JB Insights

Future of AI in jewellery industry lies in customized, value-driven solutions

Aniruddha Pal, Co-Founder and CEO, Algoneering speaks to JewelBuzz on the present and future of AI in the jewellery industry . He underscores that success of AI hinges on collaboration, data sharing, and a deep understanding of the specific needs of each organization. By embracing these principles, the industry can unlock the full potential of AI to enhance creativity, streamline operations, and ultimately drive greater success.

AI’s Role in the Jewellery Industry

AI is revolutionizing the jewellery industry across disciplines such as designing, manufacturing, streamlining operations, and even ERP and customer solutions. Its presence is reshaping the way operations are conducted, offering new efficiencies and possibilities.

AI Integration Across Industries

AI is making its mark in every industry, from fashion to daily life operations. The jewellery industry, being layered and complex, presents unique challenges. As tech entrepreneurs, we started exploring its potential three years ago, even without a deep jewellery background.

Early Challenges in AI for Jewellery

Initially, the idea of AI designing jewellery seemed far-fetched. Today, the focus has shifted to refining and improving AI-generated designs. The industry is ideating and exploring solutions to its daily challenges, though AI adoption requires clarity on specific problem statements.

AI’s Efficiency Over Perfection

While AI may not yet meet 100% accuracy, its ability to perform even 20% of tasks with high efficiency is valuable. For instance, tools like generative AI simplify processes like content creation, saving significant time on repetitive tasks.

Customization as a Core Requirement

Every organization in the jewellery industry has unique needs and perspectives. One-size-fits-all solutions don’t work. Customization, value-driven approaches, and understanding industry-specific nuances are essential for successful AI integration.

Operational Challenges in Jewellery Manufacturing

Jewellery manufacturing involves significant manual effort, leading to potential errors and missed deadlines. Streamlining operations with AI and implementing strong SOPs can address these issues effectively.

Generative AI in Jewellery Design

Generative AI offers inspiration by creating original jewellery concepts. However, the jewellery industry requires tailored platforms that focus on creating industry-specific designs rather than relying solely on generic tools.

Building a Strong AI Ecosystem

Establishing a robust AI system requires resource allocation, team upskilling, and infrastructure development. Solely relying on AI without supporting resources is not sustainable for long-term growth.

Industry Excitement vs. Realistic Adoption

While there is significant excitement about AI in the jewellery industry, the pace of adoption is slower than expected. Awareness, resource constraints, and organizational protocols are key factors impacting progress.

Importance of Data and Democratization

For AI to thrive, the industry must focus on structured data collection and sharing while maintaining security protocols. The example of Tata Memorial Hospital democratizing MRI data highlights the potential benefits of such an approach.

AI Penetration and Resource Constraints

Penetration of AI in the jewellery sector is slow due to limited awareness and specialized resources. While large brands may have dedicated AI teams, smaller manufacturers face cost and expertise challenges.

Customization and Collaboration as the Future

The future of AI in jewellery lies in customized, value-driven solutions. It hinges on collaboration, data sharing, and a deep understanding of the specific needs of each organization. Collaborative efforts between organizations and AI developers are crucial to training machines with relevant data and building effective models.

AI’s Role in Workflow and SOPs

While AI fits well in product development and reducing design timelines, a strong SOP framework is essential to complement its capabilities. This ensures precision and efficiency in the manufacturing process.

Overcoming Initial Resistance

Early resistance to AI stemmed from data-sharing insecurities and doubts about its ability to understand jewellery-specific nuances. Gradual adoption and collaboration have improved trust and usability.

The Journey Towards Realistic AI Designs

Significant progress has been made in training AI to design realistic jewellery pieces by addressing challenges like material composition, design elements, and client customization needs.

A Vision for the Future

Customization will continue to be the key driver of AI adoption. Structured data, team skill development, and a strong AI vertical are essential for achieving efficiency and long-term success in the jewellery industry.

Collaboration for a Better Future

To unlock AI’s full potential, industry bodies and councils must support collaborative efforts. This collective approach will help create successful models and drive the jewellery industry towards a promising future.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

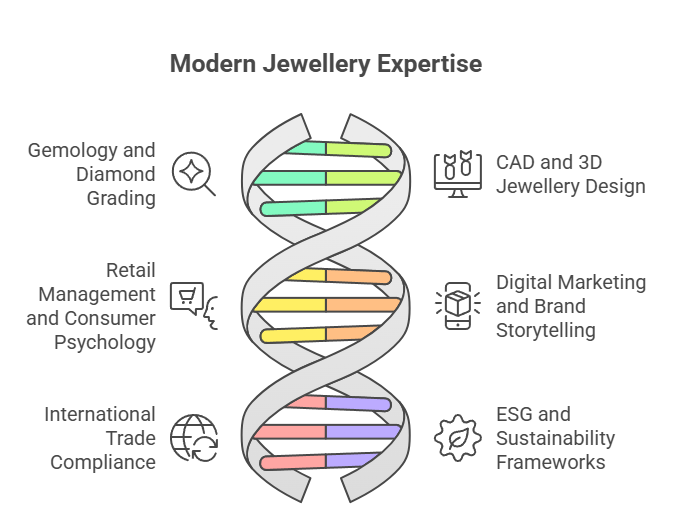

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

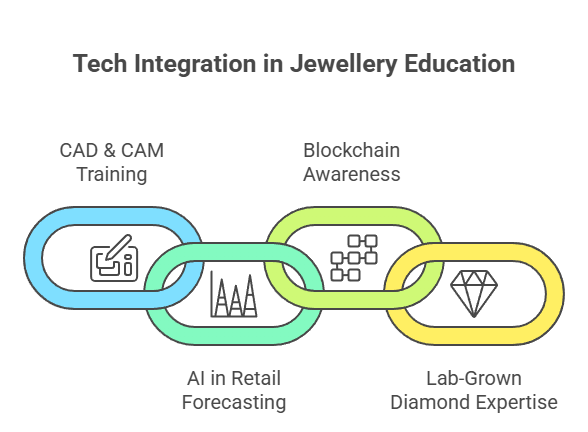

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

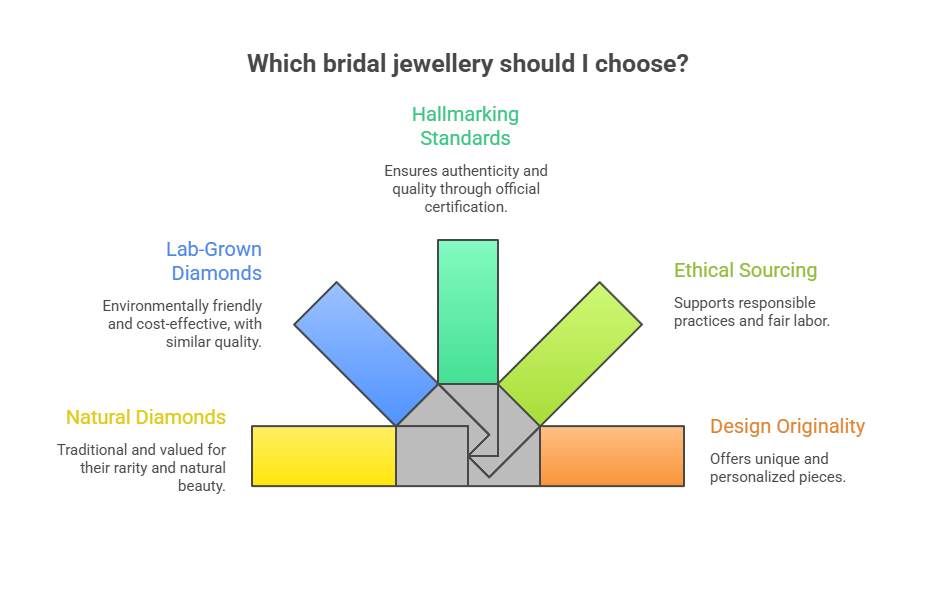

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

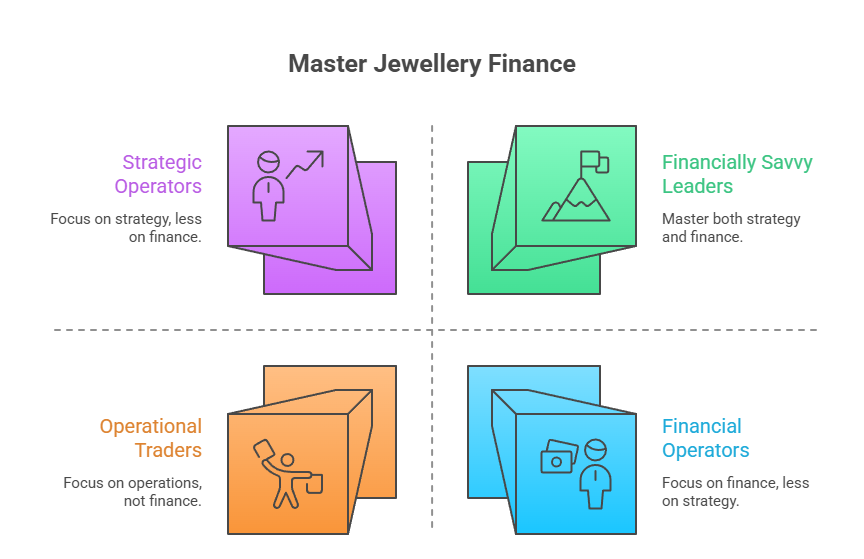

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

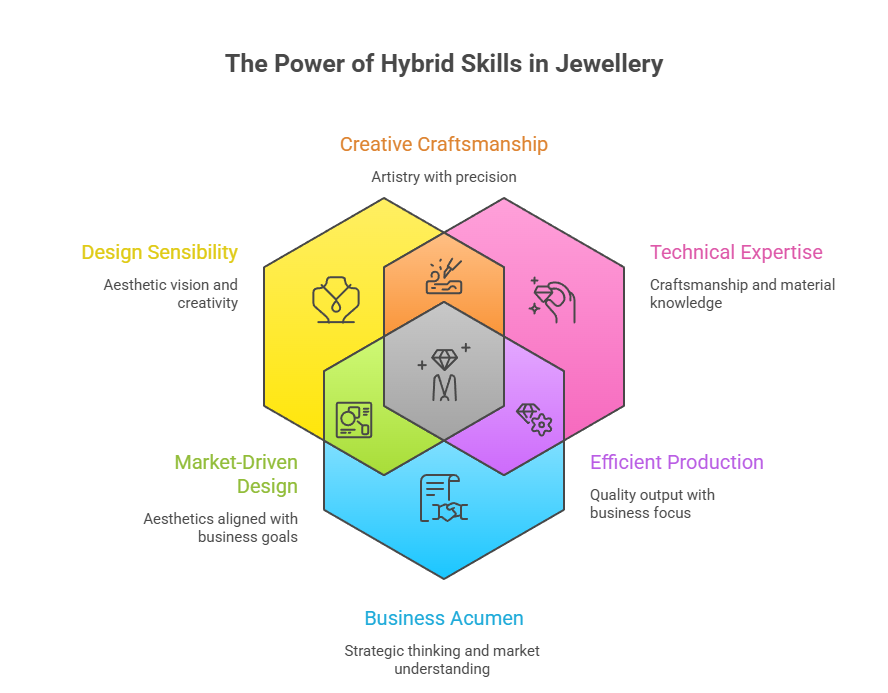

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

ShowBuzz3 days ago

ShowBuzz3 days agoIndia International Bullion Summit 2026: A Defining Platform Shaping India’s Bullion & Jewellery Ecosystem

-

International News1 day ago

International News1 day agoThe HK International Diamond, Gem & Pearl Show opens today; The HK International Jewellery Show starts Wednesday

-

International News2 days ago

International News2 days agoMiddle East Conflict Halts Global Diamond Trade in Dubai and Israel

-

GlamBuzz2 days ago

GlamBuzz2 days agoRakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds