JB Insights

Union Budget 2026-27 is a boost for India’s gems & jewellery sector via liquidity, manufacturing support, and exports.

A design-led innovation that interprets the language of the face to create a more intuitive, confident jewellery experience to frame the unique ‘Shape of You’!

#JbExclusive

Kirit Bhansali, Chairman -GJEPC

The proposed measures focus on easing trade and strengthening the gems and jewellery ecosystem through a mix of regulatory and financial reforms. Customs processes are set to become more trust-based, with digital appraisals and simplified clearances aimed at reducing delays and costs. To help manufacturers utilise idle capacity amid US tariffs, SEZ units will be allowed to sell into the domestic tariff area at concessional duties.

MSMEs and e-commerce exporters will benefit from an increased Rs.10 lakh cap on courier exports and the introduction of advance filing of Bills of Entry for faster clearances. Financial support is being reinforced through a Rs.10,000 crore Growth Fund, Rs.2,000 crore for micro units, expanded TReDS financing of Rs.7 lakh crore, and an extension of duty deferment to 30 days. Additionally, duty-free imports of lab-grown diamonds and sawn diamonds have been extended until 2028, alongside the establishment of a new National Institute of Design–linked initiative to drive design innovation, supporting the long-term goal of achieving $100 billion in gems and jewellery exports by 2047.

Prithviraj Kothari, National President-IBJA

Union Budget 2026–27 focused on sustained 7% growth through fiscal discipline, structural reforms, and people-centric development. It prioritised manufacturing, MSMEs, services, infrastructure, energy security, and trust-based governance, while advancing Viksit Bharat via inclusive growth, financial stability, and ease of doing business. The bullion industry had expected a cut in import duty on gold, GST rationalisation, export incentives and extended credit support.

The Budget announced capital gains tax exemption on RBI Sovereign Gold Bonds, applicable only to original subscribers, not to secondary market buyers, while there were no announcements of any meaningful reduction in gold import duty or GST reforms.

Rajesh Rokde, Chairman- GJC

The Union Budget 2026–27 reflects a stable and sensitive approach towards the Gems & Jewellery industry. The absence of any increase in customs duty or GST, continued policy certainty, strong MSME and cluster support, ease-of-doing-business measures, and litigation-reducing income-tax reforms together provide confidence to the trade and reinforce the Government’s recognition of our sector as a key contributor to employment, exports, and economic growth.

Avinash Gupta, Vice Chairman, GJC

The Gems & Jewellery trade welcomes the Union Budget 2026-27. The absence of any increase in customs duty, combined with strong MSME support, improved access to finance, simplified income-tax compliance, and enhanced ease-of-doing-business measures, will enable jewellers across the value chain to plan confidently and focus on sustainable growth amid global uncertainties.

Surendra Mehta, National Secretary IBJA

Gold and silver industry is relieved as there is no change in custom duty. A consistent customs duty helps industry and does not create confusion in the buyer’s mind.

Capital gain exemption on redemption of maturity of sovereign gold bond is now kept only for original subscriber -this is also a welcome step; it will avoid different tax treatment by officers for different assessee.

Jignesh Mehta, MD and Founder – Divine Solitaires

While the Finance Minister’s long-term focus on infrastructure development, skill development, and AI/technology-enabled growth elevate the manufacturing ecosystem at a broader level, the absence of key announcements for the natural diamonds industry and the Gems & Jewellery sector was a disappointment.

We were expecting more targeted reforms, given India’s position as one of the largest diamond manufacturing and processing hubs globally.

Manoj Jha, CMD Kamakhya Jewels Ltd

The Budget strikes a strong balance between growth and fiscal discipline, reinforcing stability for the gems & jewellery industry. Policy continuity, infrastructure focus and tax clarity boost confidence, improve planning across the ecosystem, and support sustainable long-term growth in India and global markets.

Suvankar Sen, MD & CEO, Senco Gold and Diamonds

The Union Minister’s focus on macroeconomic stability, infrastructure, MSME growth, skilling, and technology adoption reflects a strong long-term vision. For eastern India–based manufacturers like us, the emphasis on skilling and regional development is especially encouraging, as it will strengthen the workforce with professionally trained talent.

