JB Insights

India Silver Conference 2025 Concludes with Record Participation and Fresh Innovations in Udaipur

Over 260 delegates and 33 speakers converge to explore strategies for sustaining silver demand amid high price regimes; New networking and engagement tools introduced.

The 3rd edition of the India Silver Conference, held from April 25 to 27, 2025, at the Radisson Blu Palace Resort & Spa, Udaipur, concluded on a high note, drawing more than 260 delegates, 28 sponsors and partners, 10 exhibitors, and 33 expert speakers from across the silver value chain. Organised by Eventell Global Advisory Private Limited, this year’s conference revolved around the timely theme, “Sustaining Demand During High Price Regime”, addressing critical challenges and strategies within the silver industry.

The three-day event stood out not only for its robust content and participation but also for the seamless integration of new technology platforms to enhance attendee experience. The launch of the MyEventell App empowered participants to connect with peers, access real-time agendas, interact with sponsors, and engage in interactive games—winners of which were rewarded with exciting prizes.

Another key innovation was the Premagic Gallery, offering live photo uploads throughout the event, making it easier for attendees to relive key moments and download memories instantly.

A central moment of the conference was the ISC Excellence Awards, with 22 accolades presented to recognise exemplary contributions across diverse segments of the silver ecosystem.

The event fostered a dynamic environment of learning, networking, and business development, with attendees lauding the high level of discourse, actionable insights, and collaborative spirit that defined the gathering.

Organisers have already set sights on the India Silver Conference 2026, promising an even more enriching experience for stakeholders across the silver industry.

JB Insights

Women’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

From milestone-driven collections to personalised styling and self-purchase narratives, jewellery brands across India are celebrating women’s independence, identity, and achievements this International Women’s Day.

International Women’s Day 2026 has prompted jewellery brands across India to launch campaigns that celebrate women’s empowerment, individuality, and personal achievements. Moving beyond traditional gifting narratives, many brands are positioning jewellery as a symbol of self-expression and personal milestones, reflecting the evolving role of women as independent buyers in the jewellery market.

