DiamondBuzz

G7 traceability mechanism implementation delayed for a second time

Plans to support diamond sanctions on Russia with a blockchain-backed traceability mechanism have been delayed for a second time.The G7 and EU nations originally intended to implement the scheme on 1 September 2024, but in June 2024 it was put back to March 2025. And last week it was delayed again, until 1 January 2026.

The announcement was made last week in the 16th sanctions package against Russia, marking the third anniversary of its invasion of Ukraine.The postponement has been widely welcomed within the industry, where many feel the introduction would otherwise be rushed and poorly planned.

The Antwerp World Diamond Centre (AWDC) said an additional 10 months would give diamond companies time to prepare properly. The new sanctions package also requires diamond traders importing rough diamonds of mixed origin to present a Kimberley Process certificate listing all countries of origin “At this stage, there is still considerable uncertainty about how the traceability system will function and how it will be governed, and the G7 must first clarify these aspects,” said CEO Karen Rentmeesters

DiamondBuzz

Botswana Diamonds rebrands as Botswana Minerals PLC

Signals a definitive shift toward copper exploration as the diamond market faces a stiff cyclical downturn.

Botswana Diamonds PLC, a long-time explorer of the world’s most famous gemstones, has officially rebranded as Botswana Minerals PLC, signaling a definitive shift toward copper exploration as the diamond market faces a stiff cyclical downturn. The name change, which took effect Feb. 27, follows a strategic review that leveraged artificial intelligence to scan the company’s massive 95,000-square-kilometer geological database. While the AI was originally designed to hunt for kimberlite pipes—the volcanic rock that hosts diamonds—it instead unearthed “outstanding” evidence of copper deposits.

A High-Tech Pivot

The company, listed on London’s AIM and the Botswana Stock Exchange, has identified 11 copper targets across the country and has already secured eight prospecting licenses. The move reflects a broader trend among junior miners seeking to capitalize on the “green metal” boom driven by electric vehicles, renewable energy, and AI data centers.

The Diamond Dilemma

The rebranding comes as the natural diamond sector grapples with two simultaneous concerns:

- Technological Disruption: Lab-grown diamonds continue to cannibalize the lower end of the market, offering consumers a cheaper alternative that is chemically identical to mined stones.

- Cyclical Downturn: Sluggish global demand and high inventory levels have dampened investor enthusiasm for natural stones.

Despite the pivot, the company is not abandoning its roots entirely. It remains one of the largest holders of exploration data in Botswana and intends to maintain its diamond acreage, betting that high-quality natural stones will eventually regain their luster.

By shifting focus to copper, Botswana Minerals (trading under the new ticker BMIN) joins a growing list of players in the Kalahari Copper Belt, a region increasingly viewed as a world-class mining frontier.

-

International News3 hours ago

International News3 hours agoGold prices in India continued to decline, modest recovery in global prices

-

DiamondBuzz20 hours ago

DiamondBuzz20 hours agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz20 hours ago

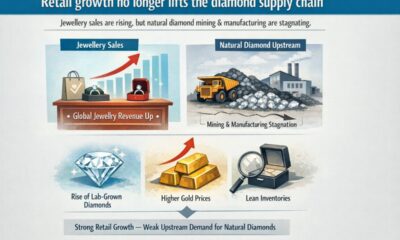

DiamondBuzz20 hours agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News23 hours ago

International News23 hours agoGold continues to get strength on the Middle East conflict