International News

WGC Gold Market Commentary: Bonds a no go

A staggering 14% rally in January took gold above the US$5,000 mark, cementing the 5k number as a headline to match the first recorded annual 5,000 tonnes of total demand. The month closed at US$4,982/oz and scored 12 all-time highs. But it was not without drama with large intraday swings on the last two days of the month.

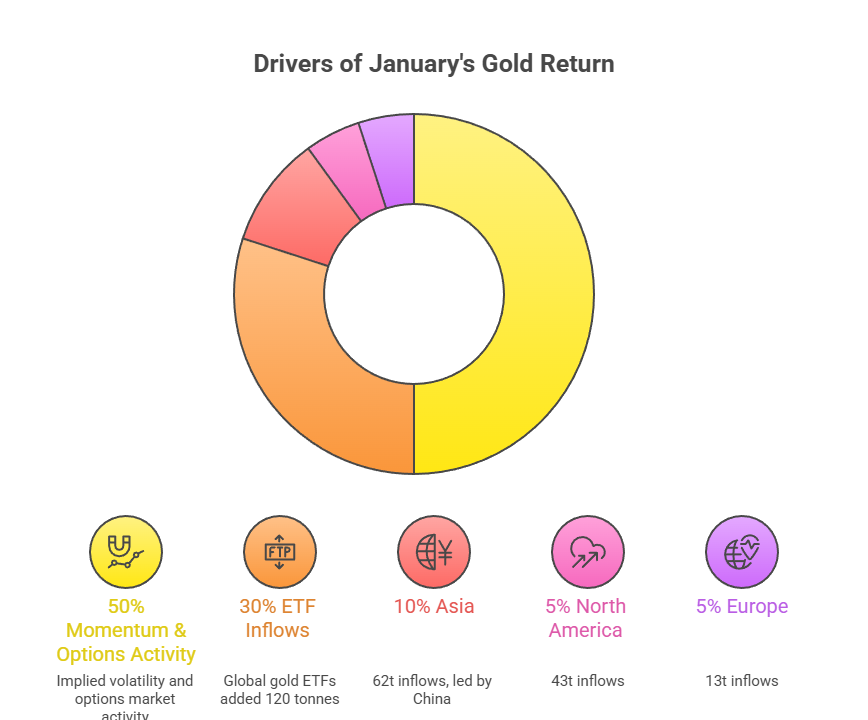

Our Gold Return Attribution Model (GRAM) showed an unusually large contribution from implied volatility (c.50% of January’s return), reflecting substantial option market activity. This variable currently sits in risk & uncertainty, although is likely more reflective here of momentum.

Global gold ETF flows provided plenty of support adding 120t in January to take holdings to a new record, valued at US$669bn. The flows were dominated by Asia (62t) and North America (43t) while Europe saw more modest inflows

Key Price Figures (January 2026)

The month was characterized by relentless momentum, scoring 12 all-time highs before ending with significant intraday volatility.

| Metric | Value (USD) | Peak Date |

| January Closing Price | US$4,982/oz | Jan 30, 2026 |

| All-Time Record High | US$5,307/oz | Jan 28, 2026 |

| Monthly Return | +14.1% | — |

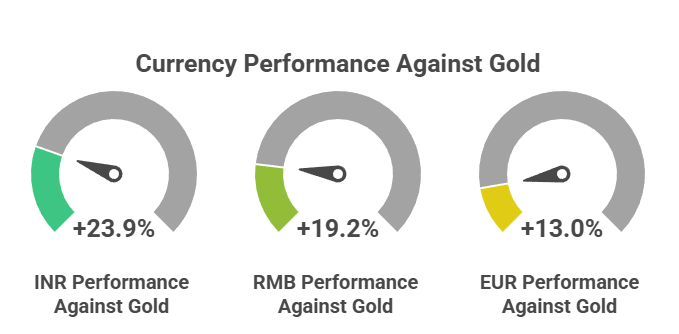

Performance in Other Major Currencies (Jan Return):

- INR: +23.9% (Record high: ₹176,306/10g)

- RMB: +19.2% (Record high: ¥1,248/g)

- EUR: +13.0% (Record high: €4,444/oz)

Major Market Drivers

- Momentum & Options (GRAM Model): Approximately 50% of January’s return was attributed to implied volatility and massive options market activity rather than pure macro fundamentals.

- ETF Inflows: Global gold ETFs added 120 tonnes (valued at US$669bn), the strongest month on record.

- Asia: 62t (led by China)

- North America: 43t

- Europe: 13t

- The “Warsh Effect”: Late-month drama was fueled by the nomination of Kevin Warsh as the next Fed Chair. Markets perceive him as a “hawk” favoring a smaller Fed balance sheet, which triggered a sharp intraday correction from the $5,300 peaks.

