JB Insights

Why Gold Loans Are Becoming So Popular in Rural India

Gold and silver trade range-bound as markets await Powell’s Jackson Hole speech for policy cues. With a 75% chance of a September cut, geopolitical tensions over Russia-Ukraine dampen optimism.

By Priyank Kothari Director, Arvog

In many parts of rural India, gold isn’t just a metal it is a quiet kind of financial security. Families don’t always have fixed deposits or savings accounts, but they’ll have gold jewellery tucked away in steel boxes or cloth pouches, brought out only on special occasions or during times of trouble.

For generations, gold has been used as a safety net. But what’s changed in recent years is how people are starting to use that gold. Instead of selling it to raise funds, more rural families are now turning to gold loans a trend that’s gaining strong momentum in villages, small towns, and semi-urban areas across the country.

A Familiar Asset in Every Household

Walk into any rural home whether in Maharashtra, Tamil Nadu, Uttar Pradesh, or Assam and chances are, you will find some amount of gold. It may be a pair of bangles gifted during marriage, a gold chain bought after a good harvest, or earrings passed down from a grandmother.

People may not always have ready cash, but gold is there. What’s changing now is how people are thinking about that gold. Instead of letting it sit idle, they’re realising Why not use it when we need money and keep it?

A Straightforward Process, No Headaches

Traditional bank loans can feel out of reach for many in rural areas. The paperwork, the need to show income, or the insistence on a credit score most of it doesn’t match how rural people earn or live.

Gold loans are different. The process is quick, the documents are minimal, and the money is often in your hand within an hour. For someone who needs ₹20,000 to buy seeds before the rain hits, or Rs 50,000 for a daughter’s medical treatment that kind of speed matters.

A Practical Choice for Everyday Needs

What makes gold loans even more appealing is how flexible they are.

There are no questions about what the money will be used for. It could go towards repairing a tractor, paying school fees, stocking up a Kirana shop, or buying new cows the lender doesn’t ask. And that freedom to use the loan as needed gives borrowers a sense of control.

You’re not being judged, questioned, or made to feel small. You walk in with something you own i.e. Gold and get something you want i.e. Money.

A Better Alternative to Local Moneylenders

In many villages, people still turn to moneylenders in a crisis. It’s what they have always done. But with interest rates as high as 7 to 10% per month, those loans can become traps.

Gold loans, by contrast, are far more affordable. Many NBFCs offer gold loans at annual rates starting from 12–14%. That’s a massive difference, especially when you’re repaying over several months.

Slowly, people are beginning to understand the difference and more importantly, they are seeing that formal lenders are not just for the city folk anymore.

Trust Has Been Built And That Matters

Earlier, there was fear. What if they steal our gold? What if it comes back damaged?

These concerns kept many away. But over time, with better communication, more transparency, and the presence of known lenders in rural areas, trust is being rebuilt.

The gold is stored securely, often in vaults with CCTV and biometric access. And importantly, people now get their gold back as safe, untampered, and intact.

Better Awareness, Better Reach

From WhatsApp videos to loudspeaker announcements, from local working staff to self-help groups awareness about gold loans is spreading fast.

And it’s not just awareness it’s access, too. NBFCs and banks are setting up small branches in tier-3 towns and villages, offering doorstep services in some places. Women, who traditionally handle gold in many households, are now more comfortable stepping into branches or talking to local representatives.

The comfort level has gone up. What was once seen as a last resort is now considered a smart way to raise money when needed without getting into long-term debt or selling valuable assets.

Nowadays people don’t want long-term, complicated loans. They want short term, flexible loans that can be paid back when the cash comes in and that’s exactly what gold loans offer.

Loan terms can be 3, 6, or 12 months. Repayment can be done in one go (bullet payment) or in EMIs. It fits the rhythm of rural life, without disrupting it.

The rise of gold loans in rural India is not just a financial trend. It reflects a deeper shift in how rural families think about credit, control, and dignity.

