penalty on top of an existing 20% duty, bringing the total to 145%. This strong approach eclipsed President Donald Trump’s 90-day postponement on heavier tariffs for other countries, raising concerns about broader economic consequences.

Investors seeking safety drove up gold prices, aided by a weakening US Dollar Index, which fell below 100 for the first time in over three years. The US dollar is falling across the board as markets react to China’s new reprisal against US imports. China stated early Friday that it will levy 125% tariffs on US imports starting Saturday, up from 84% previously declared.

The dollar has declined over 7% since Trump’s inauguration and over 2% since his comprehensive trade policy was announced last week, contrary to Wall Street’s expectations. The decrease in the dollar has coincided with sell-offs in US stocks and Treasuries. This could indicate that foreign investors are responding to Trump’s protectionist plans by selling US assets, putting downward pressure on the dollar.

The rationale for increasing gold allocations is stronger than ever in this climate of rising tariff uncertainty, poorer growth, increased inflation, and persisting geopolitical dangers. The evolving global trade, economic, and geopolitical landscape strengthens gold’s position as a safer investment haven.

In this environment of rising tariff uncertainty, poorer growth, greater inflation, and persisting geopolitical threats, the case for increasing gold allocations has never been stronger. The evolving global trade, economic, and geopolitical landscape reinforces gold’s significance as a safer investment refuge.

According to the minutes from the most recent Fed meeting, policymakers are nearly unified in acknowledging the combined problem of increasing inflation and slowing GDP, warning that the Federal Reserve will confront “difficult trade-offs” in the coming months.

| Market Insight | Price Level | Approx. INR Equivalent |

|---|---|---|

| Prices have risen significantly in a short time – caution is advised. | – | – |

| If price corrects below this level, profit booking may occur. | $3200 | ~Rs 93,000 |

| Possible downside target in case of correction. | $3100 | ~Rs 90,000 |

| Gold prices fell from record highs as trade tensions eased; US President Trump excluded smartphones and laptops from tariffs. | – | – |

| Ongoing trade and tariff volatility continues to create uncertainty in financial markets. | – | – |

| If dollar weakness continues, gold may hit new highs. | $3300 | ~Rs 95,000 |

National News

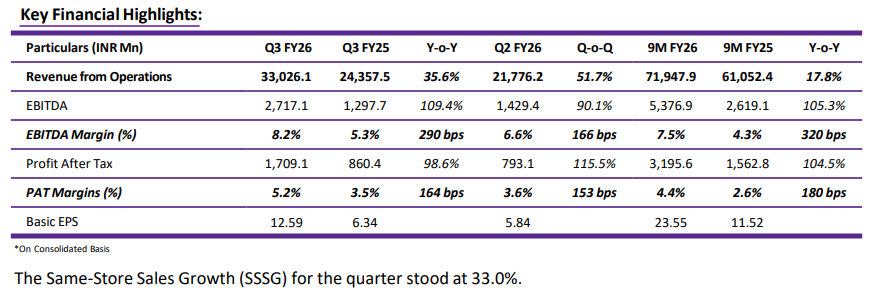

P N Gadgil Jewellers Delivers Robust 9M FY26 Performance with Revenue of ₹71,948 Mn, EBITDA Up 105.3% and PAT Growth of 104.5% YoY

Strong festive and wedding-led demand drives robust revenue growth, higher profitability, and improved store-level performance in Q3 and 9M FY26

P N Gadgil Jewellers Limited, one of the most reputed jewellers in the country, boasting around 193 years of excellence in craftsmanship and trusted service in the retail business of gold, silver, and diamond jewellery, announced its unaudited financial results for the quarter and nine months ended 31 st December, 2025.

