National News

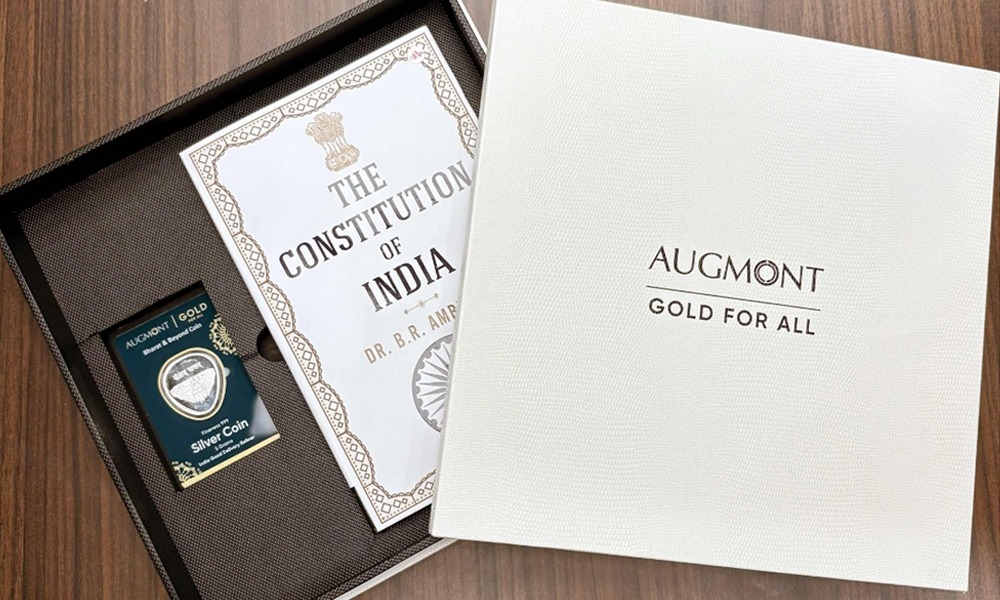

Augmont Launches Limited Edition ãBharat and Beyondã Silver Coin Kit

Commemorating Indiaãs 75th Republic Day anniversary

Pioneers in the Gold Industry, Augmont is launching limited edition Silver Coin Kit with the theme ãBharat and Beyondã to commemorate Indiaãs 75th Republic Day

Meticulously crafted by Augmont, the ãBharat and Beyond Silver Coin Kitã isnãt just a collectorãs item; it is a symbol of the nationãs extraordinary progress, celebrating the milestones in technology, healthcare, education, and infrastructure that have shaped the ãBharatã we see today.

This exclusive ãBharat and Beyond Silver Coin Kitã offers a unique commemorative experience, featuring a 5-gram 999 purity silver coin that symbolises Indiaãs progress, a copy of ãThe Constitution of Indiaã book by Dr. B.R. Ambedkar, reflecting the countryãs democratic foundation, and a selection of Augmont goodies, adding a special touch to this.

This thoughtfully curated kit serves as a tribute to Indiaãs achievements while preserving the essence of its cultural and democratic heritage.

Sachin Kothari, Director at Augmont said ãThe commemorative silver coin kit celebrates Indiaãs (Bharat) advancements over the past decade in sectors such as technology, healthcare, education, and infrastructure.

ãIt also serves as a symbol to inspire both present and future generations to continue fostering growth and development, carrying forward the flame of innovation.ã

The Bharat and Beyond coin design draws inspiration from two iconic symbols of India’s governance and cultural heritage: the recently built New Indian Parliament building and the Sengol.

The New Parliament building, representing Indiaãs vibrant democracy, stands as a symbol of strength, inclusivity, and progress in shaping Indiaãs future. And the Sengol, an ancient symbol of power and justice, reflects Indiaãs rich cultural legacy and the continuity of leadership.

Together, these elements embody Bharatãs journey of growth, bridging its glorious past with its ambitious future as it emerges as a global powerhouse leading innovation in technology, healthcare, education, and infrastructure.

National News

IJEX 6TH Fam providesô comprehensive insights into ME market

Five-day immersion under GJEPCãs Export Mentorship Programme equips Indian exporters with market intelligence, retail exposure, and strategic clarity across the UAE jewellery landscape.

The five-day Familiarisation (FAM) Program by GJEPCãs India Jewellery Exposition Centre (IJEX), Dubai, provided Indian jewellery exporters with comprehensive insights into the Middle East market, focusing on regional dynamics, consumer preferences, and retail environments across the UAE.

The 6th batch of the IJEX FAM Programme,ô initiatedô and facilitated under GJEPCãs Export Mentorship Programme (EMP),ô delivered a structured five-day immersion into the UAE jewellery ecosystem, combining market intelligence, design orientation,ô logisticsô guidance, and extensive retail visits across Dubai, Abu Dhabi, and Sharjah. Participants consistently highlighted the programmeãs practical value, mentorship, and clarity in building export readiness.ô

Day 1: Understanding the Middle East Landscape

The programme commenced at IJEX with an introduction session followed by a presentation on navigating the Middle East jewellery market, covering regional dynamics, consumer preferences across emirates, export opportunities, and positioning strategies across wholesale and retail segments. Delegates then visited Ithraa Wholesale & Retail, Goldcenter Building, Gold House, Jewel Plaza, Traditional Gold Souq, African Souq, and Gold Land, together representing around 475 retailers and 460 offices, giving participants a broad view of both wholesale and traditional trading ecosystems.

Day 2: New Dubai Retail and Design Insights

A designer interaction session focused on branding, cultural motifs, and regional aesthetics relevant to GCC consumers. Market visits to Mall of the Emirates, Lulu Hypermarket ã Al Barsha, Gold & Diamond Park, and Dubai Hills Mall allowed delegates toô observeô nearly 115ô jewellery retailers across luxury malls, diaspora-focused outlets, and specialised diamond boutiques, highlighting differences in merchandising, product mix, and customer behaviour.ô

Day 3: Logistics, Compliance and Market Diversity

A session by Ferrari Freight Forwarders covered import procedures, documentation, duties, and secureô logisticsô handling.ô Subsequentô visits to Dubai Mall, Dubai Design District (d3), Karama Centre, and Meena Bazaar brought delegates in contact with about 150 retailers, spanning ultra-luxury international brands to culturally driven Indian diaspora markets, reinforcing the diversity of customer segments within the UAE.ô .

Day 4: Abu Dhabi Market Explorationô

Visits to Madinat Zayed Gold Centre, Hamdan Street, and Abu Dhabi Mall coveredô roughly 132ô jewellery stores, offering insights into the capitalãs consumer preferences across luxury, traditional Arabic styles, and price-sensitive segments. Delegates reported improved clarity inô identifyingô suitable positioning and product strategies for different emirates.ô

Day 5: Strategy Alignment and Expansion

The final day focused on one-to-one consultations with the IJEX team, followed by a certificate ceremony and a visit to Sharjah Blue Souq, where delegates explored around 110 jewellery stores known for 18kt, 21kt, and 22kt gold, diamonds, and silver collections, further expanding their understanding of regional demand across the Northern Emirates.ô

Overall, participants described the programme as informative, well-organised, and strongly supportive, with several stating that the experience provided clarity, confidence, and a concrete roadmap for entering export markets through IJEX.ô

-

DiamondBuzz4 minutes ago

DiamondBuzz4 minutes agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz54 minutes ago

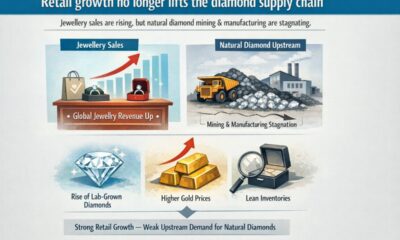

DiamondBuzz54 minutes agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News2 hours ago

International News2 hours agoIndia Pavilion at HK twin shows showcases exceptional craftsmanship

-

International News3 hours ago

International News3 hours agoGold continues to get strength on the Middle East conflict