JB Insights

Dr Chetan Kumar Mehta awarded Youth Icon – Jewellery Industry by JDIFT

Dr Chetan Kumar Mehta, CMD- Laxmi Diamonds, Bengaluru, was awarded Youth Icon – Jewellery Industry by JD Institute of Fashion Technology, Mumbai.

The award was presented by Yogesh Dalal and Payal Dalal – Partners JD Institute of Fashion Technology, Mumbai, Rahul Desai, CEO-IIG and Gunjan Sapra, COO- IIG.

JB Insights

Women’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

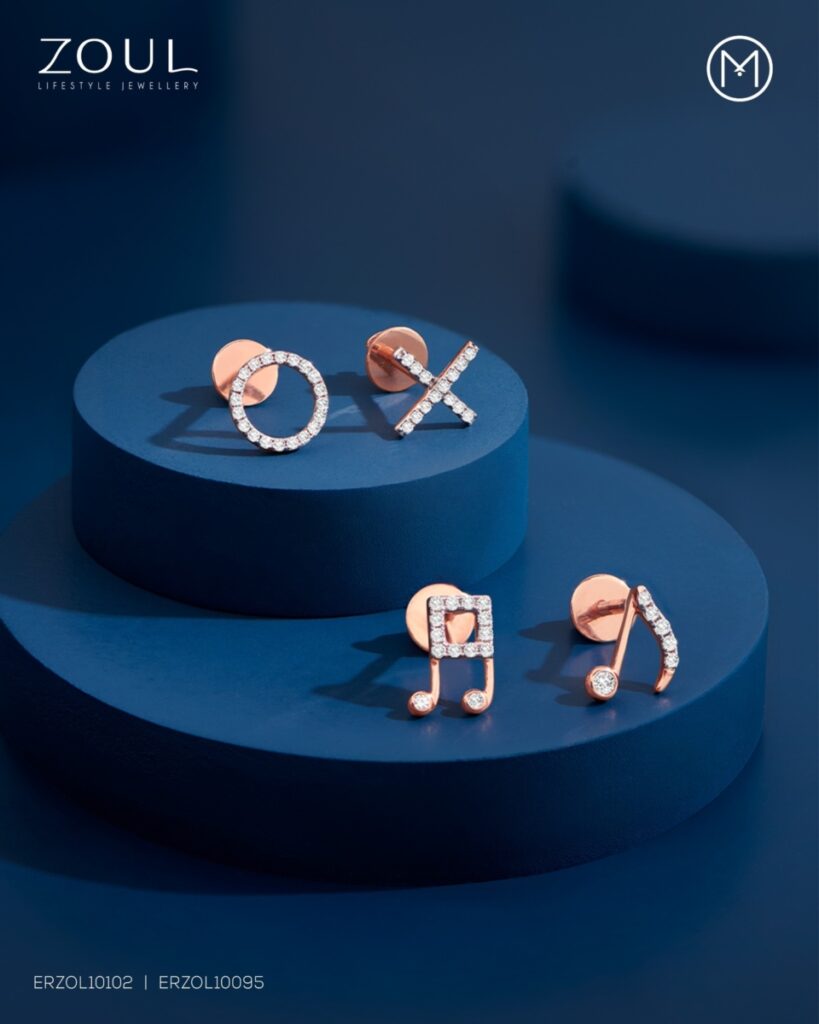

From milestone-driven collections to personalised styling and self-purchase narratives, jewellery brands across India are celebrating women’s independence, identity, and achievements this International Women’s Day.

International Women’s Day 2026 has prompted jewellery brands across India to launch campaigns that celebrate women’s empowerment, individuality, and personal achievements. Moving beyond traditional gifting narratives, many brands are positioning jewellery as a symbol of self-expression and personal milestones, reflecting the evolving role of women as independent buyers in the jewellery market.

