National News

Gold price surges past Rs 1 Lakh/ 10 gm

In a landmark moment for the Indian bullion market, gold prices have surged past the Rs 1 lakh mark per 10 grams, reinforcing the precious metal’s status as a safe-haven investment during times of economic uncertainty. On Friday, Mumbai’s renowned Zaveri Bazaar witnessed an unprecedented rise in the price of 24-carat gold, which now stands at Rs 1,01,000 per 10 grams—marking the highest ever recorded in India’s history.

This significant increase is largely attributed to a confluence of international and domestic factors. Market experts suggest that rising global gold prices, coupled with expectations of potential interest rate cuts in the United States and Europe, have played a pivotal role in boosting demand. Additionally, a weakening US dollar and ongoing geopolitical tensions, particularly in the Middle East, have further cemented gold’s appeal among investors seeking stability in volatile times.

While this surge may be welcomed by investors, it poses a financial challenge for everyday consumers, especially during the current wedding season. As gold becomes increasingly expensive, middle-class buyers may find it harder to afford new jewellery. In fact, several gold traders have reported a noticeable dip in demand for newly crafted ornaments, with many customers choosing instead to liquidate existing gold assets to take advantage of the high prices.

Looking ahead, the trajectory of gold prices remains uncertain. If global instability continues and investor demand holds strong, experts believe that prices could climb even higher. On the other hand, some analysts foresee a potential cooling-off period, citing the likelihood of profit booking by investors who may now choose to capitalize on the recent surge.

In conclusion, the current rally in gold prices underscores the metal’s enduring significance in global and domestic markets. Whether this trend will persist or see a temporary pullback remains to be seen, but for now, gold continues to shine brightly as both an investment and a symbol of security.

National News

Neha Kishorkumar Shah, Director, Chandukaka Saraf felicitates influencers at Lokmat Women Influencer Awards

At the Lokmat Women Influencer Awards hosted by Lokmat Media Group, Neha Kishorkumar Shah honoured inspiring women leaders across fields, celebrating their impact, creativity, and contributions to society.

On the occasion of International Women’s Day, the Lokmat Media Group hosted the prestigious Lokmat Women Influencer Awards in Pune, celebrating the achievements of inspiring women who have made a meaningful impact across diverse fields.

The awards honoured women who have demonstrated exceptional leadership, innovation, and resilience—whether in business, social service, education, arts, healthcare, media, or community development.

Neha Kishorkumar Shah, Director, Chandukaka Saraf, attended the ceremony as the Guest of Honor and felicitated several distinguished women influencers for their contribution, creativity, and leadership. Neha Kishorkumar Shah is the winner of Women of Vision awards organized by JewelBuzz; a celebration was about honouring visionary women, empowered women of the GJ industry.

The evening brought together inspiring voices from diverse fields, reflecting the strength and influence of women today. A memorable celebration of achievement, inspiration, and the evolving role of women in shaping tomorrow.

Lokmat Media Group reaffirmed its commitment to promoting gender equality and empowering women who are driving meaningful change in their communities and beyond.

-

National News5 hours ago

National News5 hours agoNeha Kishorkumar Shah, Director, Chandukaka Saraf felicitates influencers at Lokmat Women Influencer Awards

-

GlamBuzz7 hours ago

GlamBuzz7 hours agoDe Beers Group Partners with Abhishek Sharma to Champion Natural Diamonds in India

-

International News8 hours ago

International News8 hours ago73rd Bangkok Gems and Jewelry Fair sets new record with 4.75 Billion Baht in trade value

-

National News10 hours ago

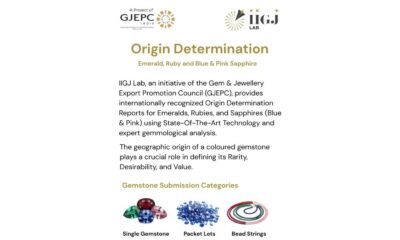

National News10 hours agoIIGJ Lab Jaipur Expands Origin Testing for Ruby, Emerald and Sapphire Lots & Strands