International News

Epitome of masterful craftsmanship: Paris Couture Week 2025 dazzled exquisite high-jewellery collections

Paris Couture Week 2025 dazzled with the unveiling of seven exquisite high-jewelry collections, each showcasing masterful craftsmanship and breathtaking gemstones. Each collection underscored the artistry and innovation that define haute joaillerie at its finest.

Boucheron’s Untamed Nature collection paid homage to the natural world with intricate, multi-wear pieces like the Airelles necklace. Louis Vuitton’s Awakened Hands, Awakened Minds drew inspiration from 19th-century France, incorporating industrial elements into striking designs. Chaumet’s Bamboo capsule collection honored Asian aesthetics with diamond-set bamboo motifs, while Dior’s Milly Dentelle translated lacework and nature into delicate gold and gemstone creations.

Piaget’s Essence of Extraleganza celebrated the brand’s 150th anniversary with cocktail-inspired designs, evoking the glamour of the ’60s and ’70s. Cartier’s Nature Sauvage continued its exploration of the animal kingdom, with bold interpretations of sea urchins and tigers adorned in precious stones.

Graff’s The Gift of Love unveiled a masterpiece featuring 125 carats of diamonds, with a pair of sparrows symbolizing love and devotionThe Gift of Love is a statement necklace glimmering with 125 carats of diamonds. Its form resembles that of a diamond feather, with two sparrows at the ends. Associated with the goddess of love Aphrodite, sparrows are emblems of love, togetherness and hope.

While the folds of the highly articulated feather-like structure are set with custom-cut baguette diamonds, the diamond birds are accented with blue sapphire eyes and black onyx beaks. As one bird flutters in mid-flight, the other presents it with a stunning treasure: A 13.51-carat fancy intense yellow pear-shape diamond.

International News

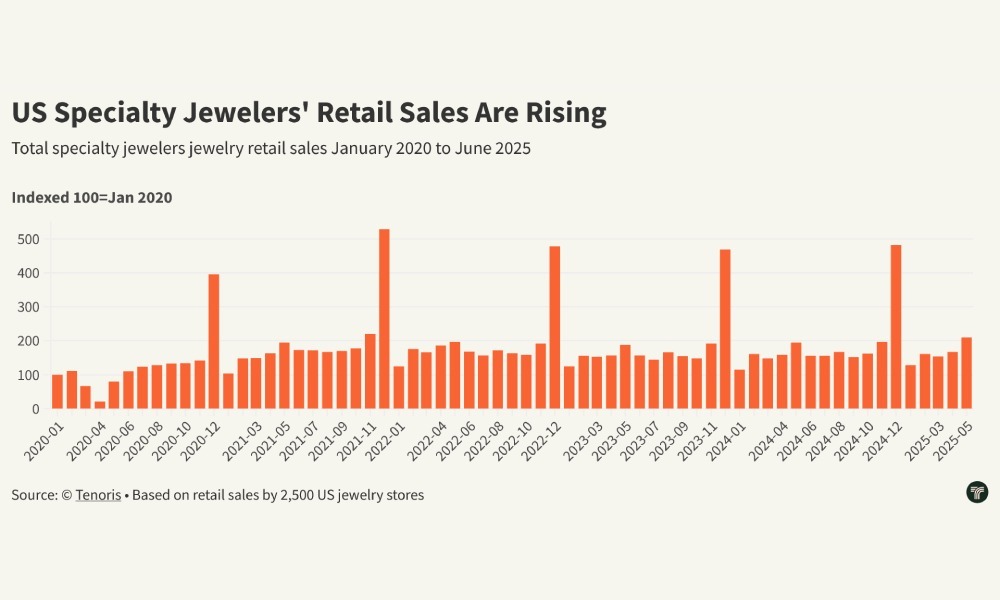

Tenoris Report: 5% rise in jewellery sales in H1 2025

Gold jewellery led category growth with low double-digit revenue gains

The jewellery market posted a healthy 5% revenue growth in H1 2025, according to Tenoris, sustained by a steady five-month rise and a 3% increase in June sales. While the total number of pieces sold declined, consumers spent more per item, leading to a 10% surge in expenditure per unit in June and higher average prices across diamond, sapphire, gold, platinum, and silver jewellery.

Lab-grown jewels stood out, recording higher unit sales despite falling average prices, reflecting shifting consumer preferences. Round diamonds, though still dominant at 52% of sales, are gradually losing ground to oval shapes, which now account for 20%.

Finished jewellery also performed well, especially bracelets, which saw nearly 10% year-on-year revenue growth. Demand is strengthening in higher price segments, notably items priced between $7,500 and $10,000.

Natural diamond jewellery sales dipped in June but rose 3% year-to-date, driven by demand for pendants, bracelets, and necklaces above $2,500, often featuring lab-grown diamonds. The loose natural diamond market saw higher average carat weights but longer inventory turnover, while lab-grown loose diamonds continued to capture market share. Overall, the industry is rebounding from flat sales in H1 2024 and is focused on tapping new consumer demographics to sustain momentum.

International News

Gold edges lower on rebounding Dollar as trade war intensifies AUGMONT BULLION REPORT

As the trade war heats up, the dollar trades at a two-week high against the yen, while gold drops below $3300.

- A 50% tariff on copper imports, possible 200% duties on pharmaceuticals, and a 10% levy on goods from BRICS nations are just a few of the extensive new measures that President Donald Trump announced, ruling out future extensions to the August 1 tariffs.

- Meanwhile, following a strong US jobs report last week, which allayed concerns about a slowing economy, the Fed lowered its July rate drop predictions.

- The expectation for more rate cuts has also decreased because the tariffs are anticipated to increase US inflation in the upcoming months.

- Investors are now waiting for the minutes of the June FOMC meeting to be released in order to gain further understanding of the Fed’s policy position.

Technical Triggers

- Gold continues to trade near the lower side of the range of $3300 (~Rs 96250) and $3400 (~Rs 98500). If prices sustain below $3280 (~Rs 96000), weakness could further extend to $3200 (~Rs 94000).

- Silver is not able to sustain above its range of $37.5 (~ Rs 108,500) and $35.5 (~ Rs 105,000). Consolidation continues before heading higher towards the next target is $38 (~Rs 110,000)

Support and Resistance

For Gold

| Region | Support Level | Resistance Level |

|---|---|---|

| International Gold | $3280/oz | $3370/oz |

| Indian Gold | ₹96,000/10 gm | ₹97,700/10 gm |

For Silver

| Region | Support Level | Resistance Level |

|---|---|---|

| International Silver | $35.5/oz | $37.5/oz |

| Indian Silver | ₹1,05,000/kg | ₹1,10,000/kg |

International News

WGC REPORT :Gold ETF Flows- June 2025

Global gold ETFs’ total AUM rose to a month-end peak and holdings bounced to the highest in 34 months

H1 in review

Global physically backed gold ETFs1 saw inflows of US$38bn during H1, boosted by strong positive flows in June (Chart 1), marking the strongest semi-annual performance since H1 2020.2 All regions saw inflows last month, with North American and European investors leading the charge.

During the first half, North America accounted for the bulk of inflows, recording the strongest H1 in five years. And despite slowing momentum in May and June, Asian investors bought a record amount of gold ETFs during H1, contributing an impressive 28% to net global flows with only 9% of the world’s total assets under management (AUM). European flows finally turned positive in H1 2025 following non-stop semi-annual losses since H2 2022.

By the end of H1 the surging gold price and notable inflows pushed global gold ETFs’ total AUM 41% higher to US$383bn, a month-end record. Collective holdings in H1 grew 397t to 3,616t, the highest month-end value since August 2022 (Chart 2).

Regional overview

North America attracted US$4.8bn in June – the strongest monthly inflow since March – bringing total H1 inflows to US$21bn. Spiking geopolitical risks amid the Israel-Iran conflict boosted investor demand for safe-haven assets and supported inflows into North American gold ETFs. Although it held rates steady in June, the US Fed continued to express concerns about slowing growth and rising inflation.3 Markets are now pricing in three rate cuts by the end of 2025 and an additional two in 2026.

The investor response has been swift: US Treasury yields declined, and the dollar continued to weaken. Persistent policy uncertainty and ongoing fiscal concerns are likely to remain an overhang on the market, which in turn could help support gold ETF demand in the near to medium term.

European inflows continued for a second month, adding US$2bn in June – the strongest since January – and lifting the region’s H1 total to US$6bn. The UK led inflows in the month; although the Bank of England kept rates unchanged at its June meeting, the stance was generally dovish. 4 Combined with weaker growth, easing inflation and the cooling labour market, investors raised their bets on future rate cuts. This resulted in local yields declining and pushed up gold’s allure. Meanwhile, the eighth cut from the European Central Bank, uncertainties surrounding growth, and rising geopolitical risks generally, contributed to gold ETF demand in several major markets.

Asian flows flipped positive in June, albeit only mildly at US$610mn, ending at US$11bn – a record amount for any H1 period. India led inflows in June, likely supported by rising geopolitical risks in the Middle East. Japan recorded inflows for the ninth consecutive month (US$198mn, US$1bn H1), possibly driven by elevated inflationary concerns – particularly when the rice price surged.6 China only saw mild inflows in the month (US$137mn) as trade tensions eased and the local gold price moderated.7 Nonetheless, China’s H1 inflows of US$8.8bn (85t) were unprecedented amid spiking trade risks with the US, growth concerns and the surging gold price.

-

National News5 days ago

National News5 days agoMalabar Gold & Diamonds Inaugurates Landmark Integrated Manufacturing Site in Hyderabad, Cementing Its Position as a Global Manufacturing Leader

-

National News2 months ago

National News2 months agoEmmadi Silver Jewellery Launches First Karnataka Store with Grand Opening in Bengaluru’s Malleshwaram

-

BrandBuzz3 months ago

BrandBuzz3 months agoMia by Tanishq Unveils ‘Fiora’ Collection This Akshaya Tritiya: A Celebration of Nature’s Blossoms and New Beginnings

-

GlamBuzz2 months ago

GlamBuzz2 months agoGokulam Signature Jewels Debuts in Hyderabad with Glamorous Launch at KPHB