Ghanshyam Dholakia, Founder & MD-Hari Krishna Exports and KISNA

We view the Union Budget 2026–27 as a constructive and growth-oriented step for the gems and jewellery sector, with an emphasis on ease of doing business. The move toward trust-based customs, faster clearances, smoother bonded warehouse movements, removal of the cap on courier exports, and an improved GST refund framework will enhance supply-chain efficiency and unlock working capital across the value chain.

Enhanced MSME financing backed by credit guarantees further strengthens liquidity for manufacturers and exporters. The balanced tax treatment of Sovereign Gold Bonds and physical gold also supports a fair and consumer-friendly market.

Kaushlendra Sinha CEO- Indian Association for Gold Excellence and Standards (IAGES)

“The Budget’s emphasis on economic stability and formalisation creates a supportive environment for India’s gold ecosystem. Amid volatile gold and silver prices, the industry’s commitment through IAGES to transparency, governance and recognised standards is vital to sustaining consumer trust. As demand grows beyond metros, compliance and excellence will be key to building a credible and globally competitive gold industry.”

Paul Alukkas, MD-Jos Alukkas

The Union Budget 2026–27 reinforces confidence in the economy by backing growth of around 7% while staying on a fiscal consolidation path, with the deficit targeted to decline from 4.8% in FY25 to 4.4% in FY26. This focus on macroeconomic stability is reassuring for households and businesses. Measures such as TDS rationalisation and lower TCS on education expenses abroad should boost disposable incomes and discretionary spending and this is a welcome measure.

The continued emphasis on MSMEs, credit availability and formalisation is expected to support jewellers, particularly in tier-2, tier-3 and rural markets.

Naresh Balani,Chairman, JMA Forum

The Union Budget 2026 is a positive and encouraging step for the MSME manufacturing sector. Its focus on credit access, technology, and Make in India will strengthen jewellery machinery manufacturers and help Indian MSMEs compete globally.

Neil Sonawala,MD, Zen Diamond

Budget 2026 strikes a pragmatic balance between fiscal discipline and consumption-led growth, which is critical for the jewellery industry. The continued focus on stable customs duties on gold and inputs brings much-needed predictability to the sector, allowing brands to plan pricing and inventory with greater confidence. Measures that support disposable income and urban consumption will directly benefit discretionary categories such as fine jewellery.

Dr. Renisha Chainani, Head of Research – Augmont

Union Budget 2026-27 focuses on action-led, people-centric growth, targeting ~7% GDP expansion through fiscal discipline, infrastructure-led capex, MSME support, manufacturing, services growth and green initiatives under the ‘Viksit Bharat’ vision. However, despite industry expectations for relief amid high gold and silver prices-such as import duty cuts, GST rationalisation and customs reforms-the Budget did not announce any major sector-specific measures for the gems and jewellery industry.

Namita Kothari, Founder – Akoirah by Augmont

Union Budget 2026-27 supports productivity-led growth and fiscal stability, reinforcing long-term confidence in discretionary sectors like jewellery. While there are no direct incentives for the industry, the focus on trade facilitation, competitiveness and capital market participation-including wider NRI access-is positive for organised, compliant players. For emerging segments like lab-grown diamonds, long-term growth will depend on manufacturing strength, skilling, export readiness and building consumer trust through transparency and quality standards.

