JB Insights

VICENZAORO JANUARY 2025 confirms its success as leading international business and networking platform

The show saw 1,300 brands, increase in international attendance and buyers from 145 countries

Vicenzaoro January 2025, the event of reference for the global jewellery industry and the starting point of the sector’s global calendar. The edition not only confirmed last year’s exceptional numbers, it also touched the international dimension record: in fact, foreign visitation – greater than that of Italians – reached the extraordinary participation number of 145 countries from all over the world , with Turkey, the United States, Germany, Spain and Greece in the lead and interesting increases in countries such as North Korea and Australia.

“We have won the internationality challenge,” commented Corrado Peraboni, CEO of Italian ExhibitionGroup, in regard to Vicenzaoro January 2025. “Several years ago, we decided to develop our leading products abroad. A successful strategy that has decisively increased foreign visitation at our most important events in Italy.”

Matteo Farsura, head of IEG’s gold and jewellery division, underlined: “With 1,300 brands and the involvement of the entire jewellery supply chain, from technologies to haute joaillerie, Vicenzaoro confirms its position as a global platform of reference, favouring dialogue among the different segments to meet the needs of the various markets.

US retailers were out in force at the Italian Exhibition Group (IEG) event staged in the Vicenza show. In attendance were buyers from leading companies, such as Macy’s, Neiman Marcus, Saks Off 5th, Ben Bridge Jeweler, Diane Glynn Jewelry, and Manfredi Jewels.

“Vicenzaoro was a fruitful experience where I filled some orders and discovered unique, well-crafted jewelry,” Lisa Vinicur of Pennsylvania-based Diane Glynn Jewelry told Rapaport News. “I specifically sought important pieces like bangles, earrings, necklaces, and rings that are only available in Vicenza, and I’m pleased to say I found them.”

“Although the venue had construction happening, [the organizers] increased the signage to make the show easy to navigate,” said Nina Bruno of Macy’s, based in New York. “We are always shopping for new inspiration in chains. We were pleased to see fresh manipulations in chains and innovative diamond cutting.”

Laura Barringer, Seattle-based senior buyer at Ben Bridge Jeweler, said the brand refilled all of its core selections and resourced and created a new collection it hoped to launch this spring. Managing partner of New York-based Manfredi Jewels Bianca Chiappelloni explained that part of the show’s draw is the ability to access Italian companies in one place. “It’s been beneficial for us to visit with so many of our Italian brands, in most cases seeing a much more complete and fuller showcase of their offerings than we see at some of the shows in the US,” she said

Vicenzaoro was held in conjunction with T.Gold, which showcased the excellence of the sector’s technologies (a T.Gold that, thanks to the Expo Centre’s expansion, will be staged inside the Vicenzaoro areas as of the second half of 2026), and VO Vintage, the fine vintage watch show, and the collaboration with Vicenza Municipality at VIOFF, the experiential off-show event that involved guests from all over the world.

A “rhythm” of business and innovation that never stopsbut continues for twelve months a year in a unicum of Italian Exhibition Group appointments and jewellery & fashion projects all over the world. IEG’s agenda will see OROAREZZO in May, SIJE in Singapore in July, Vicenzaoro September at the end of the summer (and the return of VO’Clock Privé) preceded by the new Vicenza Symposium, the Valenza Jem Forum in October, JGTD Dubai in November, and the Italian Jewellery Summit in Arezzo in December.

JB Insights

IIJS Premiere 2025 to Set Record with Global Reach and a Strong Focus on Sustainability

