JB Insights

Let us continue to harness our collective strengths, seize emerging opportunities, and embrace change with enthusiasm.

Let us uphold our legacy of craftsmanship and integrity, and propel the industry towards unparalleled success – Vipul Shah

The Indian gem and jewellery sector is a force to reckon with in the international GJ market. GJEPC has been the apex body driving India’s export-led growth in the gem and jewellery sector since 1966.Vipul Shah, Chairman GJEPC speaks to JewelBuzz on the initiatives, strategies for growth of the GJ industry, impact of geopolitical crisis on GJ sector and government policies and regulatory frameworks aiding the growth of Indian GJ sector.

Take us through the GJEPC roadmap for the year 2024—events and initiatives, strategies for growth of the GJ industry.

GJEPC is focused on growing India’s share of the global gem and jewellery pie. The Council also has a dual focus of driving export growth and creating job opportunities in the industry. Despite challenges faced in 2023, the industry is optimistic for the year 2024.

Efforts are directed towards sustaining and increasing exports to major markets like the USA, Hong Kong, and UAE. Additionally, the industry is exploring new markets such as the UK, Italy, France, Latin America, and Cambodia among many others.

Marketing efforts will be intensified to promote Indian gems and jewellery globally. This includes organising the IIJS, the India International Gem & Jewellery Show (IGJS) in Dubai and Jaipur, actively participating in major international gem and jewellery exhibitions; and facilitating product-specific and market-specific Buyer Seller Meets.

There is also a focus on investing in technology and innovation to enhance productivity, efficiency, and competitiveness. GJEPC, in collaboration with the Ministry of Commerce & Industry and SEEPZ, has launched a Mega Common Facility Center in SEEPZ Mumbai. This initiative aims to increase manufacturing capacities, drive technological advancements, and provide extensive skill development opportunities. Importantly, the services offered will benefit both SEEPZ and Domestic Tariff Area (DTA) units, reflecting inclusivity and industry-wide progress.

The geopolitical crisis and G7 sanctions banning Russian diamonds are major concerns. What is the impact on Indian diamond industry with the manufacturing sector affected drastically with shortage of rough diamonds?

The G7/EU has considered March 1st to August 31st as the “Sunrise Period.” During this phase, the US has opted for self-certification for import shipment clearance, while the EU provides two alternatives: G7 certification and a documentary evidence-based system, facilitating Indian trade in importing goods directly to India using the documentary evidence option. Certain countries allow Mixed Origin relaxation, subject to documentary evidence. The UK has provided clarification on Grandfathering diamonds movement and the necessary procedures. As of March 1, 2024, the immediate impact of G7 sanctions appears relatively manageable, with the industry adjusting to uphold support documents, coordinate two supply chains, and comprehend country-specific requirements for legal compliance. While it is still early, being only 3 weeks into the sanctions, inquiries and feedback from members are being actively received and assessed to gain a comprehensive understanding of the situation.

How are government policies and regulatory frameworks aiding the growth of Indian GJ sector?

Based on its potential for growth and value addition, the Government of India has declared the Gems and Jewellery sector as a focus area for export promotion. Over the years, through trade-friendly policies, the government has facilitated a remarkable surge in gem and jewellery exports, which now stand at USD 40 billion.

The recent Free Trade Agreements with key partners such as the UAE, Australia, and the European Free Trade Association (EFTA) countries—Switzerland, Iceland, Norway, and Liechtenstein—hold substantial promise for further boosting Indian gem and jewellery exports.

However, to enhance the industry’s competitiveness in global markets and ensure sustainable development, several measures have been proposed to the government:

- Safe harbour rule for sale of rough diamonds in Special Notified Zones (SNZs)

- Introduction of Diamond Imprest License and reduction in import duty on cut & polished diamonds to 2.5%

- Reduction in import duty on gold/silver/platinum bars to 4%

- Introduction of a mechanism like “Rates & Taxes Refund” through EDI system similar to GST refund.

Despite the various challenges there is always a positive spirit. What is your message to the GJ industry?

Despite facing challenges, the Indian gem and jewellery industry has always shown resilience, relying on its renowned craftsmanship and skills recognized worldwide.

Understanding its inherent strengths, the industry perceives setbacks as temporary hurdles, consistently striving for improvement by integrating the latest technologies. Today, it stands capable of meeting the diverse demands of global markets.

My message to the GJ industry is simple: Let us continue to harness our collective strengths, seize emerging opportunities, and embrace change with enthusiasm. Together, we can navigate through any adversity, upholding our legacy of craftsmanship and integrity, and propel the industry towards unparalleled success.

