By Invitation

You asked, we answered: Gold hits $3,000 – What comes next?

Gold Reaches New Heights: What the $3,000 Milestone Means for the Future of the Market

Key highlights

- Gold’s new milestone: Gold recently crossed US$3,000/oz intraday – a headline-worthy event, but the true significance for gold lies in the broader economic trends driving its rise

- Price momentum: Gold surged from US$2,500/oz to US$3,000 in just 210 days, pushing it three standard deviations above its 200-day moving average

- Market fundamentals: While gold may face some consolidation due to the speed of its latest move, the combination of geopolitical and geoeconomic uncertainty, rising inflation, lower rates and a weaker US dollar continue to provide powerful tailwinds to investment demand.

Gold (briefly) breaks through another psychological level

Gold crossed US$3,000/oz in intra-day trading during the early hours of Friday 14 March and then again on Monday 17 March.1 While the LBMA Gold Price PM hasn’t officially crossed the mark, setting at US$2,996.50/oz on Monday, it has nonetheless grabbed the attention of investors and media outlets around the world, triggering a myriad of questions about its significance.

So, what does this milestone really mean? Depending on who you ask: a lot or not much at all. For us, there are interesting psychological and technical aspects about this triple-zero ending price that could influence gold’s short-term behaviour. But the more meaningful – and lasting – dynamics are the ones behind gold’s performance over the past several months.

What’s meaningful about gold’s move?

Gold reached more than 40 new all-time highs in 2024 and fourteen more so far this year.2 Its upward move has been no coincidence and, in our most recent Gold Market Commentary, we talked about a potential perfect storm forming for gold. The focus isn’t just the number itself but the pace at which gold has reached it. The jump from US$2,500/oz to US$3,000/oz took just 210 days – a notably faster move that underscores the momentum gold has built over the past two years (Chart 1). Compare that to the approximate 1,700 days that gold took, on average, to achieve previous US$500/oz increments, and the move stands out (Table 1).

In fairness, gold had to double in price to go from US$500/oz to US$1,000/oz, while it only had to rise 20% to go from US$2,500/oz to US$3,000/oz. To provide additional context, gold has increased nearly sixfold since December 2005, when it first reached US$500/oz, equivalent to an annualised return of 9.7%. Over the same period, the S&P 500 spot index has increased at a rate of 8.2% per year.3

To take this relative movement into account, we look instead at how much gold has deviated from its 200-day moving average (200DMA). The recent rally has pushed gold’s price three standard deviations (3σ) above the long-term average spread of its 200DMA (Chart 2). Most recently, we saw this extreme divergence during the COVID-19 pandemic in 2020 when gold crossed US$2,000/oz and again around the time gold reached US$2,500/oz. Following these moves there was a period of consolidation before the upward trend eventually resumed.

What’s next?

As the saying goes, “even strong rallies need to catch their breath.” Gold has remained, on average, above previous multiples of US$500/oz for nine days before pulling back (Table 1). At the same time, however, gold has rebounded above the same level in just a few days four out of five times.

From a technical and positioning standpoint, if gold were to remain above US$3,000/oz over the next couple of weeks, it would likely trigger additional buying from derivatives contracts. For example, we estimate there is roughly US$8bn in net delta-adjusted notional in options contracts from US gold ETFs that expire Friday 21 March,4 and US$16bn in options on futures that expire on 26 March. While this may create a slingshot effect, it could also trigger short-term-profit taking.

In view of the speed of gold’s latest move, it would not be surprising to see some price consolidation. But despite potential short-term volatility, the most important determinant for gold’s next move is whether fundamentals can provide long-term support to its trend. As we discussed in our recent Gold Demand Trends, while price strength will likely create headwinds for gold jewellery demand, push recycling up and motivate some profit taking, there are many reasons to believe that investment demand will continue to be supported by a combination of geopolitical and geoeconomic uncertainty, rising inflation, lower rates and a weaker US dollar.

By Invitation

A fun, practical New Year note for jewellery business owners

Wishing You a Healthier, Happier & Wiser 2026 – By Shivaram A

A new year arrives with a new set of—what else—New Year resolutions. And 2026 is no different.

Resolution makers, beware. Research says nearly 80% of New Year resolutions collapse by mid-February. There’s even a name for it: the second Friday of January is officially called Quitters’ Day.

So, here’s the uncomfortable question: Do you want 2026 to be any different, or should we just block your calendar till Quitters’ Day?

If your answer is a serious yes, then it boils down to two things:

- What exactly do you want?

- How badly do you want it?

Because let’s be honest intentions are cheap. Discipline is expensive.

If you’re still reading, congratulations. You haven’t quit yet.

Most business resolutions sound familiar: higher sales, higher profits (or much higher profits), more stores, more customers. And yes—higher gold and silver prices too. On that one, we have very little control… though prayers are always welcome!

But for 2026, let’s look beyond only business numbers and focus on three areas that quietly decide your long-term success.

1. A Healthier You in 2026

A typical day before 2025 (you may recognise this): Late wake-up. Late breakfast. Reaching the store by 11 am—or noon on a “busy” day. Vendor meetings. Lunch at 3 pm. Evening snacks at 6 pm. Endless cups of chai. Store closes at 9 pm. Dinner at 10:30 pm. Netflix or phone scrolling. Sleep well past midnight.

Not everything applies—but enough of it does to make you uncomfortable.

The result? Low energy, rising health reports, and a body that protests quietly… until it doesn’t.

Resolution for a Healthier 2026

Start with a complete health check-up. Think of it as your personal P&L statement—it shows your condition on one specific day.

Identify what I like to call “golden furniture” in the body—parts that have stopped moving but still occupy space.

Then act:

- Better food (not fancy diets)

- Regular movement (not heroic gym resolutions)

- Better sleep (yes, even for business owners)

Warning: Change will be uncomfortable. But so is ignoring the problem.

Set SMART health goals—Specific, Measurable, Achievable, Realistic, Time-bound.

2. A Happier You in 2026

Let’s admit it—becoming happier has rarely featured on a jeweller’s resolution list.

Resolution for a Happier 2026

Make happiness intentional, not accidental.

Start with something simple: one family dinner or friends’ meal every week.

According to the World Happiness Report (based on over 1,50,000 people), those who regularly eat with others report:

- Higher life satisfaction

- More positive emotions

- Fewer negative emotions

One strict rule: phones stay away. If the phone joins the table, happiness leaves early.

3. A Wiser You in 2026

You’ve built a successful business. The numbers prove it. Experience, instinct, and industry knowledge have served you well.

But the world is shifting—fast.

AI. Agentic AI. AI Agents. (And yes, everyone is still figuring out the difference.)

People deep in this space believe AI may have a bigger impact than the internet itself.

The real question is not whether AI will affect jewellery retail—but whether you’ll learn early or catch up late.

For traditional business owners, the willingness to learn and apply new tools is the new unfair advantage.

A Simple 2026 Resolution Action Plan

| Action Area | Example | Final Status – 31.12.2026 |

| Healthier | 30 minutes movement daily | Achieved / Not Achieved |

| Happier | Weekly family dinner | Achieved / Not Achieved |

| Wiser | One AI implementation | Achieved / Not Achieved |

No overthinking. No complex dashboards. Just honest tracking.

Ready to make 2026 different?

If you want help converting good intentions into clear action plans—for health, happiness, or business wisdom—I’m happy to help you think it through.

Let’s ensure you’re still on track after Quitters’ Day.

Here’s wishing you a Healthier, Happier & Wiser 2026.

Call or WhatsApp on 90360 36524

Email: RetailGurukul.com

Jb Exclusive : Digital View

-

DiamondBuzz14 hours ago

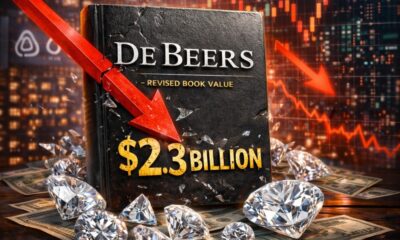

DiamondBuzz14 hours agoAnglo American cuts book value of De Beers to $2.3bn, reflects a convergence of structural and cyclical pressures

-

National News14 hours ago

National News14 hours agoHari Krishna Exports Mumbai Celebrates Annual Sports Day 2026 with Enthusiasm

-

DiamondBuzz15 hours ago

DiamondBuzz15 hours agoBAFTA 2026: De Beers Group- Desert Diamonds Emerged as the Jewellery Story of the Night

-

News16 hours ago

News16 hours agoIndia Pavilion showcases country’s finest jewellery craftsmanship at Inhorgenta Munich, Germany