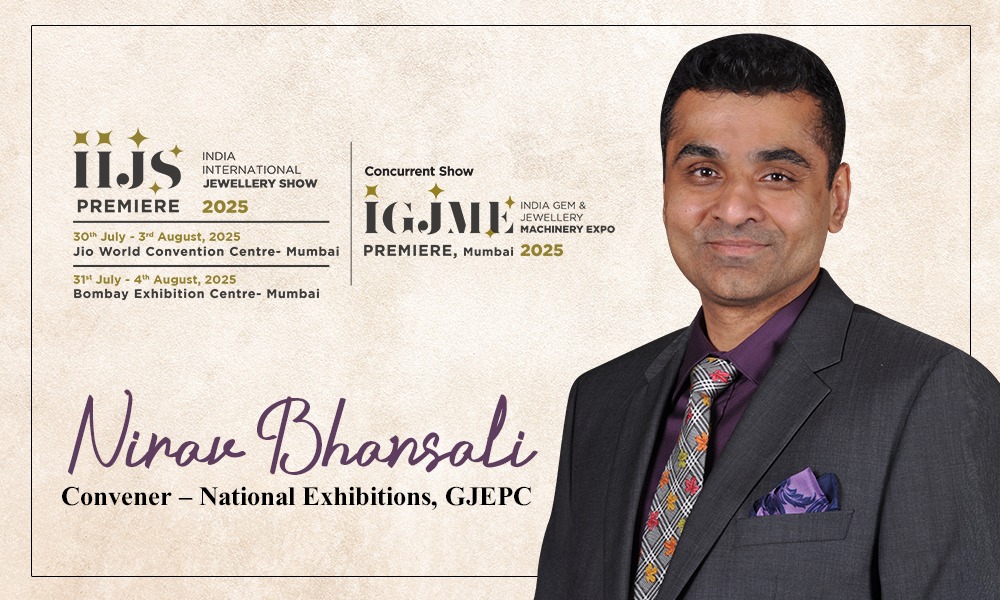

Nirav Bhansali, Convener – National Exhibitions, GJEPC, speaking to JewelBuzz, highlighted the impressive scale of IIJS Premiere 2025, the energy and enthusiasm fuelling its preparations, the aggressive promotional strategies driving its reach, IIJS Promise and the comprehensive ESG initiatives that underline GJEPCs commitment to sustainable and responsible growth.

Size and scale of IIJS Premiere 2025

We are very excited about the upcoming edition of IIJS Premiere 2025, which is generating considerable enthusiasm and energy across the industry. This will be the largest-ever IIJS Premiere, featuring 2,200 participants and over 3,800 booths.

Beyond its scale, the show will see notable expansions across key segments. The colorstone and silver sections are both being significantly enhanced to better showcase the depth and diversity of offerings. The Select Club is also expanding to 313 booths, reflecting growing interest from leading brands. Additionally, the machinery section has grown impressively and will now host over 400 booths.

Overall, this edition will not only welcome a number of new participants, but also see many existing exhibitors increase their booth spaces, underscoring the continued confidence and commitment of the industry to the IIJS platform.

Robust attendance from domestic and international visitors

We are confident of achieving strong attendance at the upcoming edition, projecting around 65,000 visitors from approximately 600 to 800 cities across India. In addition, we anticipate a significant international presence, expecting at least 15 official delegations. Around 3,000 to 4,000 international visitors are expected from 60 countries.

Most of the key markets that traditionally participate in IIJS are confirmed to attend. This includes visitors from the United States, countries across the Asia Pacific region, and the MENA region, as well as the entire GCC. Notably, we will be welcoming a sizeable delegation from Saudi Arabia, alongside delegations from Bangladesh, Sri Lanka, and Nepal. Will be welcoming a delegation from the UK, as well as delegations from the Far East, including Thailand, Vietnam, and Korea.

Overall, these projections reflect the show’s strong international appeal and its critical role as a premier networking and sourcing platform for the global gems and jewellery industry.

Multi-faceted promotional campaign

For IIJS Premiere 2025, we’ve launched an extensive and multi-faceted promotional campaign designed to maximize reach and engagement. Our strategy integrates both traditional and cutting-edge approaches to ensure no stone is left unturned in attracting key buyers and visitors.

We’re executing a robust schedule of roadshows, including international roadshows, specifically targeting global attendees. Simultaneously, our door-to-door campaigns are reaching out to a broader local audience.

A significant focus this year is our digital presence. Recognizing the increasing savviness of the new generation on social media and digital platforms, we are significantly intensifying our efforts on the digital front. This shift ensures we are effectively engaging with contemporary audiences. Our approach is a 360-degree promotional platform, leaving no channel unutilized.

This comprehensive outreach includes leveraging call centers, WhatsApp messaging, and Instagram messaging, among other diverse communication channels. Through these varied methods, we are actively reaching out to every single prominent buyer relevant to IIJS Premiere 2025, ensuring maximum participation and success.

Knowledge sessions

We’re excited to announce that InnovNXT will run concurrently with IIJS Premier 2025, offering an invaluable addition to the exhibition experience. This dedicated knowledge and networking platform will host three to four sessions daily over the five-day event.

InnovNXT is designed to provide attendees with much more than just business opportunities. Participants can expect to learn extensively, foster new connections, and explorecollaborations. The sessions will offer significant takeaways, not only enhancing business prospects but also enriching attendees with valuable industry knowledge and expanding their professional networks.

