National News

India’s polished diamond exports continue to slide in June

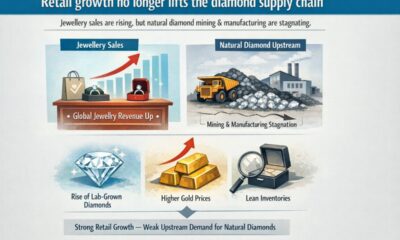

India’s gross monthly polished diamond exports declined by 23% year-on-year in June, amounting to $779 million, according to the latest data released by the Gems and Jewellery Export Promotion Council (GJEPC).

While the drop continues the downward trajectory seen over the past two years, the June decline was less severe than May, when exports fell by 35.5%, from $1.47 billion in May 2024 to $950 million—one of the steepest falls in recent memory.

India’s polished diamond exports have faced sustained pressure since 2022, with weakened consumer sentiment in major markets like the United States and China driving demand down. For the fiscal year 2024–25, exports declined 16.8% to $13.3 billion, marking the sector’s lowest performance in nearly two decades.

The latest data also highlights a 5% decline in rough diamond imports for the April–June quarter, signaling a cautious buying approach amid global market uncertainty.

While the overall gems and jewellery sector also experienced a downturn, it fared slightly better than diamonds alone, registering a 14.1% year-on-year decline in revenue.

National News

This Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

This Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey.

While jewellery is often associated with weddings and festivals, Dhirsons Jewellers, Dhiraj Dhir Group believes the most meaningful pieces are the ones that mark a woman’s personal milestones. This Women’s Day, the brand celebrates these moments with the theme “Honouring Milestones, Not Occasions.”

Moving beyond traditional celebrations, the brand highlights moments that truly define a woman’s journey. These personal achievements often go uncelebrated, yet they mark some of the most meaningful chapters in her life.

The campaign also introduces the idea of “a colour for every milestone.” Gold symbolises the woman who built her own foundation, reflecting strength and independence, while white represents the woman who chose to heal and begin again. Through this thought, Dhirsons Jewellers encourages women to recognise their journeys and celebrate the paths they have created for themselves.

Riva Dhir, Creative Director, Dhirsons Jewellers, Dhiraj Dhir Group, Lajpat Nagar said, “People often ask me what we create at Dhirsons, and my answer is simple, we don’t make jewellery for occasions, we create it for the milestones in a woman’s journey.

Over the years, I have seen women walk into our store at defining moments in their lives, celebrating a success, marking a hard-earned achievement, or simply choosing themselves for the first time. That is when I realised that jewellery is never just about gold or diamonds. It becomes a reminder of strength, growth, and a promise she once made to herself. That is why every piece we create is designed to outlive trends, because when a woman wears something truly meaningful, it becomes a part of her story.”

At its heart, the campaign celebrates the moments of courage, growth, and self-belief that shape a woman’s journey and recognises that these milestones deserve to be honoured and remembered when they happen.

-

National News3 hours ago

National News3 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz19 hours ago

BrandBuzz19 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz19 hours ago

BrandBuzz19 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz23 hours ago

BrandBuzz23 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration