By Invitation

Diamond & Jewellery Industry: 2025 Review and Leadership View on 2026

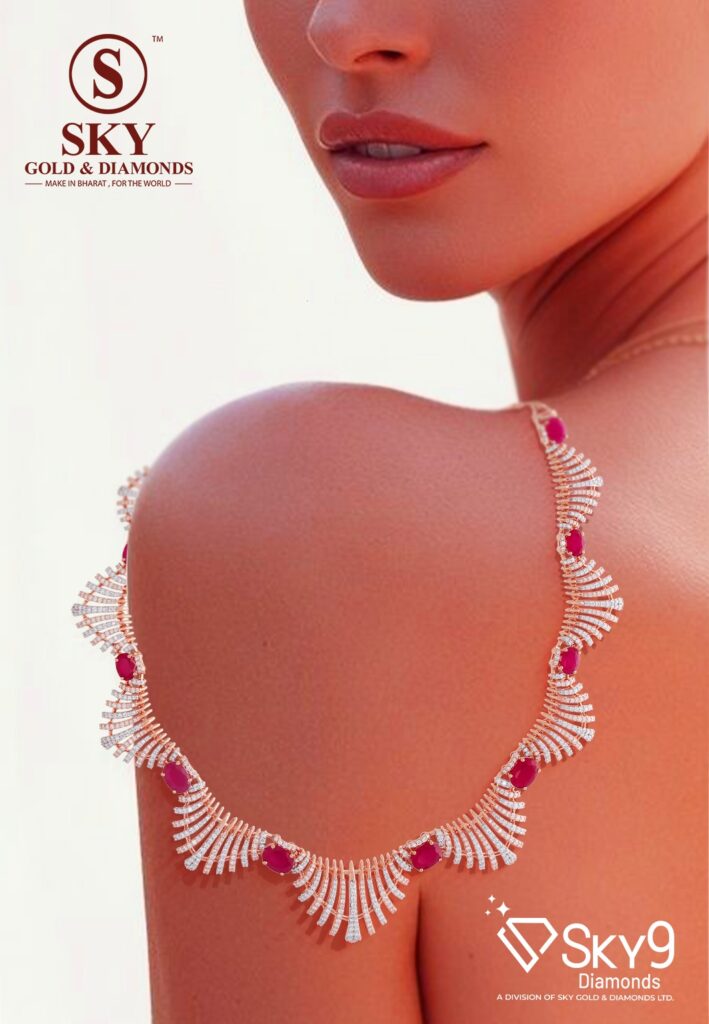

By Akash Talesara, President : Sky Gold and Diamonds Ltd

From a leadership standpoint, 2025 was a year of stabilization and disciplined execution for the diamond and jewellery industry. It was not a year of exuberant growth, but one that tested operational resilience, capital efficiency, and strategic clarity. The industry navigated a complex environment shaped by uneven demand recovery and external trade-related pressures, while continuing to adapt to changing consumer behavior.

2025: A Year of Consolidation and Control

The industry in 2025 moved through a phase of consolidation and gradual normalization. Key markets including India, the Middle East, and the U.S. showed selective recovery. India remained the strongest pillar of demand, driven by weddings, festivals, and sustained aspirational consumption.

However, trade policy uncertainty—particularly U.S. tariff-related developments—had a visible impact on sentiment and trade flows. Export-oriented businesses faced cautious ordering patterns, margin pressure, and delayed buying decisions. These conditions forced companies to recalibrate pricing, reassess supply chains, and tighten risk management. While the impact varied by segment, the overall message was clear: agility and discipline mattered more than scale.

Consumer preference during the year remained firmly aligned toward lightweight, design-led jewellery and value-conscious diamond offerings. Organized players continued to strengthen trust through branding, certification, and transparency. Across the value chain, focus areas were clear—inventory rationalization, cost optimization, and prudent working capital deployment. Volatility in gold prices and selective softness in discretionary spending reinforced the need for operational rigor.

2026: Clearer Visibility and Structural Shifts

Looking ahead to 2026, I am cautiously optimistic. With improving visibility on global trade policies and a relatively stable macroeconomic environment, confidence is expected to recover progressively.

One of the most important structural shifts gaining momentum is the move toward lower karatage gold—particularly 9KT and 14KT—across daily-wear and lifestyle jewellery. Affordability without compromising design or durability is becoming central to consumer decision-making. Lower karat gold supports higher purchase frequency, attracts younger consumers, and enables volume-led growth across domestic and export markets.

Design will be the key differentiator in 2026. As the industry moves away from purely occasion-driven consumption toward everyday relevance, design-led innovation in daily-wear, office-wear, and lifestyle jewellery will define winners.

Today’s consumers are seeking jewellery that fits seamlessly into modern life—minimalist, lightweight, functional, and versatile. Pieces that can be worn comfortably throughout the day, layered easily, and aligned with contemporary aesthetics are increasingly preferred over traditional heavy formats. This shift is especially pronounced among urban and younger consumers, and it represents a long-term change in buying behavior, not a short-term trend.

Key Takeaway

The next phase of growth in the diamond and jewellery industry will be driven less by cyclical recovery and more by strategic execution—the right product mix, right pricing architecture, design differentiation, and disciplined capital management. Companies that align closely with evolving consumer expectations while maintaining operational efficiency will be best positioned to lead in 2026 and beyond.

Jb Exclusive: Digital view

By Invitation

Natural diamonds have to rediscover their relevance to a jaded consumer that wants to separate themselves from the past

By Edahn Golan

Martyn Charles Marriott, drawing on 45 years in the diamond industry, in a blog titled Co-Operation between African Diamond Producers on the IDMA website, advocates for a new era of co-operation among African diamond producers, seeing the current debate around De Beers’ future as an opportunity. He proposes forming a diamond “OPEC,” reminiscent of the stability once maintained by the Oppenheimers’ Central Selling Organization (CSO). The CSO, through a stockpile, quota system, and vast generic advertising historically benefited the entire industry. Marriott believes a collective entity involving nations like Botswana and Angola would be more stable and bankable than a single-country approach.

JewelBuzz spoke to noted diamond industry analyst Edahn Golanon his take on Marriott’s view and how practical and feasible this “ nostalgic yearning” was. This is what Edahn Golan has to say:

I don’t think that resurrecting a monopoly is possible, much less legal. I understand the nostalgic yearning for the ‘good old days,’ but that is not where the solution will be found. On the contrary, the industry at large – and De Beers in particular – needs to evolve and adapt. They both need to reinvent themselves.

Natural diamonds have to rediscover their relevance to a jaded consumer that wants to separate themselves from the past, a consumer market that wants luxury that doesn’t shout bling. Most importantly, diamonds should stand for values that are relevant to today’s cultural norms.

That is where diamonds will find their future, not by reimposing tight control on the pipeline.

I also read Chaim Even-Zohar’s column. I worked with him for many years and hold deep respect for both him and his approach to the industry.

That said, I believe Botswana does not need to go all in on owning De Beers.The country already receives more than 75% of the diamond revenue generated locally, along with a portion of the revenue De Beers earns from its operations in Namibia, Canada, and South Africa. Expanding that share or seeking a larger cut from other countries would only deepen Botswana’s dependency on diamonds.

Instead, Botswana should diversify its income sources and invest more internally, a process it should have initiated more than a decade ago.

For example, if it channels investment into its international airport and succeeds in expanding tourism, the country would generate greater income, reduce its reliance on luxury sales, improve foreign currency inflows, and, in the process, expose more of the world to its diamonds.

-

JB Insights2 weeks ago

JB Insights2 weeks agoGold is Talking, Silver is Screaming – A Case for Prudent Repositioning

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoJapan, US Weigh Synthetic Diamond Facility to Strengthen Strategic Supply Chains

-

National News2 hours ago

National News2 hours agoGem & Jewellery Exports at US$ 23.19 Billion Remain Stable in April 2025–January 2026; India–US Trade Agreement Framework Brings Relief and Sets Stage for Recovery: Gem & Jewellery Export Promotion Council (GJEPC)