IIJS Promise

We are proud to introduce a new initiative called the IIJS Promise. Beyond facilitating business opportunities, we have identified key areas that directly influence the convenience, comfort, and overall experience of our exhibitors, visitors, and participants. By focusing on these critical aspects, we aim to make participation at IIJS truly seamless and stress-free.

Under the IIJS Promise, we are committing to measurable service standards to enhance ease of business: Fastest access and exit to and from the show, ensuring minimal wait times*Rigorous cleanliness standards, with venue facilities, including restrooms, cleaned and maintained every 20 minutes to provide a consistently pleasant environment* Booths fully set up and operational from the very start of Day 1, allowing exhibitors to focus entirely on business without last-minute delays.

ESG and sustainability

We will continue to strengthen our sustainability initiatives. So far, over two lakh trees have already been planted, and we are targeting an additional one and a half lakh trees this year, bringing the total to three and a half lakh trees. Over their lifetime, these trees are expected to generate an estimated ₹50 crores in economic value for marginalized farmers through the produce of fruits and vegetables.

In parallel, we are eliminating the use of flex prints across the show and transitioning entirely to digital or eco-friendly printing solutions. IIJS will also be powered by green energy, and we are committed to recycling plastic bottles and going paperless as far as possible to further reduce our environmental footprint.

These efforts reflect our long-term vision to not only grow the event’s scale and reach but also ensure it contributes meaningfully to environmental sustainability and social impact.By 2030 or 2032 we hope to be carbon neutral.

Conclusion

I’m extremely optimistic about the continued strong performance of the Gems & Jewellery industry. I believe the upcoming IIJS Premier 2025 will play a pivotal role in uplifting market sentiment, setting a positive tone for the entire sector for the remainder of the year.

Box item

IIJS Premiere 2025

The 41st edition of IIJS Premiere will be held across two prominent venues in Mumbai:

- Jio World Convention Centre (JWCC), BKC from 30th July to 3rd August 2025

- Bombay Exhibition Centre (BEC), Goregaon from 31st July to 4th August 2025

- 2,200+ exhibitors across 3,800+ stalls

- 135,000+ sq. mtrs. of exhibition area

- 65,000 visitors from 800+ Indian cities and 60+ countries expected

JB Insights

Shaping Gem Enthusiasts for a Global Retail Reality: Inside GSI’s Colored Stone Program

By Ramit Kapur, Managing Director GSI India

One of the recurring questions I hear from retailers, whether in the heart of Mumbai or in the luxury corridors of New York is this: Where do we find individuals who truly understand colored stones? Not just those who can name them or describe their appearance, but professionals who understand their essence. People who grasp quality, origin, treatments, pricing influences and most importantly, how all of it directly impacts customer trust and retail flow.

Too often, gemology education ends at surface-level theory. Students know the textbook answers but lack the confidence to apply that knowledge when faced with a real-world stone. That’s because being a gemological professional is never about just one thing; it’s a sum of many factors. Theory is essential, but without hands-on exposure, it stays abstract. Practical lab experience should be backed by a mindset that encourages critical thinking and pattern recognition. Add to that real-world exposure, problem-solving under pressure, and the ability to communicate insights clearly and you begin to shape someone truly capable.

A Lab-Driven Approach to Learning

That’s the exact gap GSI set out to address when we created the Colored Stone Professional (CSP) Diploma Program.

With our global expertise, advanced instrumentation, and access to live inventory, we are in a special position to build a course that doesn’t just skim the surface, but goes deeper, one that stands out in a sea of generic gemology programs. Our vision is to go beyond just another degree course and create professionals of the very standard we’d want to hire for our own labs: accurate, efficient, thoughtful. And once trained, whether they choose to become designers, sourcing leads, retail trainers, or full-time gemologists, the world becomes their oyster.

Our approach to this course is not purely academic. We built it from the inside out; as industry participants who live this work every day. GSI, as a global laboratory, examines gemstones daily from all major trading centers. Our experts are constantly updated; researching detection techniques, documenting treatment trends, and working with inventories that reflect the full range of market realities. With that vantage point, we are set to solve a real industry problem: the widening gap between gemological knowledge and real-world application.

The CSP Difference

I could write an entire book on why this course is different. And honestly, I can’t stress enough the value of learning from a global laboratory like GSI that is connected to daily realities across continents. That makes GSI a platform reflecting something much deeper than theory, it reflects practice, insight, and precision. So while I could list countless strengths of the Colored Stone Professional (CSP) Diploma, here are a few that I believe define its true character.

First, the practical exposure is unmatched. Students don’t just “learn” stones, they work with 800 gemstones across the span of the course. It’s a curriculum-integrated journey that helps them observe and identify inclusions, verify treatments, and understand what those treatments mean in real market conditions.

Then comes instrumentation. Students get the opportunity to attend advanced lab sessions, where they experience GSI’s state-of-the-art instrumentation firsthand, and understand its applicability. When they see how and why FTIR, UV-Vis, and advanced spectroscopy are used, they begin to appreciate the rigor behind every report.

We also take them to the source. Our mine visits aren’t just field trips. They’re reality checks. Students see rough material in its natural environment, understand how value begins at origin, and how supply chain complexities play out from mine to market. They grasp pricing at the root, not just from the price tag on a finished piece.

And finally, perspective. We bring in industry veterans for open sessions. These are not scripted lectures, they’re candid conversations. Students are encouraged to ask, challenge, and absorb insights from people who’ve spent decades in design, manufacturing, trading, and retail. The result is perspective rooted in reality.

International curriculum with a domestic blend.

The CSP diploma program has been carefully curated by some of the finest minds in the gem and jewelry world;not just in India, but globally. Our team includes global experts who ensure the curriculum remains current, rigorous, and industry-relevant across borders. It’s updated frequently to reflect the latest market realities, treatment discoveries, and sourcing challenges. The diploma itself is issued from our headquarters in New York, giving our graduates global credibility and recognition.

Through the CSP diploma program, we are building professionals who can sit across from a buyer and explain why two seemingly similar stones have a vast price difference, or why a particular origin commands a premium. That’s the kind of clarity that transforms retail experiences and builds trust. By the end of the program, every graduate stands at par with a fresher gemologist, equipped not only for technical positions but also to bring value in retail, sourcing, manufacturing, or design. In fact, designers who complete our program often find themselves pitching better, sourcing smarter, and delivering with far greater conviction.

JB Insights

Gold Prices May Touch ₹1 Lakh in H2 2025 Amid Strong Investment Demand: ICICI Report

Gold prices in India are expected to trend higher in the second half of 2025, potentially reaching the ₹1,00,000 per 10 grams mark, according to a report by ICICI Bank Global Markets. Prices are currently trading in the range of ₹96,500 to ₹98,500 per 10 grams, but are forecasted to edge upward due to sustained investment demand and a mild depreciation in the Indian Rupee.

“Local gold prices are expected to continue trading with an upside bias, moving from a near-term range of ₹96,500–₹98,500 to the ₹98,500–₹100,000 range in H2 2025,” the report stated.

In June, domestic gold prices rose by 0.6% despite a global slowdown in momentum, supported by a 0.2% decline in the rupee. However, jewellery demand showed signs of weakening, with gold imports declining from USD 3.1 billion in April to USD 2.5 billion in May.

Investment demand, in contrast, remains strong. AMFI data showed net inflows of ₹2.92 billion into gold ETFs in May, following two months of outflows. Globally, SPDR Gold ETF holdings increased from 930 tonnes on June 1 to 948 tonnes by July 1, and speculative net long positions rose by 13,000 lots.

Despite gold’s YTD gains of 28%, prices have remained flat in recent weeks due to improving global risk sentiment. Key geopolitical developments, including a ceasefire between Israel and Iran and progress on U.S. trade agreements with the UK, Vietnam, Japan, India, and the EU, have eased safe-haven demand.

“The upshot is that easing geopolitical tensions and expectations that trade-war 2.0 could ease in magnitude have worked to limit further sharp upside emerging in gold prices,” the report noted.

While jewellery demand remains soft, strong investment-related buying continues to underpin the yellow metal’s upward momentum.

-

New Premises2 weeks ago

New Premises2 weeks agoMalabar Gold & Diamonds Inaugurates Landmark Integrated Manufacturing Site in Hyderabad, Cementing Its Position as a Global Manufacturing Leader

-

National News2 months ago

National News2 months agoEmmadi Silver Jewellery Launches First Karnataka Store with Grand Opening in Bengaluru’s Malleshwaram

-

BrandBuzz3 months ago

BrandBuzz3 months agoMia by Tanishq Unveils ‘Fiora’ Collection This Akshaya Tritiya: A Celebration of Nature’s Blossoms and New Beginnings

-

GlamBuzz2 months ago

GlamBuzz2 months agoGokulam Signature Jewels Debuts in Hyderabad with Glamorous Launch at KPHB