National News

Limelight Lab Grown Diamonds Redefines Valentine’s Day with Meaningful, Everyday Romance

The brand pairs symbolic diamond designs with a limited-time value offer to reflect modern love

This Valentine’s Day, Limelight Lab Grown Diamonds is embracing a quieter, more thoughtful expression of romance—one rooted in emotion & connection. Moving away from grand gestures, modern couples are choosing jewellery that carries personal meaning and lasting relevance.

Supporting this shift, the brand has introduced its Valentine’s Day Collection alongside a compelling value-led proposition, offering 26% off on diamond value plus an additional 26% off on making charges, making considered diamond gifting more accessible this season.

The collection features refined, symbolic designs including the Stellar Heart Diamond Ring, which reimagines romance through contemporary minimalism; the Heartbeat Round Diamond Chain, inspired by the rhythm of love and crafted for effortless daily wear; and the Toi et Moi Heartfelt Glow Diamond Stud Earrings, a dual-heart expression of togetherness with subtle sparkle.

Together, the collection and limited-period offer reflect how today’s couples are redefining Valentine’s Day—choosing jewellery that blends emotional meaning, everyday elegance, and smart value over one-day spectacle.

source: Limelight Lab Grown Diamonds

National News

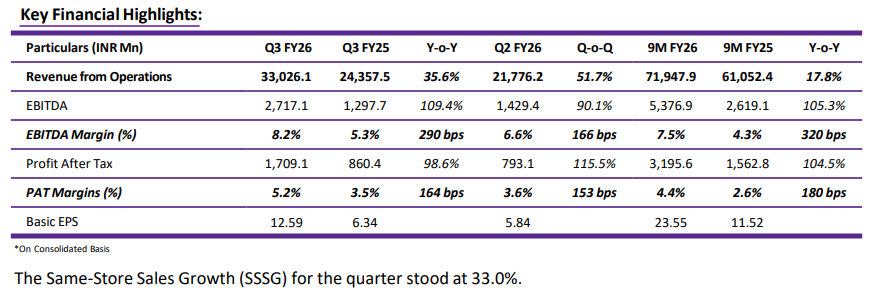

P N Gadgil Jewellers Delivers Robust 9M FY26 Performance with Revenue of ₹71,948 Mn, EBITDA Up 105.3% and PAT Growth of 104.5% YoY

Strong festive and wedding-led demand drives robust revenue growth, higher profitability, and improved store-level performance in Q3 and 9M FY26

P N Gadgil Jewellers Limited, one of the most reputed jewellers in the country, boasting around 193 years of excellence in craftsmanship and trusted service in the retail business of gold, silver, and diamond jewellery, announced its unaudited financial results for the quarter and nine months ended 31 st December, 2025.

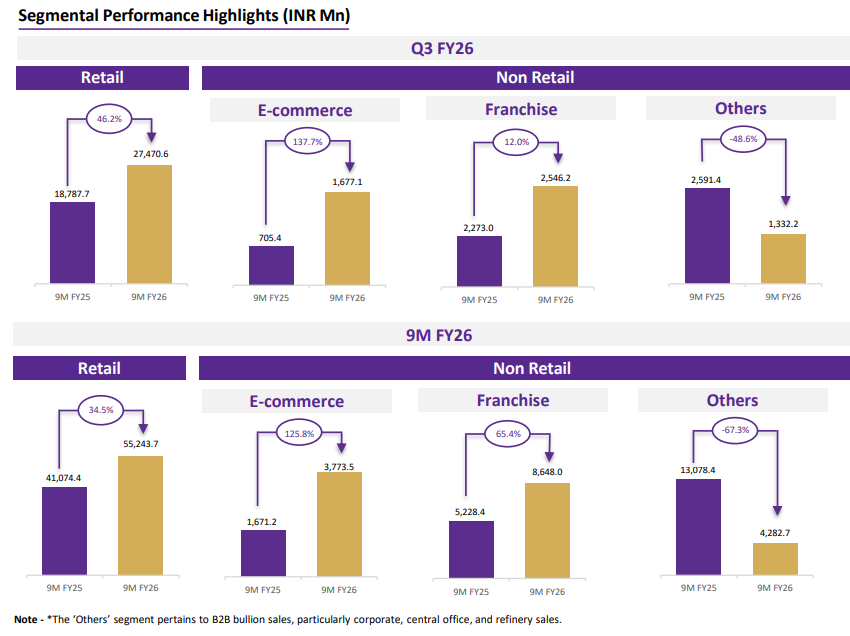

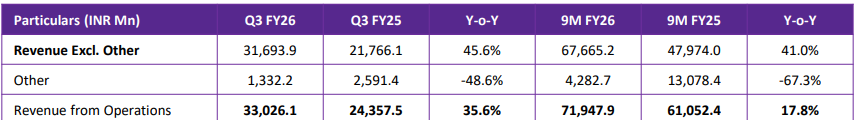

During the period under review, total revenue excluding the other segment grew by 45.6% YoY (Q3 FY26 vs. Q3 FY25) and by 41.0% YoY (9M FY26 vs. 9M FY25). The following summary presents the revenue breakdown:

• Retail segment is 83.2% of our total sales, continues to lead the way, achieving an impressive Revenue growth of 46.2% an EBITDA margin of 10.1% and a PAT margin of 6.5%.

• For 9M FY26, average revenue per store stands at around Rs. 1,090.1 million, while net profit per store reached Rs. 48.4 million, demonstrating strong efficiency and profitability at the store level.

Operational Financial Highlights

• Product-wise Performance: For nine months ended FY26, the Silver category delivered a strong performance with 96% growth in value and 56% growth in volume, while Diamond sales also improved, recording over 50% rise in volume Y-o-Y, resulting in the stud ratio reaching 8.4%.

• Festive Sales Surge: Festive sales remain a key driver of our success. Dussehra alone delivered the company’s highest-ever single-day festive sales of ₹1,900 Mn increased by 64% Y-o-Y. The company recorded festive season sales of ₹ 6,060 Mn during Diwali, registering a robust 74% growth as compared to the previous year.

• Customer Footfall and Conversion Rate: A 33% increase in footfall, coupled with a strong Conversion rate of 94%, further fuels our growth, reflecting increased Demand, customer engagement and sustained purchasing behaviour at the store level.

• Increased Transaction Count and ATV: As customer engagement continues to rise, there has been a notable uptick in both transaction volumes and average spending per visit. The transaction count grew by 35%, taking the Average Transaction Value (ATV) to Rs. 103.1k.

Commenting on the performance, Dr. Saurabh Gadgil, Chairman & Managing Director, P N Gadgil Jewellers Limited, said, “The quarter witnessed strong momentum, supported by healthy Festive and wedding-led demand. Revenue from operations increased 35.6% YoY to Rs. 33,026 Mn in Q3 FY26, despite gold price volatility. Demand remained broad-based across core markets, led by gold jewellery, new designs and an increasing preference for lightweight and studded jewellery, supported by strong brand recall and customer trust. Profitability improved significantly during the quarter, with PAT rising 98.6% YoY to Rs.1,709 Mn, supported by a favorable product mix, higher contribution from Studded jewellery, along with disciplined cost management, resulted in meaningful margin expansion. Retail continued to be the primary growth driver, complemented by strong growth in e-commerce and steady performance in the franchise segment. The Company continued to execute its expansion strategy with the addition of three new company-owned stores this quarter at Moshi (Pimpri-Chinchwad), Patna (Bihar), and Viman Nagar under the LiteStyle format, taking the Company’s total retail footprint to 66 stores as of December 2025. Going ahead, management remains focused on driving same-store sales growth, maintaining healthy inventory turns, and sustaining profitable growth, supported by continued upcoming festive & wedding led demand.”

source: PNG Jewellers

-

JB Insights2 weeks ago

JB Insights2 weeks ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India

-

JB Insights2 weeks ago

JB Insights2 weeks agoGold is Talking, Silver is Screaming – A Case for Prudent Repositioning

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoJapan, US Weigh Synthetic Diamond Facility to Strengthen Strategic Supply Chains