International News

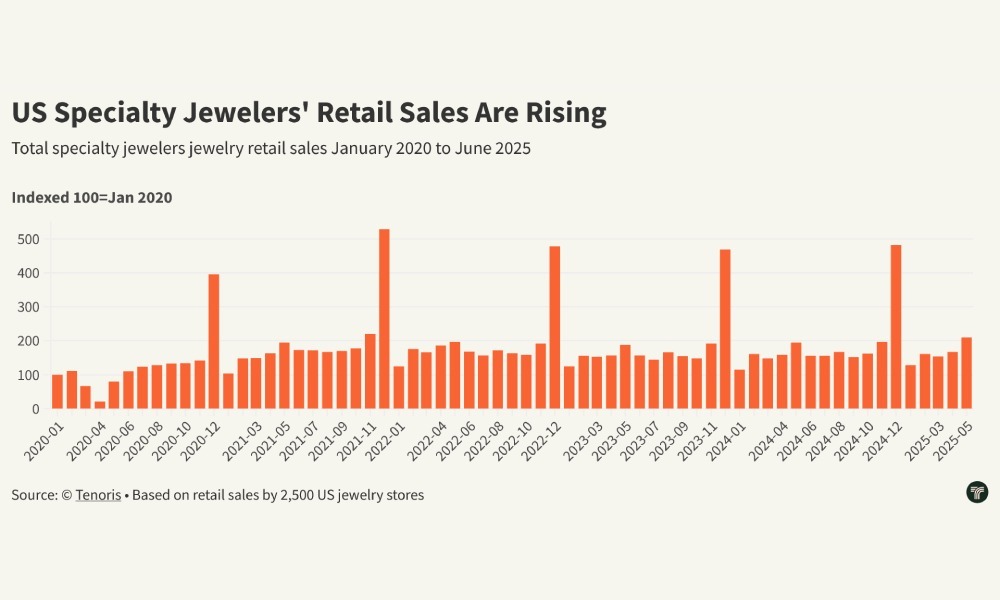

Tenoris Report: 5% rise in jewellery sales in H1 2025

Gold jewellery led category growth with low double-digit revenue gains

The jewellery market posted a healthy 5% revenue growth in H1 2025, according to Tenoris, sustained by a steady five-month rise and a 3% increase in June sales. While the total number of pieces sold declined, consumers spent more per item, leading to a 10% surge in expenditure per unit in June and higher average prices across diamond, sapphire, gold, platinum, and silver jewellery.

Lab-grown jewels stood out, recording higher unit sales despite falling average prices, reflecting shifting consumer preferences. Round diamonds, though still dominant at 52% of sales, are gradually losing ground to oval shapes, which now account for 20%.

Finished jewellery also performed well, especially bracelets, which saw nearly 10% year-on-year revenue growth. Demand is strengthening in higher price segments, notably items priced between $7,500 and $10,000.

Natural diamond jewellery sales dipped in June but rose 3% year-to-date, driven by demand for pendants, bracelets, and necklaces above $2,500, often featuring lab-grown diamonds. The loose natural diamond market saw higher average carat weights but longer inventory turnover, while lab-grown loose diamonds continued to capture market share. Overall, the industry is rebounding from flat sales in H1 2024 and is focused on tapping new consumer demographics to sustain momentum.

DiamondBuzz

Diamond Slump forces Debswana to diversify into copper, platinum and solar

Diamond-centric mining models is giving way to broader resource portfolios

Debswana Diamond Company, the 50–50 joint venture between the Botswana government and De Beers, is moving to diversify into copper, platinum and renewable energy as the prolonged downturn in natural diamond demand pressures earnings and forces the industry to rethink its growth strategy.

The company’s board has approved plans to invest in a portfolio of non-diamond projects after revenue fell 46% in 2024, the latest available financial year, highlighting the scale of the downturn in the global diamond market.

The move signals a strategic shift toward commodities with stronger long-term demand fundamentals, particularly copper, which is central to global electrification and energy-transition infrastructure.

Debswana’s diversification reflects a broader industry pivot as diamond producers confront weak consumer demand, rising competition from lab-grown stones and elevated inventories across the supply chain.

The shift is also visible among smaller exploration companies. Botswana Diamonds recently rebranded as Botswana Minerals, signalling its own strategic focus on copper exploration rather than diamonds.

Together, these moves underscore a growing consensus across the sector: the era of diamond-centric mining models is giving way to broader resource portfolios anchored in energy-transition metals.

-

National News1 hour ago

National News1 hour agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz22 hours ago

BrandBuzz22 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration