National News

Celebrating 100 years of Bhima Jewellery:Coffee table book launched at GJS 2025 to mark Bhima Jewellery’s centenary

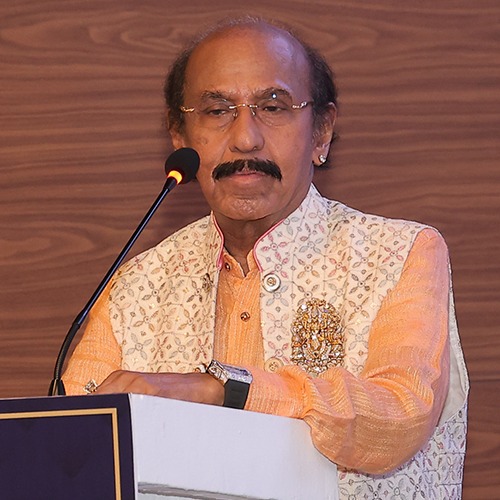

Trust, tradition, and timeless craftsmanship took center stage as the Indian jewellery fraternity came together to commemorate a historic moment—100 years of Bhima Jewellery. The centennial celebration was marked by the grand unveiling of a commemorative coffee table book at the prestigious GJS 2025 chronicling the illustrious journey of one of India’s most respected jewellery houses.

The book, a visual and narrative tribute, beautifully captures the evolution of Bhima Jewellery—from a modest store established in 1925 by visionary founder Bhima Bhattar to a household name synonymous with quality, trust, and excellence in jewellery.

Addressing an emotional gathering, Dr. B Govindan, Chairman of Bhima Jewellery, reflected on the brand’s humble origins in Kerala. With heartfelt reverence, he paid tribute to his father, Bhima Bhattar, whose entrepreneurial spirit and unwavering commitment to integrity laid the foundation for the century-old legacy.“This is not just a celebration of a business milestone,” Dr. Govindan said, “but a testament to the enduring values that have guided us—trust, craftsmanship, and our deep-rooted connection with our customers. I express my deepest gratitude to the entire jewellery fraternity for their unwavering love and support throughout this journey.”

Industry veterans, peers, and admirers lauded Bhima Jewellery’s role in shaping India’s modern jewellery landscape while staying true to its traditional roots. The event was a blend of nostalgia and pride, underscoring how heritage brands like Bhima continue to inspire generations in a rapidly evolving industry.

The coffee table book, rich with archival photographs, design evolution, family anecdotes, and cultural context, now stands as a collector’s piece and a symbol of enduring legacy—celebrating not just 100 years of Bhima, but also a century of trust.

Joining Dr B Govindan , Jaya Govindan and Suhas MS , MD Bhima Jewellery in the celebrations were Rajesh Rokde,Chairman GJC, Avinash Gupta Vice Chairman GJC, Saiyam Mehra IPC GJC and Convenor GJS,Sachin Jain, Regional CEO India-World Gold Council, Vaishali Banerjee, MD – Platinum Guild International (PGI), India,

Dr Chetan Kumar Mehta, President – Jewellery Division – IBJA, President – JAB, CMD Laxmi Diamonds, Bengaluru and Sumesh Wadhera, MD – AOJ Media.

National News

Government adds 7 new districts for mandatory gold hallmarking, taking total to 380

New Delhi, March 5, 2026 — In a decisive step towards fortifying consumer safeguards and elevating transparency in the precious metals ecosystem, the Central Government has promulgated the Hallmarking of Gold Jewellery and Gold Artefacts (Amendment) Order, 2026, effective March 2, 2026. This pivotal amendment, issued by the Ministry of Consumer Affairs, Food and Public Distribution and published in the Official Gazette, revises the territorial annexure originally established under the 2020 Hallmarking Order.

The notification substitutes the prior district schedule with an optimized, expanded framework, progressively incorporating additional jurisdictions to achieve broader nationwide coverage. As part of the sixth phase of phased implementation, this update integrates seven new districts—Rupnagar (Punjab), Banda (Uttor Pradesh), Beed (Maharashtra), Gomati (Tripura), Katihar (Bihar), Beawar (Rajasthan), and Neemuch (Madhya Pradesh)—elevating the total number of districts under mandatory BIS hallmarking to 380.

This calibrated expansion aligns with the Bureau of Indian Standards (BIS) Act, 2016, and follows extensive stakeholder consultations, underscoring the Government’s commitment to public interest priorities. In notified districts, all gold jewellery and artefacts must now bear the authoritative BIS hallmark, encompassing the BIS logo, precise purity grade (covering 14K to 24K caratages), and requisite identification marks. This standardized certification mechanism effectively mitigates adulteration risks, empowers informed consumer decision-making, and fosters greater accountability across the gold value chain.

Building on successive amendments—including the most recent prior update in July 2025—the 2026 Order accelerates the phased mandate initiated in 2021, transitioning from initial coverage of 256 districts towards comprehensive penetration in tier-2 and tier-3 markets. The initiative reinforces trust in domestic gold transactions amid elevated commodity prices and positions India’s jewellery sector for enhanced global competitiveness through uniform quality assurance protocols.

Industry participants in the newly designated districts are advised to expedite alignment with BIS certification and assaying requirements to ensure seamless compliance and uninterrupted operations.

This forward-looking regulatory measure reaffirms the Government’s proactive stance in delivering value-driven consumer protection while driving sustainable growth in one of India’s cornerstone retail and cultural sectors.

-

International News1 day ago

International News1 day agoPrecious Metals Face Macro Headwinds Amid Persistent Inflation and Geopolitical Uncertainty: AUGMONT BULLION REPORT

-

International News1 day ago

International News1 day agoPlatinum Jewellery demonstrates resilience amidst record price rally

-

National News1 day ago

National News1 day agoM P Ahammad, Chairman of Malabar Group, Conferred Maharashtrian of the Year Award 2026 by Maharashtra CM Devendra Fadnavis

-

International News1 day ago

International News1 day agoBullion Dips in India Despite Safe-Haven Demand as Dollar Firms