National News

Celebrating 100 years of Bhima Jewellery:Coffee table book launched at GJS 2025 to mark Bhima Jewellery’s centenary

Trust, tradition, and timeless craftsmanship took center stage as the Indian jewellery fraternity came together to commemorate a historic moment—100 years of Bhima Jewellery. The centennial celebration was marked by the grand unveiling of a commemorative coffee table book at the prestigious GJS 2025 chronicling the illustrious journey of one of India’s most respected jewellery houses.

The book, a visual and narrative tribute, beautifully captures the evolution of Bhima Jewellery—from a modest store established in 1925 by visionary founder Bhima Bhattar to a household name synonymous with quality, trust, and excellence in jewellery.

Addressing an emotional gathering, Dr. B Govindan, Chairman of Bhima Jewellery, reflected on the brand’s humble origins in Kerala. With heartfelt reverence, he paid tribute to his father, Bhima Bhattar, whose entrepreneurial spirit and unwavering commitment to integrity laid the foundation for the century-old legacy.“This is not just a celebration of a business milestone,” Dr. Govindan said, “but a testament to the enduring values that have guided us—trust, craftsmanship, and our deep-rooted connection with our customers. I express my deepest gratitude to the entire jewellery fraternity for their unwavering love and support throughout this journey.”

Industry veterans, peers, and admirers lauded Bhima Jewellery’s role in shaping India’s modern jewellery landscape while staying true to its traditional roots. The event was a blend of nostalgia and pride, underscoring how heritage brands like Bhima continue to inspire generations in a rapidly evolving industry.

The coffee table book, rich with archival photographs, design evolution, family anecdotes, and cultural context, now stands as a collector’s piece and a symbol of enduring legacy—celebrating not just 100 years of Bhima, but also a century of trust.

Joining Dr B Govindan , Jaya Govindan and Suhas MS , MD Bhima Jewellery in the celebrations were Rajesh Rokde,Chairman GJC, Avinash Gupta Vice Chairman GJC, Saiyam Mehra IPC GJC and Convenor GJS,Sachin Jain, Regional CEO India-World Gold Council, Vaishali Banerjee, MD – Platinum Guild International (PGI), India,

Dr Chetan Kumar Mehta, President – Jewellery Division – IBJA, President – JAB, CMD Laxmi Diamonds, Bengaluru and Sumesh Wadhera, MD – AOJ Media.

National News

MCX gold rate falls below Rs.1.61 lakh, silver slips 1% on strong dollar

Rising US Dollar Index and higher US 10‑Year Treasury Yield weigh on bullion as Multi Commodity Exchange gold dips below ₹1.61 lakh and silver declines despite ongoing US–Iran tensions.

Gold and silver prices in India opened lower on Monday, following weakness in international bullion prices as a stronger dollar weighed on the prices of precious metals.

MCX gold rate today for April futures contracts opened 0.6% lower at Rs. 1,60,651 per 10 grams as against its previous close of Rs.1,61,634 level. MCX silver price for May futures contracts opened 0.29% lower at Rs. 2,67,497 per kilogram as against its previous close of Rs. 2,68,285 level. Selling pressure intensified and MCX gold and MCX silver prices were trading over 1%3.1 Dollar Strength

The US Dollar Index (DXY) rose to 99.695, hovering near a three-month high reached the prior week. Since bullion is priced in dollars globally, a stronger greenback makes gold and silver more expensive in local currencies, suppressing international demand and exerting downward pressure on prices.

US 10-year Treasury yields climbed to a near one-month high, elevating the opportunity cost of holding non-yielding assets such as gold. Investors rotating into higher-yielding fixed-income instruments contributed to the sell-off in precious metals.

A sharp rise in crude oil prices has reignited inflation concerns, causing markets to revise downward their expectations for near-term interest rate reductions by the US Federal Reserve. Delayed rate-cut prospects are bearish for gold, which typically benefits from lower real interest rate environments.

The ongoing US-Iran conflict in the Middle East escalated further during the reporting period. Iran named Mojtaba Khamenei to succeed his father Ali Khamenei as supreme leader, adding an additional layer of geopolitical uncertainty. Paradoxically, while geopolitical risks are traditionally positive for safe-haven assets like gold, the stronger dollar and rate-cut repricing dominated market sentiment, offsetting any safe-haven premium.

-

International News4 hours ago

International News4 hours agoUAE retail gold prices dropped by Dh10 per gram within a single day

-

DiamondBuzz5 hours ago

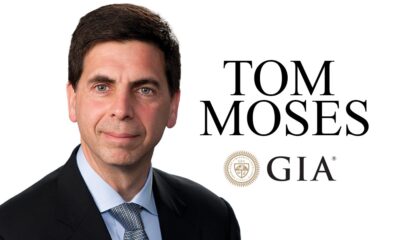

DiamondBuzz5 hours agoGIA icon Tom Moses to retire after 50-year legacy

-

National News11 hours ago

National News11 hours agoFrom Pune’s Tech Corridors to Punjab’s Fashion Capital – Gargi by PNGS Marks a Landmark Double Debut

-

National News8 hours ago

National News8 hours agoMCX gold rate falls below Rs.1.61 lakh, silver slips 1% on strong dollar