International News

Gold Surge Lifts Top 50 Mining Companies to $1.4 Trillion Despite Base Metal Slump

Precious Metals Drive Market Rebound as Trade Tensions and Battery Metal Weakness Persist

A powerful rally in gold prices has propelled the combined market capitalization of the world’s 50 most valuable mining companies to $1.4 trillion, offsetting sharp declines in copper and lithium stocks amid ongoing global trade tensions.

The sector added nearly $80 billion in value in early 2025, partially clawing back losses sparked by new U.S. tariffs that rattled global markets. While the rebound marks a positive turn, overall mining valuations remain approximately $400 billion below their 2022 peak.

The rankings, based on data as of April 17 to avoid early-quarter market volatility, show precious metals leading the resurgence. Gold soared to a record $3,420 an ounce, reshaping the industry’s top tier. Gold-related firms now represent one-third of the Top 50’s total value, and six new companies — the highest quarterly addition since tracking began — entered the rankings, helping Canada surpass Australia in total miner valuations for the first time.

Meanwhile, copper miners bore the brunt of commodity headwinds. A steep decline in copper prices erased $53 billion in market value, pushing out names like Lundin Mining and Poland’s KGHM. Their exits made way for gold-focused entrants such as Lundin Gold, which doubled its valuation to $10.1 billion.

South African producers Harmony Gold and Goldfields also saw gains on the back of the gold boom, while Russia’s Polyus and Norilsk Nickel maintained their standings despite facing ongoing sanctions and limited global trading access.

In contrast, lithium’s decline was stark. Once represented by six companies in the Top 50, only Chilean miner SQM remains following a price collapse that decimated market caps across the battery metals space. Rare earth companies continued to struggle, with only China Northern Rare Earth retaining a spot in the rankings.

The changing composition of the Top 50 underscores gold’s growing dominance amid persistent economic uncertainty. With Uzbekistan’s state-owned Navoi Mining preparing for a high-profile IPO, more gold miners could join the elite ranks in the months ahead.

International News

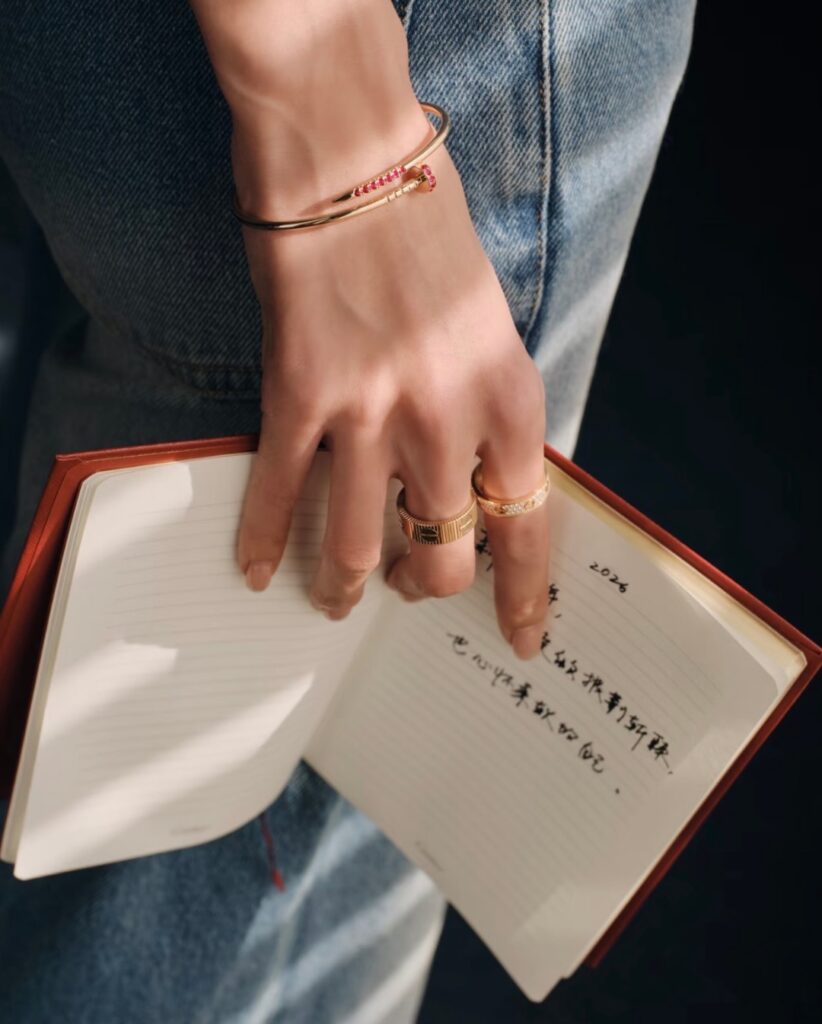

Cartier Reimagines an Icon: The Ruby-Set ‘Juste un Clou’ Debuts for Lunar New Year

A Fusion of Industrial Rebellion and Festive Elegance Marks a Limited-Edition Celebration of Luck and Prosperity.

In a bold intersection of high-fashion defiance and cultural tradition, Cartier has unveiled a limited-edition interpretation of its legendary Juste un Clou collection. This special release sees the iconic “nail” silhouette transformed with a festive row of vivid red rubies, launched specifically to commemorate the Lunar New Year.

Originally conceived in 1970s New York by designer Aldo Cipullo, the Juste un Clou has long been a symbol of the “rebellious spirit” and the elevation of the ordinary into the extraordinary. By integrating rubies—stones that traditionally symbolize luck, vitality, and renewal—Cartier effectively bridges its radical Western design heritage with the deep-rooted values of the East.

The collection features the signature wrap-around nail design in gold in bracelets, necklaces, earrings & rings with the “head” and “point” of the nail meticulously pavé-set with high-quality rubies. Industry experts view this move as a strategic masterstroke, as the “festive red” aesthetic continues to be a primary driver for luxury consumption during the spring transition.

-

BrandBuzz3 days ago

BrandBuzz3 days agoRanbir Kapoor Joins PNG Jewellers as the new Ambassador, Ushering in a New Chapter of Legacy and Modernity

-

New Premises3 days ago

New Premises3 days agoAimee Baruah Opens Grand Showroom of Manik Chand Nand Kishore Jewellers in Dibrugarh

-

National News3 days ago

National News3 days agoBakul Limbasiya Receives Prestigious APO National Award for LGD Pioneering

-

Appoinment3 days ago

Appoinment3 days agoTiffany & Co. Strengthens Leadership with David Ponzo as Deputy CEO