National News

Gold prices touchô Rs 1 lakh/10 gm mark: AUGMONT BULLION REPORT

Gold prices reached a record high of $3397 (~Rs 96747) on exchanges and nearly Rs 1 lakh in the spot market after adding 3% GST. Concerns over global economic growth as a result of the escalating Sino-U.S. trade war are driving the rise, with a weaker dollar adding to the momentum.

Fundamentally, markets are pricing in increased geopolitical risks, fueled by U.S. trade tensions and stagflation concerns, while persistent central bank demand adds to price pressures. On April 2, US President Donald Trump imposed “reciprocal tariffs” on dozens of countries, and while his administration has suspended duties for some, it has escalated its trade war with China.

China cautioned countries on Monday not to strike a bigger economic deal with the United States at its expense, a move Trump is allegedly looking for from countries seeking tariff reductions or exemptions. Meanwhile, Trump launched a slew of attacks on Federal Reserve Chairman Jerome Powell on Thursday, as his administration considers firing him.

On the geopolitical front, Russia and Ukraine accused one other of hundreds of strikes that breached President Vladimir Putin’s one-day Easter ceasefire, with the Kremlin claiming there was no instruction to extend the pause in frontline fighting.

The next potential milestone for gold could be around $3500 (~Rs 100,000) if this rally continues further, but positioning may appear crowded in the short run, and technical indications suggest near-term overbought circumstances. However, one must exercise extreme caution because prices have skyrocketed in a relatively short period. If prices fall below $3300 (~Rs 94300), profit-booking can lower prices to around $3100 (~Rs 90000). Silver prices have been trading in the range of $32 (~ Rs 94000) and $33 (~ Rs 97000) and to to continue same range in the coming week

National News

IJEX 6TH Fam providesô comprehensive insights into ME market

Five-day immersion under GJEPCãs Export Mentorship Programme equips Indian exporters with market intelligence, retail exposure, and strategic clarity across the UAE jewellery landscape.

The five-day Familiarisation (FAM) Program by GJEPCãs India Jewellery Exposition Centre (IJEX), Dubai, provided Indian jewellery exporters with comprehensive insights into the Middle East market, focusing on regional dynamics, consumer preferences, and retail environments across the UAE.

The 6th batch of the IJEX FAM Programme,ô initiatedô and facilitated under GJEPCãs Export Mentorship Programme (EMP),ô delivered a structured five-day immersion into the UAE jewellery ecosystem, combining market intelligence, design orientation,ô logisticsô guidance, and extensive retail visits across Dubai, Abu Dhabi, and Sharjah. Participants consistently highlighted the programmeãs practical value, mentorship, and clarity in building export readiness.ô

Day 1: Understanding the Middle East Landscape

The programme commenced at IJEX with an introduction session followed by a presentation on navigating the Middle East jewellery market, covering regional dynamics, consumer preferences across emirates, export opportunities, and positioning strategies across wholesale and retail segments. Delegates then visited Ithraa Wholesale & Retail, Goldcenter Building, Gold House, Jewel Plaza, Traditional Gold Souq, African Souq, and Gold Land, together representing around 475 retailers and 460 offices, giving participants a broad view of both wholesale and traditional trading ecosystems.

Day 2: New Dubai Retail and Design Insights

A designer interaction session focused on branding, cultural motifs, and regional aesthetics relevant to GCC consumers. Market visits to Mall of the Emirates, Lulu Hypermarket ã Al Barsha, Gold & Diamond Park, and Dubai Hills Mall allowed delegates toô observeô nearly 115ô jewellery retailers across luxury malls, diaspora-focused outlets, and specialised diamond boutiques, highlighting differences in merchandising, product mix, and customer behaviour.ô

Day 3: Logistics, Compliance and Market Diversity

A session by Ferrari Freight Forwarders covered import procedures, documentation, duties, and secureô logisticsô handling.ô Subsequentô visits to Dubai Mall, Dubai Design District (d3), Karama Centre, and Meena Bazaar brought delegates in contact with about 150 retailers, spanning ultra-luxury international brands to culturally driven Indian diaspora markets, reinforcing the diversity of customer segments within the UAE.ô .

Day 4: Abu Dhabi Market Explorationô

Visits to Madinat Zayed Gold Centre, Hamdan Street, and Abu Dhabi Mall coveredô roughly 132ô jewellery stores, offering insights into the capitalãs consumer preferences across luxury, traditional Arabic styles, and price-sensitive segments. Delegates reported improved clarity inô identifyingô suitable positioning and product strategies for different emirates.ô

Day 5: Strategy Alignment and Expansion

The final day focused on one-to-one consultations with the IJEX team, followed by a certificate ceremony and a visit to Sharjah Blue Souq, where delegates explored around 110 jewellery stores known for 18kt, 21kt, and 22kt gold, diamonds, and silver collections, further expanding their understanding of regional demand across the Northern Emirates.ô

Overall, participants described the programme as informative, well-organised, and strongly supportive, with several stating that the experience provided clarity, confidence, and a concrete roadmap for entering export markets through IJEX.ô

-

DiamondBuzz16 hours ago

DiamondBuzz16 hours agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz16 hours ago

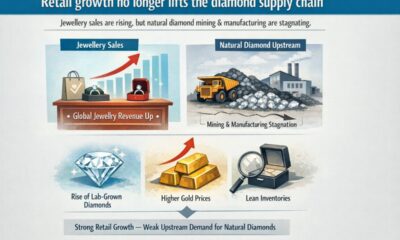

DiamondBuzz16 hours agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News18 hours ago

International News18 hours agoIndia Pavilion at HK twin shows showcases exceptional craftsmanship

-

International News18 hours ago

International News18 hours agoGold continues to get strength on the Middle East conflict