JB Insights

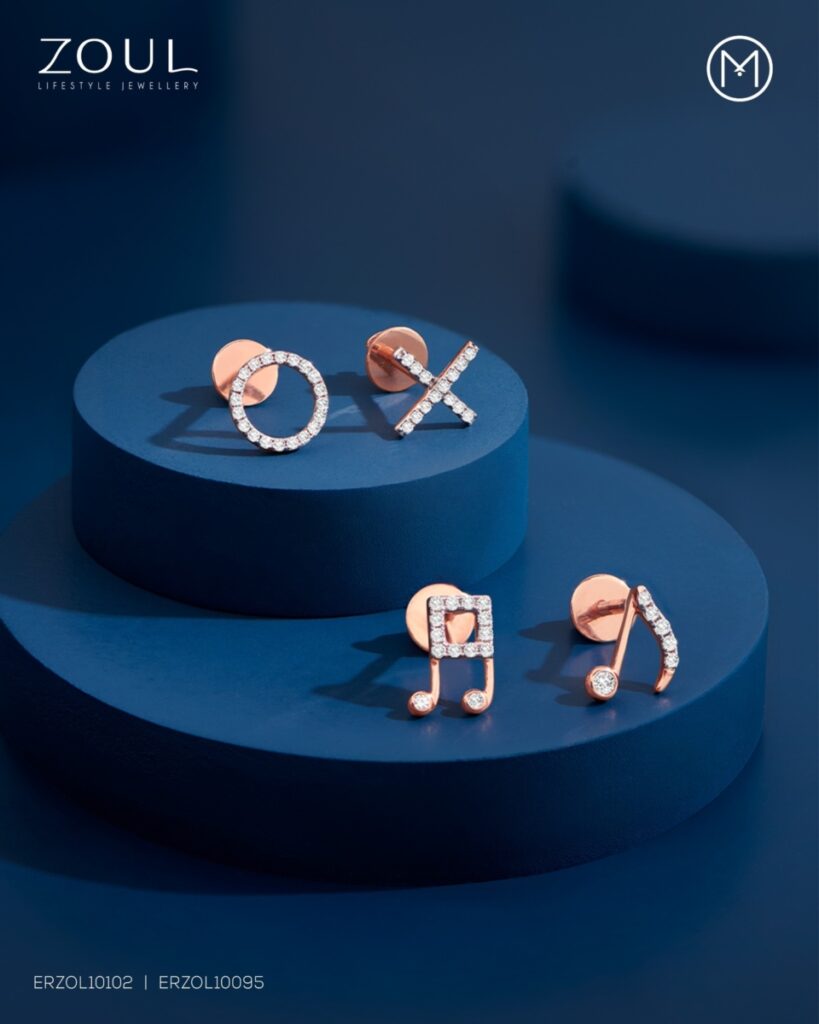

Women’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

From milestone-driven collections to personalised styling and self-purchase narratives, jewellery brands across India are celebrating women’s independence, identity, and achievements this International Women’s Day.

International Women’s Day 2026 has prompted jewellery brands across India to launch campaigns that celebrate women’s empowerment, individuality, and personal achievements. Moving beyond traditional gifting narratives, many brands are positioning jewellery as a symbol of self-expression and personal milestones, reflecting the evolving role of women as independent buyers in the jewellery market.

