JB Insights

De Beers Group delivers progress with sustainability and provenance initiatives, supporting enhanced confidence in De Beers-sourced diamonds

De Beers, believes a diamond’s journey should be as meaningful as its beauty. That’s why sustainability is embedded in everything they do – from developing renewable energy in our partner countries to advancing gender equity and supporting long-term national development.

De Beers Group today published its 2024 sustainability report, highlighting significant progress across its key focus areas of climate, livelihoods, nature and provenance. These areas were identified as the priorities for De Beers Group’s sustainability work as part of a mid-term review of the Group’s Building Forever sustainability framework initiated last year.

During the course of 2024, De Beers Group made meaningful progress in areas including emissions, safety and conservation. In addition, the business has substantially advanced its work on diamond provenance and traceability, with the blockchain-backed Tracr platform enhancing its effectiveness and scale.

With regards to its focus on climate, De Beers Group has reduced its Scope 1 and 2 emissions by 7% since 2021. The Group focused on developing renewable energy solutions in 2024, working with Envusa Energy to complete the financing of wind and solar plants in South Africa which will meet 100% of the mine’s electricity needs in 2026. De Beers Group also continued the development of the Mmadinare solar PV project in Botswana, completed its Electrification and Alternative Fuels study at Venetia, and launched alternative fuels studies at Debswana, Namdeb and Debmarine Namibia. Moreover, De Beers Group worked with its top 100 strategic partners to develop roadmaps to reduce Scope 3 emissions. De Beers Group has had its near-term emissions reduction targets validated by the Science Based Targets initiative (SBTi) and has committed to reducing absolute Scope 1 and 2 GHG emissions by 42%, and Scope 3 by 25% by 2030 (from a 2021 base year).

From a livelihoods perspective, De Beers Group made a total tax and economic contribution of $2.9bn in 2024, highlighting the socioeconomic value that responsibly sourced natural diamonds deliver. The Group also achieved its best ever safety performance, with a total recordable injury frequency rate (TRIFR) of 1.2.

Several high-impact programmes continued to drive meaningful change in host countries. Through the EntrepenHER programme, delivered in partnership with UN Women, around 500 more women were supported and the programme expanded to reach 1,500 more female entrepreneurs over the next three years, bringing the total number of women reached to more than 3,100. The Stanford SEED programme, run in collaboration with the Stanford Graduate School of Business, continued to support entrepreneurs across southern Africa and has helped create 3,400 jobs since its launch in 2018. Meanwhile, the GirlEng programme continued in partnership with WomEng and has now supported over 6,500 girls with a focus on STEM subjects since 2019.

In addition, De Beers Group developed a new 10-year Diamonds for Development Fund as part of its engagements with the Government of the Republic of Botswana for a new Debswana Sales Agreement and Mining Licences.

With respect to nature, De Beers Group managed over 375,000 acres of land for conservation purposes in 2024, ensuring the maintenance of the habitat for a range of endangered, vulnerable and threatened species. The Group relocated 10 white rhino from Botswana to South Africa as part of a rewilding project, and through the Namdeb- Debmarine Foundation partnered with conservation stakeholders to design a seabird rescue facility in Luderitz, Namibia to help prevent the extinction of the African Penguin. Furthermore, De Beers Group continued to partner with National Geographic to protect the source waters of the Okavango Delta through the Okavango Eternal programme.

Alongside the progress made with the sustainability pillars of climate, livelihoods and nature, De Beers Group delivered transformational progress with its work on provenance, advancing and scaling the Tracr blockchain platform in 2024. Nearly three million individual diamonds have been registered on the platform since 2022, with leading producers and suppliers joining the platform, including ODC and Mountain Province, thereby increasing the volume of diamonds on the platform being registered at source. Tracr has also begun providing country of origin information for all De Beers Group-sourced rough diamonds over one carat registered on the platform. In addition, Tracr is undertaking both rough-to-rough and rough-to-polished objective verification of diamonds on the platform, enhancing the levels of assurance it provides throughout the value chain.

Building on the progress delivered with sustainability and provenance, De Beers Group continues to develop consumer propositions that enable people to buy natural diamonds with assurance on their country of origin and impact on the people and places where they are discovered. This includes the launch of a new polished diamond programme called ORIGIN – De Beers Group. In recognition of the growing consumer interest in where a product has come from and the impact it has had along its journey, ORIGIN – De Beers Group enables participating retailers to access polished diamonds that have been sourced by De Beers Group, tracked through the value chain by the Tracr blockchain platform, and accompanied with rich information about each diamond’s unique journey and the meaningful impact it has delivered.

Sandrine Conseiller, CEO of Brands & Diamond Desirability at De Beers Group, said: “At De Beers, we believe a diamond’s journey should be as meaningful as its beauty. That’s why sustainability is embedded in everything we do – from developing renewable energy in our partner countries to advancing gender equity and supporting long-term national development. We’re not just powering our operations sustainably; we’re helping build infrastructure that benefits communities. We’re not just creating opportunities for women within our business; we’re unlocking potential for female students and entrepreneurs across our host nations. And through our enduring partnership with Botswana, we’re securing the future of our supply while investing in the country’s economic development and diversification. Thanks to our provenance platforms like Tracr and the consumer-facing experiences we’re building, we can share these stories with confidence.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

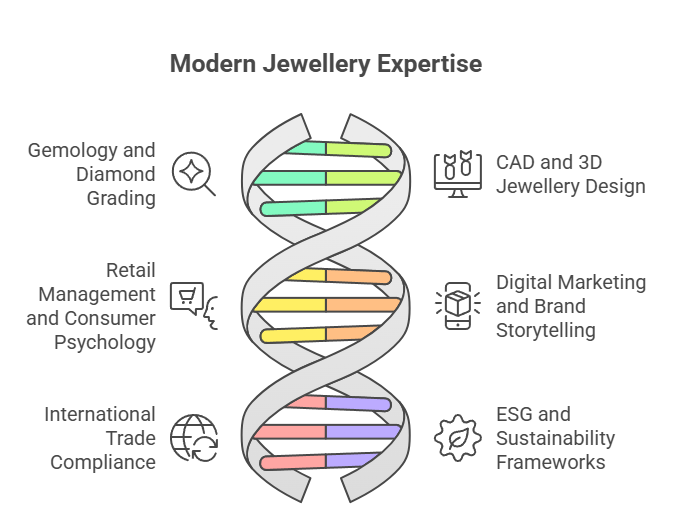

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

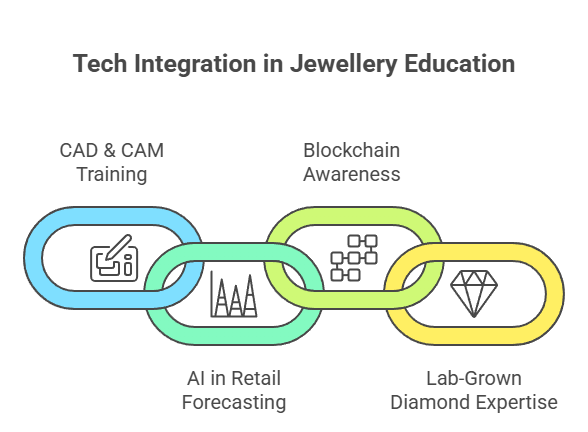

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

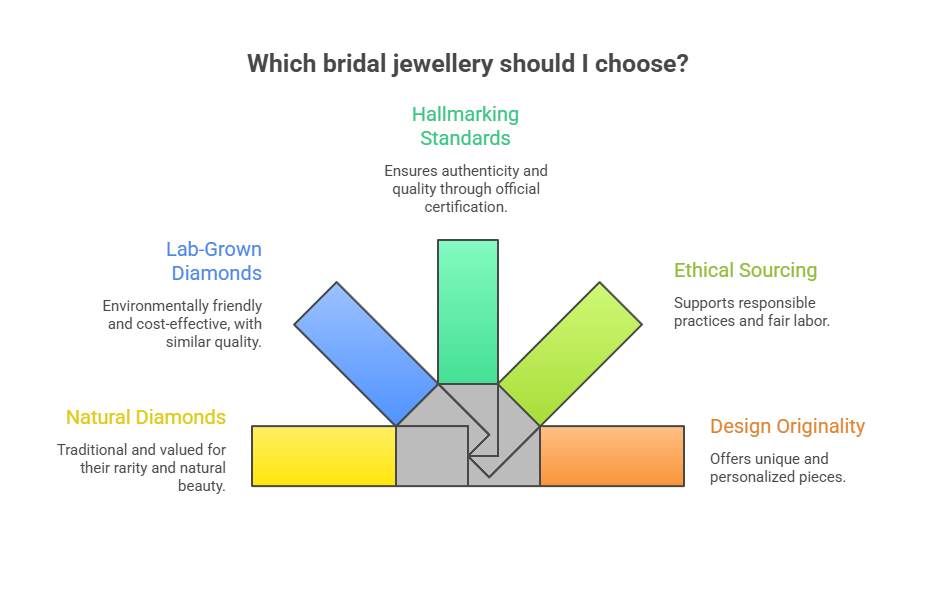

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

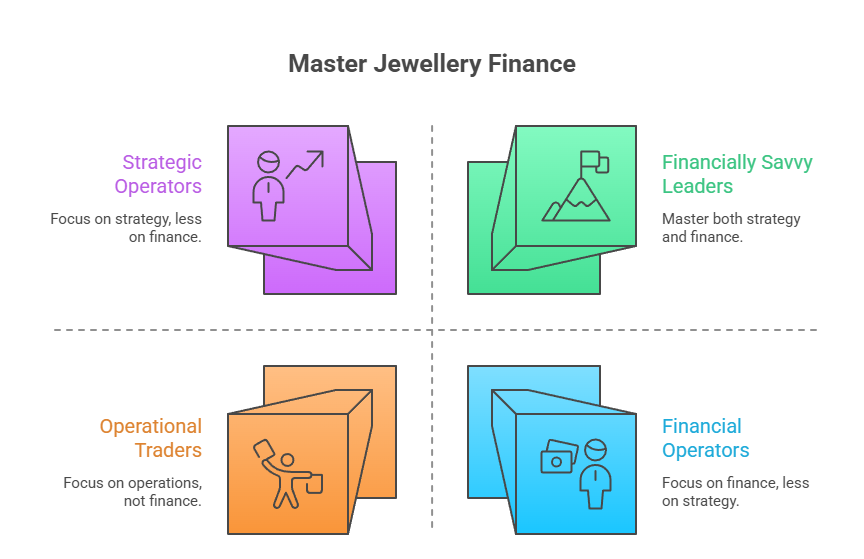

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

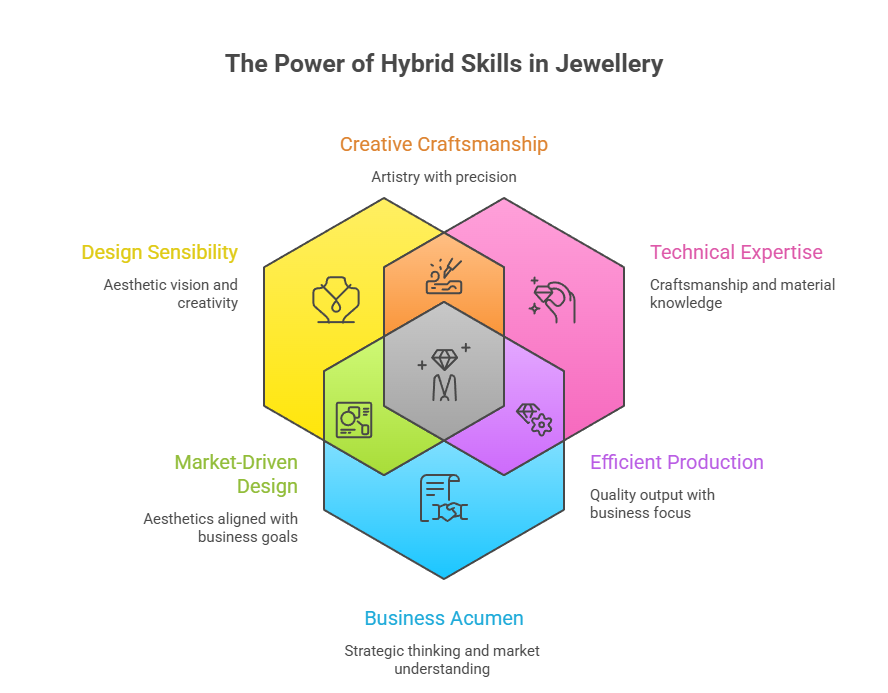

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

BrandBuzz13 hours ago

BrandBuzz13 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz13 hours ago

BrandBuzz13 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz17 hours ago

BrandBuzz17 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News17 hours ago

National News17 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression