JB Insights

Akshaya Tritiya 2025 Expectations

Festival remains a significant driver for jewelry sales due to cultural importance, gold as a secure investment.

This report analyzes the market dynamics surrounding Akshaya Tritiya 2025, focusing on the impact of rising gold prices on consumer behavior and sales trends. Despite high gold rates, the festival remains a significant driver for jewelry sales due to its cultural importance and the perception of gold as a secure investment. Jewelers anticipate resilient sales, driven by innovative designs, discounts, and a shift towards lighter jewelry and alternative precious metals like diamonds and platinum.

Key Findings

- Resilient Consumer Sentiment: Akshaya Tritiya continues to be viewed as an auspicious occasion for purchasing gold, overriding concerns about high prices.

- Shifting Purchase Patterns: Consumers are becoming more discerning, emphasizing quality, design, and value. Trends include:

- Increased interest in lightweight jewelry and gold coins for investment.

- A potential shift towards diamonds and platinum due to stable prices.

- Demand for heritage-inspired designs that blend tradition with modern aesthetics.

- Strategic Adaptations by Jewelers: Jewelers are employing various strategies to attract customers:

- Offering discounts on making charges and curated Akshaya Tritiya collections.

- Focusing on budget-friendly and lightweight designs.

- Highlighting the long-term investment potential of gold.

- Regional Variations: Markets like Tamil Nadu and Kerala exhibit strong cultural traditions driving gold purchases, while others may see more pronounced shifts to alternative investments.

Market Outlook

- Sales Value vs. Volume: While gold sales volume may experience a marginal dip due to high prices, the overall sales value is expected to remain robust.

- Alternative Investments: Diamonds and platinum are gaining traction as viable alternatives, particularly with stabilized prices and innovative product offerings like diamond coins.

- Consumer Behavior: Consumers with planned future occasions (e.g., weddings) are proactively booking gold to mitigate price fluctuations.

Recommendations

- Diversify Product Offerings: Jewelers should cater to a range of budgets by offering lightweight jewelry, gold coins, and designs in alternative precious metals.

- Emphasize Value and Craftsmanship: Highlight the quality, purity, and design excellence of jewelry to justify purchases despite high gold rates.

- Leverage Digital Marketing: Utilize targeted campaigns to connect with consumers emotionally and underscore the long-term financial benefits of investing in gold.

- Offer Flexible Purchasing Options: Consider offering pre-booking options and installment plans to accommodate budget constraints and encourage purchases.

Akshaya Tritiya 2025 presents a unique opportunity for jewelers to leverage cultural sentiments and strategic marketing to drive sales, even amid high gold prices. By adapting to evolving consumer preferences and offering a diverse range of products and purchasing options, jewelers can reinforce customer trust and achieve a successful festive season.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

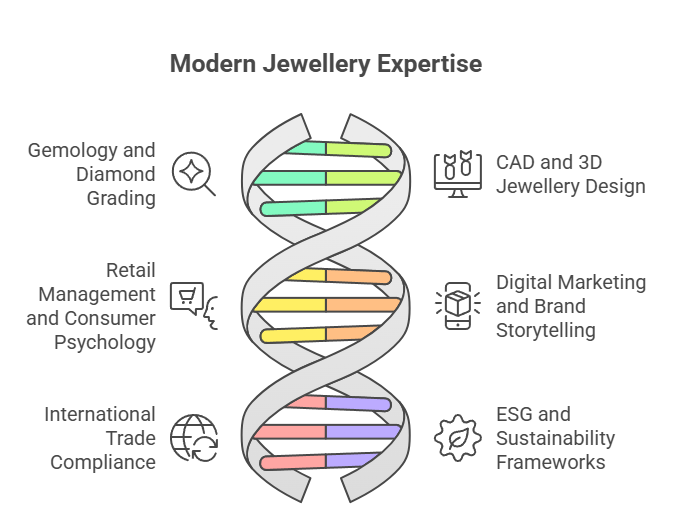

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

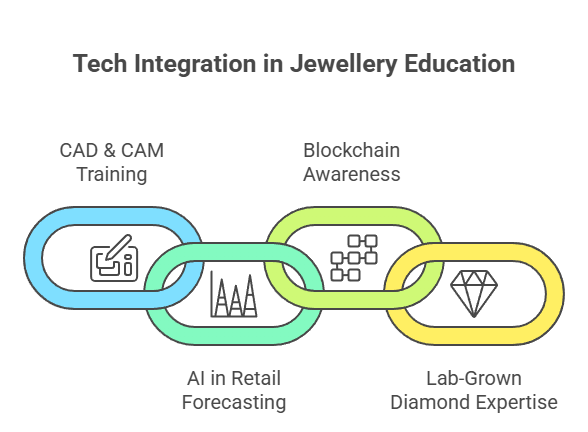

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

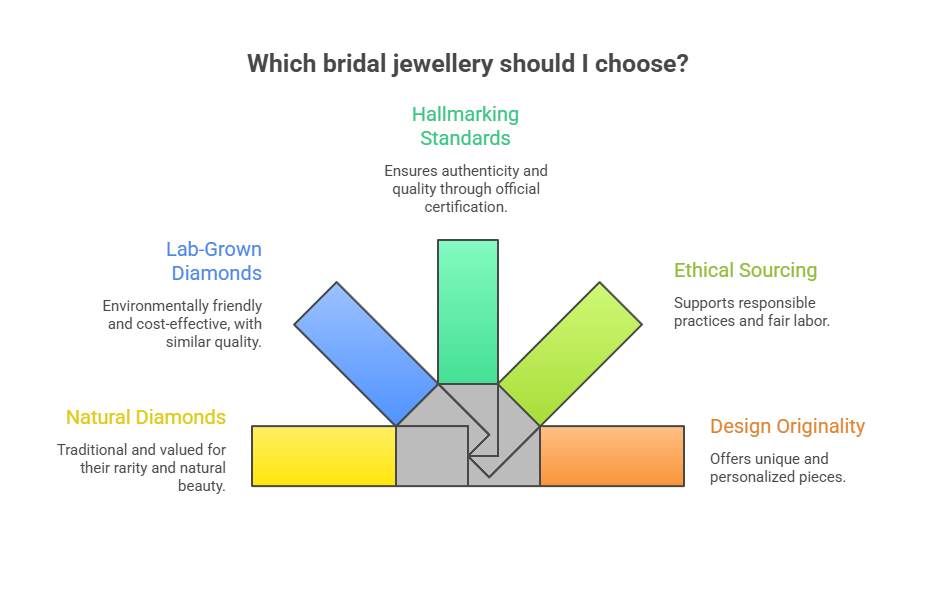

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

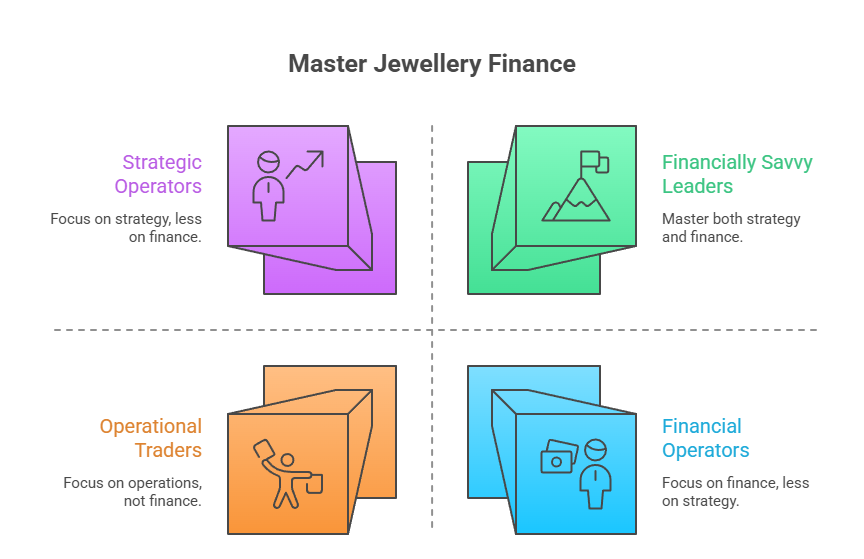

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

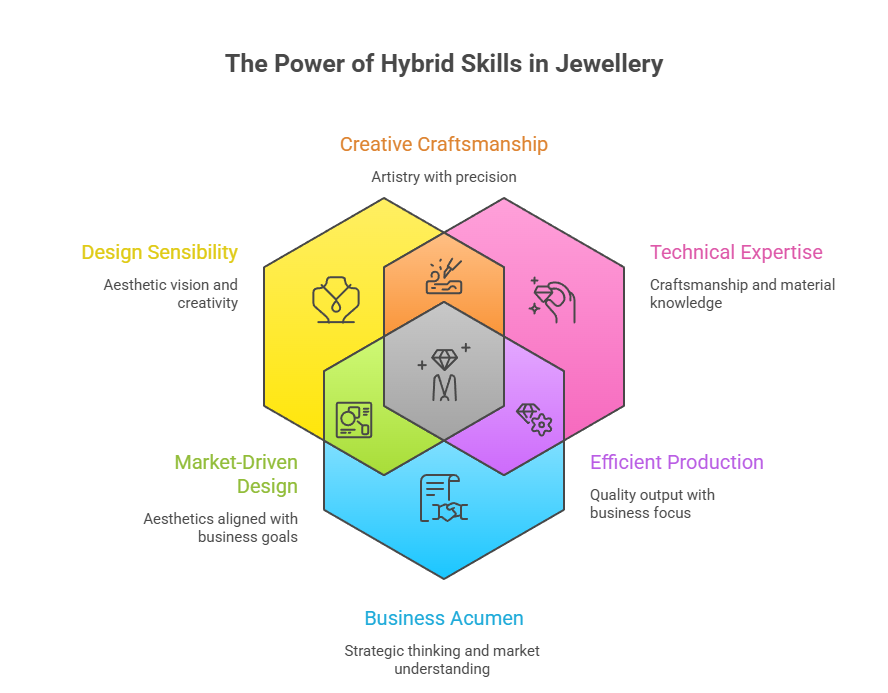

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

DiamondBuzz7 hours ago

DiamondBuzz7 hours agoDiamond Slump forces Debswana to diversify into copper, platinum and solar

-

International News7 hours ago

International News7 hours agoIGI Expressions™ 2025–26: Nine Global Winners Surface from 1,000+ Entries across 55 Countries

-

International News8 hours ago

International News8 hours agoGJEPCs statement on the geopolitical tensions in ME Region

-

International News8 hours ago

International News8 hours agoHong Kong International Jewellery Show opens, showcases global designs and trends