National News

India’s Gem & Jewellery Exports Drop 11.72% in FY25 Amid Global Pressures

Studded gold and platinum jewellery buck trend with positive growth; CPD and silver exports see sharp declines

India’s gem and jewellery (G&J) exports declined by 11.72% in the financial year 2024-25, totaling USD 28.5 billion, compared to USD 32.28 billion in FY24. The industry grappled with multiple global challenges including sluggish demand in key markets like the US and China, ongoing geopolitical tensions, and rising competition from lab-grown diamonds.

Despite the overall decline, exports of studded gold jewellery rose by 14% year-on-year to USD 6.1 billion, and platinum jewellery exports also saw an uptick of 11.79% to USD 182.75 million. In contrast, exports of cut and polished diamonds (CPD), the sector’s largest component, plummeted 16.75% to USD 13.2 billion, while silver jewellery exports dropped a staggering 40.58% to USD 962 million.

The imposition of a 26% US tariff on certain goods triggered a last-minute surge in exports, with over USD 1 billion worth of shipments sent in the 10 days prior to the tariff’s implementation — a sign of underlying global demand potential.

On the import front, gross G&J imports fell 11.96% to USD 19.6 billion, down from USD 22.2 billion in the previous fiscal year. Imports of rough diamonds, a key raw material, dropped 24.27% in value to USD 10.8 billion, while the volume declined 16.2% to 1,044.34 lakh carats.

Exports of lab-grown polished diamonds were also impacted, declining by 9.64% to USD 1.2 billion.

Gold jewellery exports were relatively stable, recording only a marginal decline of 0.11% to USD 11.21 billion. Of this, plain gold jewellery contributed USD 5.1 billion.

Signs of recovery were visible from January 2025 onwards, with month-on-month growth, although still trailing behind year-on-year figures. Exports in March 2025 were USD 2.5 billion, showing a modest 1.02% growth over February, but slightly below the USD 2.55 billion recorded in March 2024.

Industry players remain cautiously optimistic, citing stabilizing diamond prices and improving market sentiment as early indicators of a turnaround, despite ongoing global uncertainty.

BrandBuzz

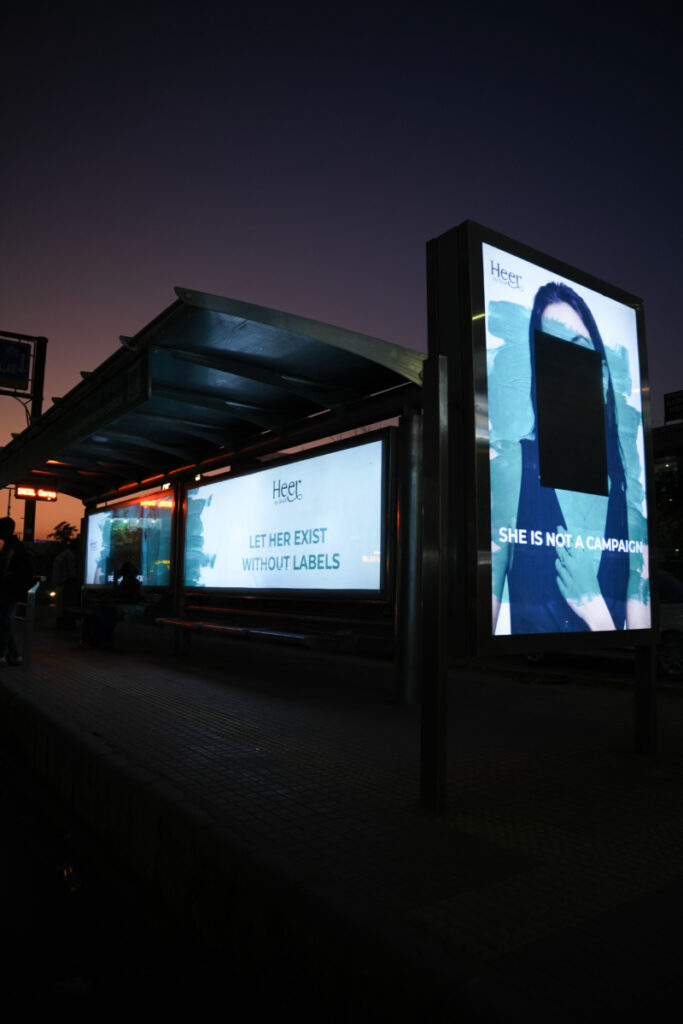

Heer by GIVA Launches ‘She Is Not a Campaign’, Celebrating Women Beyond Performative Empowerment

Heer by GIVA launches a thought-provoking campaign that shifts the focus from performative empowerment to the authentic, everyday realities of modern womanhood

Heer by GIVA, GIVA’s gold and lab-grown diamond jewellery brand, has unveiled its Women’s Day campaign titled “She Is Not a Campaign.” The initiative challenges the performative narratives often associated with Women’s Day, choosing instead to celebrate the quiet, honest realities of womanhood.

Every year, women are expected to embody inspiration, strength, and limitless ambition on cue. But real women don’t wake up every day to perform empowerment. Through this campaign, Heer by GIVA shifts the focus from idealized portrayals to authentic expressions of individuality, softness, contradictions, and everyday choices.

Instead of portraying women as constantly strong or inspirational, the campaign humanizes them, embracing their unfiltered moments, personal choices, and quiet confidence. Because real empowerment isn’t always loud and women don’t exist to become a headline, a hashtag, or a campaign brief.

At the heart of the campaign is a series of thoughtful digital films and visual stories released across Heer by GIVA’s social platforms. The content embraces minimal visuals and emotionally intelligent messaging, capturing moments that feel honest and relatable rather than performative. The campaign has also been amplified through influencer collaborations, where creators share their own interpretations of the message, reflecting on the everyday realities of being a woman rather than presenting curated notions of perfection.

Extending the campaign beyond digital storytelling, Heer by GIVA introduced an interactive out-of-home installation, transforming a routine public space into an experiential campaign touchpoint.

The bus shelter was redesigned using the campaign’s visual language and messaging. At the centre of the installation is a mirror integrated into the display, allowing people waiting at the bus stop to see their own reflection within the artwork.

With She Is Not a Campaign, Heer by GIVA hopes to move the conversation beyond symbolic gestures and toward a more meaningful acknowledgement of women’s experiences.

-

DiamondBuzz14 hours ago

DiamondBuzz14 hours agoNatural Diamonds, LGDs set for dual growth surge: Signet CEO

-

BrandBuzz15 hours ago

BrandBuzz15 hours agoHeer by GIVA Launches ‘She Is Not a Campaign’, Celebrating Women Beyond Performative Empowerment

-

DiamondBuzz15 hours ago

DiamondBuzz15 hours agoAntwerp Diamond Industry Pushes for Greater Transparency on Lab-Grown Stones

-

Education17 hours ago

Education17 hours agoGJEPC, GIA conduct training programme for newly posted Customs Officers