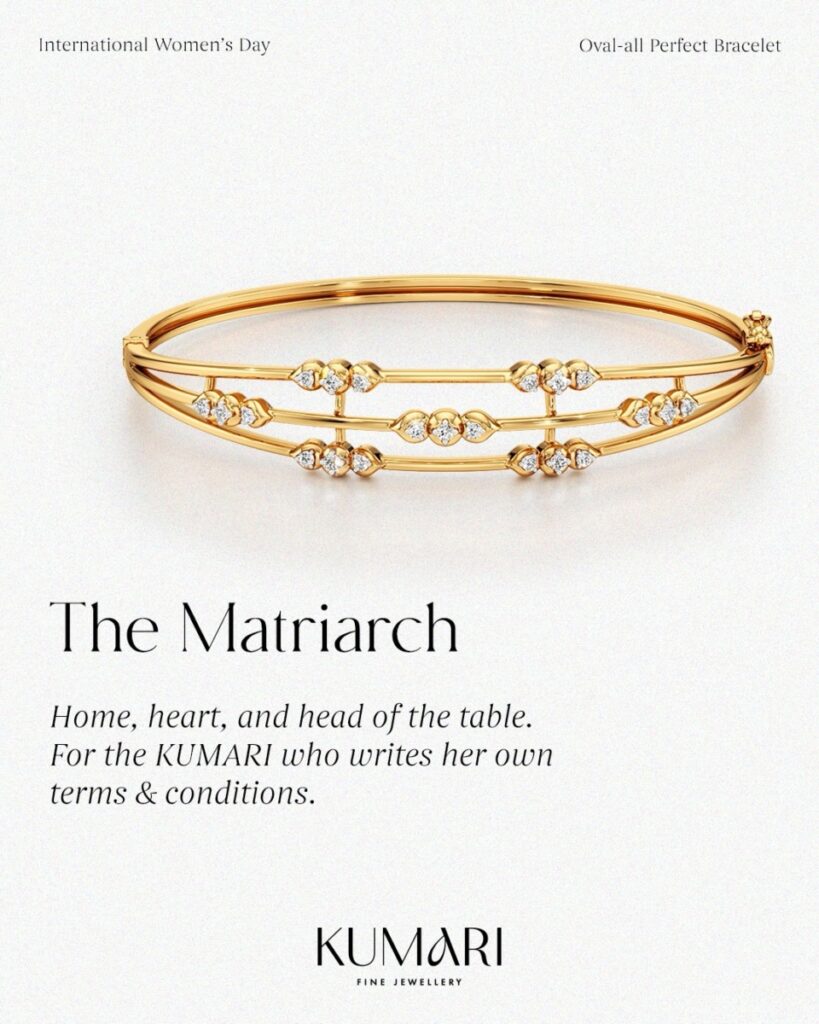

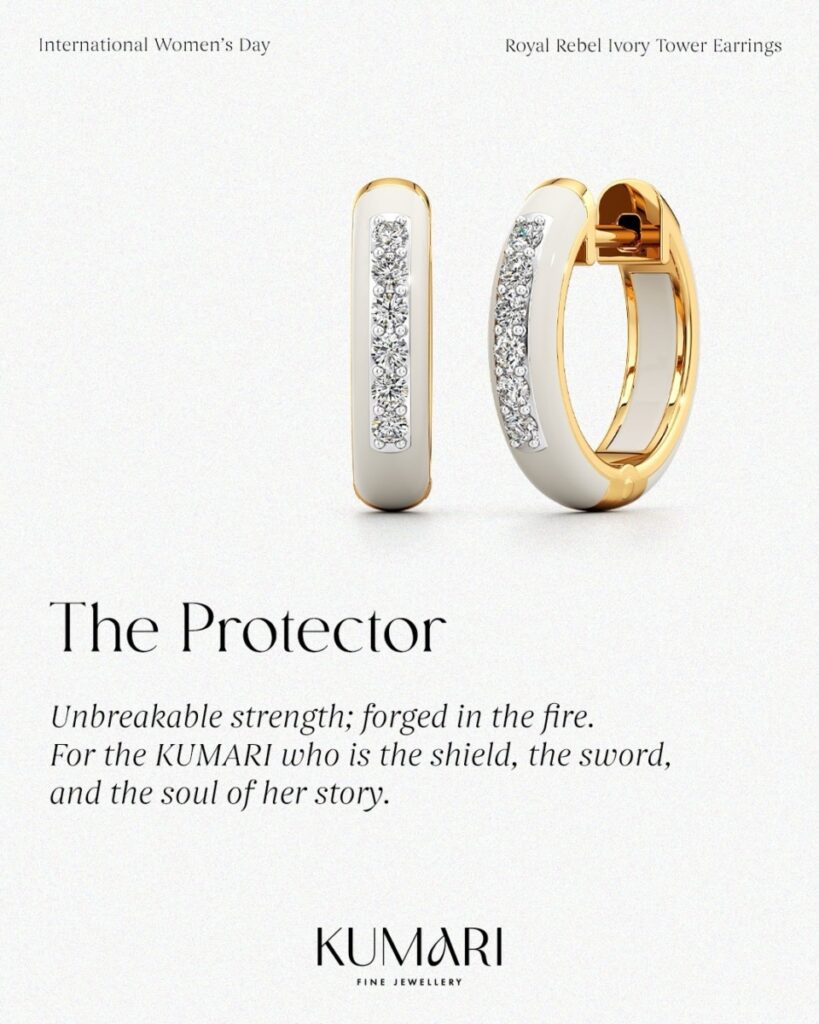

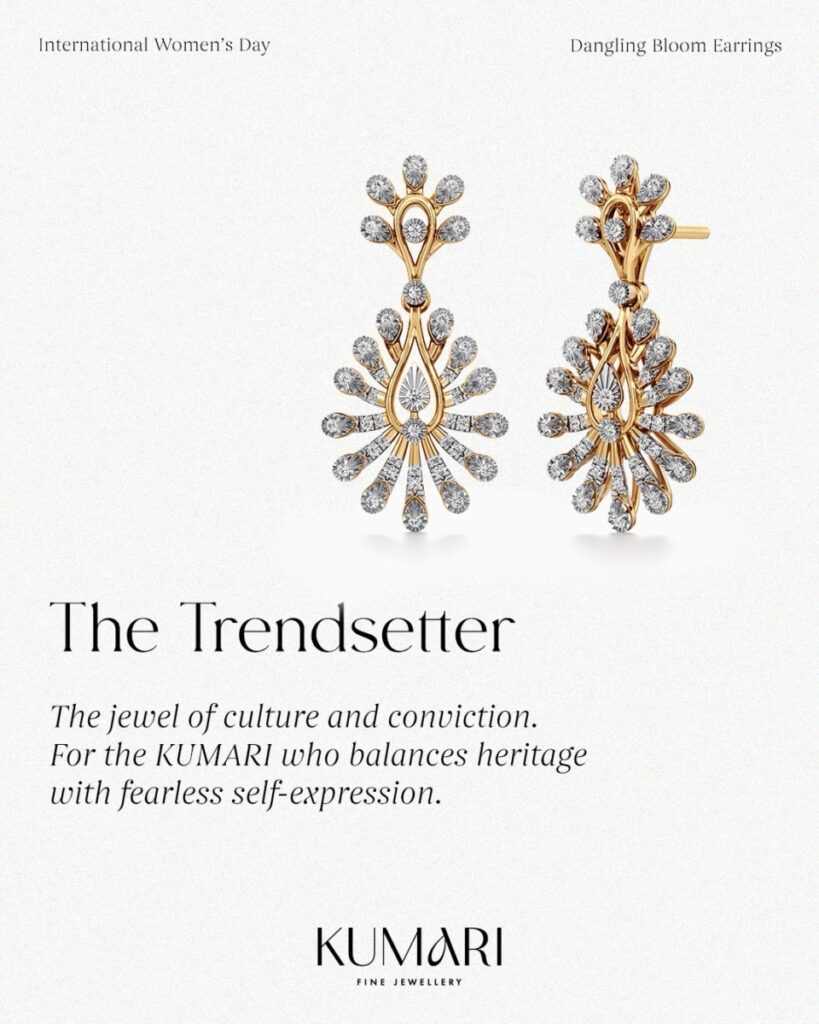

Kumari Fine Jewellery

Mumbai-based Kumari Fine Jewellery has introduced a Women’s Day showcase themed around the idea of the “Modern Indian Original.” The initiative focuses on financially independent women who mark their achievements with self-purchased jewellery. The showcase highlights lightweight gold pieces designed for everyday wear, reinforcing jewellery as both a style statement and a symbol of personal growth.

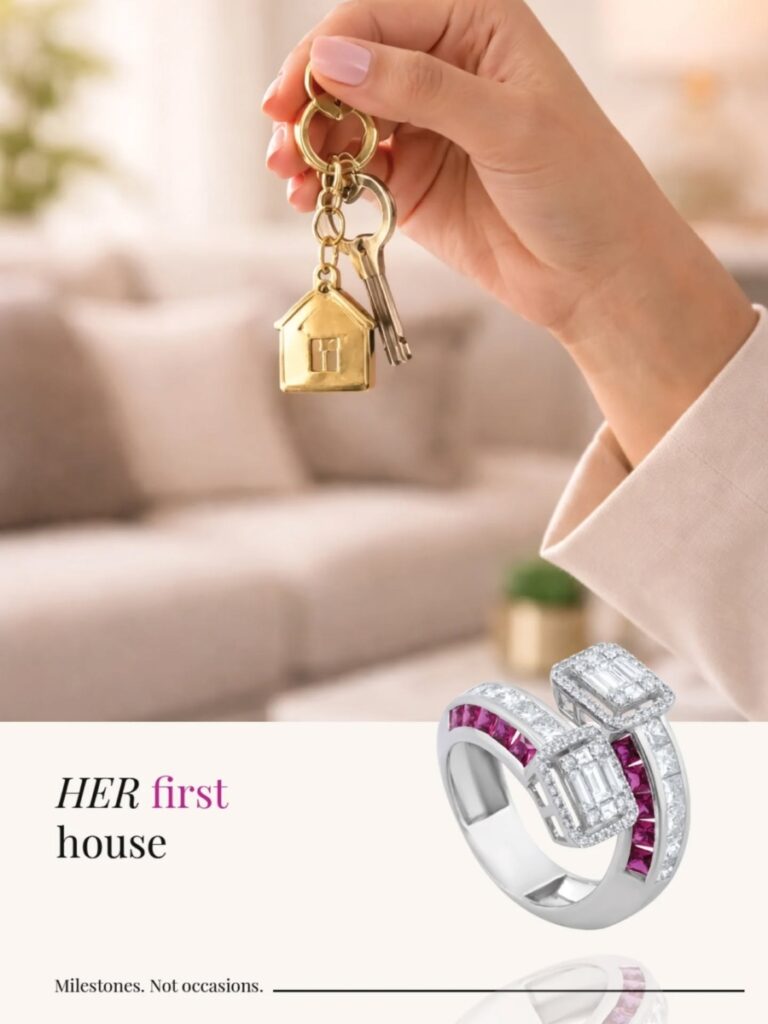

Dhirsons Jewellers

Delhi’s Dhirsons Jewellers has launched a campaign centred on celebrating milestones in a woman’s journey rather than traditional occasions. The initiative encourages women to recognise defining moments in their lives, positioning jewellery as a reflection of resilience, confidence, and self-belief.

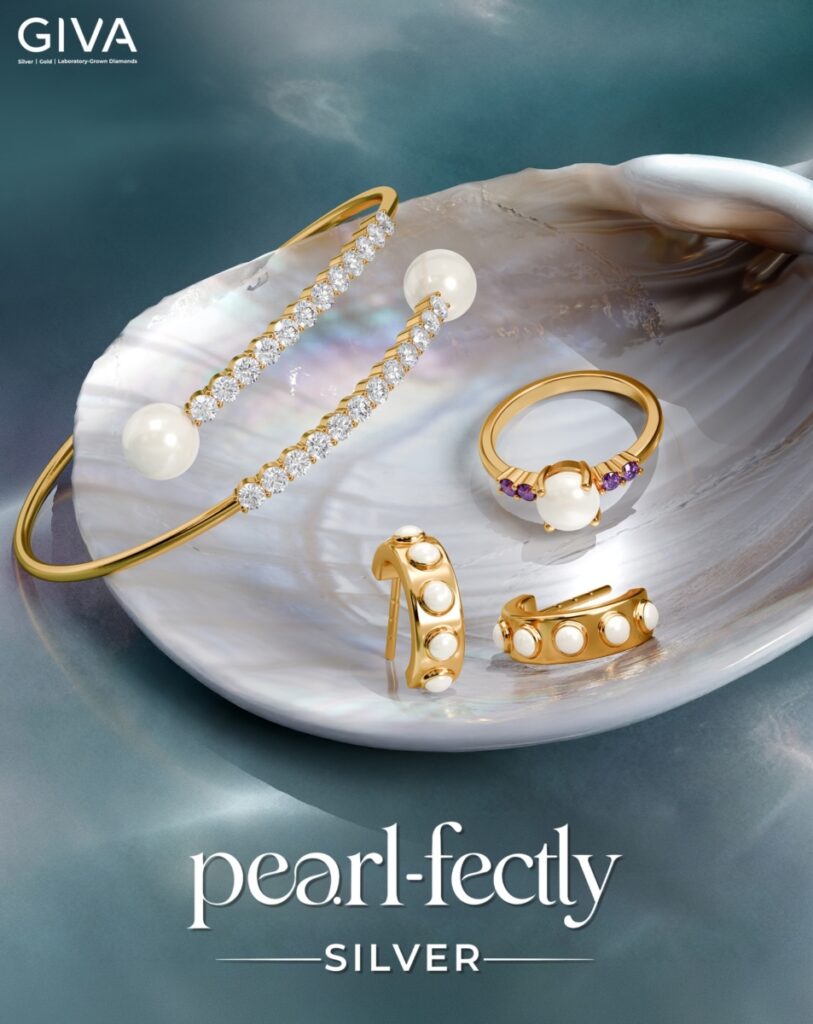

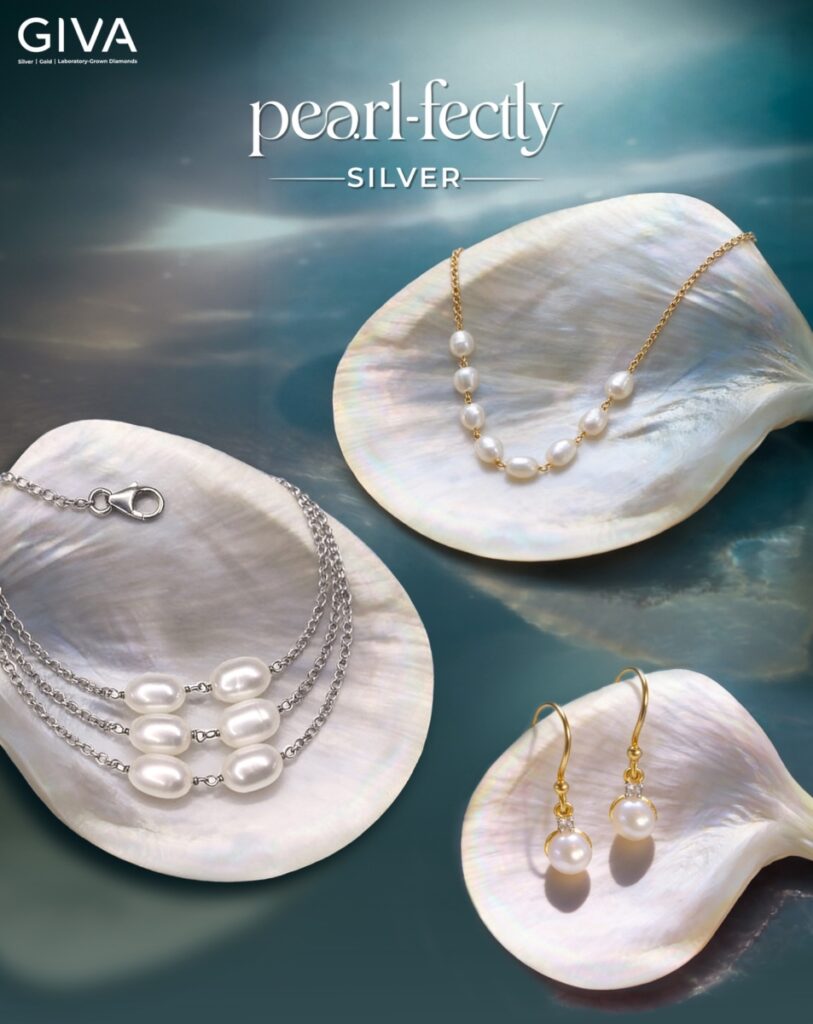

GIVA

Digital-first jewellery brand GIVA has unveiled a Women’s Day concept titled The Pearl Edit, focusing on timeless pearl jewellery that celebrates women who are building, leading, and redefining their paths. The campaign emphasises understated elegance while encouraging women to celebrate themselves through meaningful jewellery.

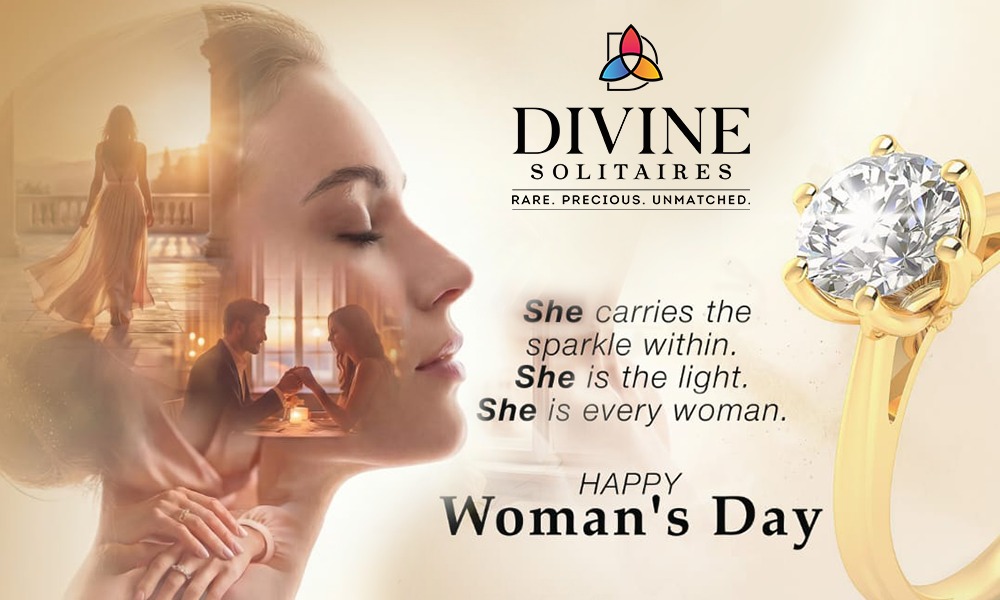

Divine Solitaires

Diamond jewellery brand Divine Solitaires has also introduced a Women’s Day campaign highlighting the emotional value of solitaire diamonds as symbols of personal milestones. The initiative focuses on recognising the journeys of women across roles—from professionals and entrepreneurs to mothers and mentors—while encouraging self-appreciation through jewellery.

Senco Gold & Diamonds

Technology-driven campaigns have also gained traction this year. Senco Gold & Diamonds has launched an initiative that integrates artificial intelligence into jewellery styling, enabling customers to discover pieces that match their personality and features. The concept highlights individuality while bringing digital innovation into the jewellery retail experience.

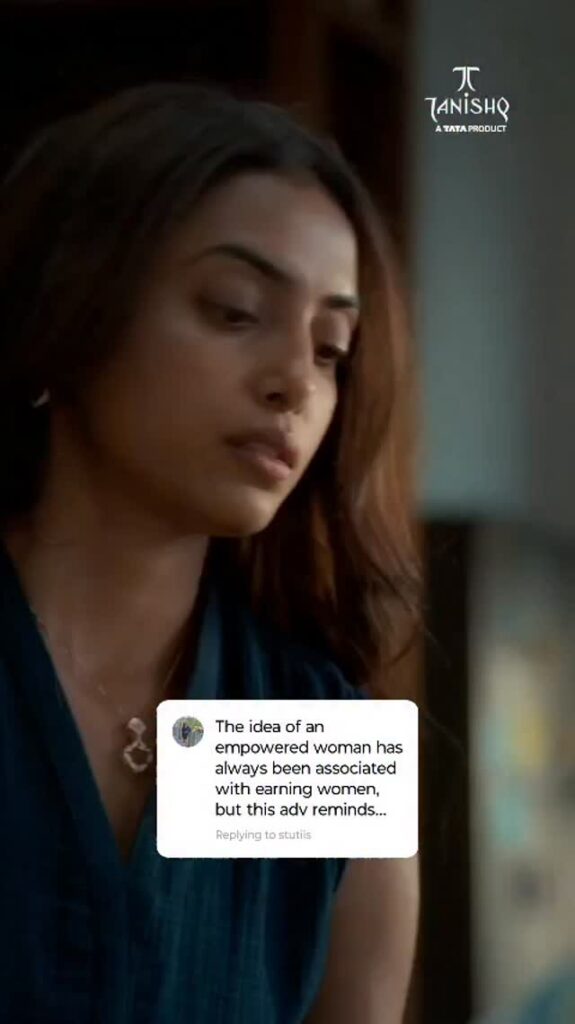

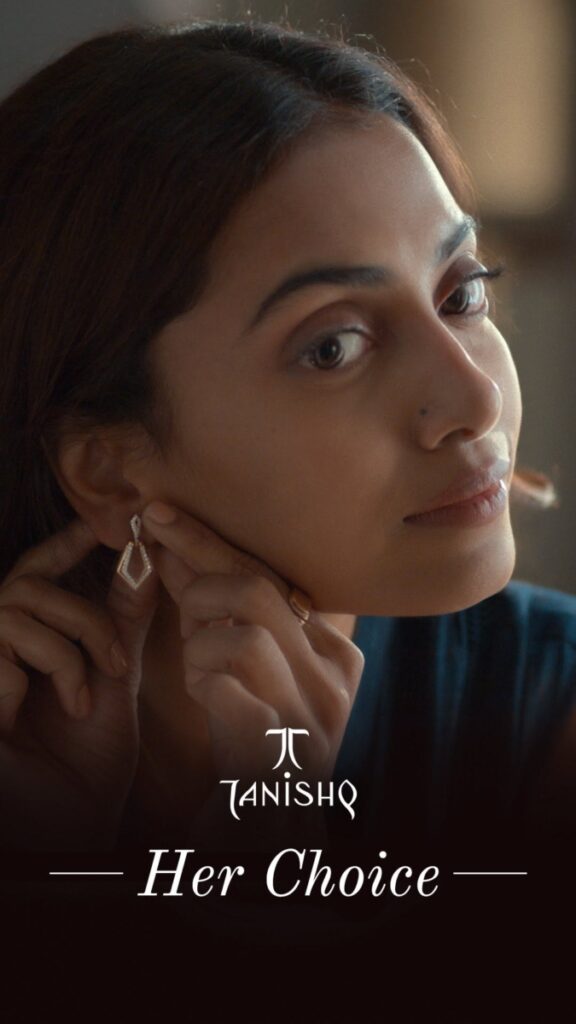

Tanishq

Large national brands are also participating in the Women’s Day narrative. Tanishq has continued its focus on celebrating modern womanhood through curated collections and storytelling campaigns that reflect the changing aspirations of contemporary women. The brand’s initiatives frequently highlight independence, confidence, and self-expression.

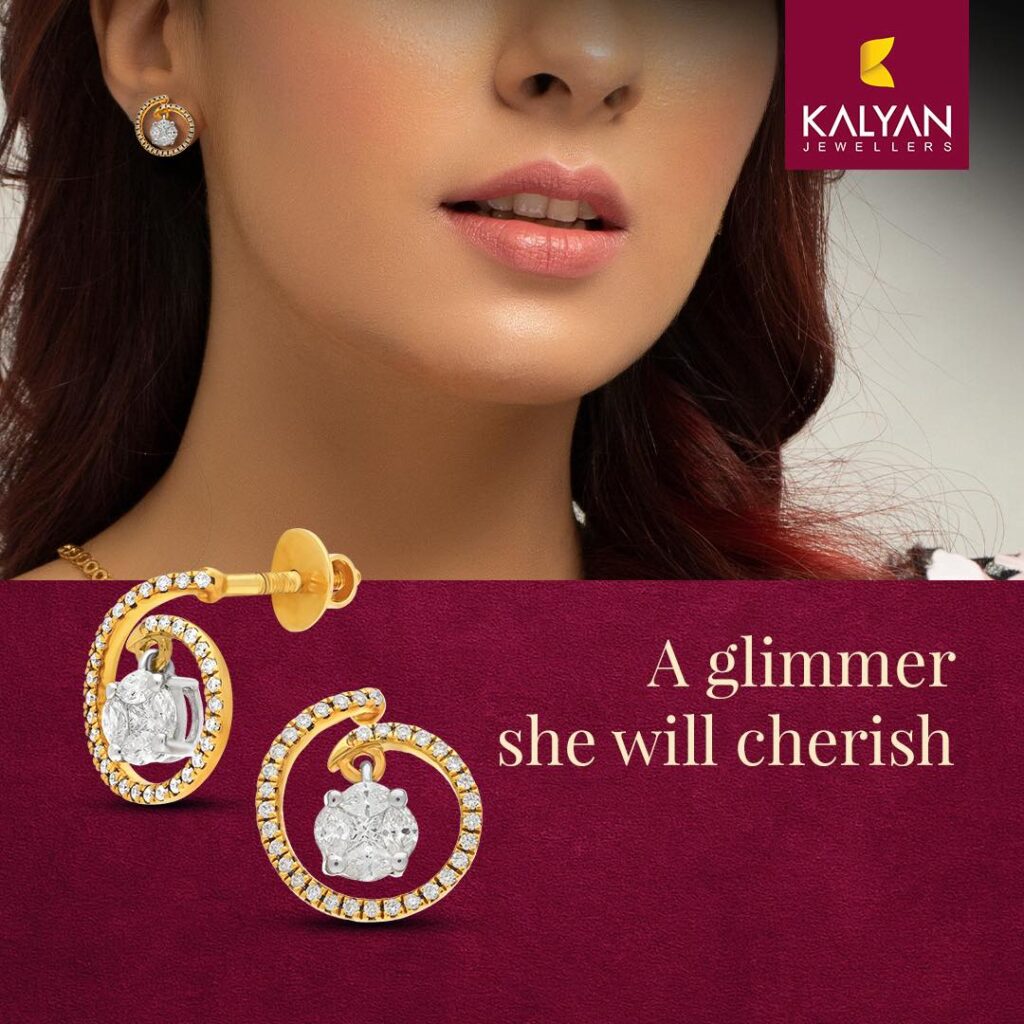

Kalyan Jewellers

Similarly, Kalyan Jewellers has aligned its messaging with women’s empowerment by supporting women-centric initiatives and partnerships, reinforcing the importance of recognising women’s achievements across different fields.

CaraLane

Other jewellery brands are also marking the occasion through special launches and themed collections. CaratLane has promoted contemporary diamond and gold jewellery collections designed for self-purchase and everyday styling, encouraging women to celebrate their personal milestones.

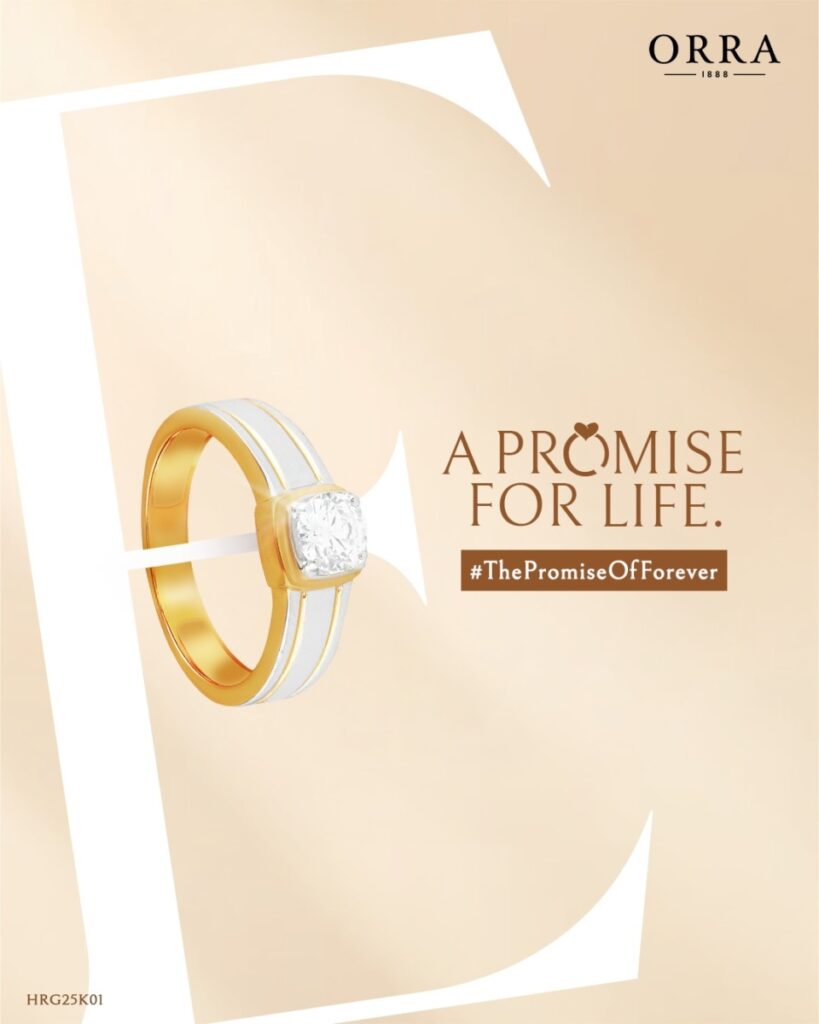

ORRA Fine Jewellery

Luxury diamond brand ORRA Fine Jewellery has highlighted modern diamond jewellery that symbolises confidence and individuality, targeting young professionals who view jewellery as a statement of identity.

Malabar Gold & Diamonds

Meanwhile, Malabar Gold & Diamonds has focused on campaigns that recognise women’s contributions to families, workplaces, and society, positioning jewellery as a tribute to their strength and achievements.

Across the industry, the Women’s Day celebration by many brands reflect a broader shift in consumer behaviour. Women are increasingly viewing jewellery not only as a traditional gift but also as a meaningful purchase that celebrates personal success, independence, and self-expression.

As jewellery brands continue to adapt to these changing aspirations, Women’s Day has become an important platform for storytelling, allowing brands to connect with modern consumers through themes of empowerment, individuality, and celebration of life’s defining milestones.

-

National News1 hour ago

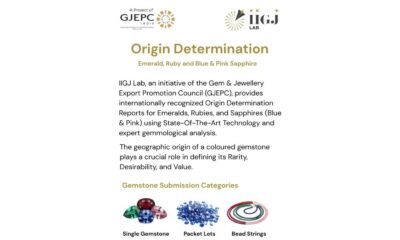

National News1 hour agoIIGJ Lab Jaipur Expands Origin Testing for Ruby, Emerald and Sapphire Lots & Strands

-

DiamondBuzz2 hours ago

DiamondBuzz2 hours agoLimelight Diamonds Expands Retail Presence in Pune with a New Store Launch in Baner

-

DiamondBuzz3 hours ago

DiamondBuzz3 hours agoDiamonds shine brightest at Hong Kong Trade Shows

-

International News3 hours ago

International News3 hours agoGold Rush in Reverse: Dubai’s NRIs are cashing out as Middle East crisis deepens