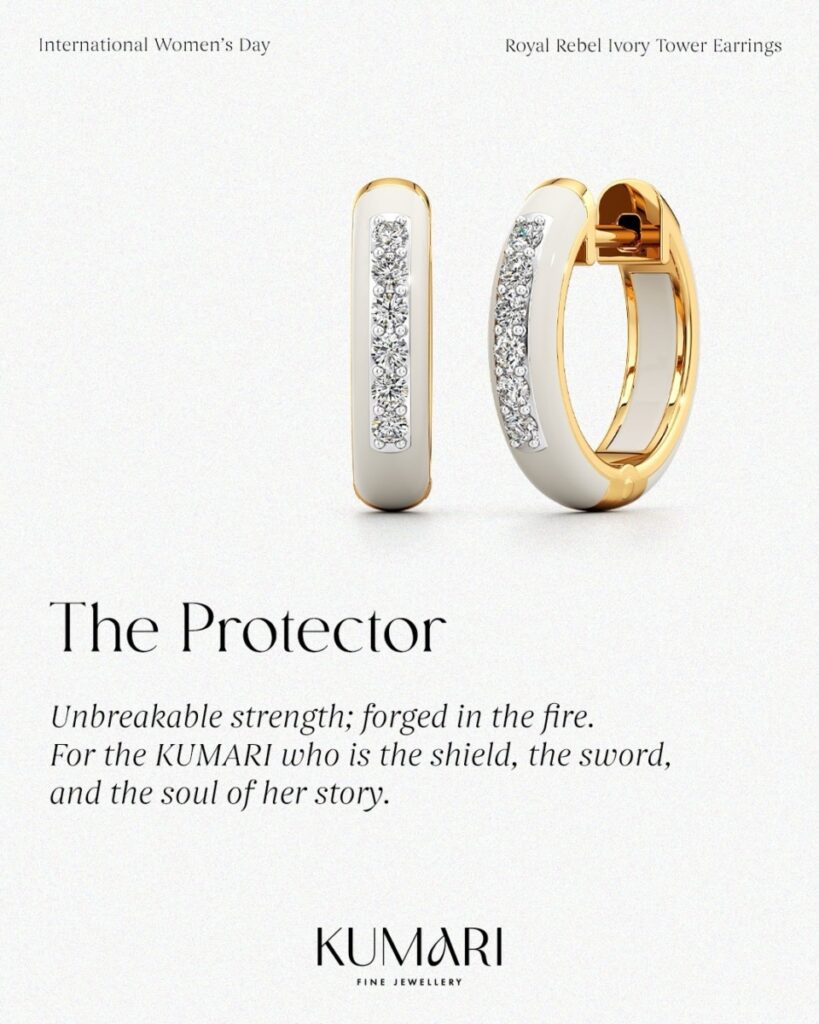

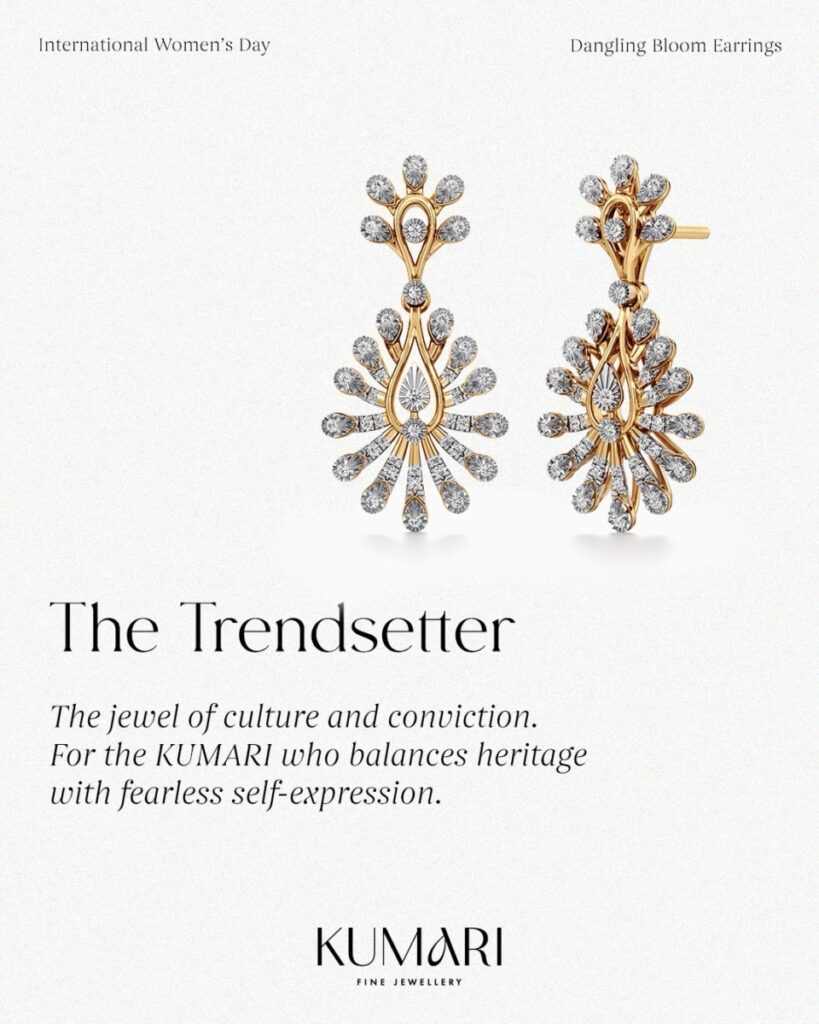

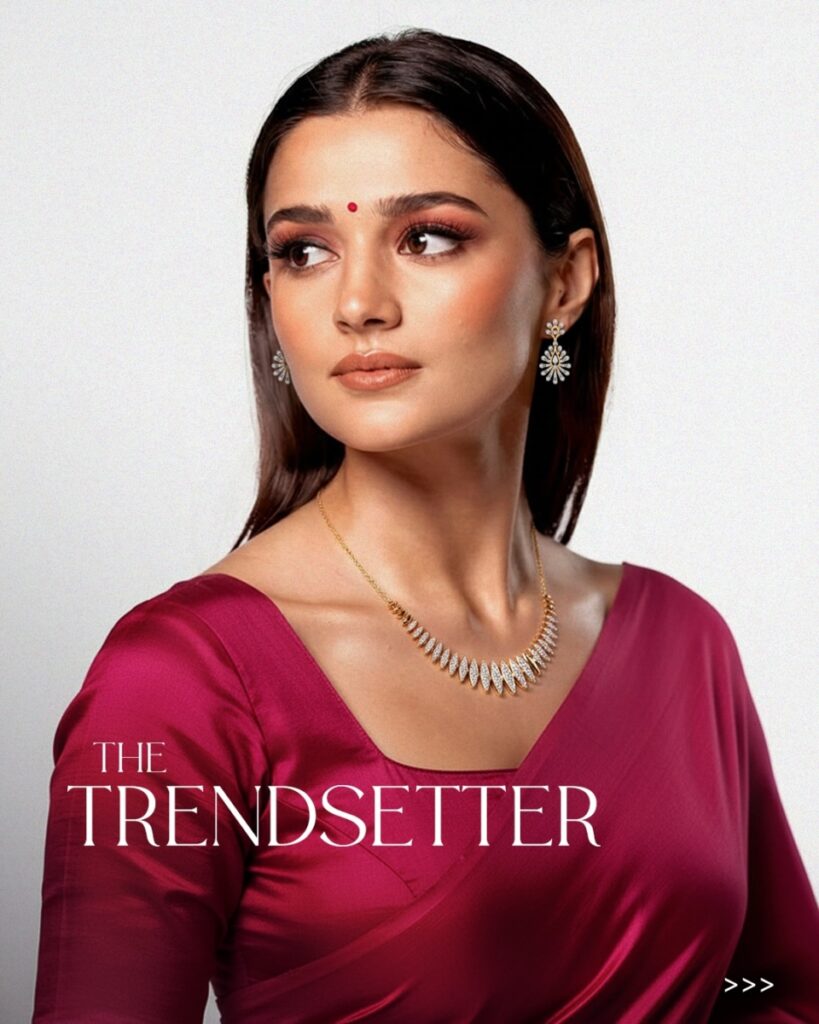

Kumari Fine Jewellery

Mumbai-based Kumari Fine Jewellery has introduced a Women’s Day showcase themed around the idea of the “Modern Indian Original.” The initiative focuses on financially independent women who mark their achievements with self-purchased jewellery. The showcase highlights lightweight gold pieces designed for everyday wear, reinforcing jewellery as both a style statement and a symbol of personal growth.

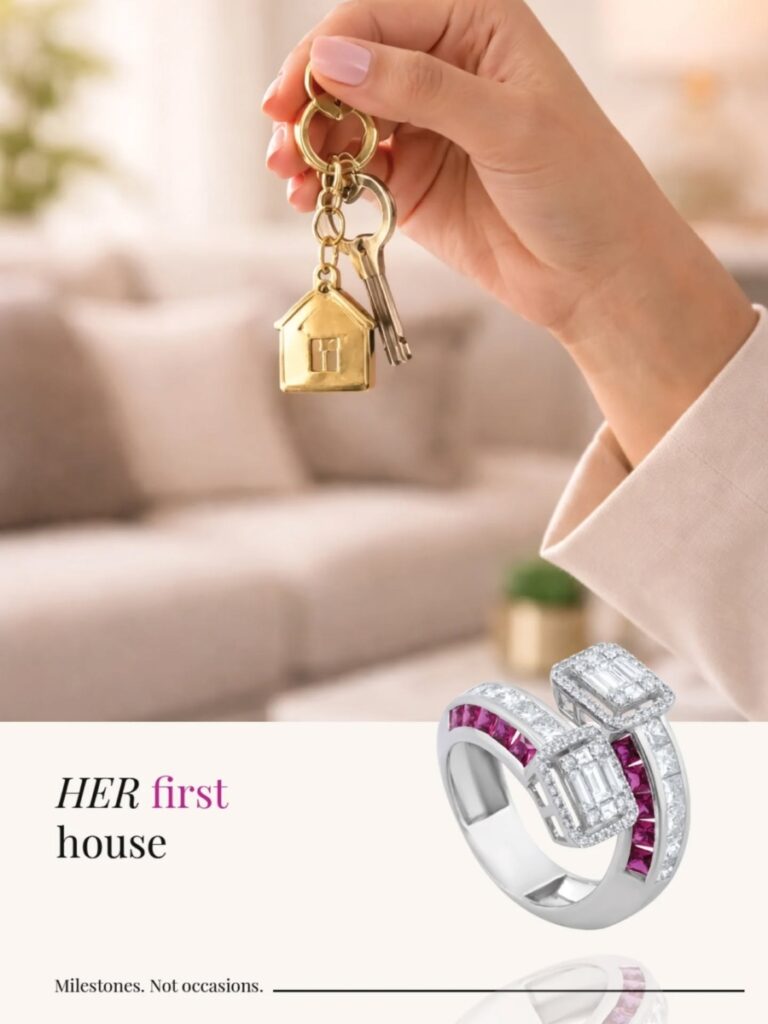

Dhirsons Jewellers

Delhi’s Dhirsons Jewellers has launched a campaign centred on celebrating milestones in a woman’s journey rather than traditional occasions. The initiative encourages women to recognise defining moments in their lives, positioning jewellery as a reflection of resilience, confidence, and self-belief.

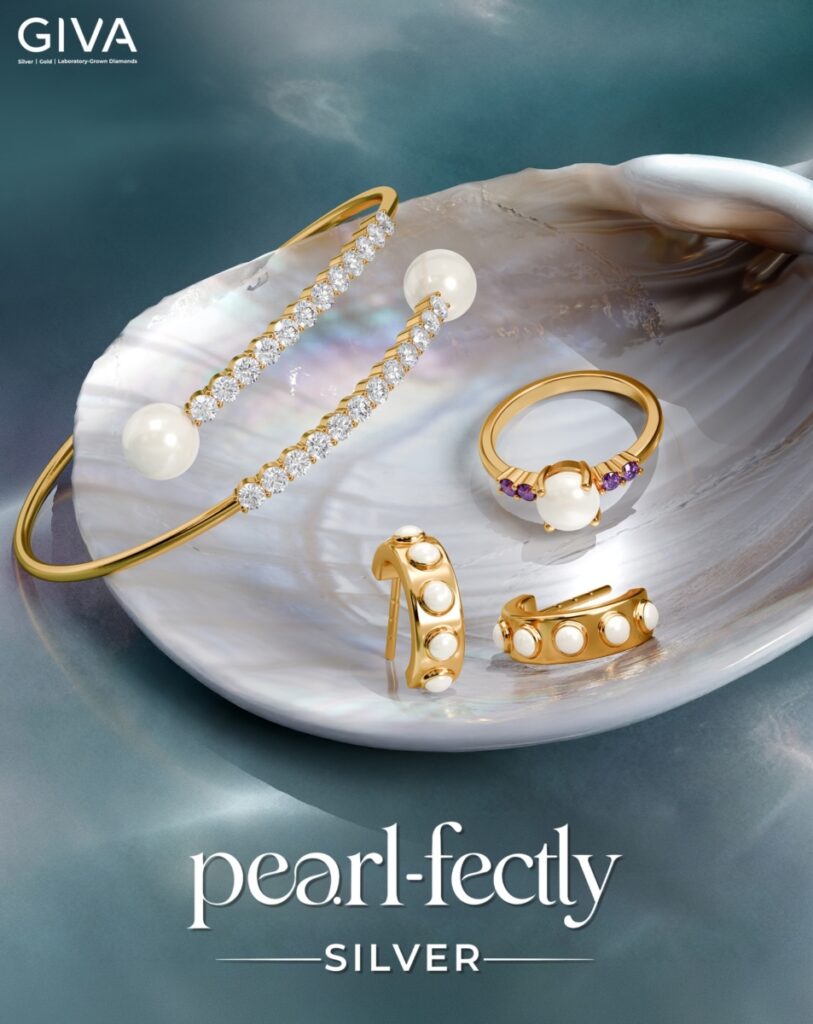

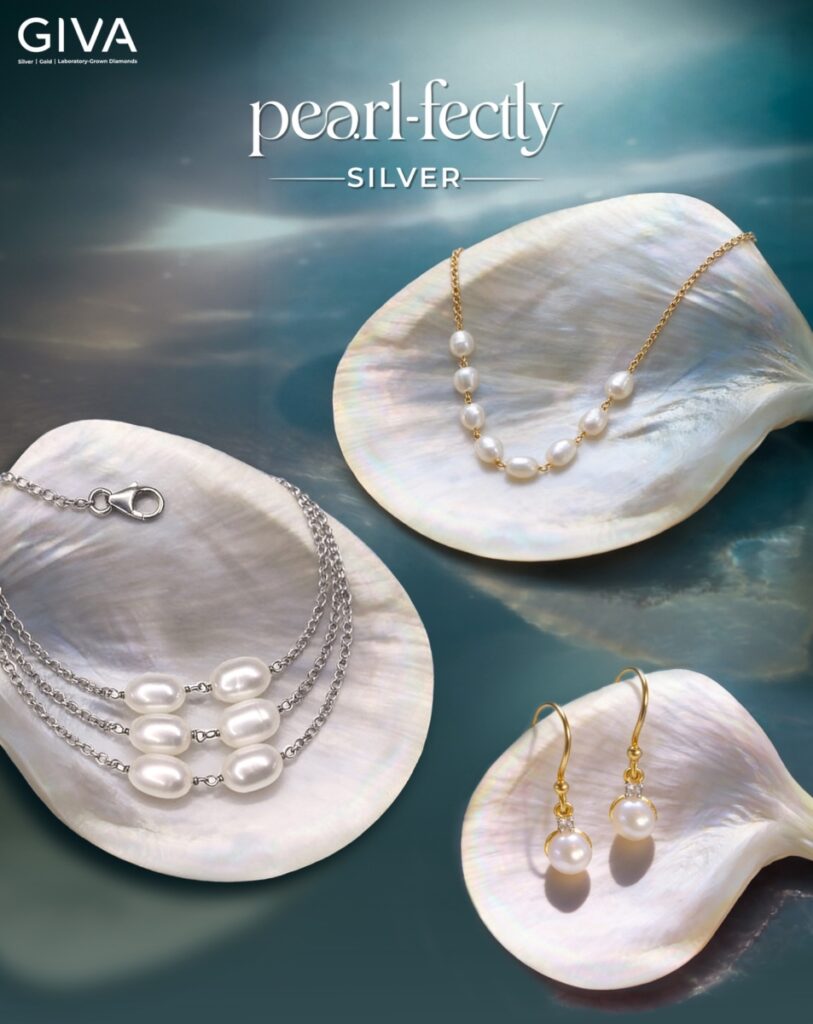

GIVA

Digital-first jewellery brand GIVA has unveiled a Women’s Day concept titled The Pearl Edit, focusing on timeless pearl jewellery that celebrates women who are building, leading, and redefining their paths. The campaign emphasises understated elegance while encouraging women to celebrate themselves through meaningful jewellery.

Divine Solitaires

Diamond jewellery brand Divine Solitaires has also introduced a Women’s Day campaign highlighting the emotional value of solitaire diamonds as symbols of personal milestones. The initiative focuses on recognising the journeys of women across roles—from professionals and entrepreneurs to mothers and mentors—while encouraging self-appreciation through jewellery.

Senco Gold & Diamonds

Technology-driven campaigns have also gained traction this year. Senco Gold & Diamonds has launched an initiative that integrates artificial intelligence into jewellery styling, enabling customers to discover pieces that match their personality and features. The concept highlights individuality while bringing digital innovation into the jewellery retail experience.

