International News

Treasury yield declines on heightened rate cut expectations AUGMONT BULLION REPORT

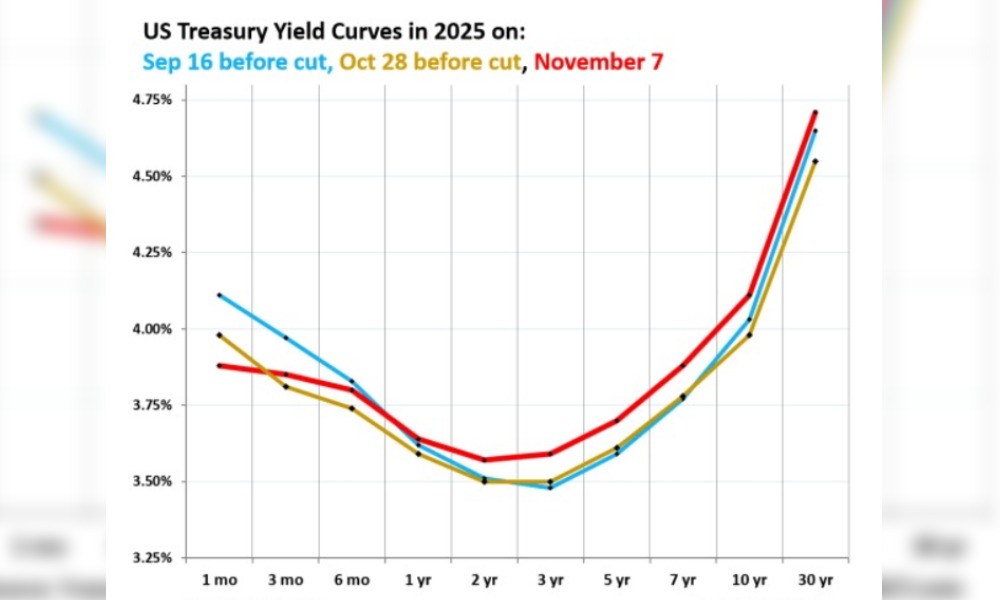

- 10-year US Treasury yields have decreased 3.5% during the past four days, coming back to 4.00% level, amid heightened rate cut expectations. US macro data revealed indications of declining inflation and increased the Federal Reserve’s leeway to further lower interest rates. Consequently, this situation helps the precious metals to trade higher and push the US dollar to a one-week low.

- The likelihood that the Fed would lower interest rates by 25 basis points to 3.50%–3.75% at the December meeting has risen to 85.3% from 50.1% a week ago, according to the CME FedWatch tool.

- Furthermore, a persistent increase in the price of the precious metal is limited by expectations of a peace agreement between Russia and Ukraine. However, given that investors are now looking to more US data for some encouragement, the fundamental background indicates that the path of least resistance for gold is to the upward.

US Technical Triggers

- Gold has been trading in the range of $4000 (~Rs 121,000) and $4200 (~Rs 127,000). Buy on dips around support and sell on rallies around resistance.

- Silver has been trading in the range of $49 (~Rs 150,000) to $53 (~Rs 160,000). Buy on dips around support and sell on rallies around resistance.

Support and Resistance

| Commodity | Support Level | Resistance Level |

|---|---|---|

| International Gold | $4000/oz | $4200/oz |

| Indian Gold | ₹121,000 / 10 gm | ₹127,000 / 10 gm |

| International Silver | $49/oz | $53/oz |

| Indian Silver | ₹150,000 / kg | ₹160,000 / kg |

GlamBuzz

All That Glitters: The Jewellery Moments Everyone Talked About at the 2026 Golden Globes

From archival diamonds to playful brooches, Hollywood’s biggest night sparkled with fearless jewellery statements

The 2026 Golden Globes didn’t just celebrate cinematic brilliance—it redefined red-carpet glamour. Set against a newly designed red carpet at the Beverly Hills Hotel, the evening shimmered beneath four magnificent Swarovski crystal chandeliers, casting a radiant glow on Hollywood’s finest. But the true spectacle lay in the extraordinary jewellery moments that unfolded as stars stepped into the spotlight.

Teyana Taylor delivered one of the night’s most talked-about looks, pairing her Best Supporting Actress win for One Battle After Another with striking 1940s Tiffany & Co. earrings. The archival diamonds perfectly offset the playful audacity of her custom Schiaparelli gown, proving once again that classic jewels and modern fashion can collide spectacularly.

Zoë Kravitz championed the romantic return of the hair pin, wearing a bespoke creation by Jessica McCormack that felt both intimate and effortlessly chic. Meanwhile, Charli xcx leaned fully into Old Hollywood glamour, completing her custom Saint Laurent ensemble with cascading De Beers diamond strands that echoed timeless screen sirens.

Men’s jewellery continued its powerful rise on the Golden Globes carpet. Colman Domingo stood out with an elegant suite of Boucheron diamonds, styled as ivy-like tendrils flowing over his custom black Valentino tuxedo—an artful blend of couture and craftsmanship. Paul Mescal reaffirmed his love for refined accessories with a Cartier tie pin, while Connor Storrie brought playful elegance with Tiffany & Co.’s iconic Bird on a Rock brooch.

One of the most imaginative jewellery moments belonged to Wicked director Jon M. Chu, who wore two beaded figurative brooches depicting his co-stars and fellow nominees Ariana Grande and Cynthia Erivo. Designed by Italy-based embroidery artist Nerd Bead—discovered by Chu on Instagram—the pieces added personality, storytelling and warmth to the red carpet.

Elsewhere, Emily Blunt sparkled in Tiffany & Co., Priyanka Chopra Jonas turned heads in Bulgari, Hailee Steinfeld chose the architectural elegance of Repossi, Claire Danes glowed in Pomellato, Natasha Lyonne dazzled in Chopard, Jennifer Lawrence opted for Swarovski, and Timothée Chalamet continued his refined jewellery streak with Cartier.

At the 2026 Golden Globes, jewellery wasn’t merely an accessory—it was a statement of individuality, creativity and evolving red-carpet expression. From archival diamonds to bold brooches, the night served as a brilliant reminder that fine jewellery remains one of Hollywood’s most powerful storytelling tools

-

GlamBuzz2 weeks ago

GlamBuzz2 weeks agoGIVA Launches ‘Glow in Motion’, Unveils New Jewellery Collection Fronted by Barkha Singh

-

International News2 weeks ago

International News2 weeks agoSilver retraces down on margin hike pressure AUGMONT BULLION REPORT

-

JB Insights2 weeks ago

JB Insights2 weeks agoThe JewelBuzz E-zine: Your Fortnightly Pulse of the Jewellery Industry

-

JB Insights2 weeks ago

JB Insights2 weeks agoIIJS Bharat Signature 2026 set to open the year with scale, innovation and global momentum