International News

MELTDOWN! Gold, silver markets witness historic reversal

The global precious metals market witnessed a historic reversal. This “flash crash” follows a relentless multi-month rally that had recently pushed both metals to lifetime highs. COMEX silver rate was more than 31% lower than its lifetime high of $121.755 per ounce. The COMEX gold price ended over 11% lower at $4,763.10/oz.

Indian Gold and Silver ETFs saw declines of up to 20% in a single session.Gold futures expiring on February 5, 2026, slid by as much as Rs 11,000, or 6.5%, to settle at Rs 1,59,984 per 10 grams. Silver contracts for March 5, 2026, delivery saw an even steeper decline, plunging Rs 68,000, or 16.6%, to Rs 3,34,503 per kg – going below the Rs 3.5 lakh per kg mark.

President Trump’s nomination of Kevin Warsh to replace Jerome Powell as Fed Chair has rattled markets.The US Dollar surged following the Fed announcement, making dollar-denominated metals more expensive for international buyers and prompting immediate profit-booking.

The Chicago Mercantile Exchange (CME) implemented aggressive margin increases for silver and gold. This forced highly leveraged traders to liquidate positions, triggering a “margin call” domino effect that drained market liquidity.

CME Group is raising margins on Comex gold and silver futures after prices suffered their biggest slides in decades.Gold margins will rise to 8% of the value of the underlying contract from the current 6% for a non-heightened risk profile. The heightened risk profile margins will be increased to 8.8% from the current 6.6%, it said.

Silver margins will climb to 15% from the current 11% for a non-heightened risk profile, while the heightened risk profile margins will be hiked to 16.5% from the current 12.1%, according to the statement. Platinum and palladium futures’ margins will also be boosted.

International News

Precious metals refining in crisis ; driven by rising commodity prices, limited refining capacity, and tight credit

The precious metals refining industry is in crisis as of January 30, 2026, due to skyrocketing commodity prices, limited refining capacity, and tight credit. Major refiners like Metalor and United Precious Metal Refining have halted new shipments, paused payments, and prioritized existing customers. This stems from a surge in trade-ins—gold hit $5,500/oz before dropping to $4,700/oz, silver reached $50/oz—overwhelming a shrunken U.S. capacity post-2019 closures of firms like Republic Metals.

Root Causes

High prices sparked massive investor and retail sell-offs of jewelry and scrap, tripling purchase volumes year-over-year. Structural bottlenecks persist: U.S. refineries, reduced to dozens, handle reservoir-scale inflows via “garden hose” infrastructure. Debt-financed models exacerbate issues—14-day processing cycles stretched to 60-90 days, payments from 48 hours to 14 days, exhausting credit lines amid doubled prices and interest costs. Banks hesitate to lend amid volatility, like gold’s $700 weekly plunge, making expanded operations unprofitable.

Key metrics

Key metrics underscore the acute strain on the precious metals refining sector: purchase volumes have surged to a 3x year-over-year increase, while gold prices have doubled over the same period; processing cycle times have ballooned from 14 days to 60-90 days, and payment cycles stretched from 48 hours to 14 days; silver recovery timelines now project 6-8 months to clear backlogs.

Capacity expansion lags due to infrastructure, regulations, and training needs. Jewelry retailers suffer cash flow hits from delayed scrap payments, disrupting supply chains like pre-holiday rushes.

Market Outlook and Recovery

Disruptions are seen as temporary liquidity crunches, not insolvency. Gold’s price retreat signals moderation; silver backlogs may take 6-8 months (e.g., Kitco halted silver buys). Stabilization should restore credit and operations, viewed as a historic event demanding better resilience.

Strategic Recommendations

- Refiners: Enhance customer communication, optimize capital, plan long-term capacity. Retailers: Revise cash planning, diversify refiners, inform customers.

- Stakeholders: View as manageable pause; track volatility and backlogs.

-

JB Insights3 days ago

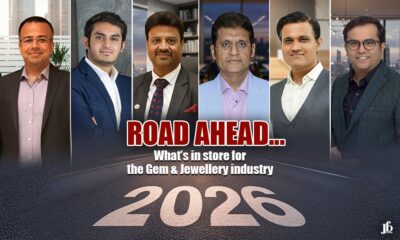

JB Insights3 days ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

BrandBuzz1 week ago

BrandBuzz1 week agoRanbir Kapoor Joins PNG Jewellers as the new Ambassador, Ushering in a New Chapter of Legacy and Modernity

-

New Premises1 week ago

New Premises1 week agoAimee Baruah Opens Grand Showroom of Manik Chand Nand Kishore Jewellers in Dibrugarh

-

DiamondBuzz2 days ago

DiamondBuzz2 days agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India