For many rural families today, a gold loan isn’t a last resort it’s the first smart step in solving a problem without losing what matters.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

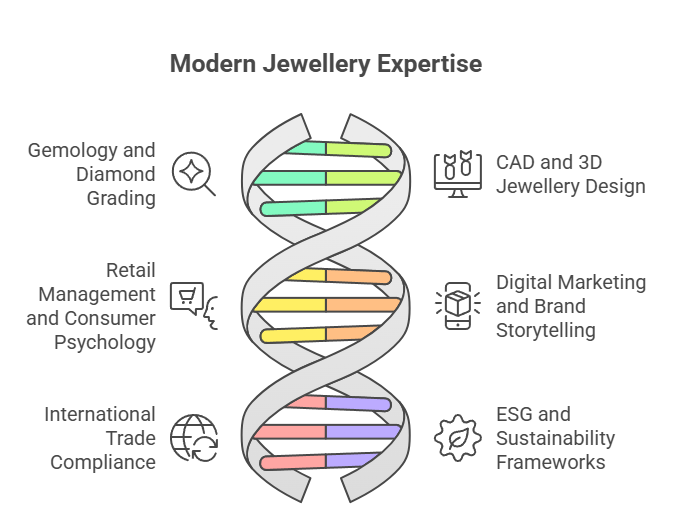

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

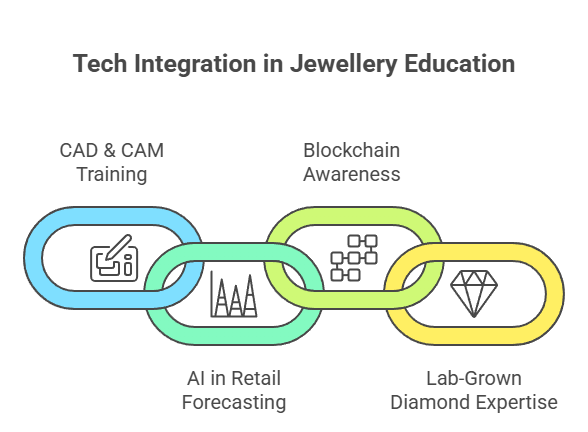

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

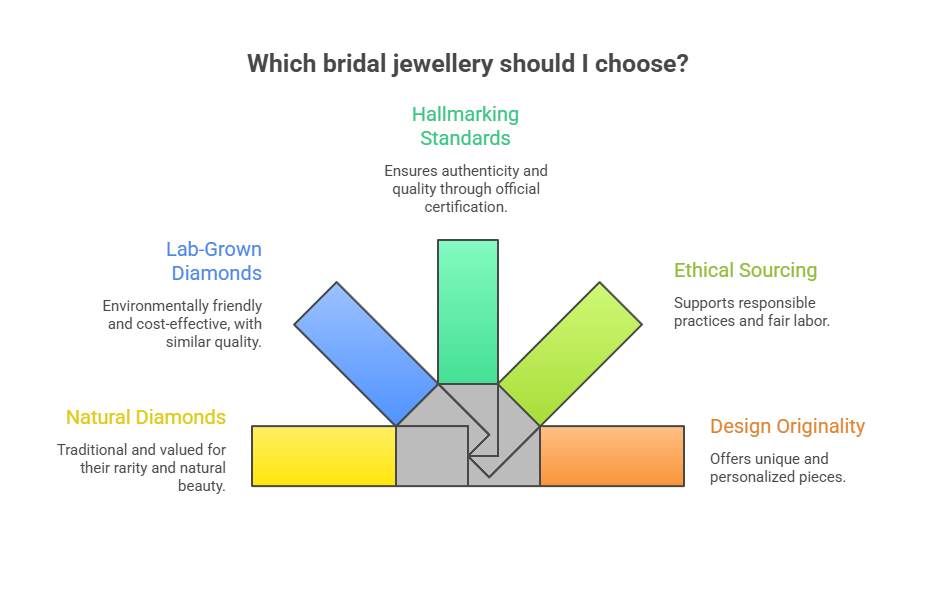

The Bridal Economy & Consumer Education

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

