JB Insights

HPJ INTERVIEW

IIJS Tritiya represents a strategic move to capitalize on the significant potential of the South Indian market, particularly leading up to the auspicious festival of Akshaya Tritiya

We create unique, rare, and exotic jewellery pieces that exemplify the skill of gold jewellery craft. Our motivation is to craft exquisite designs that capture the imagination and evoke a sense of beauty

Nikhil Parekh

Hasmukh Parekh Jewellers (HPJ) has been a trailblazer of excellence – established in 1977 at Kolkata, it is the biggest jewellery house in India that is primarily engaged in the manufacturing, exporting and wholesaling of fine gold jewellery. HPJ has been awarded the prestigious IGJA for Gold Jewellery Exporter from India for four consecutive years. Nikhil Parekh, Director, HPJ has brought a fresh perspective toward new jewellery designing, boosting the business with creative skills, dedication & strategic management. He speaks to Steve Fernandes, Chief Editor, JewelBuzz on HPJ’s journey, growth, global reach and other aspects of HPJs success story..

Four decades of excellence- a leading gold jewellery manufacturer, exporter and the wholesaler in India. Take us through this journey of HPJ —from inception to a respected, leading player that has been recognised and honoured for excellence.

HPJ’s journey from a modest Calcutta shop to a leading player in the Indian jewellery industry has been remarkable. Founded in 1977, our commitment to quality, authenticity, and customer satisfaction has propelled us forward. Through our dedication to the innovative Handcrafted Kolkata designs created by the meticulous Bengal craftsmen, we have not only earned the trust of our clients globally but also received recognition through numerous awards. Our constant drive for excellence and sticking to our core values have made us a trusted name in jewellery, shaping the industry for generations to come.

What has been your strategy for growth—from various perspectives: product development, expansion, market segmentation, going global etc?

Our contribution to HPJ’s growth and success story has been multifaceted. We have infused our brand with fresh perspectives in jewellery design, strategic management, and a relentless pursuit of excellence. With a deep understanding of ever-changing trends and demands in the jewellery market, guided by my Dad’s passionate enthusiasm for jewellery and keen eye for design, we create pieces aligned with the latest trends and perfect for every occasion. We take pride in crafting exquisite jewellery that showcases the exceptional workmanship and skill of Kolkata artisans. Through research and development, we encourage innovation, continuously sketching and experimenting with modern designs to meet the needs of both domestic and global markets. This holistic approach ensures that we stay ahead of the curve and maintain our position as a leader in the industry.

Comment on distribution network and reach in India.

At HPJ, we’re humbled by the opportunity to supply to numerous big individual retail stores and corporate houses nationwide. Our predominantly B2B model, coupled with suppliers in key locations such as Mumbai, Delhi, and Gujarat, ensures efficient distribution and widespread availability of our products. This expansive network enables us to cater to diverse market segments and meet the demands of customers across the country, reinforcing our position as a prominent player in the Indian jewellery industry.

Which global markets do you supply your products?

HPJ proudly supplies its products to a variety of global markets, we’ve been exporting our products for four decades, primarily to markets including the USA, UAE, Saudi Arabia, Singapore, Qatar, Canada, the UK, and others. Our longstanding presence in these global markets underscores our commitment to delivering quality jewellery worldwide and serving diverse clientele with our exquisite craftsmanship has garnered trust and admiration from discerning buyers across the globe, making HPJ a sought-after brand in the international jewellery landscape.

What segments of gold Jewellery do you manufacture and export? Please provide details of your main product lines?

Our focus is on promoting the handcrafted artistry of Bengal, particularly the intricate craftsmanship of Bengal goldsmiths. We exclusively manufacture Calcutta hand-made products, showcasing the unique skills and techniques of our artisans across the globe. Our main product lines encompass a diverse range of segments tailored to meet the specific preferences and tastes of each market. From traditional designs to contemporary creations, we meticulously develop our product lines according to the needs of customers, ensuring that each piece reflects the essence of its respective market segment.