JB Insights

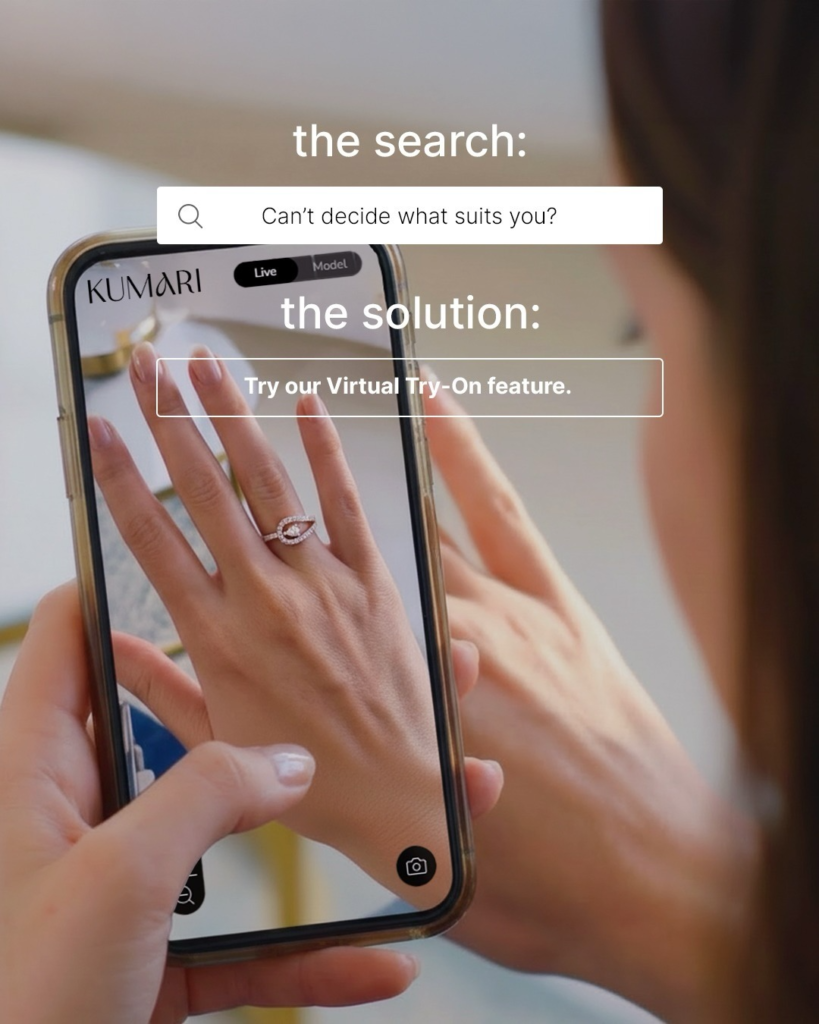

Be Your Own Valentine: Rethinking Love and Gifting This February- Kumari Fine Jewellery Inputs Shared by – Supriya Kataria, Founder, Kumari Fine Jewellery

As self-love, self-gifting, and Galentine’s Day reshape how women celebrate Valentine’s Day in India

As Valentine’s Day approaches, the conversation around love is quietly but meaningfully shifting. Once centred almost exclusively on romantic partnerships, the occasion is now being reimagined as a celebration of love in all its forms, from self-love, friendships, and family bonds to personal milestones.

Recent reports indicate a steady rise in single individuals, particularly women, who are redefining how they engage with occasions that are traditionally couple-led. In this evolving landscape, Valentine’s Day is no longer about waiting for a partner’s gesture; it has become an opportunity for personal acknowledgement and self-celebration.

Therefore, one of the most significant shifts in Valentine’s spending we have increasingly noticed has been the rise of self-gifting. Consumers today are choosing to invest in themselves, marking achievements, transitions, and moments of self-recognition. This change has been fuelled by the growing popularity of Galentine’s Day, celebrating friendships, especially between female friends, over romance and a broader cultural move towards self-care and personal investment.

Data reflects this change clearly. Bumble’s 2025 Dating Trends report reveals that 61% of single Indian women value micro-moments of care and intention over traditional romantic clichés. At the same time, Valentine’s Day shopping patterns are evolving rapidly, with 30–35% of Valentine’s Day sales in India taking place online in 2024, alongside a reported 25% increase in traffic and sales.

Against this backdrop, jewellery, long associated with milestones and meaning, has emerged as a powerful form of self-expression. Gifting oneself fine jewellery is no longer viewed as indulgent, but intentional: a way of honouring one’s journey, resilience, and individuality.

This Valentine’s Day, Kumari Fine Jewellery invites women to pause and acknowledge one quality they admire in themselves. Whether it is strength, independence, creativity, or compassion, the act of self-gifting becomes a symbol of self-recognition.

At the heart of this philosophy is my own relationship with what love means today. For me, love does not require an audience, but it does require acknowledgement. The idea is simple yet powerful: love begins with me.

As women continue to redefine celebration on their own terms, Valentine’s Day stands as a reminder that the most enduring form of love is the one we choose to recognise within ourselves, a spark from within, worthy of being honoured.

source:Bumble & Kumari Fine Jewellery

-

JB Insights2 weeks ago

JB Insights2 weeks ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India

-

JB Insights2 weeks ago

JB Insights2 weeks agoGold is Talking, Silver is Screaming – A Case for Prudent Repositioning

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoJapan, US Weigh Synthetic Diamond Facility to Strengthen Strategic Supply Chains