International News

Gold prices surged to an all-time high breaching $3,300/oz

Gold prices surged to an all-time high on Wednesday, breaching $3,300 an ounce in international spot markets for the first time as escalating U.S.-China trade tensions sent investors fleeing to traditional safe havens.

The yellow metal climbed to $3,318 per ounce in overseas trading, extending its recent rally and drawing closer to the symbolic ₹1,00,000 per 10 grams mark for 24-karat gold in India. Domestically, prices mirrored the global trend: in Delhi, gold was quoted at ₹98,100 per 10 grams by evening, while June futures on the Multi Commodity Exchange (MCX) hit a record ₹95,435.

President Trump’s directive for a probe into critical minerals added to the market anxiety, reinforcing the rush toward safe haven assets.

The sharp price escalation, however, has chilled consumer demand in India—the world’s second-largest gold market—prompting local jewelers to sell at a discount to imported prices. Gold is currently trading at a 1–2% discount to its landing cost in Indian markets.

Meanwhile, silver has trailed the gold rally. International spot prices for the white metal hovered around $32.80 per ounce Wednesday, crossing ₹1,00,000 per kilogram in Delhi, but still lagging behind gold in terms of momentum.

For now, analysts expect gold’s bullish run to persist, fueled by geopolitical uncertainty, inflation concerns, and growing investor caution.

International News

India gold prices rise, higher than in Dubai

Today, the price of 24K gold was at Rs.157,780 per 10 grams, reflecting a gain of ₹1,270 compared to its previous close. Meanwhile, 22K gold is at Rs.144,632 per 10 grams.

Gold prices in India are largely influenced by international spot gold rates, US dollar fluctuations, and import duties on gold, among other factors.

Gold prices in India continue to remain higher than in Dubai. On 11 February 2026, the price of 24K gold in India stood at Rs.157,780 per 10 grams, while in Dubai it was Rs.149,441, reflecting a difference of Rs.8,339 or 5.58%.

US gold and silver prices rose in early morning trade after falling briefly in yesterday’s session, as US Treasury bond yields declined following data showing December retail sales growth stalled, signalling a softening economy ahead of key US jobs data

-

JB Insights2 weeks ago

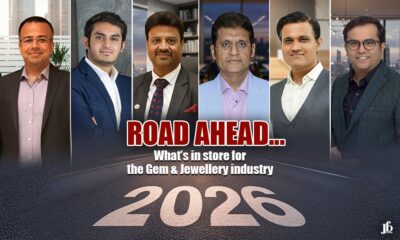

JB Insights2 weeks ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India

-

JB Insights2 weeks ago

JB Insights2 weeks agoGold is Talking, Silver is Screaming – A Case for Prudent Repositioning

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoJapan, US Weigh Synthetic Diamond Facility to Strengthen Strategic Supply Chains