DiamondBuzz

U.S. couples spent 5% less on engagement rings in 2024 : The Knot

In recent years, the engagement ring market has witnessed significant changes, particularly in consumer spending and gemstone preferences. According to a report by The Knot, U.S. couples spent approximately 5% less on engagement rings in 2024 compared to the previous year. The average cost of an engagement ring fell from $5,500 in 2023 to $5,200 in 2024, marking a 10% decline from 2022 and a 13% decrease from 2021. This trend aligns with the increasing preference for lab-grown diamond center stones, which, for the first time, accounted for more than half of all engagement rings purchased. The shift towards synthetic diamonds has surged by 40% since 2019, contributing significantly to the downward trend in overall spending on engagement rings.

The rise in demand for lab-grown diamonds is not only reducing costs but also influencing the size of center stones. While the average cost of a natural diamond engagement ring remains at $7,600, couples who opt for lab-grown alternatives tend to select larger stones. In 2024, the average engagement ring center stone measured 1.7 carats, an increase from the 1.5-carat average in 2021. This shift suggests that couples are prioritizing carat size while seeking more affordable alternatives to mined diamonds. Additionally, shape and metal preferences have remained relatively stable, with round and oval cuts being the most popular, and white and yellow gold accounting for over 70% of engagement ring settings. Notably, yellow gold has increased in popularity by 5% year-over-year, while white gold has declined by 3%.

Beyond gemstone and metal choices, setting styles are also evolving. Prong settings continue to dominate, with 35% of respondents selecting this classic option. However, the hidden halo setting—a cluster of diamonds encircling the base of the center stone—has gained traction, capturing 18% of the market and surpassing the traditional halo setting, which saw a decline to 13%. This trend reflects a shift in aesthetic preferences among modern couples who seek a balance between timeless elegance and contemporary design. Moreover, the engagement ring purchasing process has become more meticulous. Over half of proposers spent between one and four months researching and selecting a ring, with a quarter taking even longer. The increase in shopping duration correlates with a rise in the number of jewelers visited. On average, proposers explored five stores in 2024, compared to just two in 2022 and 2023, underscoring the importance of in-person evaluation before making a purchase.

The engagement ring industry continues to adapt to evolving consumer behavior, as financial considerations, ethical concerns, and aesthetic trends shape purchasing decisions. With lab-grown diamonds offering an affordable yet visually identical alternative to natural diamonds, the shift in spending and preferences is likely to persist. As couples become more discerning and invested in the selection process, the future of the engagement ring market may see further innovations and adjustments to meet the needs of modern consumers.

DiamondBuzz

Botswana Diamonds rebrands as Botswana Minerals PLC

Signals a definitive shift toward copper exploration as the diamond market faces a stiff cyclical downturn.

Botswana Diamonds PLC, a long-time explorer of the world’s most famous gemstones, has officially rebranded as Botswana Minerals PLC, signaling a definitive shift toward copper exploration as the diamond market faces a stiff cyclical downturn. The name change, which took effect Feb. 27, follows a strategic review that leveraged artificial intelligence to scan the company’s massive 95,000-square-kilometer geological database. While the AI was originally designed to hunt for kimberlite pipes—the volcanic rock that hosts diamonds—it instead unearthed “outstanding” evidence of copper deposits.

A High-Tech Pivot

The company, listed on London’s AIM and the Botswana Stock Exchange, has identified 11 copper targets across the country and has already secured eight prospecting licenses. The move reflects a broader trend among junior miners seeking to capitalize on the “green metal” boom driven by electric vehicles, renewable energy, and AI data centers.

The Diamond Dilemma

The rebranding comes as the natural diamond sector grapples with two simultaneous concerns:

- Technological Disruption: Lab-grown diamonds continue to cannibalize the lower end of the market, offering consumers a cheaper alternative that is chemically identical to mined stones.

- Cyclical Downturn: Sluggish global demand and high inventory levels have dampened investor enthusiasm for natural stones.

Despite the pivot, the company is not abandoning its roots entirely. It remains one of the largest holders of exploration data in Botswana and intends to maintain its diamond acreage, betting that high-quality natural stones will eventually regain their luster.

By shifting focus to copper, Botswana Minerals (trading under the new ticker BMIN) joins a growing list of players in the Kalahari Copper Belt, a region increasingly viewed as a world-class mining frontier.

-

DiamondBuzz22 minutes ago

DiamondBuzz22 minutes agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz1 hour ago

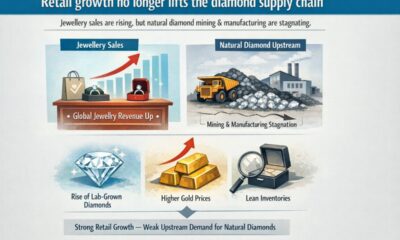

DiamondBuzz1 hour agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News3 hours ago

International News3 hours agoIndia Pavilion at HK twin shows showcases exceptional craftsmanship

-

International News3 hours ago

International News3 hours agoGold continues to get strength on the Middle East conflict