National News

Surge in gold import drives India’s trade deficit to $41.68 billion

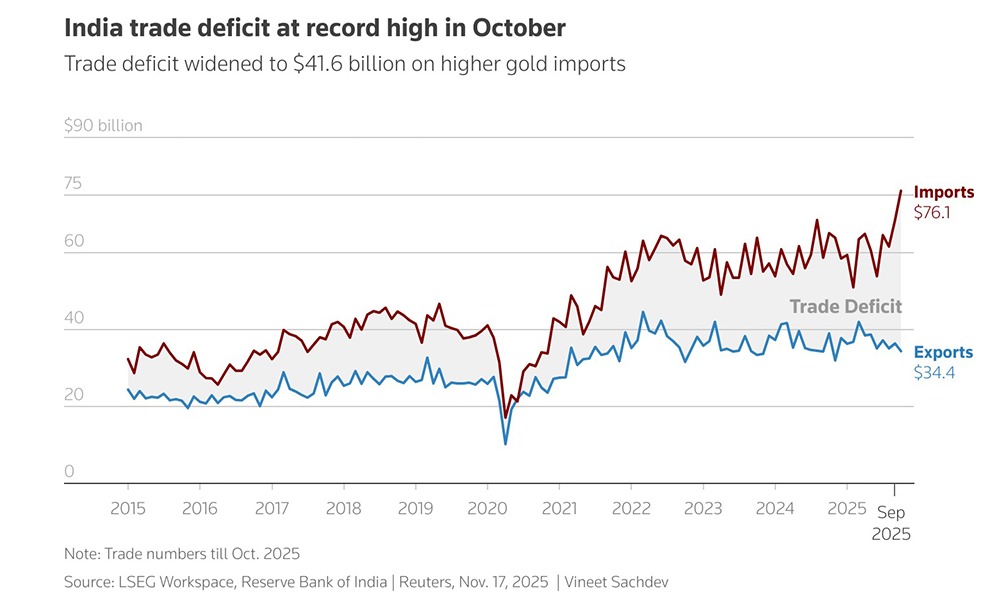

India’s merchandise trade deficit widened to a record $41.68 billion in October, as gold imports trebled and outbound shipments registered their sharpest contraction in 14 months. The surge reversed the recent trend of narrowing deficits, raising concerns over external imbalances amid global economic uncertainties.

Merchandise imports jumped to $66.1 billion from $52.3 billion a year earlier, while exports grew only marginally to $44.3 billion, according to provisional data from the Commerce Ministry. Gold imports more than doubled, crossing $7 billion, as jewellers stocked up for Dussehra and Diwali sales, marking the peak festive season.

Gold imports surged 199.2 per cent year-on-year to $14.72 billion in October, fuelled by pent-up demand and the festival season. Silver imports rose sixfold to $2.72 billion, driven by increased shipments of plain silver from a free-trade agreement partner country, government officials said.

Analysts noted that while the seasonal jump in bullion demand is temporary, it added pressure on the rupee and may influence the Reserve Bank of India’s stance on currency management. Non-oil, non-gold imports also showed an uptick, signaling revival in domestic consumption.

Economists expect the deficit to ease in the coming months as festive purchases taper, but warn that elevated gold demand and volatile crude prices could keep the external gap above comfort levels through the December quarter.

National News

Gold & Precious Metals – A future outlook

The session saw a power packed panel of experts that comprisedSurendra Mehta, National Secretary- IBJA,Ranjith Singh,Head of Business Development, IIBX, Shweta Dhanak, Director – Vijay Exports,S Thirupathi Rajan, MD Goldsmith Academy, Shivanshu Mehta, SVP & Head Bullion-MCX.The session was moderated by Chirag Seth, Principal Consultant, Metals Focus.

Some salient points made by the panelists:

- Gold prices are not linked to consumer demand. They are linked to central bank buying and ETFs

- Till the banking system doesn’t collapse, gold price will continue to rise

- Jewellers were advised to use a mix of futures and options for risk mitigation

- Given the current situation manufacturers selling on credit or unfavorable deals could be fatal flaw for business.

- Precious metals forecast: Surendra Mehta said he sees gold in 2026 in $4900-5100 range and silver in $90-105.Looking further he said by 2030-2035 gold could touch $18000- 20000 and silver could reach $500. Chirag Seth predicted silver touching $105 this year and gold moving in the $ 5200- $ 5500.

-

GlamBuzz2 weeks ago

GlamBuzz2 weeks agoGIVA Launches ‘Glow in Motion’, Unveils New Jewellery Collection Fronted by Barkha Singh

-

International News2 weeks ago

International News2 weeks agoSilver retraces down on margin hike pressure AUGMONT BULLION REPORT

-

JB Insights2 weeks ago

JB Insights2 weeks agoThe JewelBuzz E-zine: Your Fortnightly Pulse of the Jewellery Industry

-

JB Insights2 weeks ago

JB Insights2 weeks agoIIJS Bharat Signature 2026 set to open the year with scale, innovation and global momentum