International News

India takes centre stage as Partner Country at INHORGENTA 2025

India takes centre stage as Partner Country at INHORGENTA 2025

India proudly takes centre stage as the role of official partner country at INHORGENTA 2025, marking a pivotal moment in the global gem and jewellery industry. The show, INHORGENTA 2025, was inaugurated at the India Pavilion today by Shatrughna Sinha, IFS, Consul General of India, Munich; Kirit Bhansali, Chairman, GJEPC; Stefan Rummel, CEO of Messe München; and Stefanie Maendlein, Exhibition Director of INHORGENTA.

Curated by GJEPC, the India Pavilion is showcasing a stunning array of diamond jewellery, gold and platinum pieces, fine jewellery, and loose gemstones. The India Experience Lounge at INHORGENTA 2025 offers visitors a multi-sensory journey into India’s rich heritage, blending craftsmanship, culture, and innovation.

Additionally, the Brand India Gallery displays masterpieces from the Artisan Jewellery Design Awards, demonstrating India’s exceptional talent and creative excellence. From the exquisite jewellery and Manchaha Rugs, handwoven by rural artisans, to the flavors of Kashmiri Kahwa and Masala Chai, every element engages the senses. The aroma of sandalwood and the melodic strains of the Sitar create an immersive atmosphere, making the lounge a true celebration of India’s artistry and tradition.

A panel discussion, The Rising Indian Jewellery Influence in the Global Landscape, will explore India’s growing impact on the global market, featuring industry experts Alice Cicolini, a high-end jewellery designer based in the UK, and Radhika Somaia, a brand architect, curator, and jewellery contributor.

International News

73rd Bangkok Gems and Jewelry Fair sets new record with 4.75 Billion Baht in trade value

Over 40,000 visitors from 118 countries propel the fair to its highest trade value since inception.

The Department of International Trade Promotion (DITP), in collaboration with the Gem and Jewelry Institute of Thailand (GIT), announced the successful conclusion of the 73rd Bangkok Gems and Jewelry Fair, held from February 22–26, 2026, at the Queen Sirikit National Convention Center (QSNCC). The event generated total trade value exceeding 4.75 billion baht, the highest since the fair’s inception.

The fair welcomed 40,721 visitors from 118 countries, with international visitors accounting for 61% of total attendance, reaffirming Thailand’s role as a global hub for the gem and jewelry trade. The top five visiting nations included India, Myanmar, China, Japan, and Sri Lanka, whose buyers drove high demand across key categories such as colored stones, silver jewelry, fine jewelry, diamonds, and industry machinery and equipment.

“The success of the 73rd Bangkok Gems & Jewelry Fair reflects the confidence of buyers and industry players worldwide in Thailand’s potential,” said Sunanta Kangvalkulkij, Director-General of DITP. “This event not only set a new record with over 4.75 billion baht in trade value, but it also reinforced Thailand’s vital role as a key global hub for gems and jewelry, even amidst the current challenges of the international economic landscape.”

To accommodate the industry’s growing interest, the 73rd edition expanded its exhibition space to over 53,000 square meters, covering Halls 1–8 and Plenary Halls 1–2. The fair hosted 1,222 companies from 19 countries across 2,794 booths.

The fair was also honored by the presence of Her Royal Highness Princess Sirivannavari Nariratana Rajakanya, who presided over the opening ceremony and viewed the “TREASURE OF DREAMS” exhibition. The showcase featured a high-jewelry collection designed by Her Royal Highness and crafted by master Thai artisans, reflecting her commitment to preserving and advancing traditional Thai craftsmanship while promoting Thailand’s jewelry industry on the international stage.

The 74th Bangkok Gems and Jewelry Fair is scheduled to take place from

September 8–12, 2026, at the Queen Sirikit National Convention Center (QSNCC).

-

National News1 hour ago

National News1 hour agoNeha Kishorkumar Shah, Director, Chandukaka Saraf felicitates influencers at Lokmat Women Influencer Awards

-

GlamBuzz3 hours ago

GlamBuzz3 hours agoDe Beers Group Partners with Abhishek Sharma to Champion Natural Diamonds in India

-

International News4 hours ago

International News4 hours ago73rd Bangkok Gems and Jewelry Fair sets new record with 4.75 Billion Baht in trade value

-

National News6 hours ago

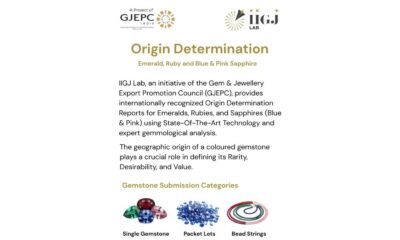

National News6 hours agoIIGJ Lab Jaipur Expands Origin Testing for Ruby, Emerald and Sapphire Lots & Strands