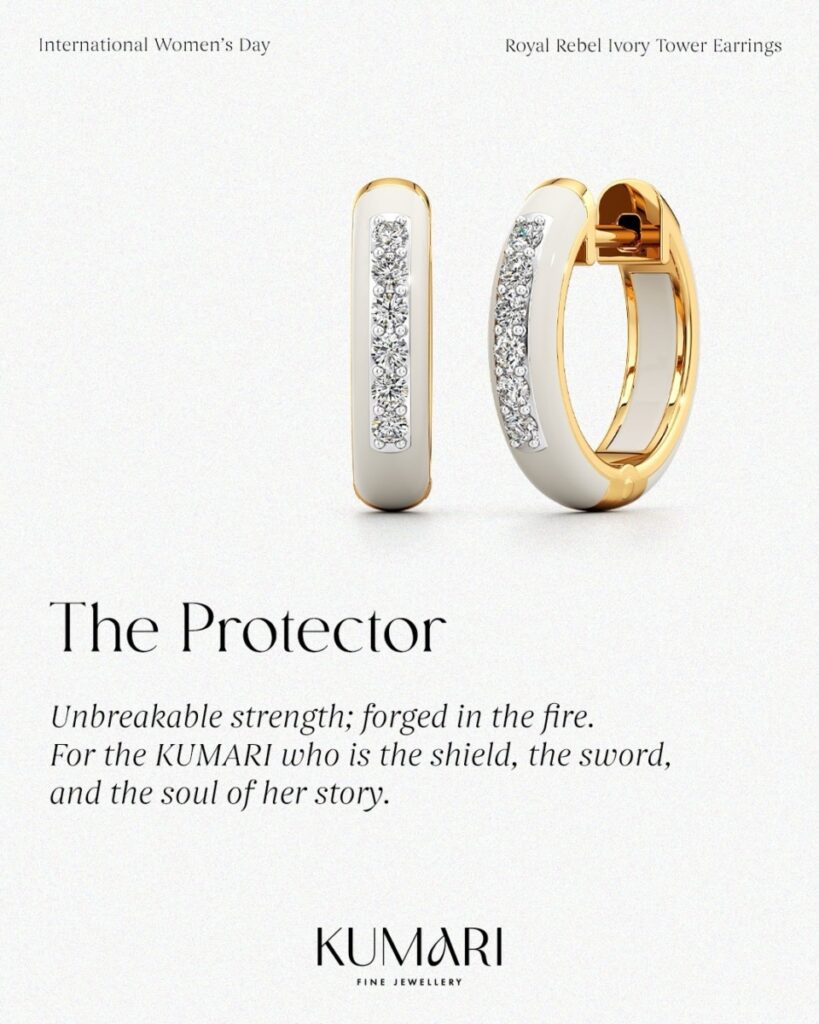

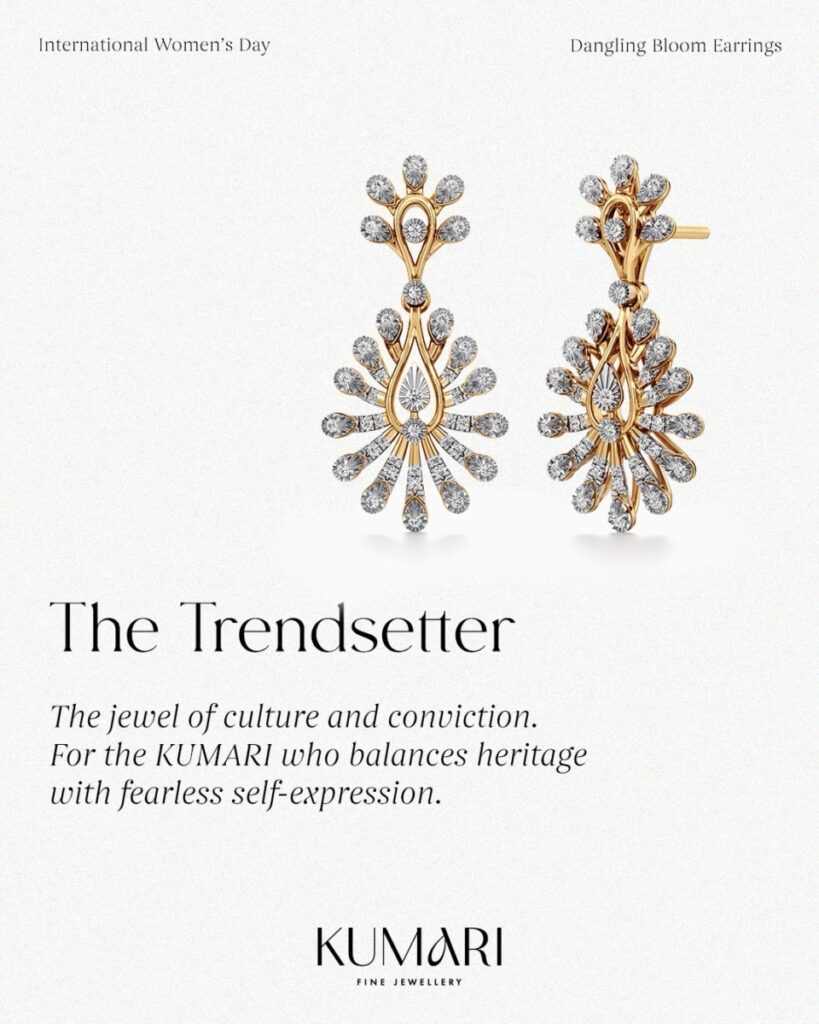

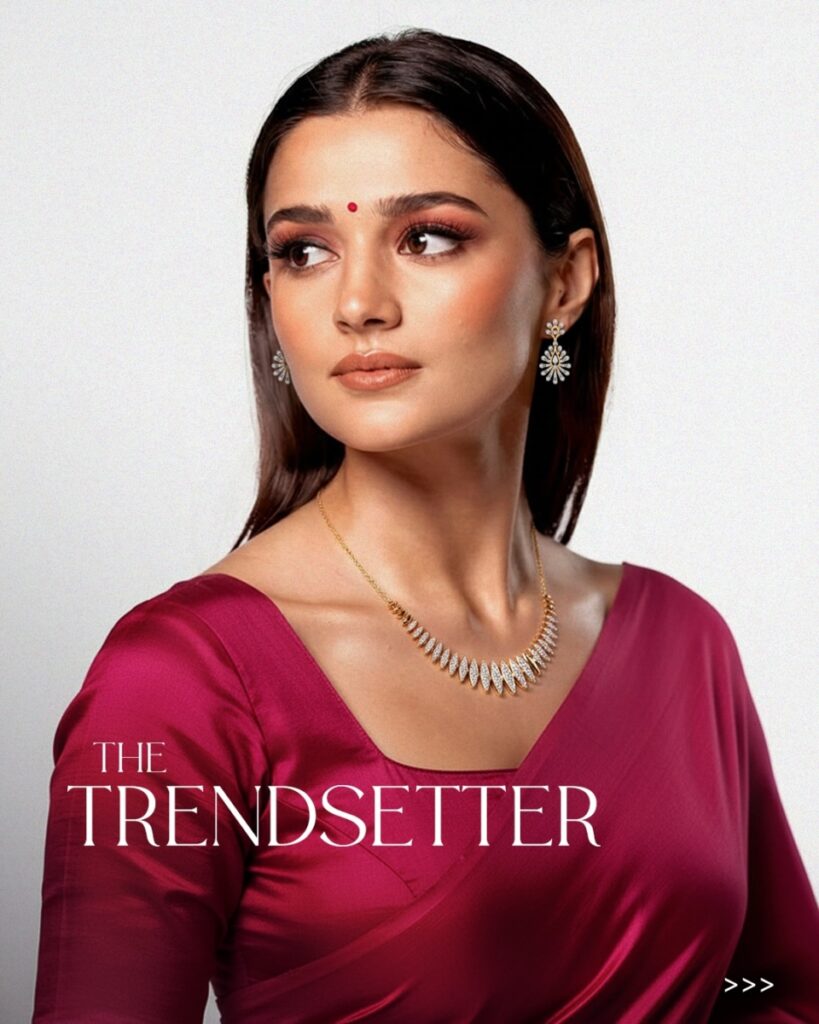

Kumari Fine Jewellery

Mumbai-based Kumari Fine Jewellery has introduced a Women’s Day showcase themed around the idea of the “Modern Indian Original.” The initiative focuses on financially independent women who mark their achievements with self-purchased jewellery. The showcase highlights lightweight gold pieces designed for everyday wear, reinforcing jewellery as both a style statement and a symbol of personal growth.

Dhirsons Jewellers

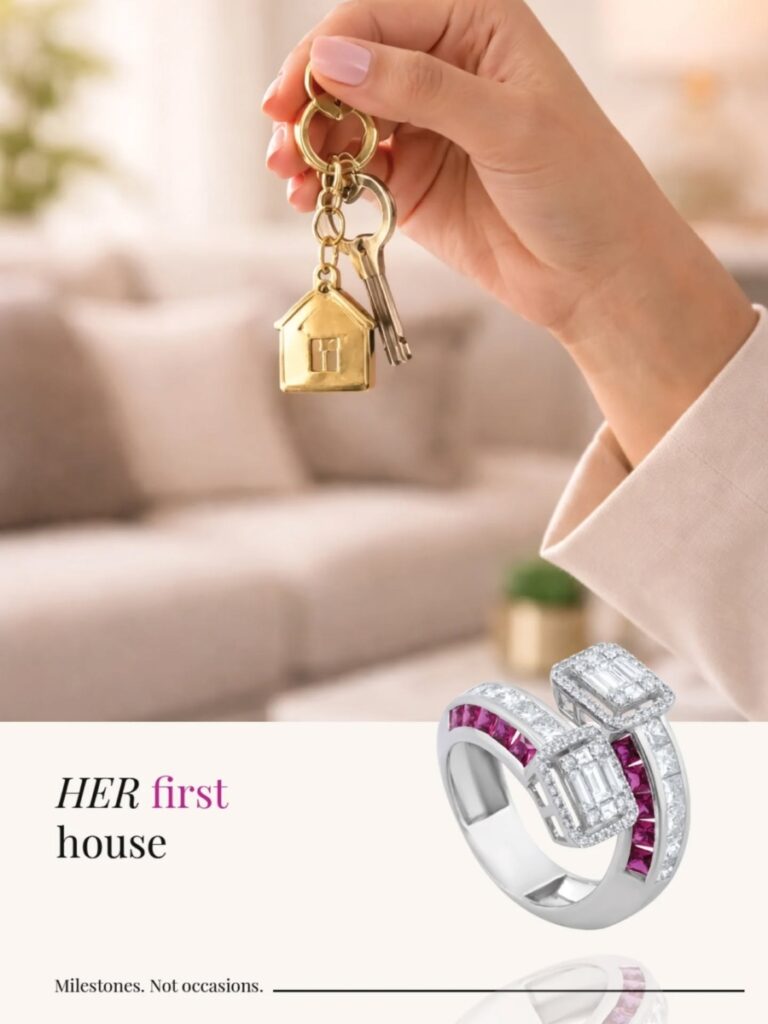

Delhi’s Dhirsons Jewellers has launched a campaign centred on celebrating milestones in a woman’s journey rather than traditional occasions. The initiative encourages women to recognise defining moments in their lives, positioning jewellery as a reflection of resilience, confidence, and self-belief.

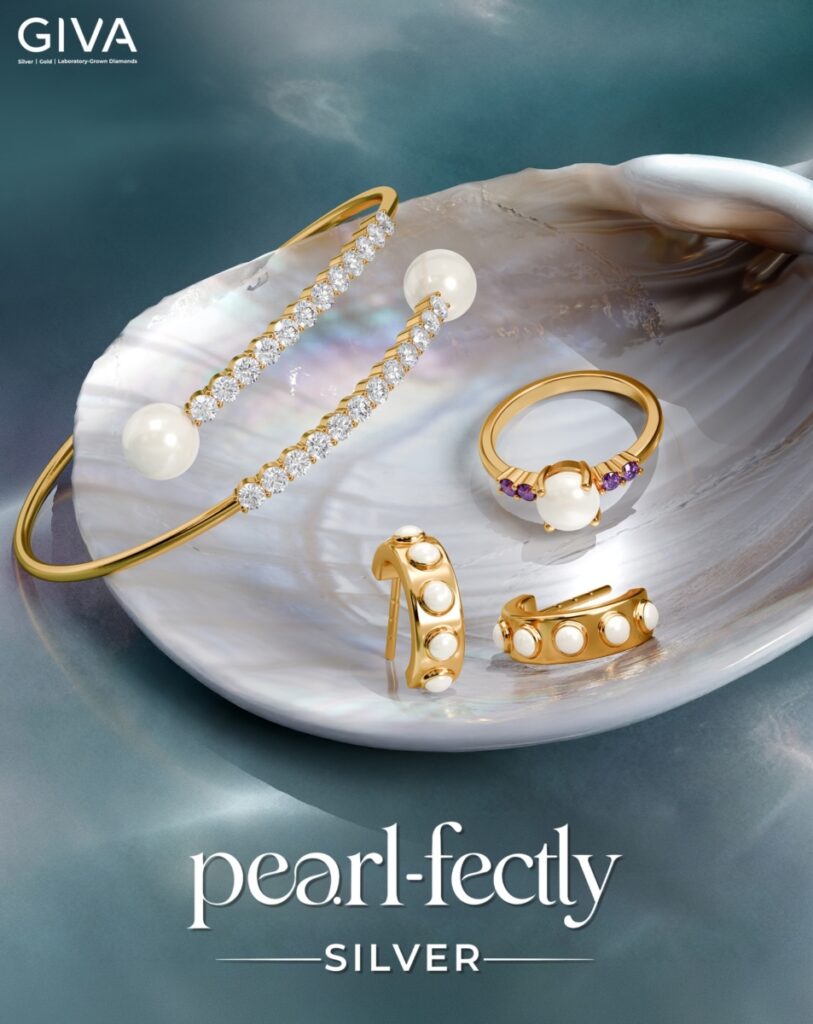

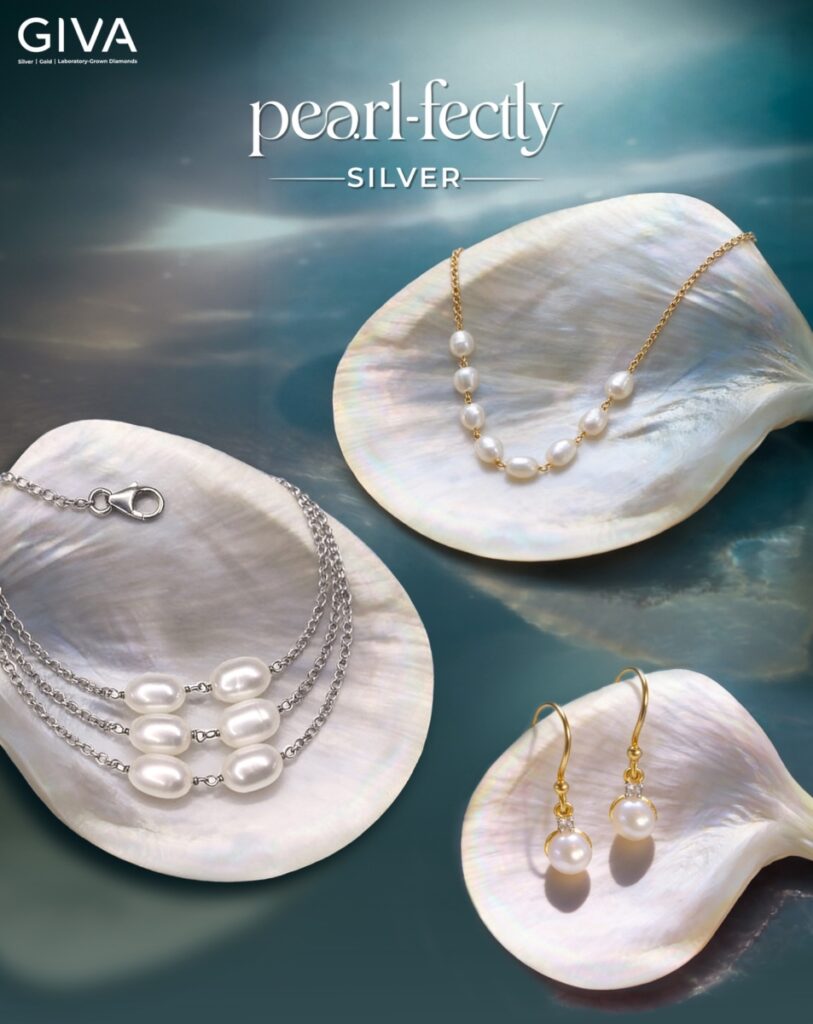

GIVA

Digital-first jewellery brand GIVA has unveiled a Women’s Day concept titled The Pearl Edit, focusing on timeless pearl jewellery that celebrates women who are building, leading, and redefining their paths. The campaign emphasises understated elegance while encouraging women to celebrate themselves through meaningful jewellery.

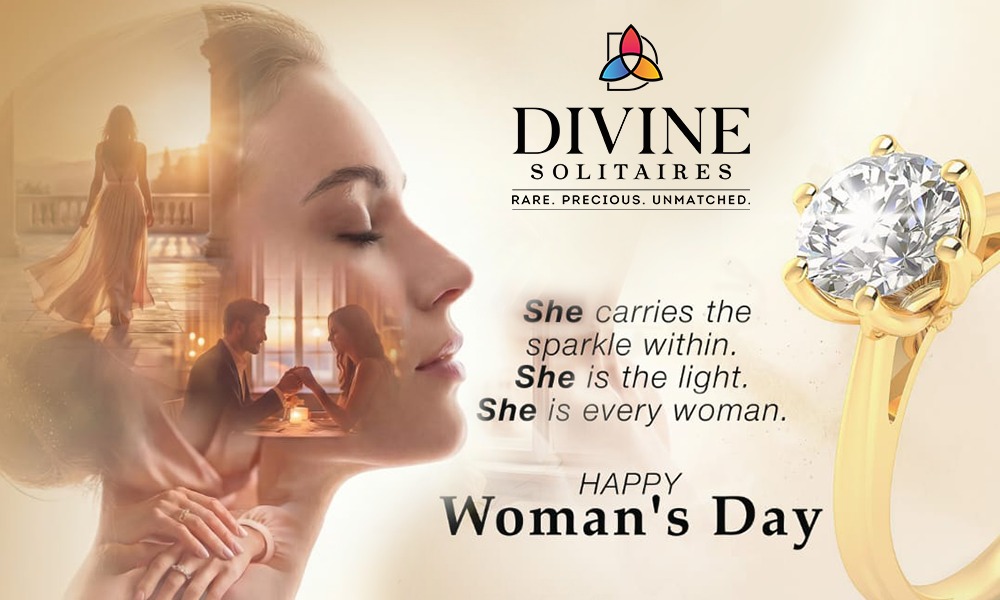

Divine Solitaires

Diamond jewellery brand Divine Solitaires has also introduced a Women’s Day campaign highlighting the emotional value of solitaire diamonds as symbols of personal milestones. The initiative focuses on recognising the journeys of women across roles—from professionals and entrepreneurs to mothers and mentors—while encouraging self-appreciation through jewellery.

Senco Gold & Diamonds

Technology-driven campaigns have also gained traction this year. Senco Gold & Diamonds has launched an initiative that integrates artificial intelligence into jewellery styling, enabling customers to discover pieces that match their personality and features. The concept highlights individuality while bringing digital innovation into the jewellery retail experience.

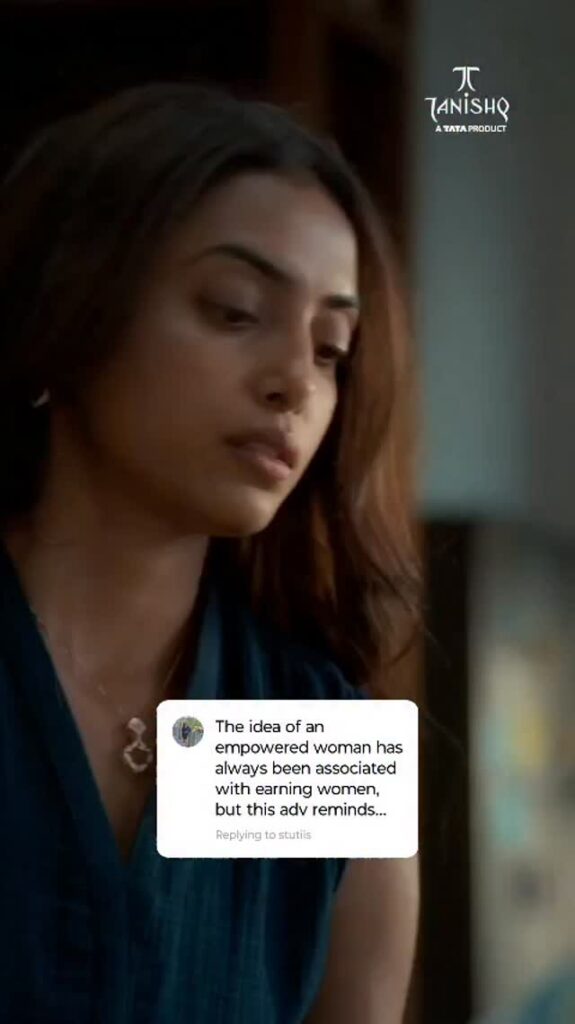

Tanishq

Large national brands are also participating in the Women’s Day narrative. Tanishq has continued its focus on celebrating modern womanhood through curated collections and storytelling campaigns that reflect the changing aspirations of contemporary women. The brand’s initiatives frequently highlight independence, confidence, and self-expression.

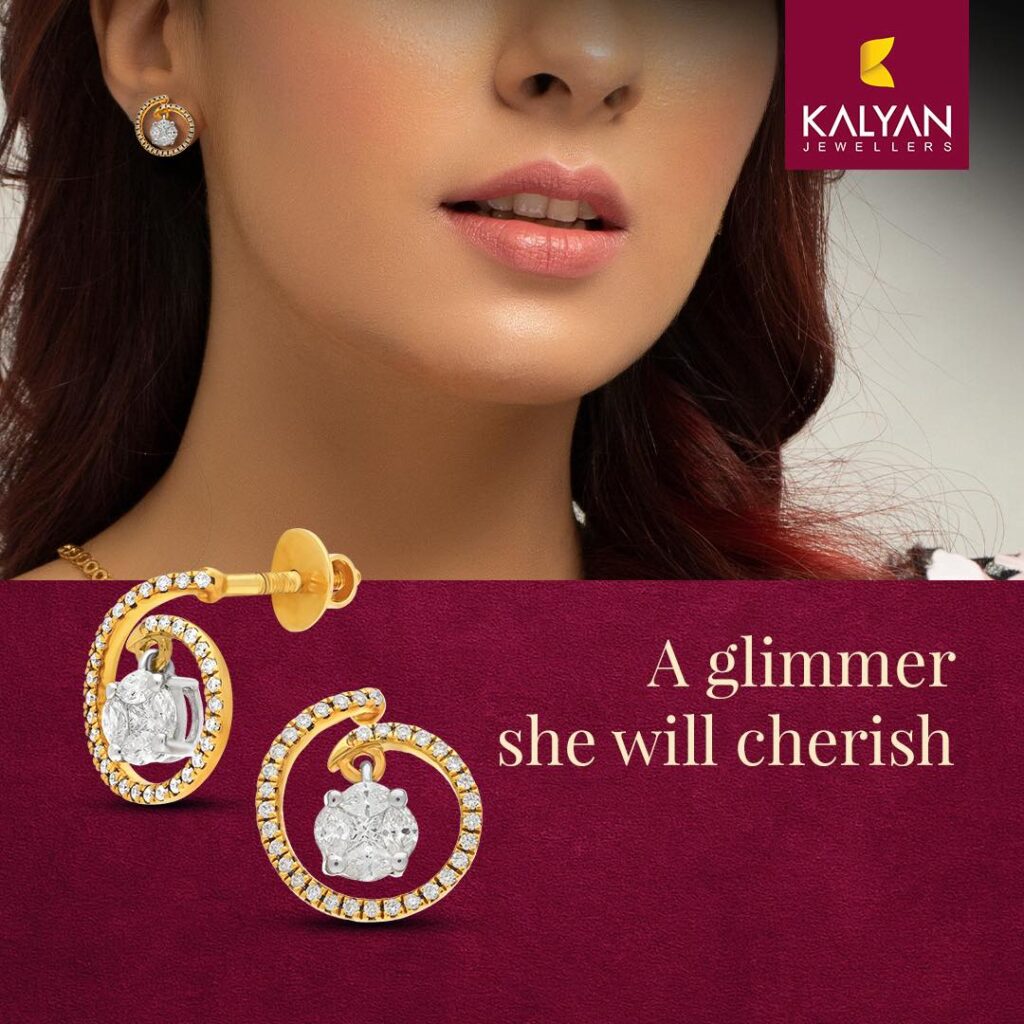

Kalyan Jewellers

Similarly, Kalyan Jewellers has aligned its messaging with women’s empowerment by supporting women-centric initiatives and partnerships, reinforcing the importance of recognising women’s achievements across different fields.