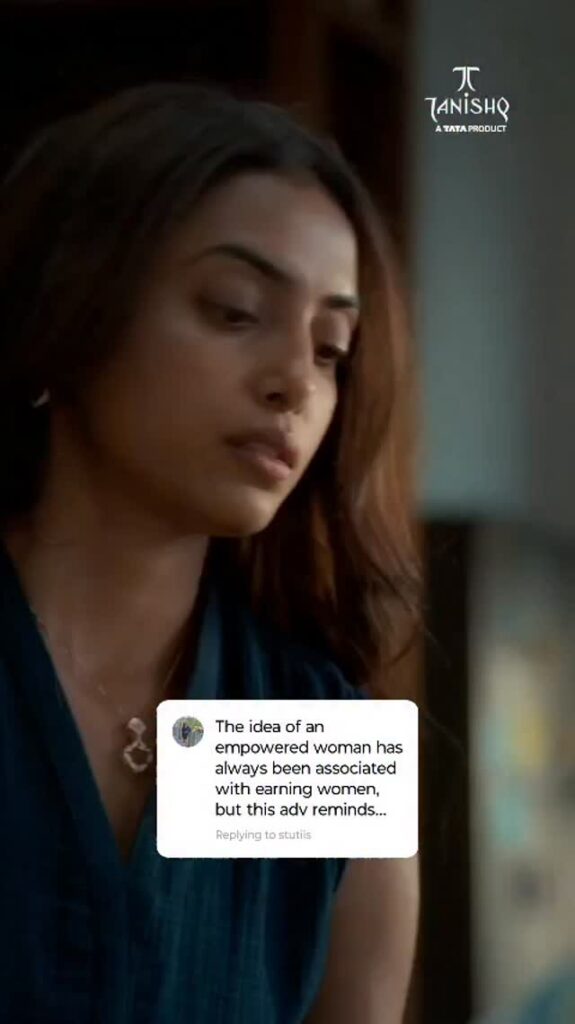

Tanishq

Large national brands are also participating in the Women’s Day narrative. Tanishq has continued its focus on celebrating modern womanhood through curated collections and storytelling campaigns that reflect the changing aspirations of contemporary women. The brand’s initiatives frequently highlight independence, confidence, and self-expression.

Kalyan Jewellers

Similarly, Kalyan Jewellers has aligned its messaging with women’s empowerment by supporting women-centric initiatives and partnerships, reinforcing the importance of recognising women’s achievements across different fields.

CaraLane

Other jewellery brands are also marking the occasion through special launches and themed collections. CaratLane has promoted contemporary diamond and gold jewellery collections designed for self-purchase and everyday styling, encouraging women to celebrate their personal milestones.

ORRA Fine Jewellery

Luxury diamond brand ORRA Fine Jewellery has highlighted modern diamond jewellery that symbolises confidence and individuality, targeting young professionals who view jewellery as a statement of identity.

Malabar Gold & Diamonds

Meanwhile, Malabar Gold & Diamonds has focused on campaigns that recognise women’s contributions to families, workplaces, and society, positioning jewellery as a tribute to their strength and achievements.

Across the industry, the Women’s Day celebration by many brands reflect a broader shift in consumer behaviour. Women are increasingly viewing jewellery not only as a traditional gift but also as a meaningful purchase that celebrates personal success, independence, and self-expression.

As jewellery brands continue to adapt to these changing aspirations, Women’s Day has become an important platform for storytelling, allowing brands to connect with modern consumers through themes of empowerment, individuality, and celebration of life’s defining milestones.

-

National News21 hours ago

National News21 hours agoJewellery That Honors Her Journey: Celebrating Women’s Day with Kalyan Jewellers

-

BrandBuzz22 hours ago

BrandBuzz22 hours agoAkoirah by Augmont Unveils “Unscripted,” A Women’s Day Collection That Celebrates Becoming Over Perfection

-

JB Insights2 days ago

JB Insights2 days agoWomen’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

-

National News2 days ago

National News2 days agoGold Rebounds in India After Five-Day Slide; Dollar Strength Keeps Pressure Intact