JB Insights

Diamond ETF: The path to reinvigorate natural diamond sales

The natural diamond industry is at a critical juncture, as prices continue to plummet. The spread of cheap lab-grown diamonds is undermining the value and reputation of natural diamonds, confusing consumers who mistakenly assume that lab-grown diamonds are equivalent – just cheaper, and even more ethical.

The truth is that lab-grown diamonds mimic natural diamonds and leverage their reputation, but are not scarce and contribute relatively little to the economy. The deception threatens millions of jobs, and the value of every diamond already owned by consumers, retailers and the midstream.

If this challenge is not addressed, natural diamonds will permanently lose value. The industry needs to clearly differentiate natural diamonds from lab-grown to reinvigorate demand. Many propose to increase advertising, without identifying a source of funding. But category marketing could easily backfire in this new age of social media backlash. Consumers reject hype.

The good news is that diamond vendors and mines can restore the reputation and demand for natural diamonds by supporting an exchange traded fund (ETF) – and Diamond Standard already has approval. An ETF will quickly position diamonds as an investment asset, and unlock more sources of demand: Diamonds are the ideal asset to support Islamic finance – which prohibits the lending of money with interest – and a digital commodity currency.

This is where Diamond Standard steps in: Diamond Standard has approval to file a diamond ETF. Only one ingredient is needed – $200 million of initial assets to meet listing requirements and achieve the size needed to attract institutional investors.

The proposal: to form the initial AUM (Assets Under Management), Diamond Standard is purchasing excess inventory from mines, manufacturers and dealers in exchange for ETF shares. Post IPO, the ETF will purchase a projected $3 billion of diamonds from participating vendors.

Diamond Standard is already making diamonds an investable asset class for individuals and institutions with four different investment products including its Diamond Standard Coins, pictured above, all backed by physical natural diamonds.

The challenges facing the diamond industry today are falling demand and excess supply. Even if consumer demand improves, vendors will struggle for years as excess inventory destroys profits. By investing a small fraction of inventory into an ETF, we can unlock new demand (from investors, consumers and others) and increase the value of everyone’s remaining inventory.

For the first time ever, institutional investors can allocate to diamonds like gold and silver. Both metals were in a severe slump, and their ETFs led to an increase in prices. A diamond ETF can do the same. Investor demand is especially attractive to the diamond market – it is not seasonal like jewelry, and is proportional across all the various diamond qualities. The ETF assets can’t return to the market since investors sell their shares instead of selling diamonds. This ensures price stability and creates lasting demand.

JB Insights

Stay informed. Stay Inspired. Ahead of the curve. With JewelBuzz, IndiaŌĆÖs No.1 B2B Jewellery Trade Magazine.

Gracing the cover of this issue is Kartik Aaryan for Aham by Senco Gold & Diamonds. AhamŌĆöcrafted for the modern Indian manŌĆöis a perfect fit for Kartik . His signature style, effortlessly deliberate, embodies the collection’s refined edge.

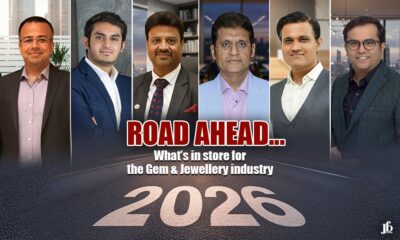

This issue spotlights our powerhouse exclusiveŌĆö2026ŌĆ” Looking Ahead .JewelBuzz tapped into the entire GJ ecosystem: manufacturers, retailers, trade bodies, designers, and consultantsŌĆöfor a truly pan-India pulse on explosive trends, evolving consumer vibes, and game-changing strategies propelling the gems and jewellery sector into the future.

Plus, don’t miss our deep-dive trade event recaps, breaking news, expert insights, brand spotlights, retail expansions, and more!

Stay connected with┬ĀJewelBuzz Magazine┬Āon┬ĀwhatsApp┬Āand across all platforms! Follow us on┬ĀInstagram, stay updated through our┬ĀFacebook Profile┬Ā,Facebook Page, catch the latest highlights on┬ĀTwitter,┬Āand explore exclusive videos on our┬ĀYouTube Channel.┬ĀWeŌĆÖre also on┬ĀLinkedIn┬Āand┬ĀPinterest┬ĀŌĆō your trusted sources for the latest in jewellery trends, news, and industry updates.

-

JB Insights5 days ago

JB Insights5 days ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability,┬Ā Personalization

-

BrandBuzz2 weeks ago

BrandBuzz2 weeks agoRanbir Kapoor Joins PNG Jewellers as the new Ambassador, Ushering in a New Chapter of Legacy and Modernity

-

New Premises2 weeks ago

New Premises2 weeks agoAimee Baruah Opens Grand Showroom of Manik Chand Nand Kishore Jewellers in Dibrugarh

-

DiamondBuzz4 days ago

DiamondBuzz4 days agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India