From both, a domestic and global markets point of view how do you go about identifying markets, understanding Client mindsets, developing product lines, pricing etc. What is your design philosophy? How is it aligned to ever changing market and client preference dynamics?

Our design philosophy revolves around creating unique, rare, and exotic jewellery pieces that exemplify the skill of gold jewellery craft. Our motivation is to craft exquisite designs that capture the imagination and evoke a sense of beauty. We believe in blending artistry with innovation to create designs that resonate with clients both domestically and globally. To identify markets and understand client mindsets, we conduct thorough research to stay abreast of ever-changing trends and preferences. We engage with clients to gain insights into their desires, guiding our product development process to ensure our designs meet their expectations. Our pricing strategy reflects the value and exclusivity of our designs while remaining competitive in the market. Overall, our design philosophy is aligned with evolving market dynamics and client preferences, allowing us to continuously innovate and create jewellery that captivates hearts and minds worldwide.

You are a winner of four consecutive India Gems & Jewellery Awards. Comment on what it means to your organisation and how it drives you to reach newer heights of excellence.

Winning the highest Gold Jewellery Exporter from India for four consecutive years holds immense significance for us and our entire team at HPJ. In an industry marked by fluctuating market conditions and increasing competition due to factors like the introduction of CEPA in UAE and other FTAs, maintaining our position as the top exporter requires relentless effort and dedication. This accolade motivates us to push our boundaries, innovate with new designs, and stay ahead of market trends while upholding the top-notch finishing quality that HPJ is renowned for. It serves as a testament to our team’s competitiveness and commitment to excellence, driving us to continue our legacy of delivering exceptional jewellery for years to come.

Your message to the gem and jewellery industry.

Our message to the gem and jewellery industry is simple: let’s preserve the integrity of our craft by resisting the temptation to devalue our jewellery through extreme price competition. We acknowledge the challenges of operating within thin profit margins, but compromising on quality or undercutting prices can jeopardise the sustainability of our businesses for future generations. Instead, let’s embrace healthy competition based on the uniqueness and quality of our designs, not solely on pricing. By prioritising craftsmanship and creativity, we can uphold the value of our industry and ensure its longevity for years to come.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

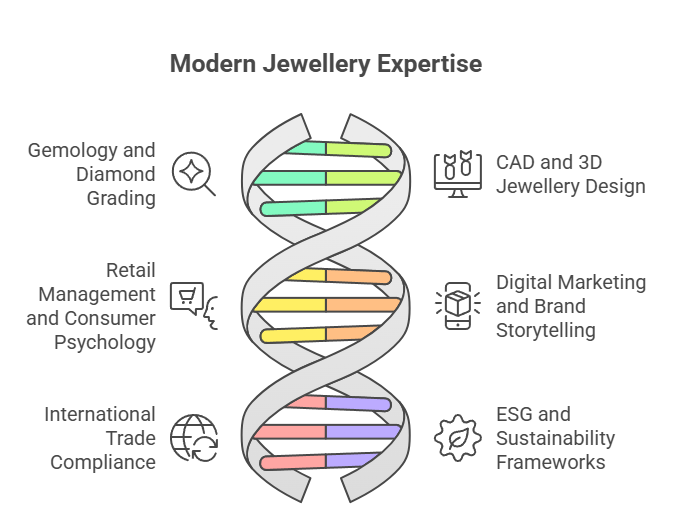

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

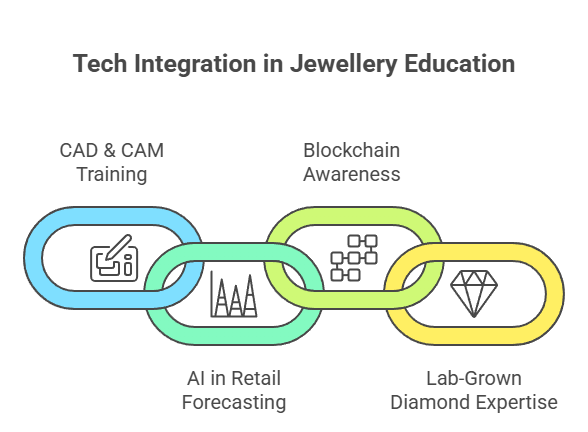

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

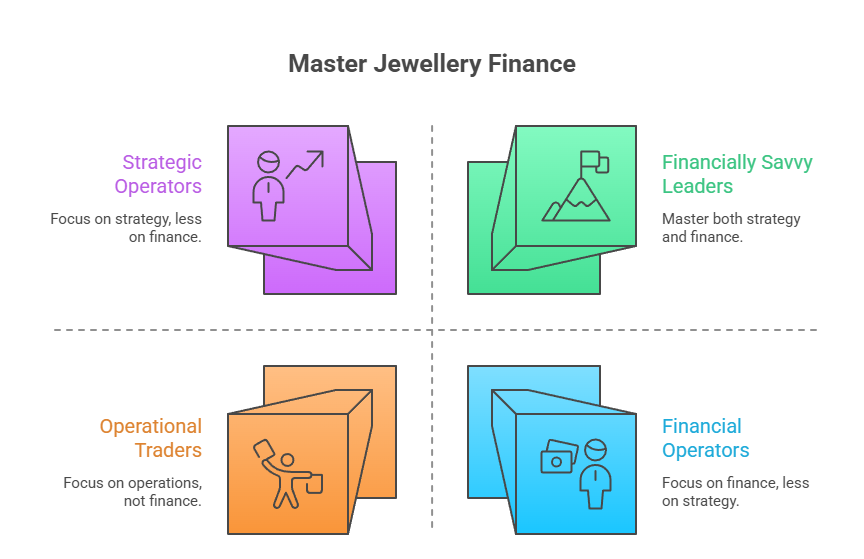

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

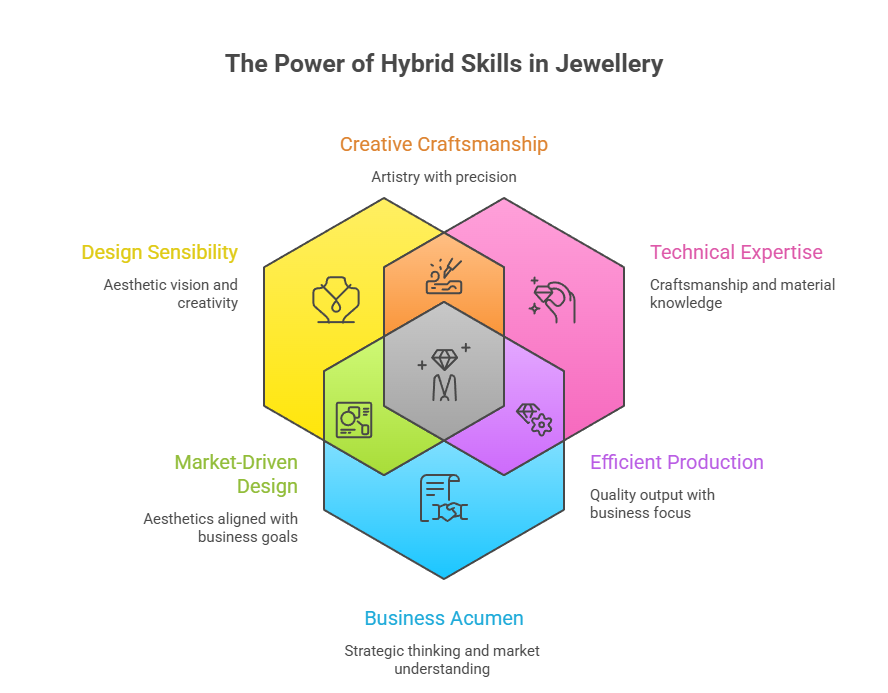

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

BrandBuzz13 hours ago

BrandBuzz13 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz14 hours ago

BrandBuzz14 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz17 hours ago

BrandBuzz17 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News18 hours ago

National News18 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression