By Invitation

Mangalsutra market glows with steady 11% growth rate

by Tanvi shah

Director & Head – CareEdge Advisory & Research

Tanvi shah -Director & Head – CareEdge Advisory & Research

The gems and jewellery market has clocked a healthy CAGR of 11% from CY20-24, to reach at Rs. 8,110 billion in CY24. A similar growth trajectory is expected to continue in the next 5 years. Furthermore, bangles and chains hold a large share in the overall jewellery market. As consumer preferences evolve, the Indian jewellery sector is undergoing notable transformation. Central to this shift is the Mangalsutra—a piece that embodies both cultural heritage and modern sensibility. Traditionally revered as a symbol of marital unity and prosperity, the Mangalsutra has maintained its cultural significance while aligning with contemporary aesthetics and changing lifestyles.

The Mangalsutra market has grown at over 10% compounded annual growth rate (CAGR) over the past five years and estimated to be Rs 190 billion in CY24(E). With the consistently rising number of weddings in India, the market is set to expand steadily and is expected to surpass Rs 250 billion by CY29.

Weddings: The Prime Driver of Demand

Weddings remain the key driver of Mangalsutra purchases, with the ornament continuing to symbolize matrimony across communities. As weddings evolve—especially with greater financial independence among millennial couples—buying behaviours are also shifting. While 80–82% of wedding expenses are still covered through savings, around 10% rely on loans and 6–8% liquidate assets.

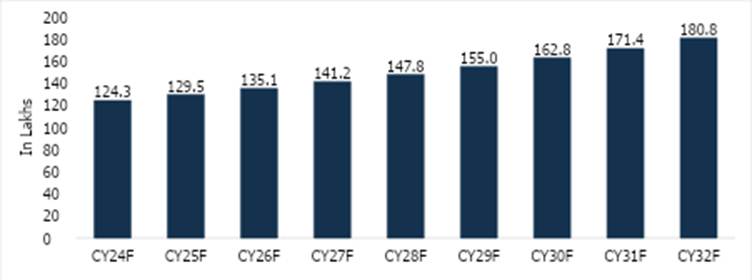

In 2024, India recorded 124.3 lakh weddings, marking a strong post-pandemic momentum. This upward trend continued from earlier years and is expected to accelerate, with weddings projected to reach 180.8 lakh by 2032, registering a CAGR of 4.8%. This growth is also fuelling demand for bridal jewellery, underscoring the wedding sector’s resilience and its rising contribution to the national economy.

Chart 1: Total Number of Weddings in India, CY2024-32

Source: Industry Sources, CareEdge Research

Source: Industry Sources, CareEdge Research

The rise of destination weddings and thematic ceremonies has prompted demand for multiple Mangalsutra designs. Brides now seek elaborate gold pieces for traditional rituals and minimalist styles for more modern or informal functions. This shift has encouraged jewellers to diversify their offerings, enabling repeat purchases beyond the initial wedding.

Evolving Designs: A Fusion of Style and Sentiment

Although traditional Mangalsutras—characterised by black beads and gold links—continue to dominate, capturing a 62% share of the market in CY24, the preference for modern alternatives is rising. Designs featuring sleek lines, diamonds, and mixed metals now comprise 32% of the market and resonate particularly with younger, urban consumers who prioritise versatility and style.

Chart 2: Indian Mangalsutra Market: Break-up by Design (% share) for CY24(E)

Source: CareEdge Research

Customisation has emerged as a notable trend. Consumers increasingly request bespoke elements, including unique pendant shapes, gemstone settings, and tailored chain lengths. Presently, customised Mangalsutras account for approximately 5% of the market. Jewellers are responding by embracing advanced design technologies and personalised consultations, enabling them to cater to diverse tastes and preferences.

Material preferences reflect shifting choices considering prices

Gold remains the market leader in Mangalsutra, and 22K gold accounts for 52% of the share because of its long-standing tradition of symbolizing security and affluence. Nevertheless, an price increase—from around Rs 67,175 per 10 grams during April 2024 to Rs 90,050 as of 24th April 2025—has forced consumers to question their decisions, tending towards lighter or affordable options.

Chart 3: Indian Mangalsutra market breakup by material type (% share) for CY24(E)

Source: CareEdge Research

Note: Others include Beads, Synthetic Metals, Semi-Precious stones, etc.

Silver Mangalsutras, now commanding a 31% share, offer an affordable and wearable alternative. Their simplicity appeals to younger consumers who seek practical, everyday options. Meanwhile, diamond Mangalsutras hold a 12% market share, gaining popularity among those who value elegance and symbolic distinction. Fusion designs, incorporating gold, silver, and diamonds, are also gaining ground as jewellers strive to serve a broader demographic.

Market Outlook: Strong sentiment supporting healthy sales growth

Gold Mangalsutras continue to represent nearly 52.3% of the total market, but interest in alternative silver or diamond variants is also attracting more consumers. Going forward, these changing consumer preferences will encourage many new replacement and repeat purchases, creating fresh opportunities for jewellers.

In contrast to the overall demand for gold jewellery, which declined by 2.3 percent year-on-year in CY24, the Mangalsutra market demonstrated remarkable resilience by maintaining double-digit growth. As weddings continued and consumer preferences evolved, the Mangalsutra adapted accordingly embracing new and exciting designs without compromising its cultural significance.

A commitment symbol and a personal style will keep it constantly relevant in India’s jewellery landscape, full of diversity and dynamism.

By Invitation

A fun, practical New Year note for jewellery business owners

Wishing You a Healthier, Happier & Wiser 2026 – By Shivaram A

A new year arrives with a new set of—what else—New Year resolutions. And 2026 is no different.

Resolution makers, beware. Research says nearly 80% of New Year resolutions collapse by mid-February. There’s even a name for it: the second Friday of January is officially called Quitters’ Day.

So, here’s the uncomfortable question: Do you want 2026 to be any different, or should we just block your calendar till Quitters’ Day?

If your answer is a serious yes, then it boils down to two things:

- What exactly do you want?

- How badly do you want it?

Because let’s be honest intentions are cheap. Discipline is expensive.

If you’re still reading, congratulations. You haven’t quit yet.

Most business resolutions sound familiar: higher sales, higher profits (or much higher profits), more stores, more customers. And yes—higher gold and silver prices too. On that one, we have very little control… though prayers are always welcome!

But for 2026, let’s look beyond only business numbers and focus on three areas that quietly decide your long-term success.

1. A Healthier You in 2026

A typical day before 2025 (you may recognise this): Late wake-up. Late breakfast. Reaching the store by 11 am—or noon on a “busy” day. Vendor meetings. Lunch at 3 pm. Evening snacks at 6 pm. Endless cups of chai. Store closes at 9 pm. Dinner at 10:30 pm. Netflix or phone scrolling. Sleep well past midnight.

Not everything applies—but enough of it does to make you uncomfortable.

The result? Low energy, rising health reports, and a body that protests quietly… until it doesn’t.

Resolution for a Healthier 2026

Start with a complete health check-up. Think of it as your personal P&L statement—it shows your condition on one specific day.

Identify what I like to call “golden furniture” in the body—parts that have stopped moving but still occupy space.

Then act:

- Better food (not fancy diets)

- Regular movement (not heroic gym resolutions)

- Better sleep (yes, even for business owners)

Warning: Change will be uncomfortable. But so is ignoring the problem.

Set SMART health goals—Specific, Measurable, Achievable, Realistic, Time-bound.

2. A Happier You in 2026

Let’s admit it—becoming happier has rarely featured on a jeweller’s resolution list.

Resolution for a Happier 2026

Make happiness intentional, not accidental.

Start with something simple: one family dinner or friends’ meal every week.

According to the World Happiness Report (based on over 1,50,000 people), those who regularly eat with others report:

- Higher life satisfaction

- More positive emotions

- Fewer negative emotions

One strict rule: phones stay away. If the phone joins the table, happiness leaves early.

3. A Wiser You in 2026

You’ve built a successful business. The numbers prove it. Experience, instinct, and industry knowledge have served you well.

But the world is shifting—fast.

AI. Agentic AI. AI Agents. (And yes, everyone is still figuring out the difference.)

People deep in this space believe AI may have a bigger impact than the internet itself.

The real question is not whether AI will affect jewellery retail—but whether you’ll learn early or catch up late.

For traditional business owners, the willingness to learn and apply new tools is the new unfair advantage.

A Simple 2026 Resolution Action Plan

| Action Area | Example | Final Status – 31.12.2026 |

| Healthier | 30 minutes movement daily | Achieved / Not Achieved |

| Happier | Weekly family dinner | Achieved / Not Achieved |

| Wiser | One AI implementation | Achieved / Not Achieved |

No overthinking. No complex dashboards. Just honest tracking.

Ready to make 2026 different?

If you want help converting good intentions into clear action plans—for health, happiness, or business wisdom—I’m happy to help you think it through.

Let’s ensure you’re still on track after Quitters’ Day.

Here’s wishing you a Healthier, Happier & Wiser 2026.

Call or WhatsApp on 90360 36524

Email: RetailGurukul.com

Jb Exclusive : Digital View

-

National News41 minutes ago

National News41 minutes agoGold Rebounds in India After Five-Day Slide; Dollar Strength Keeps Pressure Intact

-

National News2 hours ago

National News2 hours agoKumari Fine Jewellery Celebrates the “Modern Indian Original” with Exclusive Women’s Day Showcase

-

National News5 hours ago

National News5 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz22 hours ago

BrandBuzz22 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA