JB Insights

Gold is Talking, Silver is Screaming – A Case for Prudent Repositioning

A WhiteOak Capital MF Report

In the language of commodities, Gold is supposed to be the steady narrator of macroeconomic health. When it “talks”, it mainly signals geopolitical tensions, systemic risks inside or outside major global economies, and may portend currency devaluation because of the above risks. But when Silver begins to “scream”, outperforming gold with high velocity/parabolic moves, it often signals the final, speculative stage of a run; one that historically ends against investors’ best interests.

As we move through Q1 2026, the screaming has reached a fever pitch that should give every investor pause. With Gold near Rs.1,58,885/10g and Silver testing Rs.3,45,375/kg, the data suggests that for the prudent Indian investor, the most profitable move now is not to chase, but to diversify.

The Ratio Trap: Why Silver is “Expensive” in INR

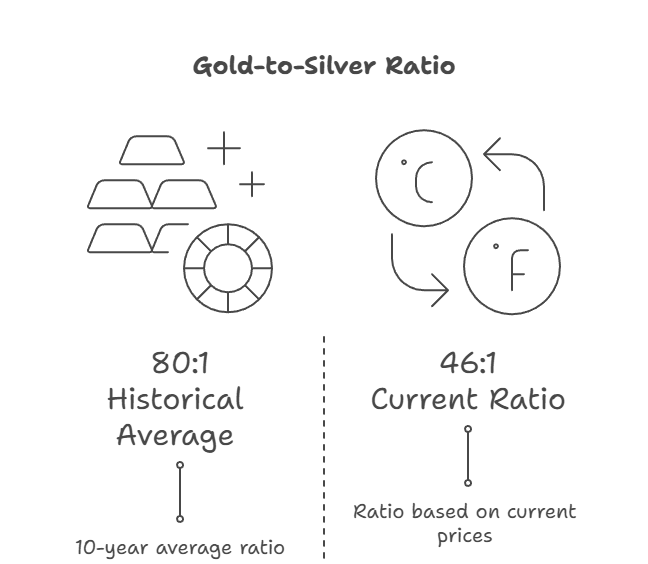

The Gold-to-Silver Ratio (GSR) measures the relative value between the two metals.

- The Compression: Based on current prices, the ratio has collapsed to approximately 46:1.

- The Warning: Historically, the 10-year ratio averages close to 80:1. When it drops below 50:1, silver is no longer cheap. In previous cycles, a ratio this low has preceded a mean reversion where silver prices corrected significantly faster relative to gold.

The Case for Indian Equities over exposure to these metals

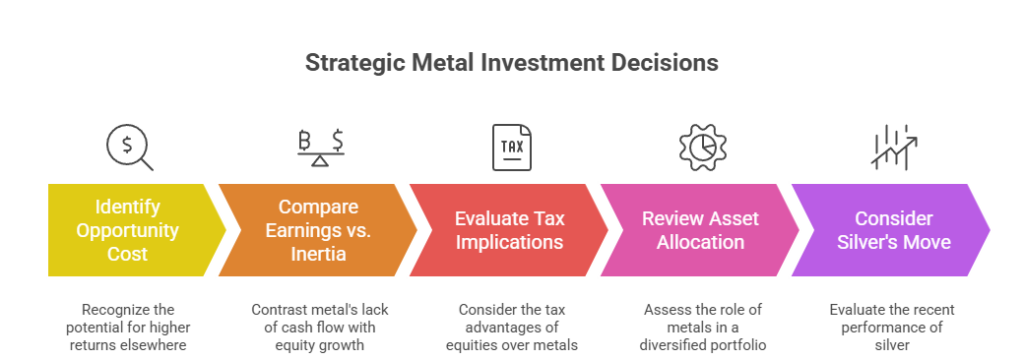

The biggest risk of holding metals at record highs is the opportunity cost.

- Earnings vs. Inertia: An ounce of gold/silver produces no cash flow. In contrast, the Nifty 50 companies reinvest profits to grow, and reward investors by returning cash (in the form of dividends), as well as through capital appreciation. Since inception, the Nifty 50 (TRI) has matched or exceeded gold’s CAGR of ~13.2% while providing far superior liquidity compared to holding physical metal.

- The Tax Alpha:In the 2026 tax landscape, Indian equities offer a Rs1.25 Lakhannual exemption on Long-Term Capital Gains (LTCG). Physical gold and silver have no such exemption and require a longer holding period to qualify for lower tax rates.

At WhiteOak, we have historically viewed Gold through the lens of asset allocation. While we previously maintained only an arbitrage position in Silver, its recent explosive move warrants a closer look at how these “insurance” assets should function in an investor’s portfolio.

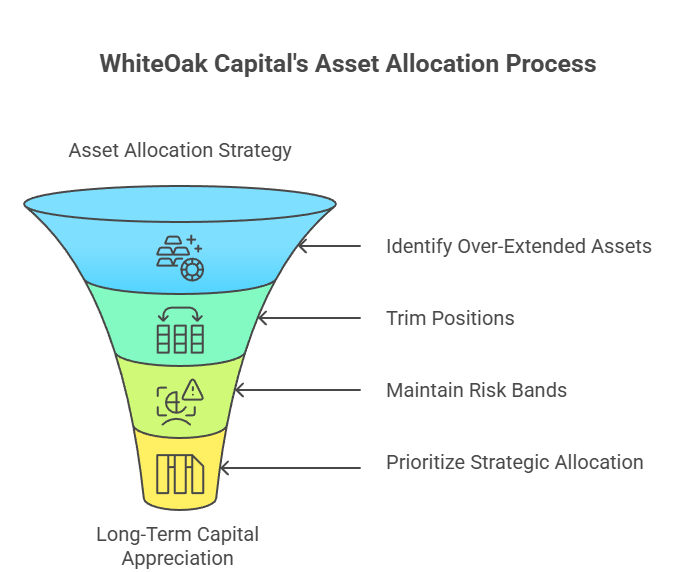

How We Manage This: The WhiteOak Capital Multi Asset Allocation Fund Approach

In MAAF, we treat gold and silver as tactical components within a broader mix of Equity and Debt.

Dynamic Rebalancing: Our objective is to generate long-term capital appreciation by investing across multiple asset classes

Current Stance: When metals “scream” as they are doing now, the MAAF framework allows us to systematically trim these positions to stay within risk appropriate bands, ensuring we aren’t exposed to a single, speculative or over-extended trade.

We may be early in trimming these positions, but staying true to our strategic allocation allows us to be nimble and prioritizes the integrity of our investment process.

The “Insurance” Framework: How much is enough?

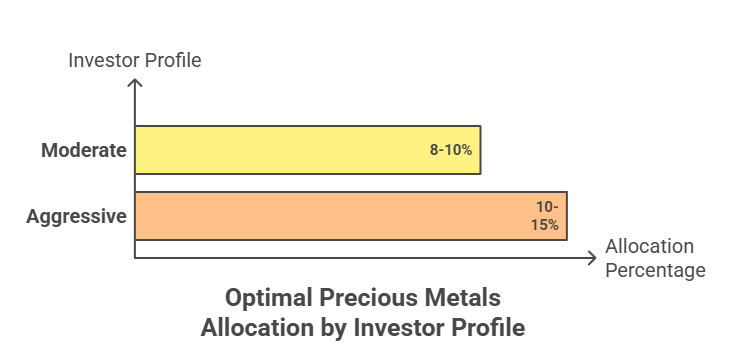

Under normal market conditions, precious metals act as a hedge against inflation, market, and any other exogenous shock. The optimal allocation depends on an investor’s risk profile.

- Moderate Investor Profile: 8%-10% – mainly to balance resilience and inflation protection

- Aggressive Investor Profile: 10%-15%: mainly tactical positioning to aid a high equity allocation

The Insurance has Worked: If an investor held these target allocations a year ago, the recent price surges mean that their portfolio is likely now overinsured, and that the allocation has likely drifted far beyond these desirable levels. This may be the optimum time to harvest the gains rather than pay for more insurance.

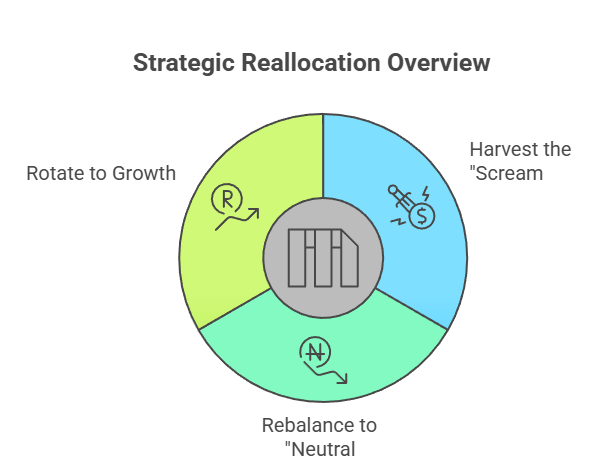

Strategic Reallocation: What to do Now

Harvest the “Scream”: Take profits on silver first, as its current valuation is the most over-extended relative to historical periods.

Rebalance to “Neutral”: Trim your precious metals back to a safe haven level in your total portfolio.

Rotate to Growth: Move harvested gains into diversified Indian equity funds or blue-chip stocks.

Final Thought: Gold and silver are essential insurance, but we don’t buy more insurance after the house has already been saved. The “screaming” in the silver market is the signal that the exit door is getting crowded. It may be prudent to move your capital to an asset that builds wealth, not one that simply waits for a disaster.

JB Insights

The JewelBuzz E-zine: Your Fortnightly Pulse of the Jewellery Industry

The JewelBuzz E-zine, A M MEDIA’s fortnightly digital publication, offers a concise yet in-depth view of the gems and jewellery landscape, delivered every 15 days. Each edition brings together key industry headlines—from policy developments and trade updates to brand launches, store expansions and major market movements—ensuring readers stay fully informed.

Created for seamless digital consumption and supported by a strong online presence, the JewelBuzz E-zine has become a preferred information hub for jewellery professionals, decision-makers and advertisers across the industry.

Over the past fortnight, the sector witnessed notable policy decisions, high-impact trade events, strategic brand growth and new product introductions—all captured in our latest issue with clarity and relevance.

Stay connected with JewelBuzz Magazine on whatsApp and across all platforms! Follow us on Instagram, stay updated through our Facebook Profile ,Facebook Page, catch the latest highlights on Twitter, and explore exclusive videos on our YouTube Channel. We’re also on LinkedIn and Pinterest – your trusted sources for the latest in jewellery trends, news, and industry updates.

JewelBuzz — delivering credible jewellery news, trends and industry intelligence.

-

JB Insights3 days ago

JB Insights3 days ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

BrandBuzz1 week ago

BrandBuzz1 week agoRanbir Kapoor Joins PNG Jewellers as the new Ambassador, Ushering in a New Chapter of Legacy and Modernity

-

New Premises1 week ago

New Premises1 week agoAimee Baruah Opens Grand Showroom of Manik Chand Nand Kishore Jewellers in Dibrugarh

-

DiamondBuzz2 days ago

DiamondBuzz2 days agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India