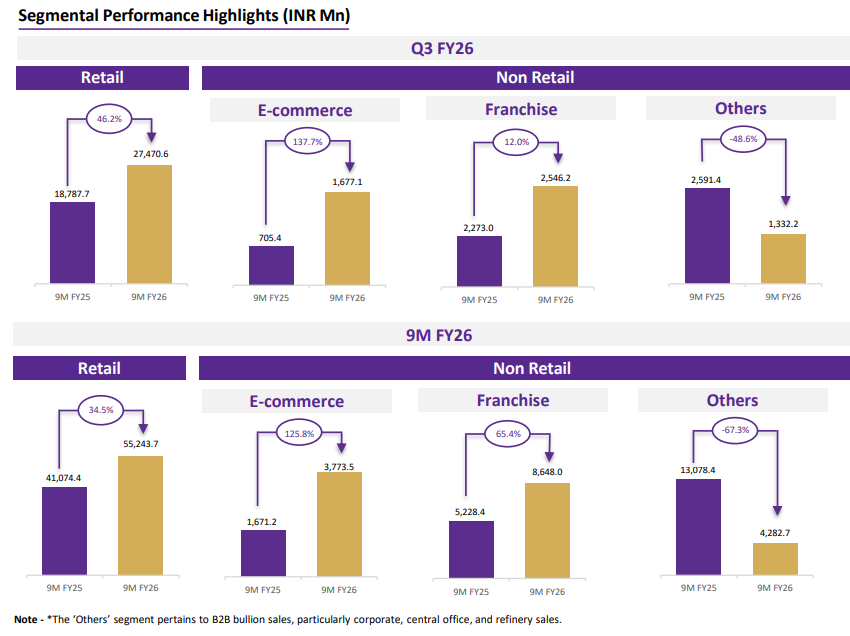

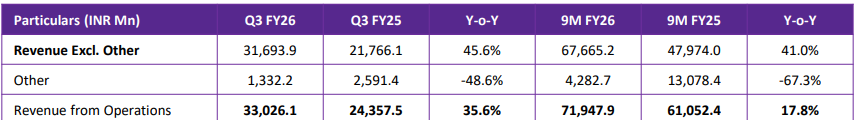

During the period under review, total revenue excluding the other segment grew by 45.6% YoY (Q3 FY26 vs. Q3 FY25) and by 41.0% YoY (9M FY26 vs. 9M FY25). The following summary presents the revenue breakdown:

• Retail segment is 83.2% of our total sales, continues to lead the way, achieving an impressive Revenue growth of 46.2% an EBITDA margin of 10.1% and a PAT margin of 6.5%.

• For 9M FY26, average revenue per store stands at around Rs. 1,090.1 million, while net profit per store reached Rs. 48.4 million, demonstrating strong efficiency and profitability at the store level.

Operational Financial Highlights

• Product-wise Performance: For nine months ended FY26, the Silver category delivered a strong performance with 96% growth in value and 56% growth in volume, while Diamond sales also improved, recording over 50% rise in volume Y-o-Y, resulting in the stud ratio reaching 8.4%.

• Festive Sales Surge: Festive sales remain a key driver of our success. Dussehra alone delivered the company’s highest-ever single-day festive sales of ₹1,900 Mn increased by 64% Y-o-Y. The company recorded festive season sales of ₹ 6,060 Mn during Diwali, registering a robust 74% growth as compared to the previous year.

• Customer Footfall and Conversion Rate: A 33% increase in footfall, coupled with a strong Conversion rate of 94%, further fuels our growth, reflecting increased Demand, customer engagement and sustained purchasing behaviour at the store level.

• Increased Transaction Count and ATV: As customer engagement continues to rise, there has been a notable uptick in both transaction volumes and average spending per visit. The transaction count grew by 35%, taking the Average Transaction Value (ATV) to Rs. 103.1k.

Commenting on the performance, Dr. Saurabh Gadgil, Chairman & Managing Director, P N Gadgil Jewellers Limited, said, “The quarter witnessed strong momentum, supported by healthy Festive and wedding-led demand. Revenue from operations increased 35.6% YoY to Rs. 33,026 Mn in Q3 FY26, despite gold price volatility. Demand remained broad-based across core markets, led by gold jewellery, new designs and an increasing preference for lightweight and studded jewellery, supported by strong brand recall and customer trust. Profitability improved significantly during the quarter, with PAT rising 98.6% YoY to Rs.1,709 Mn, supported by a favorable product mix, higher contribution from Studded jewellery, along with disciplined cost management, resulted in meaningful margin expansion. Retail continued to be the primary growth driver, complemented by strong growth in e-commerce and steady performance in the franchise segment. The Company continued to execute its expansion strategy with the addition of three new company-owned stores this quarter at Moshi (Pimpri-Chinchwad), Patna (Bihar), and Viman Nagar under the LiteStyle format, taking the Company’s total retail footprint to 66 stores as of December 2025. Going ahead, management remains focused on driving same-store sales growth, maintaining healthy inventory turns, and sustaining profitable growth, supported by continued upcoming festive & wedding led demand.”

source: PNG Jewellers

-

JB Insights2 weeks ago

JB Insights2 weeks ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India

-

JB Insights2 weeks ago

JB Insights2 weeks agoGold is Talking, Silver is Screaming – A Case for Prudent Repositioning

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoJapan, US Weigh Synthetic Diamond Facility to Strengthen Strategic Supply Chains