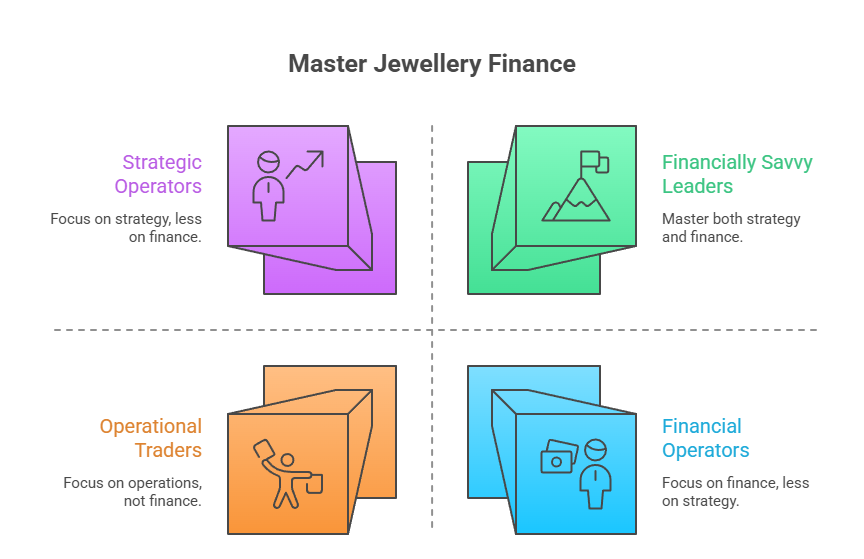

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

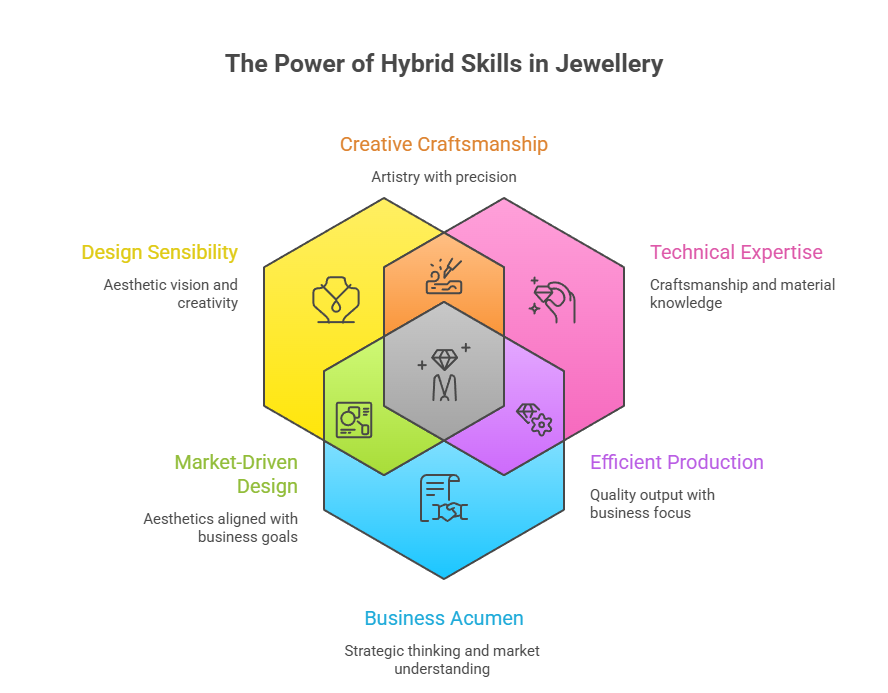

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

BrandBuzz16 hours ago

BrandBuzz16 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz17 hours ago

BrandBuzz17 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz20 hours ago

BrandBuzz20 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News21 hours ago

National News21 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression