JB Insights

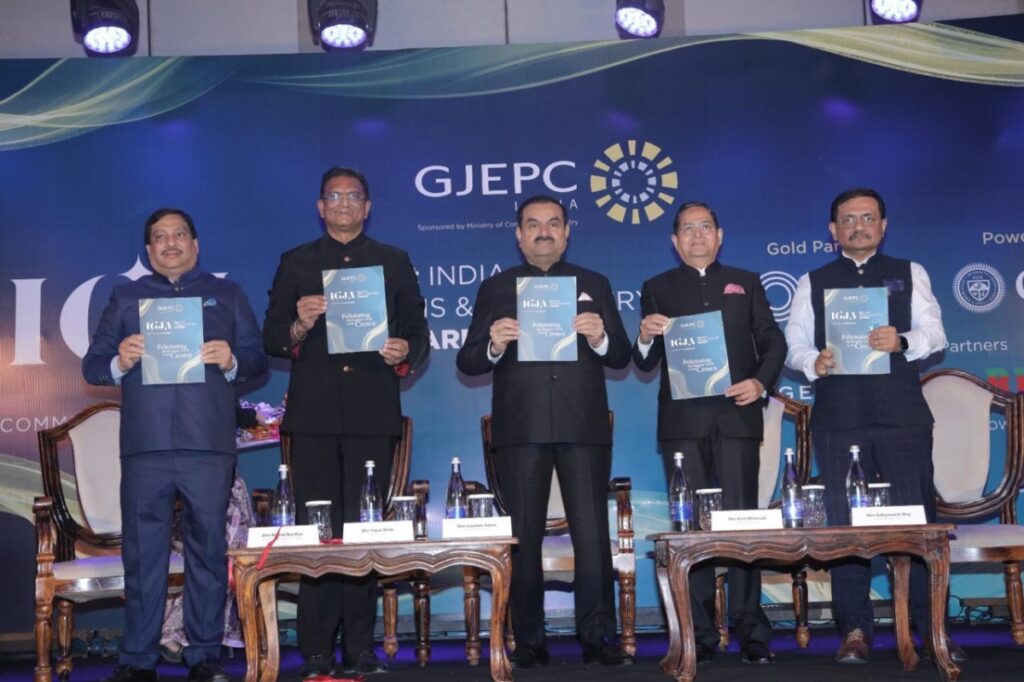

GJEPC’s 51st India Gem & Jewellery Awards held in Jaipur

Presiding Guest Gautam Adani says technology & sustainability are twin pillars of our future

Shri 24 awards presented at IGJA 2023-24

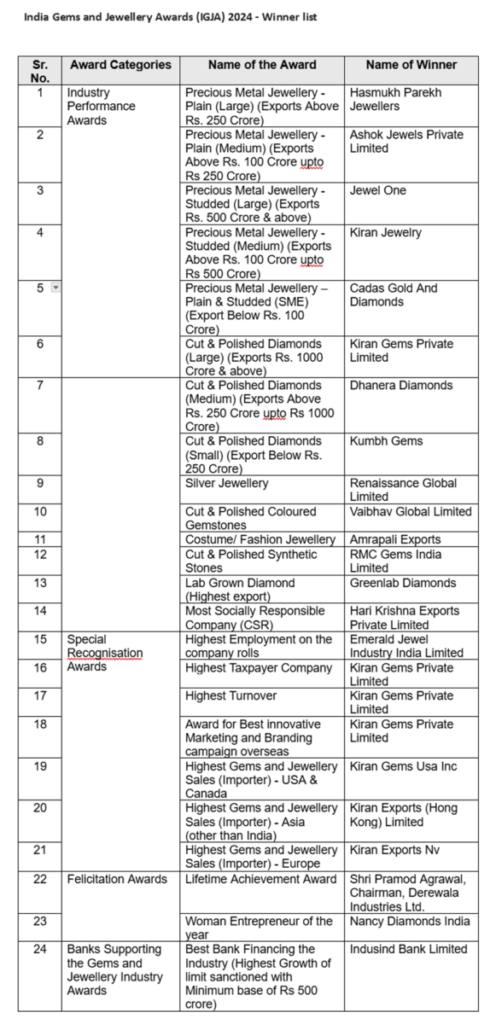

The Gem & Jewellery Export Promotion Council (GJEPC) presented the coveted 51st India Gem & Jewellery Awards (IGJA) held in Jaipur, honouring the leading exporters of the gems & jewellery industry. GJEPC presented a total of 24 IGJ Awards: 14 – Industry Performance Awards; 7- Special Recognition Awards; 2 – Felicitation Awards; and 1- Bank supporting the Gems & Jewellery Industry Awards. Pramod Agrawal (Chairman, Derewala Industries Ltd) wins the Lifetime Achievement Award

Business tycoon Shri Gautam Adani (Chairman, Adani Group) graced GJEPC’s 51st edition of the IGJ Awards as Presiding Guest. Representing GJEPC were Shri Vipul Shah, Chairman, GJEPC; Shri Kirit Bhansali, Vice Chairman, GJEPC; Shri Nirmal Bardiya, Regional Chairman, Rajasthan, GJEPC; Shri Sabyasachi Ray, ED, GJEPC, and Shri Sachin Jain, Regional CEO – India, World Gold Council and Shri Gopal Kumar, Director and General Manager, Gemfields India Pvt. Ltd was also present along with the who’s who and doyens of India’s gem & jewellery industry.

While addressing a packed hall of diamond, gem and jewellery trade, Shri Gautam Adani, Chairman, Adani Group, said, “Technology and sustainability are the twin pillars of our future. As we embrace the digital age, let’s ensure our growth is both innovative and responsible. Empowering and uplifting our skilled artisans and craftsmen with digital tools will propel our jewellery heritage to new heights. Ultimately, our youth are the architects of tomorrow. Let’s nurture their potential, and create an India that shines brightly on the world stage.”

Adani further added, “Innovation and sustainability are not just trends but the foundation for the future of the gem and jewellery industry. From advanced manufacturing techniques to smart wearables, technology is revolutionizing the jewellery industry, offering endless opportunities for customisation and connection. The gem and jewellery industry must embrace change, challenge the status quo, and adapt to evolving consumer needs to remain a global leader.”

Shri Vipul Shah, Chairman, GJEPC addressing the audience said, “Think big, innovate relentlessly, and embrace technology—the future of India’s gem and jewellery industry is brighter than ever. With robust retail growth, projects like the India Jewellery Park in Mumbai, Jaipur’s Gem Bourse, and the Bharat Ratnam Mega CFC are transforming the landscape. Supported by visionary government policies and FTAs, our industry is poised to scale new heights. Together, we can position India as a global leader in gems and jewellery, setting benchmarks for innovation, excellence, and sustainability.”

The selection criteria this year included export performance, value addition, employment generation and investment in R&D among other parameters. In recognition of the business excellence demonstrated by companies that are helping to strengthen ‘Brand India’, GJEPC not only felicitate industry players for their exemplary performance, but also recognizes entities such as banks which play a key role in the growth of the sector.

IGJA has evolved over the years to embrace new categories, including social responsibility, innovation, and entrepreneurship, reflecting the dynamic nature of our industry.

JB Insights

Women’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

From milestone-driven collections to personalised styling and self-purchase narratives, jewellery brands across India are celebrating women’s independence, identity, and achievements this International Women’s Day.

International Women’s Day 2026 has prompted jewellery brands across India to launch campaigns that celebrate women’s empowerment, individuality, and personal achievements. Moving beyond traditional gifting narratives, many brands are positioning jewellery as a symbol of self-expression and personal milestones, reflecting the evolving role of women as independent buyers in the jewellery market.

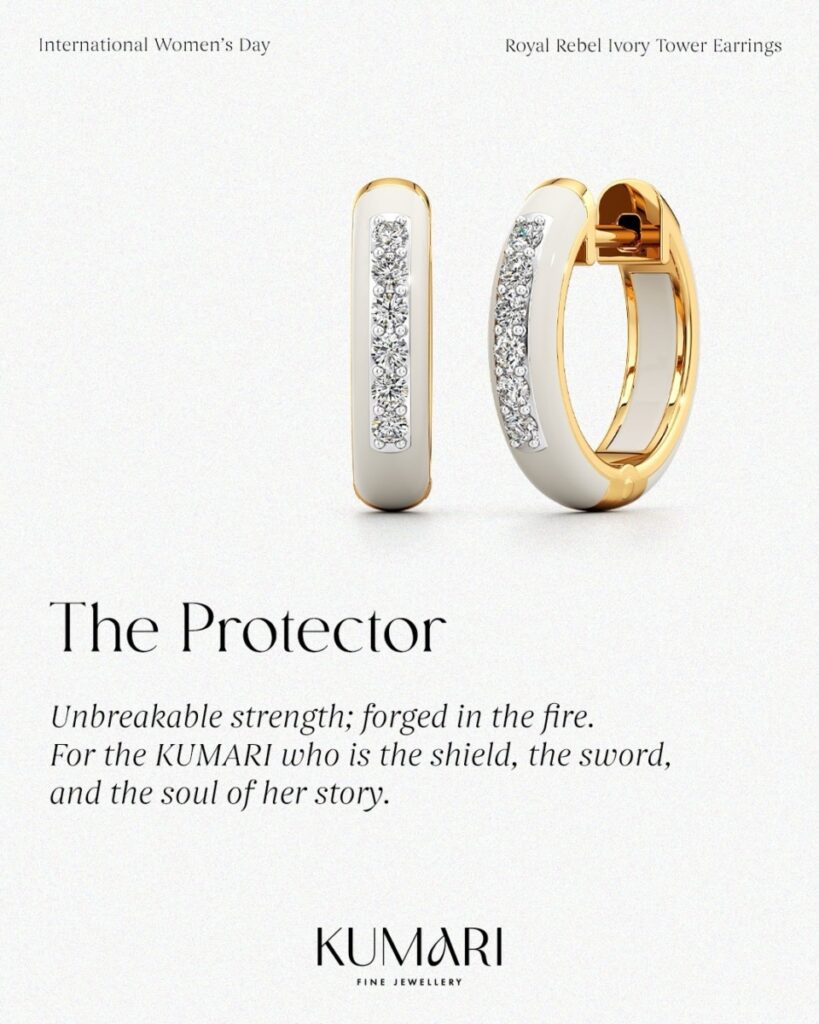

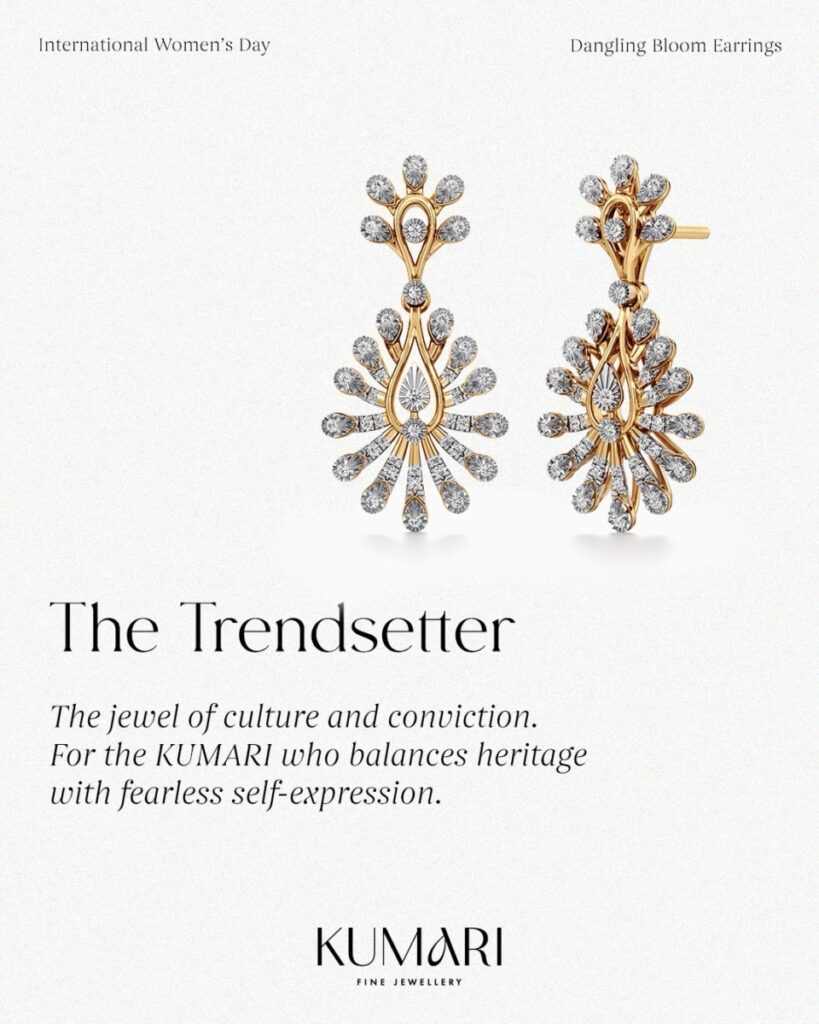

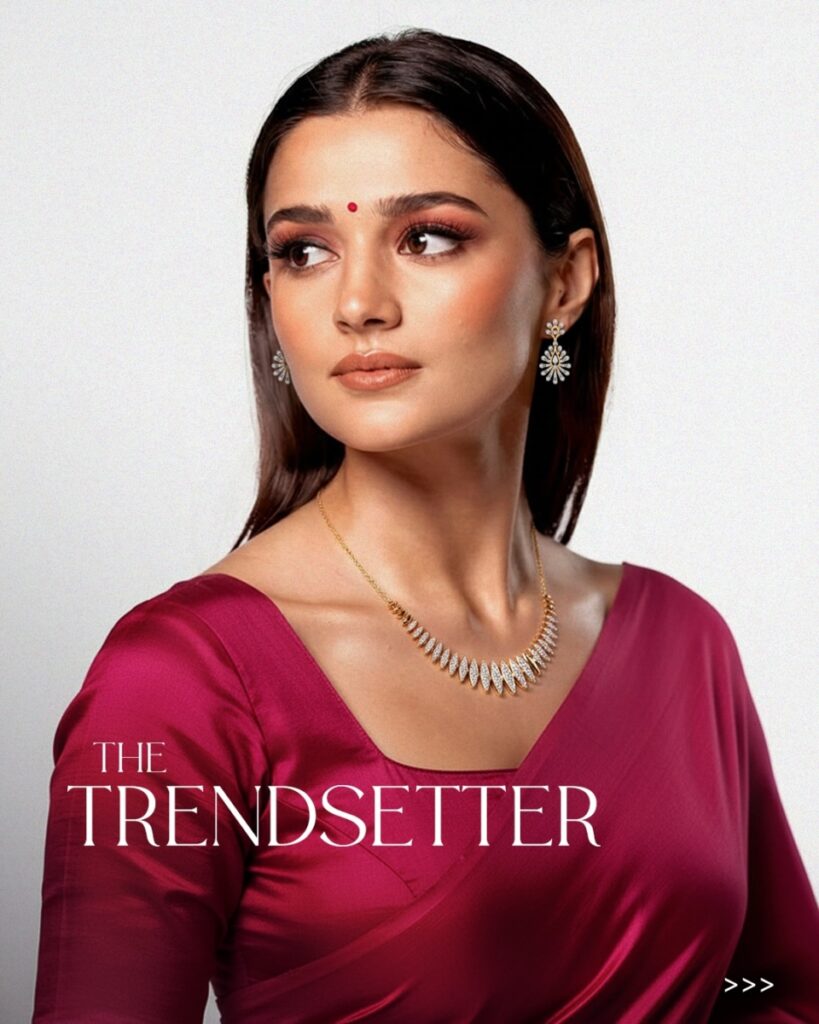

Kumari Fine Jewellery

Mumbai-based Kumari Fine Jewellery has introduced a Women’s Day showcase themed around the idea of the “Modern Indian Original.” The initiative focuses on financially independent women who mark their achievements with self-purchased jewellery. The showcase highlights lightweight gold pieces designed for everyday wear, reinforcing jewellery as both a style statement and a symbol of personal growth.

