JB Insights

IIJS Tritiya represents a strategic move to capitalize on the significant potential of the South Indian market, particularly leading up to the auspicious festival of Akshaya Tritiya

IIJS Tritiya, the third exhibition under the IIJS banner, stands out as an exceptional platform in South India that brings together renowned jewellery manufacturers, retailers, wholesalers, and industry professionals under one roof. It showcases an extensive range of gold jewellery collections that reflect the rich heritage and craftsmanship of India’s jewellery industry.Nirav Bhansali- Convener, National Exhibitions-GJEPC speaks to JewelBuzz on what to expect from IIJS Tritiya 2024 including exciting, innovative features.

- What’s in store at IIJS Tritiya 2024?

This is the second edition of IIJS Tritiya, a novel platform for the gem and jewellery industry that showcases the latest collections and innovations especially to the southern half of the country. The show is a strategic initiative to tap into the huge potential of the South Indian market, especially in the run-up to the auspicious festival of Akshaya Tritiya. We are confident that this show will provide a boost to the trade and create new opportunities for growth and collaboration.

- Provide details of number of exhibitors, stalls, number of visitors expected (breakup of domestic and international visitors), total exhibition area etc.

There are over 900+ exhibitors and 1900+ stalls spanning 40,000sqm of exhibition area. More than 15000 trade visitors from 500+ cities in India and 60+ countries are expected.

- Any new, innovative, unique aspects in this year’s IIJS Tritiya?

The India Gem & Jewellery Machinery Expo (IGJME) for the first time is concurrently held with IIJS Tritiya. The platform will showcase the latest and the best of National & international machineries.

Other features of IIJS Tritiya:

- Innov8 Talks (Seminar Series): Providing insights and expertise.

- Fashion Show on 5th April for the Retailers

- Prime Lounge (VIP Only): Offering exclusive services.

- Elite Coffee Shop (VIP Only): A premium refreshment experience.

- Digital Badges on Mobile: Streamlining entry and exit processes

- Face Recognition process introduce for further convenience.

- IIJS App: Providing real-time updates and assistance.

- Buggy Service: Ensuring swift mobility inside the venue.

Additionally, this year introduces the ‘World of GJEPC’ zone, showcasing the Council’s diverse offerings and highlighting its comprehensive support to the industry, extending beyond IIJS exhibitions.”

- Please give details of IIJS Tritiya Visitor Campaign across India and in international markets.

The IIJS Tritiya Visitor Campaign achieved extensive outreach by conducting door-to-door activities in 134 cities, resulting in registrations from visitors in 645 cities. Impressively, the campaign engaged with over 20,000 jewellery retail companies during these visits, demonstrating significant interest and participation for the show. We also have international visitor registration at the show which adds to the opportunity

- Elections are being held in April; will they impact IIJS Tritiya?

GJEPC is proactively engaging with the regulatory bodies to ensure a seamless show. With clear Standard Operating Procedures (SOPs) in place, the show is poised to navigate potential challenges and deliver a positive experience for exhibitors and visitors alike.

- What is your take on the current market sentiment and timing of IIJS Tritiya?

In terms of the current market sentiment and the timing of IIJS Tritiya, I believe the sentiment is positive. This event represents a strategic move to capitalize on the significant potential of the South Indian market, particularly leading up to the auspicious festival of Akshaya Tritiya. We are confident that the show will stimulate trade activity and foster fresh avenues for expansion and partnership within the industry.

JB Insights

Valentine’s Day 2026: How Jewellery Brands Are Redefining Romance

From symbolic jewellery collection to sustainable sparkle, this season’s collections celebrate intentional love with meaning and modern elegance.

JbExclusive

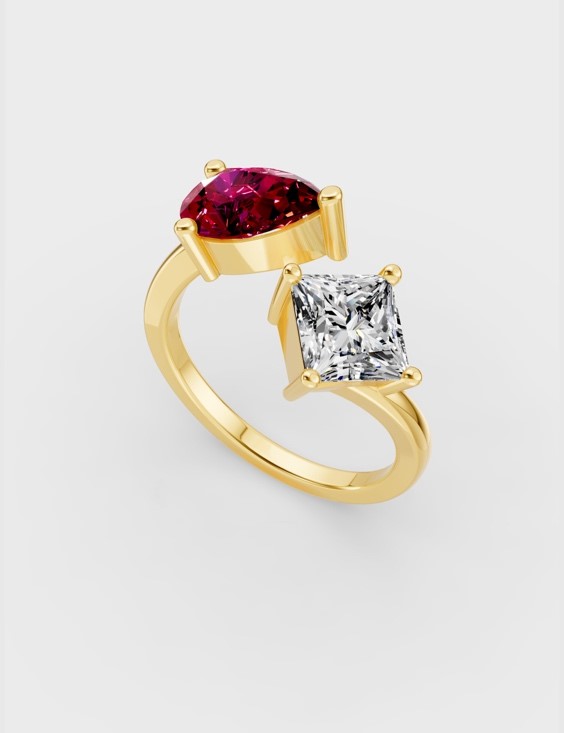

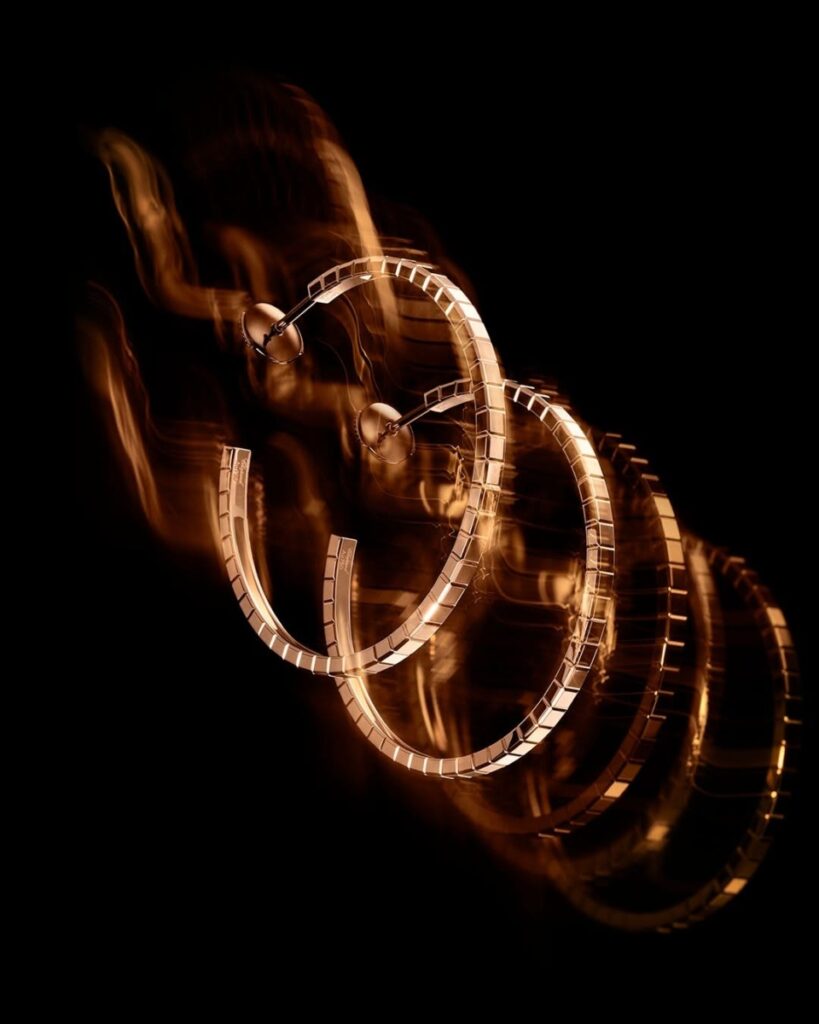

What do brands in the jewellery industry have in store this Valentine’s Day 2026? This year, the focus has shifted from extravagant gestures to deeply personal expressions of love. Leading jewellers are embracing storytelling, sustainability, and symbolism—introducing heart-led designs, lab-grown diamonds, platinum love bands, and minimalist everyday pieces that reflect connection, commitment, and conscious luxury. Whether it’s a timeless solitaire, a contemporary toi et moi ring, or a delicate pendant meant for daily wear, the emphasis is on jewellery that feels intimate, intentional, and enduring.

Gargi by P N Gadgil & Sons

Gargi by PNG & Sons celebrates Valentine’s Day 2026 with delicate designs that honour modern love—thoughtful, expressive, and crafted to sparkle in every shared moment. Blending contemporary elegance with everyday wearability, the collection is designed for heartfelt gifting and self-expression alike. Because this season, love isn’t just celebrated—it’s beautifully adorned.

Senco Gold & Diamonds

This Valentine’s Day, Senco Gold & Diamonds presents a thoughtfully curated edit of romantic gifts from its Sennes, Everlite, Perfect Love and Aham collections, designed to celebrate love in all its forms. From minimal, everyday diamond jewellery in Everlite to expressive, emotion-led designs in Sennes, and timeless symbols of commitment from the Perfect Love collection, each piece blends craftsmanship with meaning. Whether you’re marking a new beginning or a lifelong bond, these collections offer elegant gifting options that feel personal, enduring, and effortlessly romantic.

Kalyan Jewellers

This Valentine’s Day, jewellery becomes more than a gift, it becomes an expression of emotion, connection, and personal meaning. From delicate heart-inspired motifs to contemporary designs accented with diamonds and subtle touches of colour, each piece is crafted to celebrate love in all its forms. Whether it’s a gesture of self-love, a symbol of a lifelong bond, or the start of something new, these timeless designs blend elegance with sentiment, creating keepsakes to be cherished long after Valentine’s Day has passed.

Malabar Gold & Diamonds

Malabar Gold & Diamonds introduces Zoul 2026 – Allure, a sub-collection within its Zoul 2026 range, centred on contemporary diamond jewellery with a clean, refined aesthetic. Designed for modern wearability, the collection reflects a growing preference for jewellery that feels relevant beyond occasion-led dressing.

The Allure edit features fancy-cut diamonds set in minimal, thoughtfully balanced silhouettes. With an emphasis on lightness and subtle brilliance, the designs are crafted to sit comfortably within everyday wardrobes while still offering a distinct visual appeal.

Dassani Brothers

Dassani Brothers has unveiled ‘Eternal Love’, a Valentine’s Day collection that reimagines classic solitaires with a modern, affordable approach. The collection blends luminous yellow diamonds, traditional solitaires, and innovative pie-cut setting diamonds to deliver brilliance, elegance, and accessible luxury.

A key highlight is the pie-cut setting technique, designed to create the visual impact of a solitaire while enhancing affordability without compromising on craftsmanship. The collection includes rings, pendants, earrings, and statement pieces crafted in fine gold, celebrating warmth, sophistication, and enduring commitment.

Limelight Lab Grown Diamonds

This Valentine’s Day, romance is taking a more meaningful turn, with couples choosing symbolic jewellery over grand gestures. Reflecting this shift, Limelight Lab Grown Diamonds has introduced its Valentine’s Day Collection alongside a compelling value proposition—offering 26% off on diamond value plus an additional 26% off on making charges, making thoughtful diamond gifting more accessible.

Highlights from the collection include the Stellar Heart Diamond Ring with its refined, contemporary silhouette; the Heartbeat Round Diamond Chain inspired by the rhythm of love; and the Toi et Moi Heartfelt Glow Diamond Stud Earrings, celebrating togetherness through a dual-heart design with subtle sparkle.

Joy Alukkas

Joyalukkas marks the season with romantic diamond and gold creations that blend tradition with contemporary styling. From elegant solitaires to heart-inspired pendants and couple bands, the brand focuses on versatile designs that celebrate affection with timeless appeal.

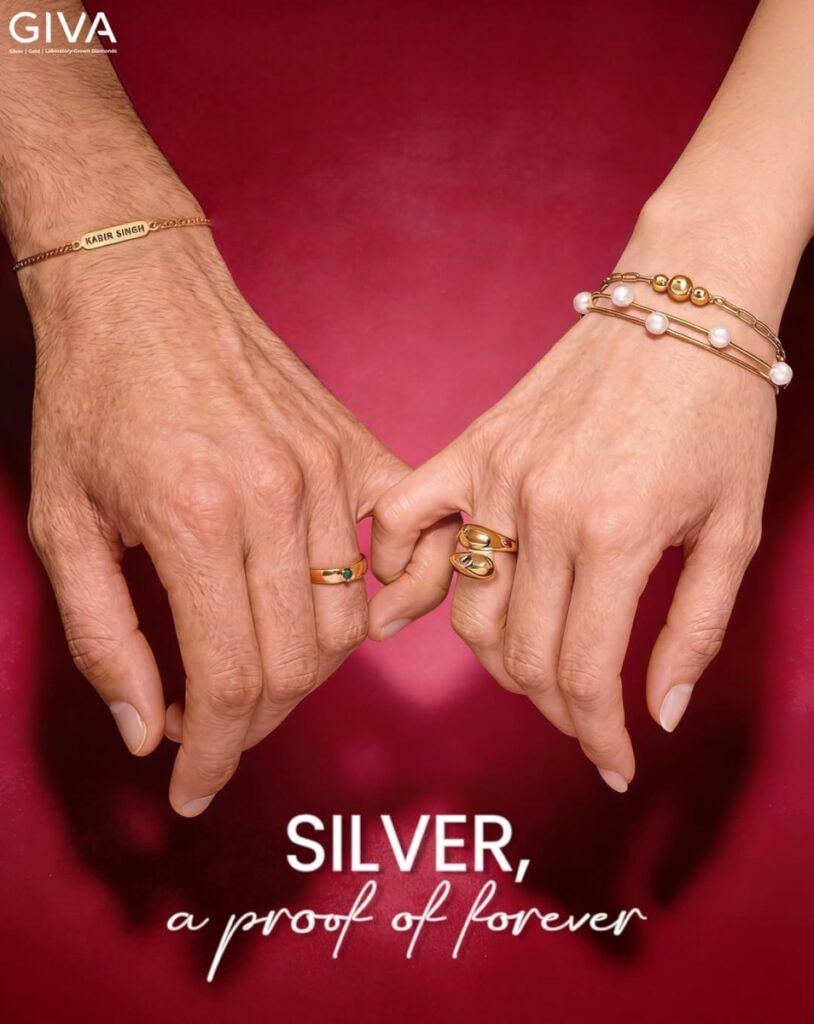

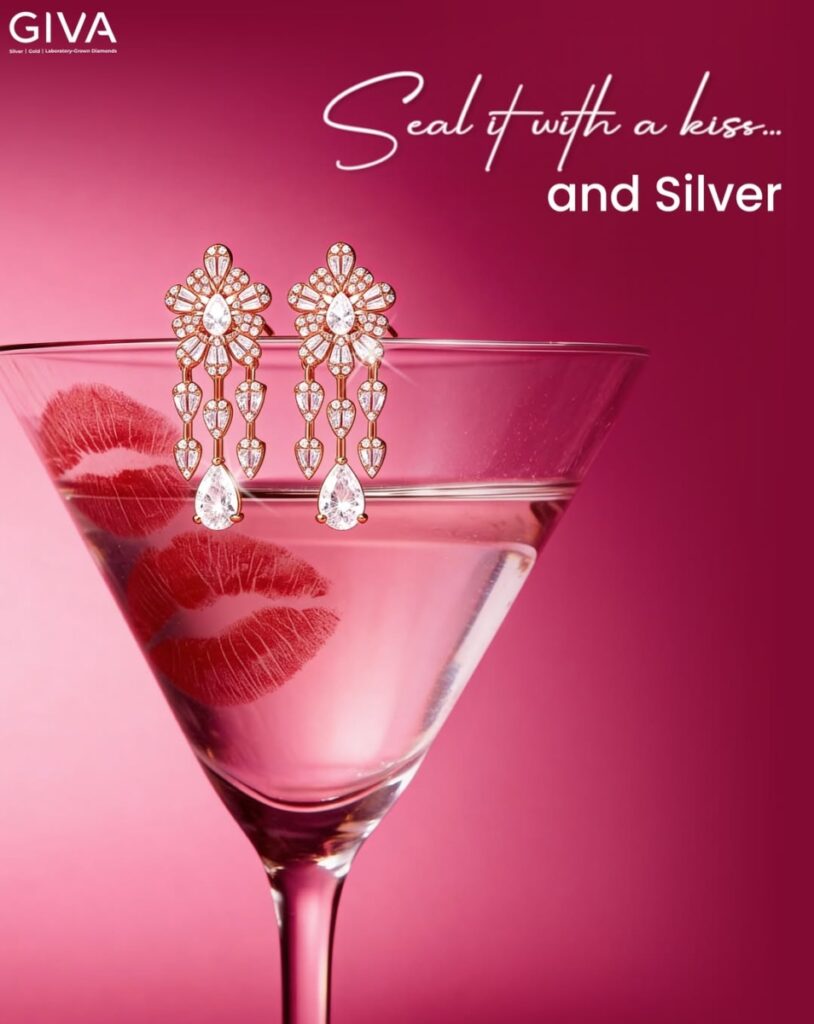

Giva

GIVA embraces youthful romance with minimalist silver and gold-plated jewellery accented by sparkling stones and heart motifs. Designed for everyday gifting, its Valentine’s range reflects accessible luxury tailored to a new generation of expressive consumers.

Divine Solitaires

This Valentine’s Day, Divine Solitaires celebrates meaningful love through its signature 8Hearts 8Arrows diamonds—where perfect symmetry and brilliance mirror the harmony of a couple’s bond.

Visible under specialised light, the rare 8Hearts 8Arrows pattern is a mark of exceptional craftsmanship and precision cutting, offering new-age couples a powerful and enduring symbol of pure, natural love.

Akoirah

This Valentine’s season, Akoirah by Augmont presents Made of Us, a design-led collection rooted in the belief that love isn’t one-size-fits-all -it is personal, layered, and quietly meaningful.

From emerald-toned lariats and wrap rings to halo studs and heart-set tennis bracelets, the collection blends intimacy with refined craftsmanship, including personalised Morse code necklaces.

Crafted in 14K recycled gold and set with lab-grown diamonds, the collection reflects Akoirah’s belief that meaningful jewellery is shaped not just by materials, but by stories and shared moments.

Lukson

Lukson introduces Love-Lore, a thoughtfully curated Valentine’s collection celebrating modern, intentional love. Crafted in luminous 18K gold vermeil with solid gold options, and adorned with SGL-certified lab-grown diamonds, the collection blends clean lines, heart motifs, and infinity-inspired silhouettes to create elegant pieces designed for everyday wear.

From delicate pendants and expressive rings to refined couple bands and bracelets, Love-Lore captures shared beginnings and lasting promises. With prices starting at ₹4,249, the collection reflects Lukson’s commitment to accessible, transparent, and sustainable luxury—offering jewellery that is both meaningful and responsibly crafted.

Jos Alukkas

Jos Alukkas presents jewellery designed to celebrate commitment and cherished moments. From classic contemporary heart-inspired pieces, to continue the brand’s offerings focus on craftsmanship and timeless romance.

How International Jewellery Houses Celebrated Love this season

For Valentine’s Day 2026, leading global jewellery brands spotlighted iconic motifs, coloured gemstones, and elevated everyday luxury, blending heritage with contemporary romance.

Platinum Guild International (PGI)

PGI promoted platinum love bands and minimalist couple jewellery, highlighting purity, rarity, and enduring commitment. Campaigns focused on modern partnerships, self-expression, and platinum’s natural white sheen as a symbol of lasting love.

Swarovski

Swarovski embraced playful romance through its heart-shaped crystal jewellery and vibrant statement pieces, spotlighting bold colours and contemporary silhouettes. The brand leaned into gifting narratives, amplifying sparkle with accessible luxury.

Chopard

Chopard highlighted its signature collections, celebrating the golden love. The maison reinforced themes of joy, femininity, and timeless elegance, paired with ethical gold craftsmanship.

Bvlgari

Bvlgari showcased its iconic collections, positioning love as bold and powerful. With striking designs, the brand celebrated passion, strength, and modern romance.Harry Winston

Harry Winston focused on its exceptional high jewellery creations, celebrating rare diamonds and timeless romance. The house underscored themes of eternal love, brilliance, and red-carpet glamour

Harry Winston

Harry Winston focused on its exceptional high jewellery creations, celebrating rare diamonds and timeless romance. The house underscored themes of eternal love, brilliance, and red-carpet glamour.

As Valentine’s Day 2026 unfolds, one thing is clear: modern love is thoughtful, expressive, and rooted in authenticity. Jewellery brands are responding with creations that go beyond aesthetics—offering pieces that symbolize shared journeys, personal values, and lasting devotion. Because today, the most meaningful gifts aren’t just beautiful—they tell a story worth keeping forever.

-

National News10 hours ago

National News10 hours agoHari Krishna Group Turns Anniversary into Contribution: 459 Units Donated, Total Blood Collection Reaches 21,863

-

Appointment13 hours ago

Appointment13 hours agoKISNA Appoints Nitin Naik as Chief Technology Officer to Drive Digital Innovation and Omnichannel Scale

-

National News11 hours ago

National News11 hours agoJos Alukkas Presents ‘Second Sunrises’

-

BrandBuzz14 hours ago

BrandBuzz14 hours agoCadbury Silk, GIVA & Blinkit’s “Say it with Silk, Seal it with GIVA” Valentine’s Campaign