BrandBuzz

Sri Jagdamba Pearls Unveils ‘Aurah’—Its First Lab-Grown Diamond Collection

Heritage brand embraces sustainable luxury with a modern jewellery line aimed at eco-conscious consumers

Sri Jagdamba Pearls, a heritage brand with roots dating back to the Nizam era, has made its entry into the lab-grown diamond segment with the launch of Aurah, a new collection designed for today’s environmentally conscious and style-savvy buyers.

Established in 1975 with its first store on Hyderabad’s MG Road, the brand is known for blending tradition with innovation. The Aurah line continues this legacy by offering elegant, sustainable, and affordable jewellery, without sacrificing the timeless charm that defines Sri Jagdamba Pearls.

Lab-grown diamonds have been steadily transforming the global jewellery industry, and India’s market alone is expected to surpass ₹10,000 crore by 2033. With this launch, Sri Jagdamba Pearls seeks to tap into the rising demand for ethical and responsible luxury.

“The launch of Aurah marks a new chapter for us, bringing together sustainability, beauty, and affordability for today’s discerning customers,” the company said in an official statement.

BrandBuzz

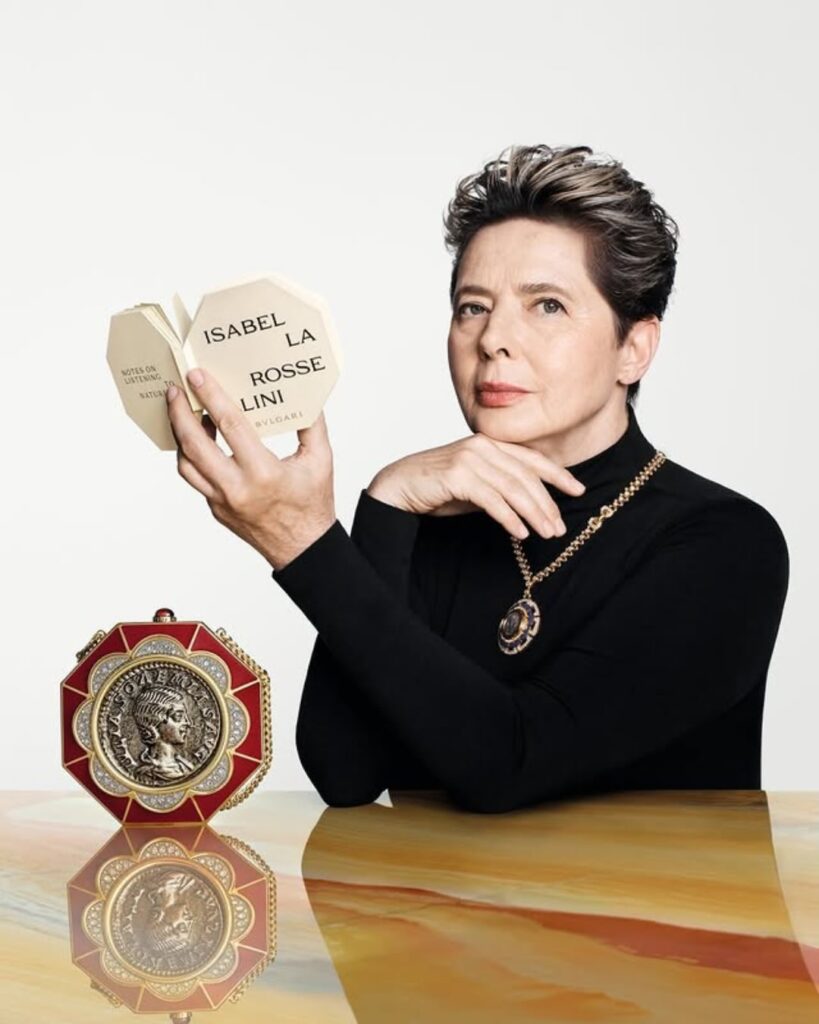

Bvlgari Debuts First Icons Minaudière Collection, Elevating Mini Bags to Collectible Art

Designed by Mary Katrantzou, these sculptural evening pieces reimagine the Roman maison’s iconic motifs with couture elegance.

Italian luxury house Bvlgari has unveiled its first-ever dedicated minaudière collection, marking a significant expansion of its evening accessories portfolio and underscoring the enduring appeal of mini bags in high fashion. Designed by Mary Katrantzou, the Icons Minaudière Collection transforms some of the brand’s most recognisable signatures—Serpenti, Monete, Tubogas, Divas’ Dream and Bvlgari Bvlgari—into exquisitely sculpted statement pieces.

Positioned at the intersection of jewellery and couture accessories, each minaudière is conceived as a collectible object rather than a purely functional bag. The designs showcase intricate detailing, refined finishes and artisanal techniques deeply rooted in Bvlgari’s Roman heritage, while presenting a contemporary interpretation of its iconic codes.

Available in limited quantities at select boutiques worldwide, the collection highlights exclusivity and craftsmanship, reinforcing Bvlgari’s commitment to artisanal excellence. The launch campaign features a diverse group of influential personalities, including Isabella Rossellini, Linda Evangelista, Chimamanda Ngozi Adichie, Kim Ji-won and Sumayya Vally, celebrating themes of strength, transformation and individuality.

With the debut of the Icons Minaudière Collection, Bvlgari further cements the mini bag’s status as a lasting luxury statement—demonstrating that compact accessories can deliver significant cultural, artistic and design impact.

-

JB Insights4 days ago

JB Insights4 days ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

BrandBuzz1 week ago

BrandBuzz1 week agoRanbir Kapoor Joins PNG Jewellers as the new Ambassador, Ushering in a New Chapter of Legacy and Modernity

-

New Premises1 week ago

New Premises1 week agoAimee Baruah Opens Grand Showroom of Manik Chand Nand Kishore Jewellers in Dibrugarh

-

DiamondBuzz3 days ago

DiamondBuzz3 days agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India