JB Insights

Gold loans shine brightest in India’s retail credit segment

According to Reserve Bank of India (RBI) data, outstanding loans against gold jewellery soared 103% to ₹2.09 lakh crore as of March 2025, up from ₹1.03 lakh crore a year earlier, making gold loans the fastest-growing category even as overall bank credit growth slowed

Several factors have converged to fuel this remarkable expansion:

- Rising Gold Prices: The value of pledged jewellery increased as gold prices surged, enabling borrowers to secure larger loans against the same collateral.

- Regulatory Shifts: The RBI’s crackdown on unsecured lending, particularly personal and microfinance loans, prompted both banks and non-banking finance companies (NBFCs) to pivot toward secured lending products like gold loans

- Loan Reclassification: In 2023, the RBI directed banks to reclassify certain agricultural loans as gold loans, further boosting the reported figures

- Shift from Informal to Formal Sector: Regulatory tightening and digital onboarding have encouraged borrowers to move from informal lenders to banks and NBFCs, especially in southern India where gold-backed lending is deeply entrenched

Market Impact and Outlook

Gold loans now account for approximately 3.5% of total retail credit, up from 1.2% five years ago

Lenders highlight the appeal of gold loans for their low credit risk and quick disbursal, with repeat customers often leveraging rising gold prices to refinance or increase their borrowing limits.

Contrary to popular perception, gold loans are not limited to financially distressed borrowers. Banks report growing demand from small businesses and middle-class households seeking short-term working capital, with average ticket sizes exceeding ₹1 lakh and low default rates.

Gold and silver ended lower on the week despite sharp intraday rebounds, with price action reflecting continued volatility and fragile positioning rather than a sustained recovery. In the absence of a definitive macro catalyst, a broad-based decline across equities and cryptocurrencies prompted investors to raise liquidity, briefly dragging gold below the key $5,000 per ounce threshold. Non-yielding assets came under pressure as earlier stronger-than-expected US employment data pushed expectations for the first Federal Reserve rate cut further into midyear, reducing the appeal of bullion. Sentiment shifted, however, after inflation data showed annual CPI slowing to 2.4% and core inflation easing to 2.5%, reviving dovish expectations. The softer inflation print weighed on Treasury yields and pressured the dollar, allowing gold to recover toward the $4,990 region. Silver experienced similar turbulence, sliding sharply during the liquidation phase before rebounding above $76 per ounce, though it remained on track for another weekly decline.

Gnanasekar Thiagarajan

Introduction:

Gold finished the period under pressure despite sharp rebounds, with price action dominated by cross-asset volatility and shifting rate expectations. After initially recovering more than 2% on softer-than-expected US inflation, bullion briefly pushed back toward the $5,000–$5,020 region as annual CPI slowed to 2.4% and core inflation eased to 2.5%, reinforcing expectations of multiple Federal Reserve rate cuts this year. Lower yields and a softer dollar provided near-term relief, reviving the structural appeal of non-yielding assets.

However, gains proved fragile as the dollar rebounded and gold slipped back below $5,020, underscoring hesitation around the psychological $5,000 threshold. Earlier strength in US labor data had already delayed expectations for the first rate cut toward midyear, capping upside momentum. Markets now await further guidance from FOMC minutes, GDP data and the core PCE print, while geopolitical developments — including renewed US-Iran nuclear talks and broader Middle East tensions — continue to shape safe-haven flows.

Silver tracked gold’s volatility but continued to underperform structurally, remaining in a corrective phase after January’s extreme surge. The metal rebounded nearly 3% on softer inflation data and firmer rate-cut expectations, briefly moving back above $76 per ounce, but gains faded as liquidity stayed thin amid China holidays and broader risk sentiment remained fragile. Heavy speculative positioning left silver exposed to sharp reversals, and prices are still far below late-January highs above $120 after the collapse toward the mid-$60s. While lower yields and debasement concerns offer underlying support, near-term trade points to consolidation rather than a swift return to the prior rally.

Gold and Silver:

Gold fell below $5,020 per ounce on Monday after rising more than 2% in the previous session, following weaker-than-expected US CPI data. The soft inflation print reinforced expectations for Federal Reserve rate cuts this year, with markets now pricing in slightly more than two reductions. Investors are awaiting the release of FOMC meeting minutes, the US GDP advance estimate, and PCE inflation data for further clues on the timing of the next rate cut. On the geopolitical front, traders are monitoring nuclear talks between the US and Iran, as well as US-led negotiations aimed at ending the war in Ukraine, both scheduled to resume on Tuesday. Developments in these areas could influence risk sentiment and safe-haven demand. Despite recent volatility, the precious metal remained supported by ongoing geopolitical uncertainty, strong central bank buying, and investor flight from sovereign bonds and currencies.

Silver March

Silver fell more than 1% toward $76 per ounce on Monday, reversing gains from the previous session, although trading volumes were subdued due to market holidays in the US, China and other countries. On Friday, the metal had jumped nearly 3% after soft US inflation data reinforced expectations that the Federal Reserve will cut interest rates later this year. Markets are currently pricing in a Fed rate cut in July, with a strong probability of a move in June. Investors now turn to the latest Fed minutes and the Fed-preferred core PCE price index report for further guidance on the US monetary outlook.

Meanwhile, mainland China’s markets are closed this week for the Lunar New Year holiday. Chinese traders had driven a speculative surge in precious metals in recent weeks, prompting authorities to curb market risks through various measures. Silver peaked above $120 an ounce in late January before falling to around $64 earlier this month as sentiment reversed.

Gold April

Technical View: $4996. Weekly chart shows a strong underlying uptrend with price holding well above the short-term moving averages and momentum expanding positively. The recent pullback appears corrective, with support seen near $4886/4878; holding above this zone keeps the broader structure intact for a move towards $5460. A decisive break below $4765 will be the first sign of deeper corrective pressure.

-

DiamondBuzz14 hours ago

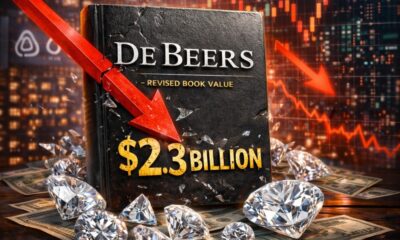

DiamondBuzz14 hours agoAnglo American cuts book value of De Beers to $2.3bn, reflects a convergence of structural and cyclical pressures

-

National News15 hours ago

National News15 hours agoHari Krishna Exports Mumbai Celebrates Annual Sports Day 2026 with Enthusiasm

-

DiamondBuzz16 hours ago

DiamondBuzz16 hours agoBAFTA 2026: De Beers Group- Desert Diamonds Emerged as the Jewellery Story of the Night

-

News17 hours ago

News17 hours agoIndia Pavilion showcases country’s finest jewellery craftsmanship at Inhorgenta Munich, Germany