JB Insights

Indian Gold Industry announces ‘Indian Association for Gold Excellence and Standards’ (IAGES)

IAGES is self-regulatory organization (SRO) for the Indian gold industry, by the Indian gold industry that is supported by the WGC

The Indian gold industry has today announced the formation of the Indian Association for Gold Excellence and Standards (IAGES – pronounced as I-AAY-GES), a self regulatory organisation (SRO) created by the Indian gold industry, for the Indian gold industry and supported by the World Gold Council.

IAGES will aim at increasing consumer confidence and enhancing trust in the Indian gold industry through encouraging adoption of fair, transparent and sustainable practices, regulatory compliance, establishing code of conduct and introducing an audit framework – created by the Indian gold industry, for the Indian gold industry across the entire industry value chain. It will be inspired by the World Gold Council’s Retail Gold Investment Principles IAGES will aim to give gold providers a detailed set of best practices and a road map for implementing them.

IAGES will be formed by national industry associations including Indian Bullion and Jewellers Association (IBJA), All India Gems and Jewellery Council of India (GJC) and Gem and Jewellery Export Promotion Council (GJEPC) and supported by the World Gold Council.

IAGES logo represents coming together of various stakeholders of the Indian industry for the greater good of the gold industry and colour red denotes purity, commitment and represents India’s warm diversified culture.

IAGES will be independently governed and professionally managed. The Code of Conduct created by it will be available for everyone from the industry, however, its adoption will be entirely voluntary. The registrations for IAGES membership will be announced soon and the organisation will be operational by early 2025.

Sachin Jain, Regional CEO, India, World Gold Council, said, “The gold industry is integral to the Indian economy, contributing approx. 2% to Indian GDP and 3-5mn in employment. The World Gold Council has been promoting a need for creating a Self-regulatory organisation to promote adoption of best practices. The launch of IAGES marks a pivotal step towards enhancing trust for the Indian gold industry. Self-regulation will help empower stakeholders to build a sustainable and trusted gold market. We at the World Gold Council are fully committed to supporting IAGES. It is a unique initiative and global gold industry will be watching it, it should help propel India’s gold market to global prominence.”

Vipul Shah, Chairman, Gem and Jewellery Export Promotion Council (GJEPC), said, “The formation of IAGES is a landmark achievement for the Indian gold industry. It underscores our collective commitment to establishing the highest standards of ethics, transparency, and sustainability. By creating a self-regulatory body, we are taking a proactive step to build trust and confidence among Govt., consumers, investors, and international stakeholders in the Indian gem & jewellery industry. IAGES will not only strengthen India’s position as a global gold hub but also drive innovation and growth within the industry.

Saiyam Mehra, Chairman, All India Gems and Jewellery Council of India (GJC); “All India Gem & Jewellery Domestic Council is honoured to be associated with the IAGES. IAGES is surely the need of the hour, and this collaboration represents a significant step towards advancing the standards of excellence and transparency within the gold industry in India.

Prithviraj Kothari, National President, India Bullion and Jewellers Association (IBJA); “The establishment of IAGES marks a significant milestone for the Indian gold sector, showcasing our united dedication to upholding the highest standards of integrity, transparency, and sustainability. Through the creation of a self-regulating entity, we are proactively fostering trust and confidence among governmental bodies, consumers, investors, and international partners within the Indian gem and jewellery domain.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

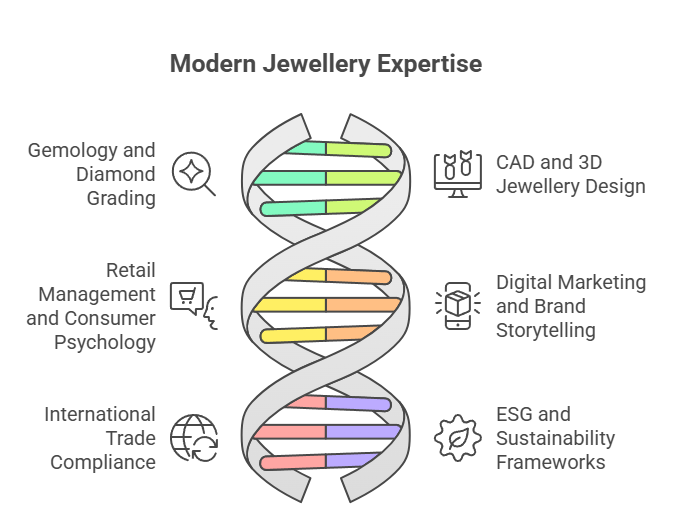

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

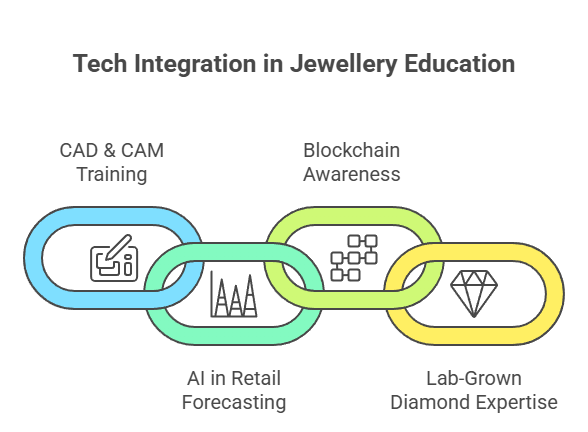

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

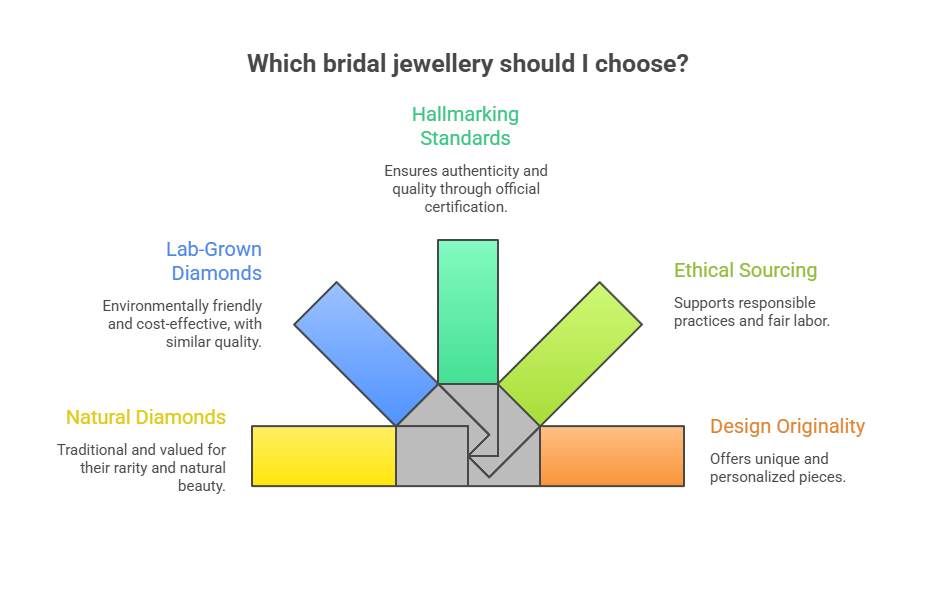

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

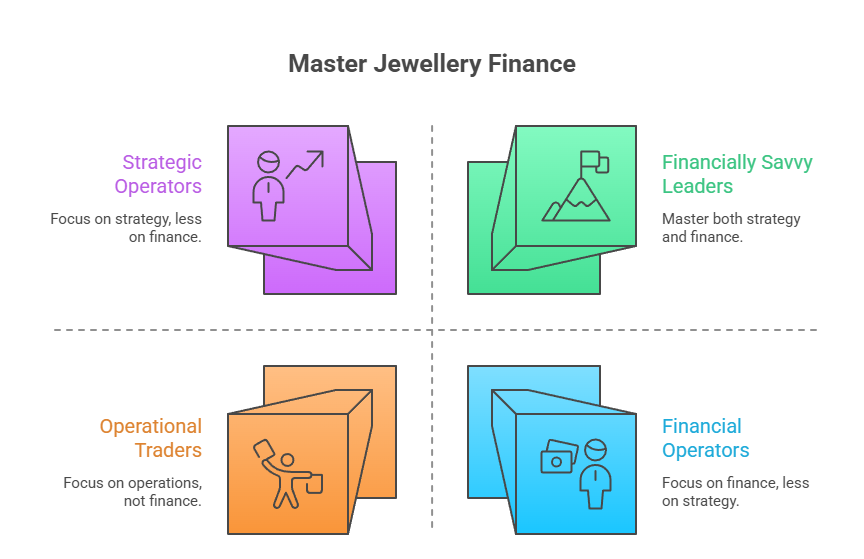

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

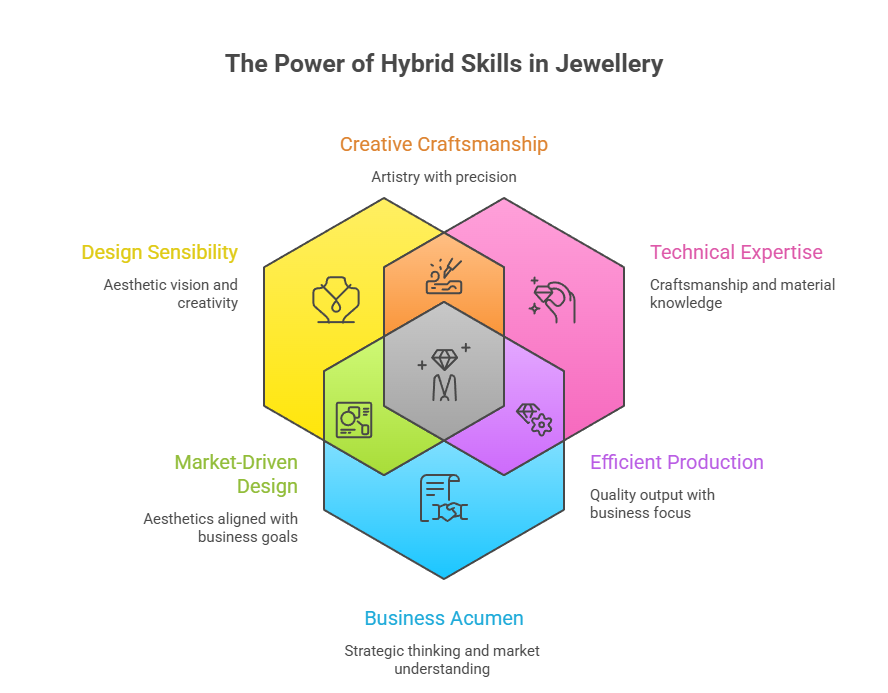

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

National News45 minutes ago

National News45 minutes agoKumari Fine Jewellery Celebrates the “Modern Indian Original” with Exclusive Women’s Day Showcase

-

National News4 hours ago

National News4 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz21 hours ago

BrandBuzz21 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz21 hours ago

BrandBuzz21 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business