International News

Tanishq Expands U.S. Footprint with New Store in Atlanta, Georgia

India’s Premier Jewelry Brand Opens Sixth U.S. Location in Cumming, Offering a Blend of Tradition and Contemporary Luxury

Tanishq, India’s leading jewelry brand, has marked a major milestone in its U.S. expansion with the grand opening of its sixth store in Cumming, Georgia. Situated at 580 Peachtree Parkway, the new 3,270 sq. ft. showroom showcases over 5,000 unique jewelry designs, ranging from intricate bridal collections to modern everyday essentials. The opening, celebrated on February 26, reflects the brand’s growing presence in the U.S. market, particularly in Atlanta—a dynamic, fast-growing city known for its diverse retail scene.

The store is designed to cater to both South Asian traditions and American tastes, offering fine gold and diamond jewelry perfect for weddings, festivals, and daily elegance. Tanishq’s expansion into Atlanta comes at a time of increased demand for high-quality, ethically sourced jewelry in the region.

The grand opening was graced by Ramesh Babu Lakshmanan, Consul General of India in Atlanta, as well as numerous distinguished guests and excited customers eager to explore the brand’s renowned collections. Tanishq’s commitment to exceptional craftsmanship, paired with its legacy of trust, has garnered an enthusiastic response from the community.

Amrit Pal Singh, Business Head for North America at Titan Company Limited, shared, “Atlanta is an important market for us, and we are excited to bring Tanishq’s innovative yet heritage-driven designs to this vibrant community, offering a destination for high-quality jewelry that celebrates both tradition and modernity.”

Tanishq invites the residents of Atlanta to visit the new store and discover a curated selection of fine jewelry crafted to make life’s most special moments truly memorable.

DiamondBuzz

Botswana Diamonds rebrands as Botswana Minerals PLC

Signals a definitive shift toward copper exploration as the diamond market faces a stiff cyclical downturn.

Botswana Diamonds PLC, a long-time explorer of the world’s most famous gemstones, has officially rebranded as Botswana Minerals PLC, signaling a definitive shift toward copper exploration as the diamond market faces a stiff cyclical downturn. The name change, which took effect Feb. 27, follows a strategic review that leveraged artificial intelligence to scan the company’s massive 95,000-square-kilometer geological database. While the AI was originally designed to hunt for kimberlite pipes—the volcanic rock that hosts diamonds—it instead unearthed “outstanding” evidence of copper deposits.

A High-Tech Pivot

The company, listed on London’s AIM and the Botswana Stock Exchange, has identified 11 copper targets across the country and has already secured eight prospecting licenses. The move reflects a broader trend among junior miners seeking to capitalize on the “green metal” boom driven by electric vehicles, renewable energy, and AI data centers.

The Diamond Dilemma

The rebranding comes as the natural diamond sector grapples with two simultaneous concerns:

- Technological Disruption: Lab-grown diamonds continue to cannibalize the lower end of the market, offering consumers a cheaper alternative that is chemically identical to mined stones.

- Cyclical Downturn: Sluggish global demand and high inventory levels have dampened investor enthusiasm for natural stones.

Despite the pivot, the company is not abandoning its roots entirely. It remains one of the largest holders of exploration data in Botswana and intends to maintain its diamond acreage, betting that high-quality natural stones will eventually regain their luster.

By shifting focus to copper, Botswana Minerals (trading under the new ticker BMIN) joins a growing list of players in the Kalahari Copper Belt, a region increasingly viewed as a world-class mining frontier.

-

DiamondBuzz5 hours ago

DiamondBuzz5 hours agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz6 hours ago

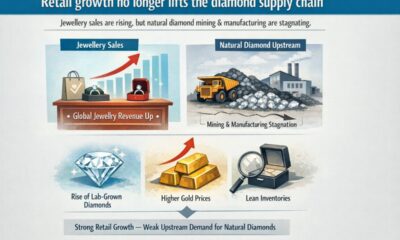

DiamondBuzz6 hours agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News8 hours ago

International News8 hours agoIndia Pavilion at HK twin shows showcases exceptional craftsmanship

-

International News8 hours ago

International News8 hours agoGold continues to get strength on the Middle East conflict