International News

Silver slips after strong rally, bears eye $34

US spot silver reached a five-month high of $34.58 before experiencing a significant pullback towards the $34.00 level. This suggests profit-taking by traders and a reduction in exposure ahead of potentially volatile US macroeconomic releases.

The price action indicates a breach of the initial support level at $34.23, the March 18 peak. This breach signals potential for further downward momentum.Traders are exhibiting caution, likely due to the anticipation of upcoming US economic data, which could significantly impact the US Dollar and, consequently, the price of silver.

Key Support and Resistance Levels:Support: $34.23 (breached), $33.51 (March 26 daily low), $33.00.Resistance: $34.25, $34.58 (YTD high), $35.00.

The recent price action suggests a shift in short-term momentum from bullish to bearish.A daily close below $34.23 is a critical indicator of potential further downside.The next support levels at $33.51 and $33.00 are crucial for determining the extent of the pullback.Conversely, if XAG/USD manages to hold above $34.25, it could signal a resumption of the bullish trend, with the YTD high of $34.58 and the $35.00 level as potential targets.

US Macroeconomic Data: Upcoming US economic releases will be a significant driver of XAG/USD price action. These releases will influence the strength of the US Dollar, which has an inverse relationship with silver prices.Trader Positioning: The recent pullback suggests traders are unwinding long positions and reducing risk exposure.

Gold Price Correlation: Silver often exhibits a strong correlation with gold prices. Movements in gold will likely influence XAG/USD.Global Economic Uncertainty: Ongoing global economic uncertainty, including geopolitical tensions, can drive safe-haven demand for precious metals like silver.

International News

India gold prices rise, higher than in Dubai

Today, the price of 24K gold was at Rs.157,780 per 10 grams, reflecting a gain of ₹1,270 compared to its previous close. Meanwhile, 22K gold is at Rs.144,632 per 10 grams.

Gold prices in India are largely influenced by international spot gold rates, US dollar fluctuations, and import duties on gold, among other factors.

Gold prices in India continue to remain higher than in Dubai. On 11 February 2026, the price of 24K gold in India stood at Rs.157,780 per 10 grams, while in Dubai it was Rs.149,441, reflecting a difference of Rs.8,339 or 5.58%.

US gold and silver prices rose in early morning trade after falling briefly in yesterday’s session, as US Treasury bond yields declined following data showing December retail sales growth stalled, signalling a softening economy ahead of key US jobs data

-

JB Insights2 weeks ago

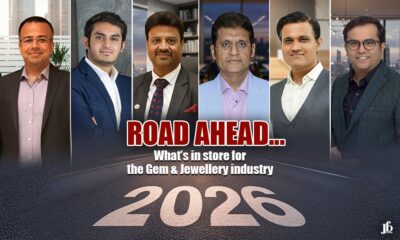

JB Insights2 weeks ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India

-

JB Insights2 weeks ago

JB Insights2 weeks agoGold is Talking, Silver is Screaming – A Case for Prudent Repositioning

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoJapan, US Weigh Synthetic Diamond Facility to Strengthen Strategic Supply Chains