International News

WGC Gold Market Commentary: Riding a wave of uncertainty

Dollar weakness and ETF flows fuel gold

Gold continued its uptrend in February, hitting multiple new highs before pulling back to end the month at US$2,835/oz – up 0.8% m/m.1 This performance was echoed across major currencies, all of which also registered new record highs (Table 1). General interest in gold was bolstered by continued flows of gold into COMEX inventories, driven by continued tariff uncertainty.

Gold hit new highs during the month, supported by a weaker US dollar, extending its y-t-d gains to 9percent According to our Gold Return Attribution Model (GRAM), US dollar weakness during the month was one of the primary drivers of gold’s performance, alongside an increase in geopolitical risk and a drop in interest rates (Chart 1). And while gold’s strong price appreciation in January created a small drag, it was counterbalanced by positive support from flight-to-quality flows. This was best illustrated by gold ETF activity, which saw massive net inflows of US$9.4bn (100t) – the strongest month since March 2022 – led by US- and Asian-listed funds.

Reassessing risk and reward

• The “Trump trade” – stronger dollar and US stocks – has taken a back seat amidst concerns about tariffs and hawkish foreign policies, conditions that will likely remain

• As governments look to increase military spending, budgets deficits are likely to increase and credit ratings to fall

• At the same time, despite inflationary pressures, markets expect a more dovish Fed, pricing in at least two full rate cuts by the end of the year

• These factors combined are creating a particularly supportive environment for gold.

Risk-off in, risk-on out

The “Trump trade” – which hinged on the pro-US growth agenda of the new administration and fuelled a dollar and stock rally post US election – appears to have faded.

While European stocks continue to do well, the major beneficiaries have been risk-off assets such as US Treasuries and gold (Chart 2).

Inflation is bubbling up

Trump‘s campaign agenda hinged on a few key items, including: tariffs, immigration and tax cuts2 – all of which have the potential to flare up inflation However, assessing the economic impact of tariffs is not straightforward: while they might be inflationary in a very strong economy, they could lower spending in a weaker one.3 And there are already signs that consumer sentiment in the US is beginning to falter: the University of Michigan consumer and expectation surveys are at their lowest level since 2023.4

Lower levels of immigration (and higher deportations) will likely lead to higher labour costs, although the strength of the labour market is key to determine its full effect. Nominal wages in the US are currently plateauing while potential large-scale Federal layoffs could increase labour supply. However, those workers are unlikely to fill the spaces left by immigration.

Tax cuts for businesses and the wealthy will boost growth and inflation. However, any anticipated boost from tax cuts has yet to materialise as they may take ‘months to negotiate’.5

Uncertainty, uncertainty, uncertainty

Investor nervousness has pushed bond prices higher and yields lower. Market participants now expect two full rate cuts by the end of the year…a far more dovish read from mid-January, pre-Trump inauguration. And the probability of a Fed hike appears to have peaked .

While January inflation data generally runs hot, policymakers at the Fed seem content with the progress that has been made so far. At the same time, elevated uncertainty was heavily cited in the last meeting minutes, whether through tariffs, immigration or domestic policy, such as potential large-scale Federal layoffs, a nod to the Fed’s dual mandate of price stability and full employment.

What’s more, US Treasury Secretary Bessent’s comments that they are focused on bringing down the 10-year yield has also served to ease conditions somewhat.

New world (dis)order?

Negotiations to end the Russia-Ukraine war have led to much handwringing and consternation, particularly across Europe during February. This has compounded already elevated geopolitical uncertainty as positive outcomes are by no means guaranteed and existing political alliances are being questioned.

Speculation that Europe will need to ramp up defence spending going forward – resulting in larger deficits – has already pushed up borrowing costs. Yield curves on European sovereign debt have become increasingly steep; short-term rates are falling while long-term rates remain high as expectations grow for an increased supply of long dated debt.

The UK has already committed to increase defence funding,8 and Germany’s future chancellor, Friedrich Merz, has begun discussions on the topic.9 For the latter, this could be further

complicated by the potential need to rely on the support of fringe parties after a somewhat mixed election outcome.10 The performance of the European defence sector, one of the best this year, is reflecting the likely continuation of this trend.

Should a resolution to the Russia-Ukraine war be found – and importantly, this will need to be one agreeable to all parties – this could dampen any geopolitical risk premium in gold. But it remains to be seen whether real progress can be made and, if so, what the implications will be. Until then, it is likely that gold will remain well supported.

Perfect conditions for gold?

Uncertainty appears to be the undertone across markets. Concerns over tariffs, and the wide-ranging impact they could have on global growth, continue to cast a cloud and question US exceptionalism. This has added to already rising geopolitical risk. Recent events have highlighted the need for greater military spending, which will likely result in even higher deficits.

There are several factors that could reinstate the thorny problem of higher inflation, especially at a time when deteriorating economic conditions may necessitate interest rates staying low. The US economy is likely in ‘stagflation’ and consumers appear to see it that way.

Historically, each of these drivers has individually been positive for gold. A move up in the GPR index of 100 points is typically linked to a 2.5% increase in the price of gold, all else equal. Similarly, a rise in 10-year break-even inflation expectations of 50bps is typically associated with an approx. 4% rise in gold prices. And a 50bps fall in 10-year Treasury rates over the long-run has been associated with a 2.5% rise in gold.

Although these drivers seldom occur simultaneously, their combined effect can create an environment in which gold can continue to perform positively.

It is worth noting, nonetheless, that a solid fundamental case for gold still must scale the hurdle of a temporary technical stretched price. A retracement may create short-term headwinds but could also provide a welcome respite for uninitiated investors, as well as for consumer gold demand . In all, we expect gold to remain in the limelight given the current market conditions.

International News

Global Platinum Jewellery Market Rebounds, Driven by Surging Demand in China and Resilience in Key Markets

The global platinum jewellery market showed strong recovery in the first quarter of 2025, according to Platinum Guild International’s (PGI) latest Platinum Jewellery Business Review. Growth was led by a sharp rebound in China and steady gains in India, alongside positive trends in the US, UAE, and Japan.

In India, platinum jewellery continued to grow despite wider market challenges, including record-high gold prices and the seasonal slowdown at the end of the financial year in March. PGI’s top 15 strategic partners in India posted an average year-on-year platinum sales growth of 7%, supported by in-store activations, digital campaigns such as Platinum Love Bands, and celebrity-led marketing.

China delivered the strongest performance, with platinum jewellery fabrication rising 50% year-on-year in Q1, significantly outperforming gold and diamond categories. The surge was driven by both plain and gem-set platinum jewellery, as jewellers shifted away from gold amid high prices and sluggish diamond demand. PGI reported the opening of over 40 platinum-dedicated wholesale showrooms and the conversion of several gold production lines to platinum. Retail sales rose 16% year-on-year, prompting calls for stronger marketing and new product offerings to sustain demand.

In the UAE, platinum jewellery retail sales grew 25% year-on-year. Platinum now has a presence in 136 stores across the GCC, with PGI’s focused partnerships and campaigns helping to expand the category’s footprint, particularly among South Asian communities.

Japan saw platinum jewellery outperform the broader market for the sixteenth straight quarter. Unit sales rose 1% year-on-year in Q1, driven by discount stores, department stores, and non-store channels. Pendants, necklaces, Kihei chains, and affordable platinum pieces remained in demand.

In the United States, platinum jewellery unit sales rose 19% year-on-year among PGI’s strategic partners, with revenue up nearly 24%. Wedding bands and fashion jewellery led the gains, and some retailers continued to convert inventory from white gold to platinum.

“As consumers increasingly seek meaningful, high-quality pieces at accessible price points, platinum is gaining ground not just in China, but also in key markets such as India, Japan, the United States and the United Arab Emirates,” said Tim Schlick, CEO, PGI. “PGI’s strategic partnerships remain at the heart of this growth story, helping to build lasting consumer connections with platinum.”

International News

Gold stable as Fed maintains data-driven stance AUGMONT BULLION REPORT

Supported by a declining dollar, gold extended its gains from the previous session to approximately $3325 (~Rs 96500) as investors continued to keep an eye on trade events and review the most recent FOMC minutes.

- The Fed’s June meeting minutes revealed disagreement among officials over the timing and scope of possible interest rate cuts.

- Views varied from supporting a reduction as early as July to favouring no cuts at all by year’s end, even though the majority expected some easing later this year.

- In the face of conflicting economic signals, such as tariff-related inflation threats, declining consumer spending, and a labour market that is nonetheless robust, the Fed remained cautious and data-driven.

Technical Triggers

- Gold continues to trade near the lower side of the range of $3300 (~Rs 96250) and $3400 (~Rs 98500). If prices sustain below $3280 (~Rs 96000), weakness could further extend to $3200 (~Rs 94000).