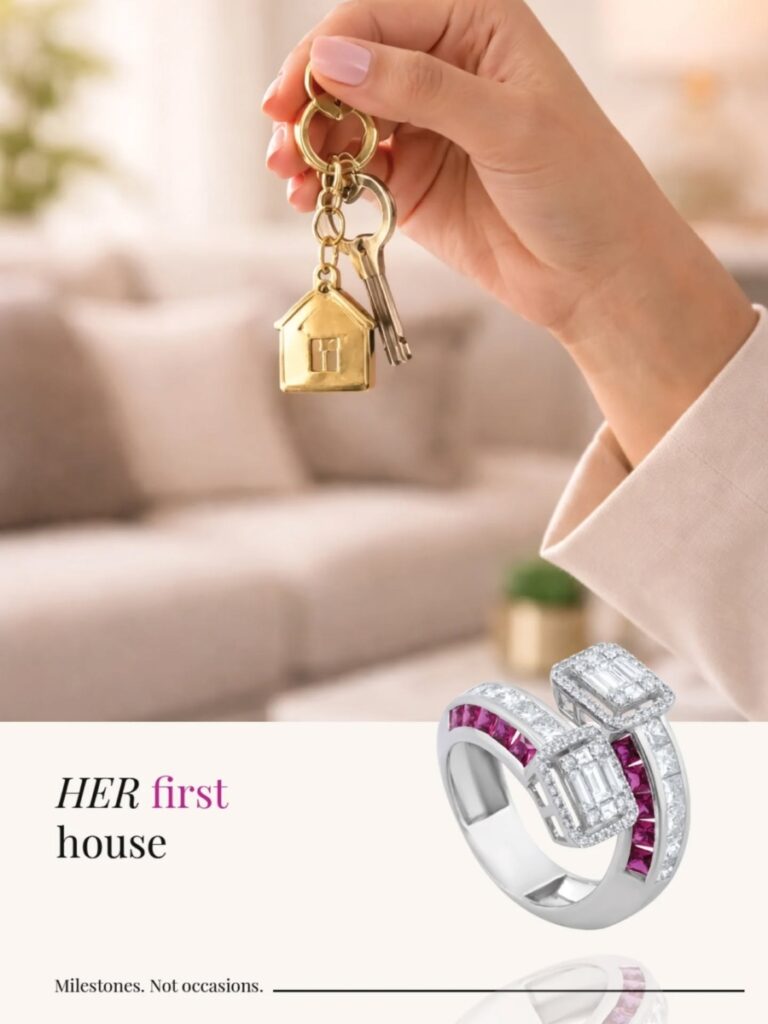

Dhirsons Jewellers

Delhi’s Dhirsons Jewellers has launched a campaign centred on celebrating milestones in a woman’s journey rather than traditional occasions. The initiative encourages women to recognise defining moments in their lives, positioning jewellery as a reflection of resilience, confidence, and self-belief.

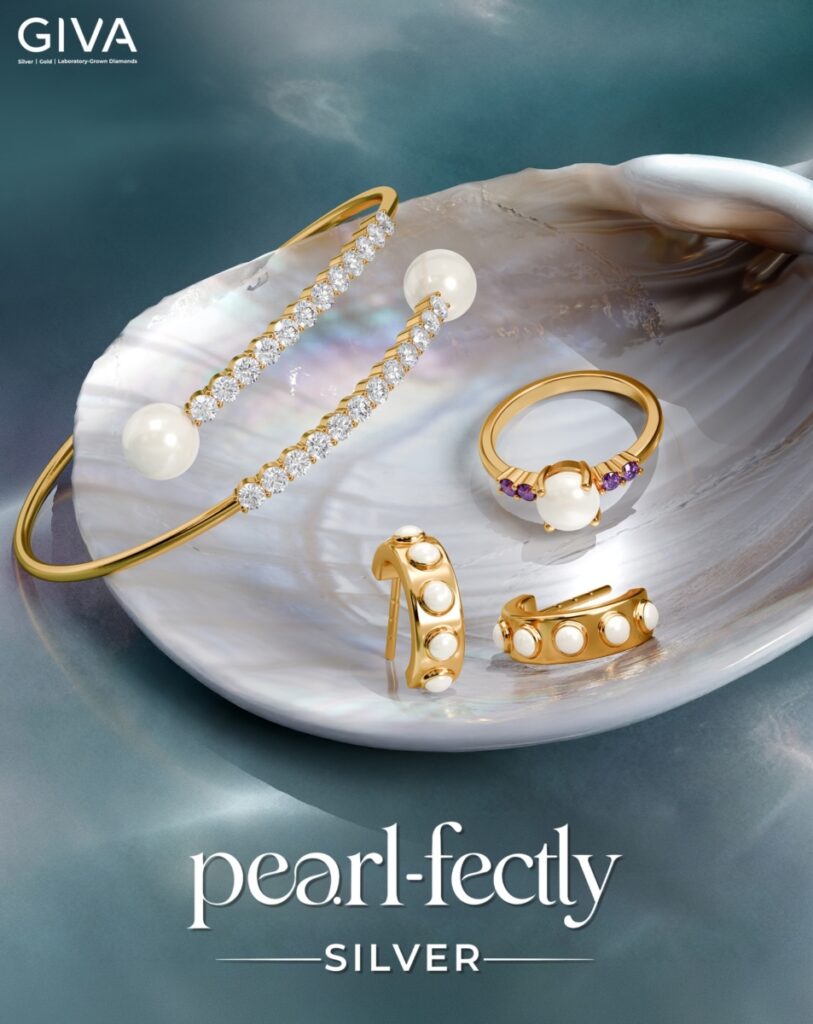

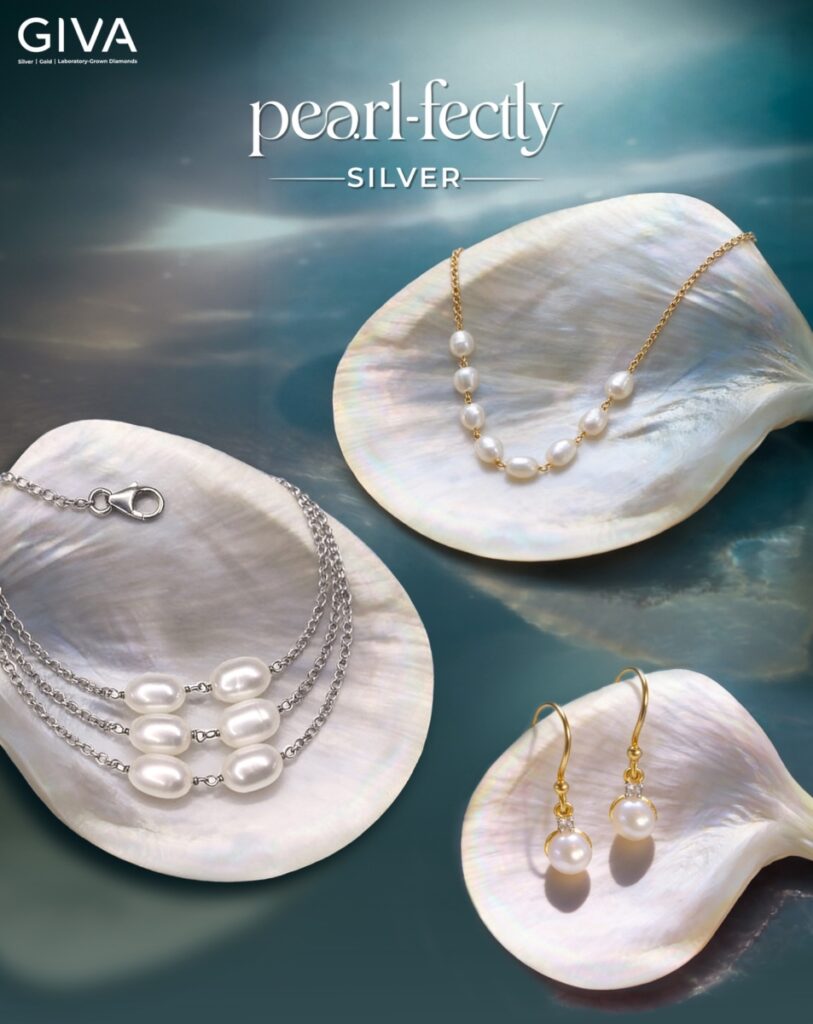

GIVA

Digital-first jewellery brand GIVA has unveiled a Women’s Day concept titled The Pearl Edit, focusing on timeless pearl jewellery that celebrates women who are building, leading, and redefining their paths. The campaign emphasises understated elegance while encouraging women to celebrate themselves through meaningful jewellery.

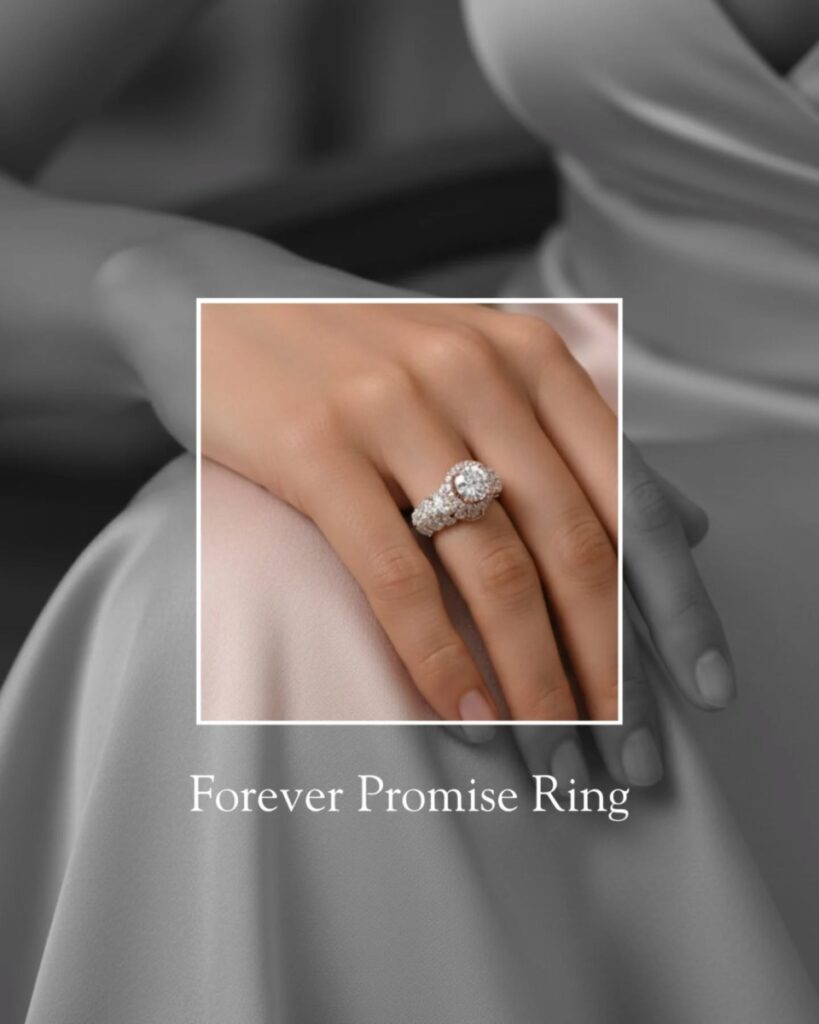

Divine Solitaires

Diamond jewellery brand Divine Solitaires has also introduced a Women’s Day campaign highlighting the emotional value of solitaire diamonds as symbols of personal milestones. The initiative focuses on recognising the journeys of women across roles—from professionals and entrepreneurs to mothers and mentors—while encouraging self-appreciation through jewellery.

Senco Gold & Diamonds

Technology-driven campaigns have also gained traction this year. Senco Gold & Diamonds has launched an initiative that integrates artificial intelligence into jewellery styling, enabling customers to discover pieces that match their personality and features. The concept highlights individuality while bringing digital innovation into the jewellery retail experience.

Tanishq

Large national brands are also participating in the Women’s Day narrative. Tanishq has continued its focus on celebrating modern womanhood through curated collections and storytelling campaigns that reflect the changing aspirations of contemporary women. The brand’s initiatives frequently highlight independence, confidence, and self-expression.

Kalyan Jewellers

Similarly, Kalyan Jewellers has aligned its messaging with women’s empowerment by supporting women-centric initiatives and partnerships, reinforcing the importance of recognising women’s achievements across different fields.

CaraLane

Other jewellery brands are also marking the occasion through special launches and themed collections. CaratLane has promoted contemporary diamond and gold jewellery collections designed for self-purchase and everyday styling, encouraging women to celebrate their personal milestones.

ORRA Fine Jewellery

Luxury diamond brand ORRA Fine Jewellery has highlighted modern diamond jewellery that symbolises confidence and individuality, targeting young professionals who view jewellery as a statement of identity.

Malabar Gold & Diamonds

Meanwhile, Malabar Gold & Diamonds has focused on campaigns that recognise women’s contributions to families, workplaces, and society, positioning jewellery as a tribute to their strength and achievements.

Across the industry, the Women’s Day celebration by many brands reflect a broader shift in consumer behaviour. Women are increasingly viewing jewellery not only as a traditional gift but also as a meaningful purchase that celebrates personal success, independence, and self-expression.

As jewellery brands continue to adapt to these changing aspirations, Women’s Day has become an important platform for storytelling, allowing brands to connect with modern consumers through themes of empowerment, individuality, and celebration of life’s defining milestones.

-

International News10 hours ago

International News10 hours agoUAE retail gold prices dropped by Dh10 per gram within a single day

-

National News14 hours ago

National News14 hours agoMCX gold rate falls below Rs.1.61 lakh, silver slips 1% on strong dollar

-

National News17 hours ago

National News17 hours agoFrom Pune’s Tech Corridors to Punjab’s Fashion Capital – Gargi by PNGS Marks a Landmark Double Debut

-

DiamondBuzz11 hours ago

DiamondBuzz11 hours agoGIA icon Tom Moses to retire after 50-year legacy