JB Insights

The diamond industry is at an inflection point

McKinsey & Co Diamond Industry Report

This report by McKinsey explores the challenges and opportunities facing the diamond industry in the wake of several significant shifts. Here’s a breakdown of the key points:

Market Downturn:

- Diamond prices have plummeted after a surge during the pandemic.

- This is due to a combination of factors, including:

- Increased supply chain normalcy.

- Reemergence of traditional engagement timelines.

- Rise of lab-grown diamonds (LGDs) as a more affordable alternative.

- Growing consumer demand for ethical and sustainable sourcing (ESG).

- Sanctions on Russia, a major diamond producer.

Shifting Consumer Preferences:

- Younger generations (Gen Z) are driving changes in diamond buying habits:

- More frequent purchases for self-reward.

- Preference for ethical sourcing and sustainability.

- Increased online shopping for jewelry.

- Growing interest in LGDs and recycled diamonds.

The Rise of Lab-Grown Diamonds:

- LGDs pose a major challenge to natural diamonds due to:

- Lower cost (up to 80% discount).

- Perceived ethical and environmental advantages.

- Increasing quality and size availability.

The Future of the Industry:

- The industry needs to adapt to survive:

- Natural diamond producers can:

- Invest in traceability and ESG practices.

- Highlight the unique value proposition of natural diamonds (rarity).

- Consider vertical integration to manage costs and ensure compliance.

- LGD producers can:

- Focus on further price reduction and technological advancements.

- Address potential environmental limitations of LGD production.

- All diamond players can:

- Develop innovative marketing strategies.

- Embrace digital technologies for transparency and efficiency.

- Build stronger partnerships for financing and branding.

- Natural diamond producers can:

Uncertainties Remain:

- The long-term impact of LGDs on the diamond market is unclear.

- Questions remain about diamond price volatility and ownership of the value chain.

Conclusion:

The diamond industry is at a crossroads. Adapting to changing consumer preferences, embracing technology, and addressing ethical concerns will be crucial for companies to ensure stability and longevity in the years to come.

The Diamond Industry: Navigating a Market in Transition

Insights from Changing Consumer Behavior, Technological Advancements, and ESG Imperatives

The global diamond industry, long associated with timeless luxury and tradition, is undergoing a seismic transformation. Once characterized by stability and predictable growth patterns, it now faces significant disruptions fueled by shifting consumer behavior, technological advancements, and heightened environmental, social, and governance (ESG) expectations. This article examines these trends, highlighting how diamond producers—both natural and lab-grown—can position themselves for sustained relevance and profitability.

A Market Recalibrated Post-Pandemic

The diamond industry experienced an unprecedented surge in prices during the COVID-19 pandemic, driven by delayed engagements, disrupted supply chains, and an increase in discretionary spending on luxury goods. However, this trend has reversed sharply, with diamond prices now at multi-year lows.

Several factors have contributed to this decline:

- Rise of Lab-Grown Diamonds (LGDs): Offering affordability and perceived ethical benefits, LGDs have captured a growing share of the market.

- Return to Pre-Pandemic Norms: Engagement and marriage cycles have resumed their traditional rhythms, reducing the urgency of purchases.

- Sanctions on Russian Diamonds: Restrictions on Russian producers, including Alrosa, have altered global supply dynamics.

- Increased ESG Awareness: Consumers now demand greater transparency and sustainability in diamond sourcing, putting pressure on traditional producers to innovate.

Shifting Consumer Preferences: A Generational Shift

Consumer behavior, particularly among younger generations, is reshaping the diamond market. Key trends include:

- Ethical Sourcing and Sustainability:

Generation Z and Millennials prioritize brands that align with their values. Ethical labor practices, sustainable sourcing, and carbon-neutral operations are non-negotiable for these consumers. - Increased E-Commerce Activity:

Online diamond purchases are growing, with projections suggesting that nearly 20% of fine jewelry sales will occur digitally by 2025. The convenience and transparency of online platforms are redefining how consumers engage with brands. - Lab-Grown Diamonds as an Alternative:

LGDs are no longer confined to industrial use. They now represent a viable, affordable, and ethical alternative for fine jewelry, particularly in Western markets. - Self-Purchasing Trends:

Younger consumers increasingly view diamond purchases as a form of self-reward rather than traditional markers of engagements or anniversaries.

Technological Disruptions: LGDs and Supply Chain Traceability

Lab-Grown Diamonds: A Rising Threat

The affordability, scalability, and ethical appeal of LGDs have positioned them as the most significant disruptor to the natural diamond market. LGD prices, currently at an 80% discount compared to natural diamonds, have accelerated adoption among value-conscious consumers. Technological advancements have enabled the production of larger, high-quality stones, further eroding the exclusivity of natural diamonds.

Supply Chain Innovations

Traceability is becoming a central pillar for diamond producers. Blockchain technologies and other digital tools allow consumers to verify the origin, production methods, and journey of their stones. Beyond compliance, this transparency creates opportunities for storytelling, connecting consumers to the unique narratives behind their diamonds.

Strategic Imperatives for Industry Players

To navigate these challenges, stakeholders across the diamond value chain must adopt proactive strategies:

For Natural Diamond Producers

- Invest in ESG Compliance: Ensure ethical mining practices, sustainable water use, and community engagement.

- Promote Rarity: Highlight the uniqueness and natural origin of mined diamonds, leveraging these qualities as a counterpoint to LGDs.

- Vertical Integration: Streamline operations to enhance efficiency and reduce costs while meeting ESG targets.

For LGD Producers

- Focus on Innovation: Continue improving production methods to lower costs and increase scalability.

- Address Environmental Concerns: While LGDs are marketed as sustainable, energy-intensive production processes must be optimized.

For Retailers and Midstream Players

- Embrace Digital Transformation: Develop e-commerce platforms and invest in digital marketing to engage younger, tech-savvy consumers.

- Offer Recycled and Vintage Options: Cater to the growing demand for sustainable and upcycled jewelry.

Looking Ahead: Uncertainties and Opportunities

The future of the diamond industry is far from settled. Several questions remain unanswered:

- How will LGDs reshape market dynamics?

- Can natural diamond producers justify their premium pricing amid rising LGD quality?

- How will geopolitical tensions and regulatory shifts impact supply chains?

Despite these uncertainties, one fact is clear: adaptation is essential. Whether through technological investment, strategic partnerships, or redefining value propositions, diamond industry players must evolve to meet the demands of a changing market.

The industry is at a crossroads. Those willing to innovate, align with consumer values, and embrace technological advancements will not only survive but thrive in this new era.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

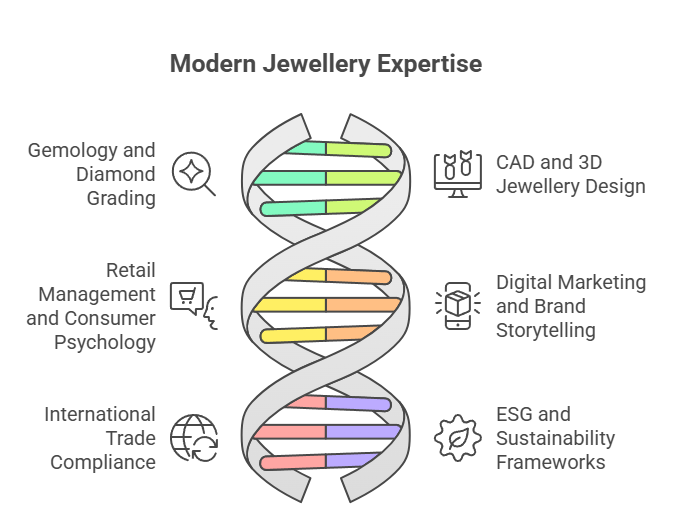

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

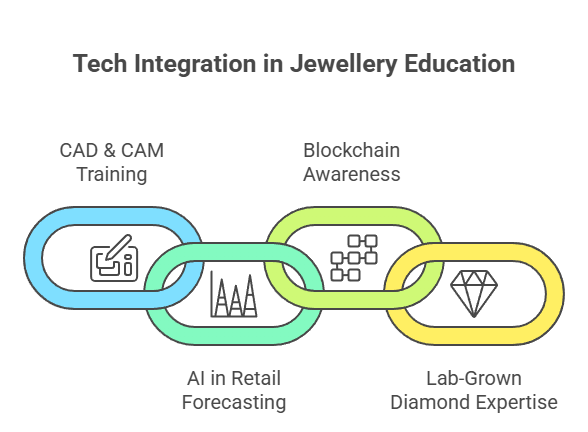

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

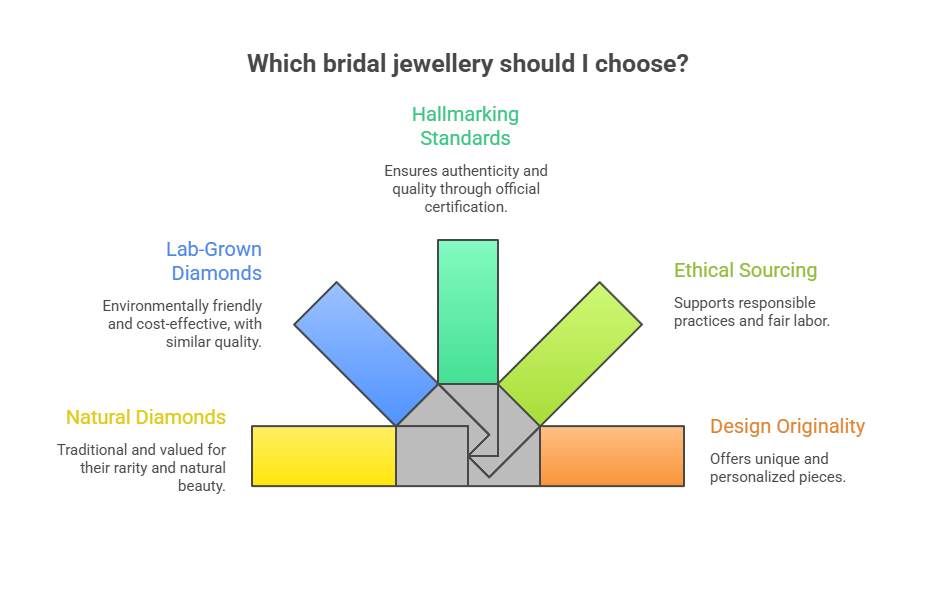

The Bridal Economy & Consumer Education

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

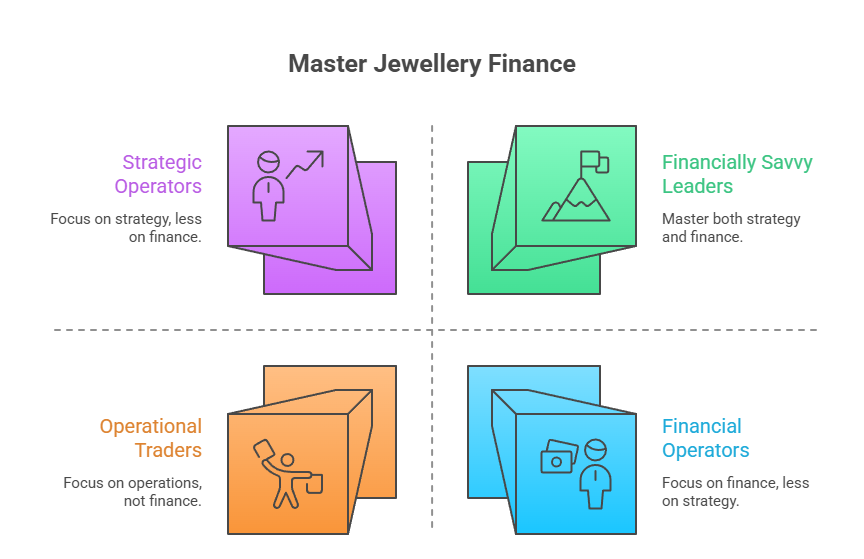

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

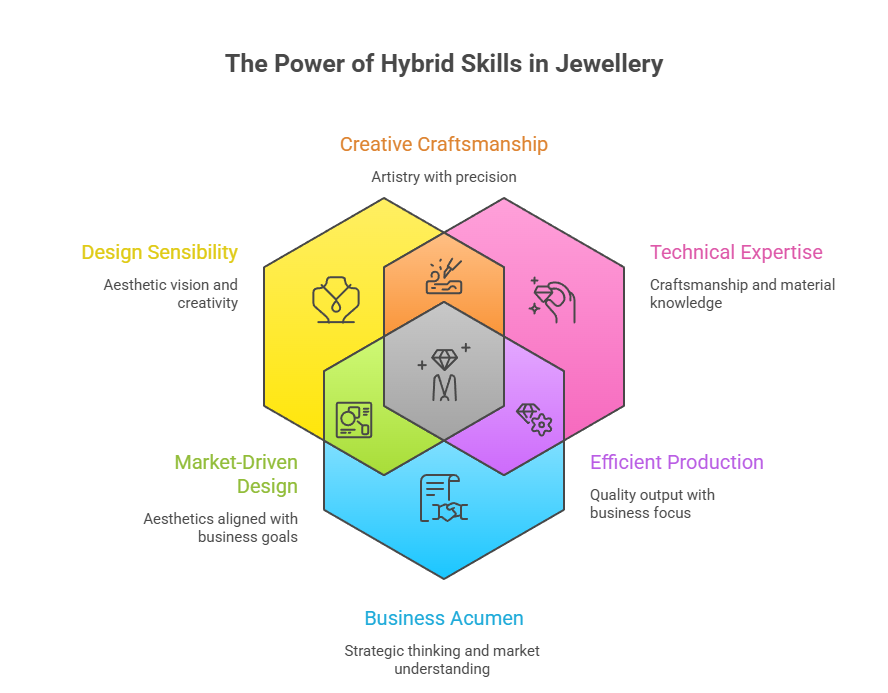

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

DiamondBuzz2 hours ago

DiamondBuzz2 hours agoDiamond Slump forces Debswana to diversify into copper, platinum and solar

-

International News3 hours ago

International News3 hours agoIGI Expressions™ 2025–26: Nine Global Winners Surface from 1,000+ Entries across 55 Countries

-

International News3 hours ago

International News3 hours agoGJEPCs statement on the geopolitical tensions in ME Region

-

International News4 hours ago

International News4 hours agoHong Kong International Jewellery Show opens, showcases global designs and trends