- Silver is not able to sustain above its range of $37.5 (~Rs 108,500) and $35.5 (~Rs 105,000). Consolidation continues before heading higher towards the next target is $38 (~Rs 110,000).

Support and Resistance

| Category | Support Level | Resistance Level |

|---|---|---|

| International Gold | $3280/oz | $3370/oz |

| Indian Gold | ₹96,000/10 gm | ₹97,700/10 gm |

| International Silver | $35.5/oz | $37.5/oz |

| Indian Silver | ₹1,05,000/kg | ₹1,10,000/kg |

International News

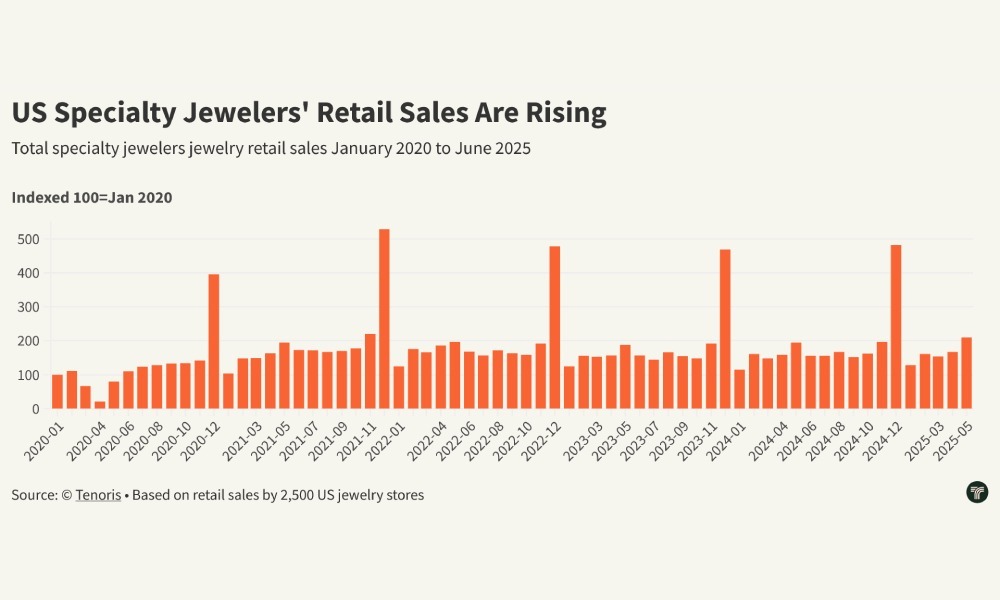

Tenoris Report: 5% rise in jewellery sales in H1 2025

Gold jewellery led category growth with low double-digit revenue gains

The jewellery market posted a healthy 5% revenue growth in H1 2025, according to Tenoris, sustained by a steady five-month rise and a 3% increase in June sales. While the total number of pieces sold declined, consumers spent more per item, leading to a 10% surge in expenditure per unit in June and higher average prices across diamond, sapphire, gold, platinum, and silver jewellery.

Lab-grown jewels stood out, recording higher unit sales despite falling average prices, reflecting shifting consumer preferences. Round diamonds, though still dominant at 52% of sales, are gradually losing ground to oval shapes, which now account for 20%.

Finished jewellery also performed well, especially bracelets, which saw nearly 10% year-on-year revenue growth. Demand is strengthening in higher price segments, notably items priced between $7,500 and $10,000.

Natural diamond jewellery sales dipped in June but rose 3% year-to-date, driven by demand for pendants, bracelets, and necklaces above $2,500, often featuring lab-grown diamonds. The loose natural diamond market saw higher average carat weights but longer inventory turnover, while lab-grown loose diamonds continued to capture market share. Overall, the industry is rebounding from flat sales in H1 2024 and is focused on tapping new consumer demographics to sustain momentum.

-

National News7 days ago

National News7 days agoMalabar Gold & Diamonds Inaugurates Landmark Integrated Manufacturing Site in Hyderabad, Cementing Its Position as a Global Manufacturing Leader

-

National News2 months ago

National News2 months agoEmmadi Silver Jewellery Launches First Karnataka Store with Grand Opening in Bengaluru’s Malleshwaram

-

BrandBuzz3 months ago

BrandBuzz3 months agoMia by Tanishq Unveils ‘Fiora’ Collection This Akshaya Tritiya: A Celebration of Nature’s Blossoms and New Beginnings

-

GlamBuzz2 months ago

GlamBuzz2 months agoGokulam Signature Jewels Debuts in Hyderabad with Glamorous Launch at KPHB