Macro Outlook: The Inflation Resurgence

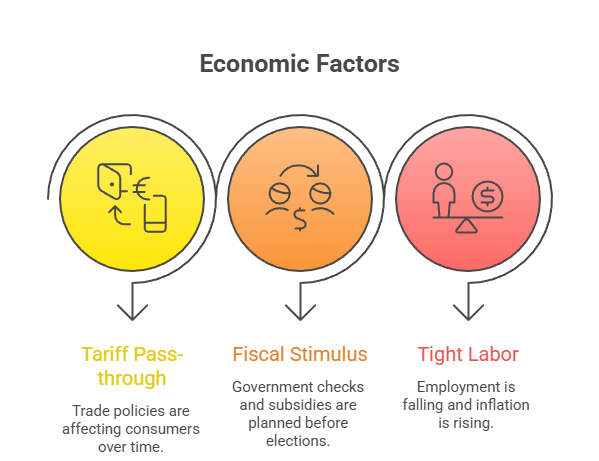

While geopolitics dominated January, the narrative is shifting toward resurgent US inflation risks for the remainder of 2026. Key triggers include:

- Tariff Pass-through: Lagged effects of trade policies hitting consumers.

- Fiscal Stimulus: Prospective $2,000 “tariff dividend” checks and ACA subsidies ahead of the US mid-term elections.

- Tight Labor: A falling breakeven employment rate and rising household inflation expectations.

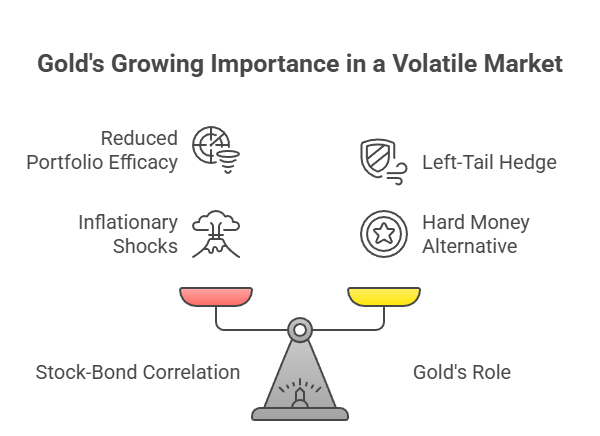

Investment Implications

- Stock-Bond Correlation: Inflationary shocks are making stocks and bonds move in the same direction, reducing the efficacy of traditional 60/40 portfolios.

- Gold’s Role: Gold is increasingly viewed as a left-tail hedge and a “hard money” alternative as sovereign debt levels (reaching 30% of the $340T global sector debt) raise debasement fears.

The gold market is likely to “pause” after the January surge, but the combination of fiscal expansion and Fed leadership uncertainty suggests investment demand will remain a structural feature of 2026.

source :WGC

Appointment

Maryam Al Hashemi appointed 2026 Chair of the Kimberley Process Committee on Participation and Chairmanship

The Kimberley Process (KP) has announced the appointment of Maryam Al Hashemi as the 2026 Chair of its Committee on Participation and Chairmanship (CPC). A highly respected industry leader and KP veteran, Al Hashemi brings extensive expertise to this critical role. India will chair the KP in 2026, the third time it has chaired the body overall, with commitments to building consumer confidence, accelerating digital traceability and advancing data-driven compliance.

Currently serving as the Senior Director of Precious Stones and Metals at DMCC and the UAE KP Director, Al Hashemi has been instrumental in positioning Dubai as the world’s leading diamond trading hub. Under her leadership, Dubai’s rough and polished diamond trade has exceeded one billion carats in rough and polished over the past five years. She also oversees the Dubai Diamond Exchange (DDE), the world’s largest diamond trading platform with over 1,365 members, and spearheads key industry events such as the Dubai Diamond Conference and the Dubai Precious Metals Conference.

With a deep background in diamond trade regulation, Al Hashemi leads the only ISO-certified KP Office globally and has played a pivotal role in managing the UAE’s sole entry and exit point for rough diamonds. Her contributions to the UAE’s KP Vice Chairmanship in 2015, Chairmanship in 2016 and 2024, and her previous tenure as CPC Chair in 2017 highlight her wealth of experience in KP governance.

The CPC is a vital body within the Kimberley Process, responsible for evaluating new participants, reviewing compliance matters, and assessing Vice-Chair candidates. Its recommendations are presented at the KP Plenary meeting, ensuring the integrity of the certification scheme. As per KP protocol, the previous year’s KP Chair assumes the role of CPC Chair the following year.

Al Hashemi’s appointment underscores her long-standing commitment to strengthening the KP framework. Her leadership is expected to further reinforce the KP’s mission in promoting responsible diamond trade practices worldwide.

source:DMCC

-

JB Insights2 weeks ago

JB Insights2 weeks ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India

-

JB Insights2 weeks ago

JB Insights2 weeks agoGold is Talking, Silver is Screaming – A Case for Prudent Repositioning

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoJapan, US Weigh Synthetic Diamond Facility to Strengthen Strategic Supply Chains