International News

Trump’s back-and-forth on tariffs creates uncertainty, drives surge in gold prices

Gold price rebounds toward record highs of $3,246 after the previous pullback. Trump’s back-and-forth on tariffs creates uncertainty, underpinning Gold’s safe-haven appeal.Gold remains poised for a fresh leg higher on bullish technical setup on the daily chart.Gold price is bouncing back toward the record highs of $3,246 set on Monday as buyers fight back control despite a sense of calm across the financial markets early Tuesday.

This resurgence comes despite relative calm in broader financial markets, and it underscores the enduring appeal of gold as a safe-haven asset amid political and economic turbulence. Central to this dynamic is the evolving and often erratic trade policy rhetoric emanating from the United States, particularly from former President Donald Trump. As markets struggle to interpret shifting stances on tariffs and brace for consequential economic data, gold appears poised to continue its upward trajectory, supported by both technical and fundamental factors.

The reemergence of gold’s bullish momentum occurs against a backdrop of a moderating U.S. bond market. Last week’s surge in Treasury yields—a swift 50 basis point increase—has partially reversed, with the benchmark 10-year yield falling by approximately 10 basis points. This stabilization has provided a brief respite for investors, many of whom are digesting not only earnings reports from major U.S. corporations but also the ongoing ambiguity surrounding American trade policy.

Trump’s recent comments on adjusting the 25% tariffs on auto and auto parts imports from key partners such as Mexico and Canada have injected fresh uncertainty into the market. His administration’s exemptions for certain technology products, like smartphones and laptops, only added complexity, especially as these items remain subject to less severe 20% tariffs rather than the previously discussed 145% rate. Trump’s mention of impending tariff decisions on semiconductors further adds to the volatility.

Such unpredictability has clear implications for investor sentiment, which in turn sustains the allure of gold. As a non-yielding asset traditionally viewed as a hedge against economic instability, gold thrives during periods when policy inconsistency undermines market confidence. Moreover, the anticipation of further dovish shifts by the Federal Reserve amplifies this dynamic. Remarks from Fed Governor Christopher Waller this week highlighted the economic strain caused by tariff policies, suggesting that rate cuts might be necessary even in the face of persistent inflation. While some voices, like Atlanta Fed President Raphael Bostic, urge a wait-and-see approach, markets are pricing in substantial rate reductions—approximately 85 basis points by year’s end—with high confidence that rates will remain unchanged at the Fed’s next meeting in May.

Beyond the U.S., global factors are also reinforcing the upward pressure on gold prices. Chinese investors have significantly increased their holdings in physically backed gold exchange-traded funds (ETFs) in April, a trend confirmed by the World Gold Council. This inflow reflects both domestic economic concerns and a broader global appetite for risk hedging, particularly as China prepares to release its first-quarter GDP data. Monday’s announcement from China Customs, revealing a 12.4% year-over-year surge in exports for March, underscores the urgency with which Chinese exporters have responded to looming U.S. tariff hikes.

As gold continues its climb, technical indicators on the daily chart support the potential for further gains. Yet, this ascent remains contingent on several evolving narratives: Trump’s tariff proclamations, the Fed’s policy responses, and the tone of incoming macroeconomic data from China and beyond. In this complex and fluid environment, gold retains its timeless luster—not merely as a commodity, but as a barometer of global uncertainty.

International News

Gold prices in India continued to decline, modest recovery in global prices

geopolitical risks,rising energy prices continue to underpin gold demand globally.

Gold prices in India continued to decline on Thursday, marking the third straight session of losses even as global bullion prices attempted a modest recovery amid rising geopolitical tensions.

In the domestic market, 24-karat gold has fallen sharply over the past three days, with prices dropping by about ₹85,800 per 100 grams. The correction reflects a mix of global market volatility, profit-taking after recent highs, and currency movements affecting local bullion pricing.

As of Thursday morning, 24-karat gold was quoted at ₹16,451 per gram, down ₹311 from the previous session. The price of 22-karat gold slipped to ₹15,080 per gram, a decline of ₹285.

The drop in domestic prices comes even as international gold markets showed signs of stabilizing. Global bullion prices climbed back above $5,160 an ounce on Wednesday after recovering part of their earlier losses.

The rebound followed escalating tensions in the Middle East as the conflict involving the U.S., Israel and Iran entered its fifth day. Reports that Israel targeted a building where clerics were meeting to discuss the selection of a new Supreme Leader heightened geopolitical uncertainty, prompting renewed safe-haven flows into gold.

In India, however, retail bullion prices continued to reflect the recent correction.

On the derivatives side, gold futures on the Multi Commodity Exchange (MCX) were largely flat. The April 2026 contract opened at ₹1,63,265 per 10 grams, traded between ₹1,61,241 and ₹1,64,047 during the session, and was last quoted around ₹1,61,550—up marginally by ₹25, or 0.02%.

Market participants say geopolitical risks and rising energy prices could continue to underpin gold demand globally. Analysts note that if international prices hold above the $5,200 level, bullion could move toward the $5,450–$5,600 range in the near term, with price dips likely to attract strategic buying.

-

International News6 minutes ago

International News6 minutes agoGold prices in India continued to decline, modest recovery in global prices

-

DiamondBuzz17 hours ago

DiamondBuzz17 hours agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz18 hours ago

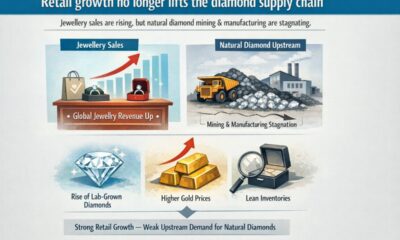

DiamondBuzz18 hours agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News20 hours ago

International News20 hours agoGold continues to get strength on the Middle East conflict