CaraLane

Other jewellery brands are also marking the occasion through special launches and themed collections. CaratLane has promoted contemporary diamond and gold jewellery collections designed for self-purchase and everyday styling, encouraging women to celebrate their personal milestones.

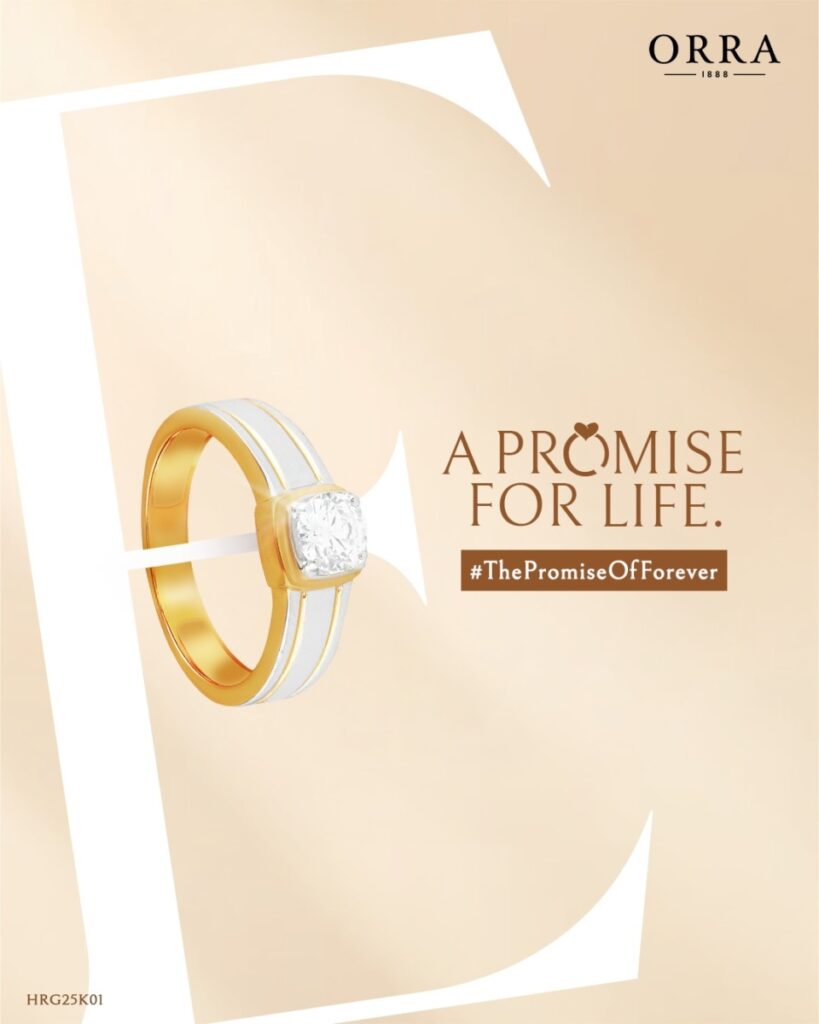

ORRA Fine Jewellery

Luxury diamond brand ORRA Fine Jewellery has highlighted modern diamond jewellery that symbolises confidence and individuality, targeting young professionals who view jewellery as a statement of identity.

Malabar Gold & Diamonds

Meanwhile, Malabar Gold & Diamonds has focused on campaigns that recognise women’s contributions to families, workplaces, and society, positioning jewellery as a tribute to their strength and achievements.

Across the industry, the Women’s Day celebration by many brands reflect a broader shift in consumer behaviour. Women are increasingly viewing jewellery not only as a traditional gift but also as a meaningful purchase that celebrates personal success, independence, and self-expression.

As jewellery brands continue to adapt to these changing aspirations, Women’s Day has become an important platform for storytelling, allowing brands to connect with modern consumers through themes of empowerment, individuality, and celebration of life’s defining milestones.

-

International News12 hours ago

International News12 hours agoUAE retail gold prices dropped by Dh10 per gram within a single day

-

National News16 hours ago

National News16 hours agoMCX gold rate falls below Rs.1.61 lakh, silver slips 1% on strong dollar

-

National News18 hours ago

National News18 hours agoFrom Pune’s Tech Corridors to Punjab’s Fashion Capital – Gargi by PNGS Marks a Landmark Double Debut

-

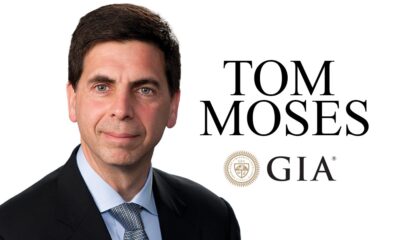

DiamondBuzz13 hours ago

DiamondBuzz13 hours agoGIA icon Tom Moses to retire after 50-year legacy