JB Insights

SEBI red-flags unregulated digital gold market

SEBI’s November 8, 2025 circular on digital gold investment exposes a critical gap in India’s financial regulatory framework. Digital gold platforms—which have attracted millions of retail investors with their low entry barriers and convenience—operate in a regulatory no-man’s land. They are neither securities under SEBI’s jurisdiction nor commodity derivatives, creating what regulators call a “shadow gold market.”

This is particularly concerning because these platforms have democratized gold investment for young, first-time investors who may lack awareness of traditional investment risks, let alone unregulated product risks.

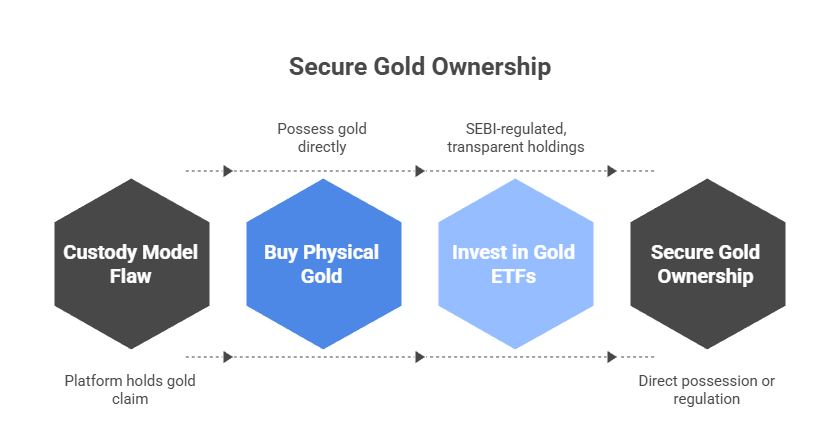

The fundamental flaw in digital gold products lies in the custody model. When you buy digital gold:

- You don’t own gold directly — you own a claim against the platform

- The platform promises to hold equivalent physical gold somewhere

- No regulatory authority verifies this claim in real-time

- If the platform collapses, you’re an unsecured creditor with no regulatory recourse

This differs sharply from buying physical gold (you possess it) or Gold ETFs (SEBI-regulated, transparent holdings).

SEBI’s timing suggests growing concerns about:

- Market penetration: Digital gold apps have scaled rapidly through fintech partnerships and micro-investment features

- Systemic risk: If multiple platforms face liquidity crunches simultaneously, millions of small investors could face losses

- Regulatory arbitrage: Companies exploiting the gap between RBI (payment systems) and SEBI (securities) oversight

Traditional SEBI-regulated products provide:

- Mandatory disclosures and periodic audits

- Net Asset Value (NAV) transparency

- Investor grievance mechanisms

- Capital adequacy norms for intermediaries

- Insurance or investor protection funds

Digital gold platforms face none of these requirements, creating asymmetric risk for retail investors.

SEBI’s Recommended Alternatives

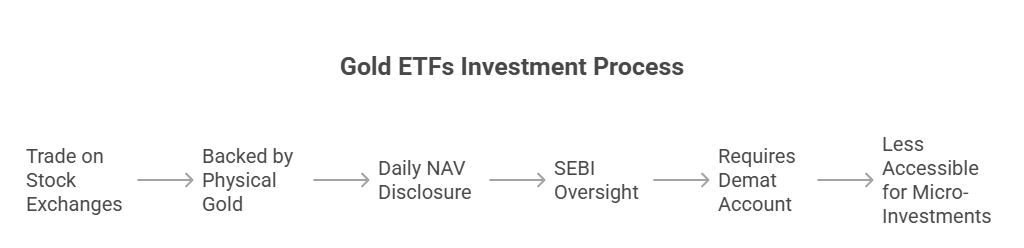

1. Gold ETFs (Exchange Traded Funds)

- Trade on stock exchanges like stocks

- Backed by physical gold held by custodians

- Daily NAV disclosure, SEBI oversight

- Limitation: Requires demat account, less accessible for micro-investments

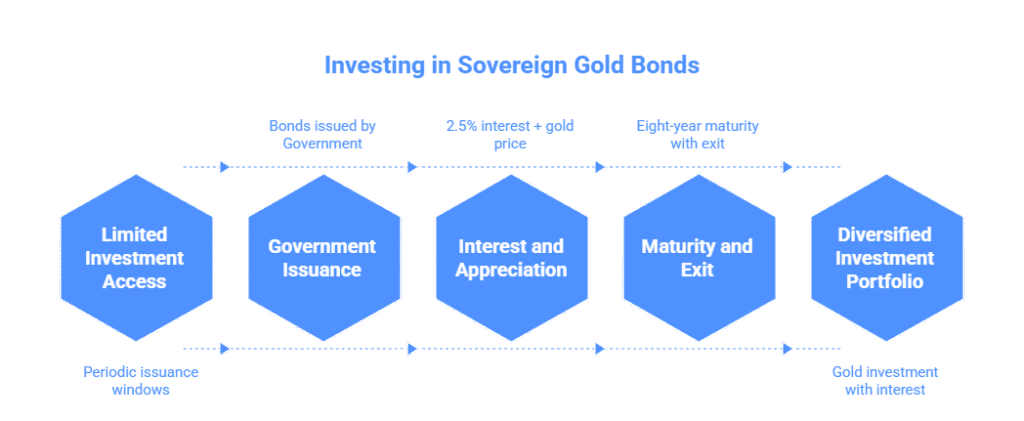

2. Sovereign Gold Bonds (SGBs)

- Issued by Government of India

- 2.5% annual interest + gold price appreciation

- Eight-year maturity with exit options

- Limitation: Periodic issuance windows, lock-in considerations

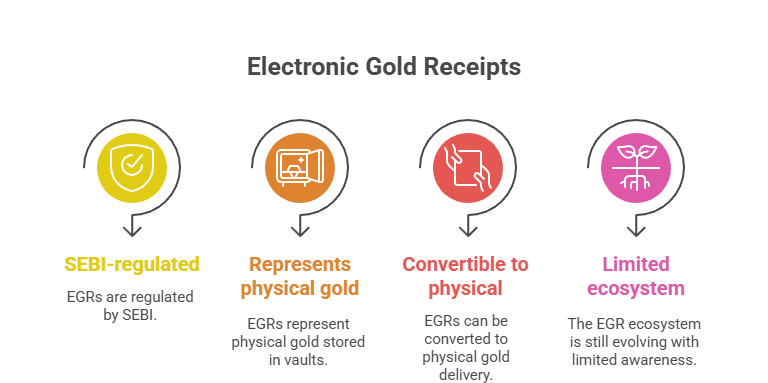

3. Electronic Gold Receipts (EGRs)

- Recently introduced, SEBI-regulated

- Represents physical gold in vaults

- Can be converted to physical delivery

- Limitation: Still evolving ecosystem, limited awareness

How Investors Are Encouraged to Buy Gold ETFs

SEBI’s clear preference for Gold ETFs as the primary alternative to digital gold reflects the regulator’s confidence in this mature, transparent investment vehicle. Here’s how investors are being encouraged to transition:

The Gold ETF Value Proposition

Regulatory Comfort: SEBI emphasizes that Gold ETFs operate under the same stringent framework as equity mutual funds—with Asset Management Companies (AMCs), custodians, and trustees all operating under regulatory oversight. Every unit of a Gold ETF represents physical gold (typically 99.5% purity or higher) stored in insured vaults.

Transparency That Digital Gold Lacks: Unlike digital gold platforms where you trust the company’s word, Gold ETFs publish daily NAV, disclose exact holdings, and undergo mandatory audits. You can verify on the NSE/BSE that your investment genuinely corresponds to physical gold.

Liquidity Without Platform Risk: Gold ETFs trade during market hours at prices reflecting real-time gold rates. You’re not dependent on a single platform’s “buyback” mechanism—you can sell on the exchange to any willing buyer. This eliminates counterparty risk entirely.

Addressing the Accessibility Gap

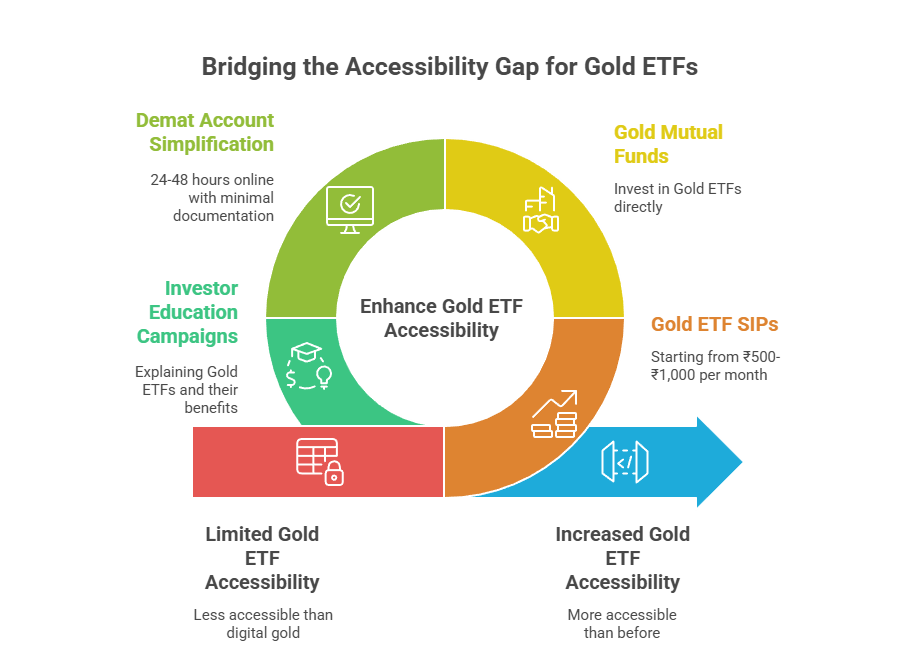

SEBI and market participants recognize that Gold ETFs have historically been less accessible than digital gold apps. Efforts to bridge this gap include:

1. Systematic Investment Plans (SIPs) in Gold ETFs: While not as seamless as digital gold’s micro-investment features, many AMCs now offer Gold ETF SIPs starting from ₹500-₹1,000 per month through mutual fund platforms.

2. Gold Mutual Funds (Fund-of-Funds): For investors without demat accounts, Gold Mutual Funds invest in Gold ETFs and can be purchased directly through AMC websites or distributor apps—combining ETF safety with mutual fund accessibility.

3. Demat Account Simplification: With digital account opening processes maturing, opening a demat account now takes 24-48 hours online with minimal documentation. Discount brokers offer zero annual maintenance charges, removing cost barriers.

4. Investor Education Campaigns: SEBI, along with stock exchanges and AMCs, has launched awareness campaigns explaining:

- How to open demat accounts

- How to place Gold ETF buy orders

- Cost comparison between digital gold and ETFs (showing ETFs often have lower expense ratios of 0.5-1% versus digital gold’s 2-3% spreads)

Addressing Behavioral Patterns

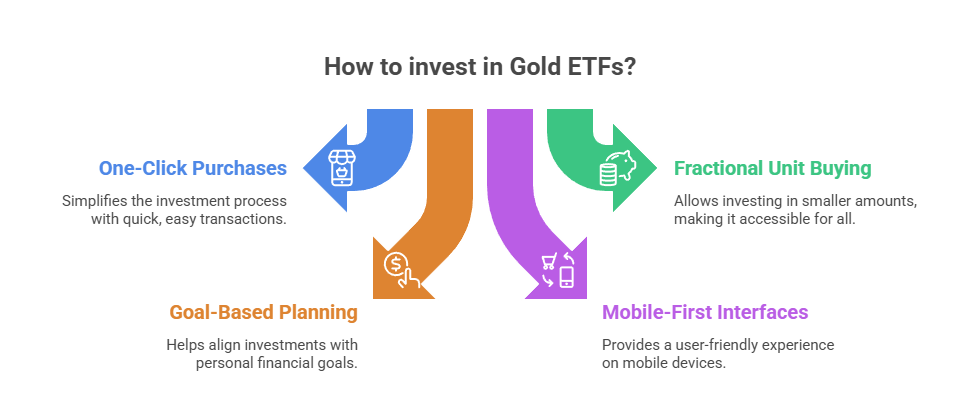

SEBI understands that digital gold succeeded because it tapped into micro-saving behaviors—auto-investing spare change, rounding up transactions, gamified savings. To compete, the regulator encourages:

Fintech-Broker Partnerships: Companies like Groww, Zerodha, and ET Money now offer simplified Gold ETF investing with:

- One-click purchases

- Fractional unit buying (through mutual fund route)

- Goal-based planning tools

- Mobile-first interfaces matching digital gold apps

Employer-Sponsored Investments: Encouraging corporates to offer Gold ETF SIPs through payroll deductions, similar to PPF/NPS contributions.

Financial Literacy Integration: Making Gold ETF awareness part of SEBI’s broader investor education mandate, especially targeting young investors who form digital gold’s core demographic.

The Trust Message

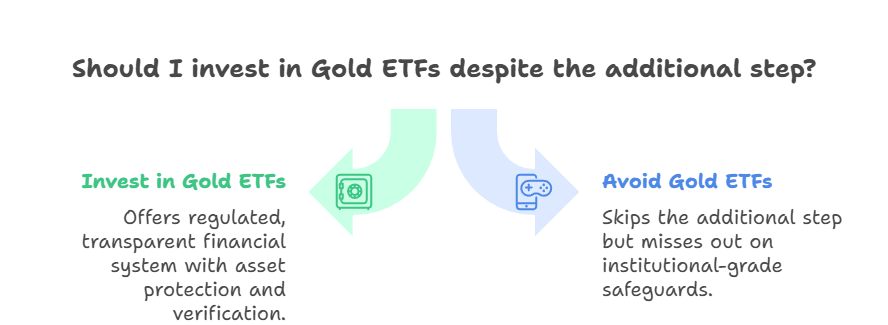

SEBI’s communication strategy essentially says: “Yes, Gold ETFs require one additional step (demat account), but that step connects you to the regulated, transparent financial system where your rights are protected and your assets are verifiable.”

The regulator positions this not as inconvenience but as investing maturity—moving from app-based gamified savings to serious wealth building with institutional-grade safeguards.

The Behavioral Shift Required

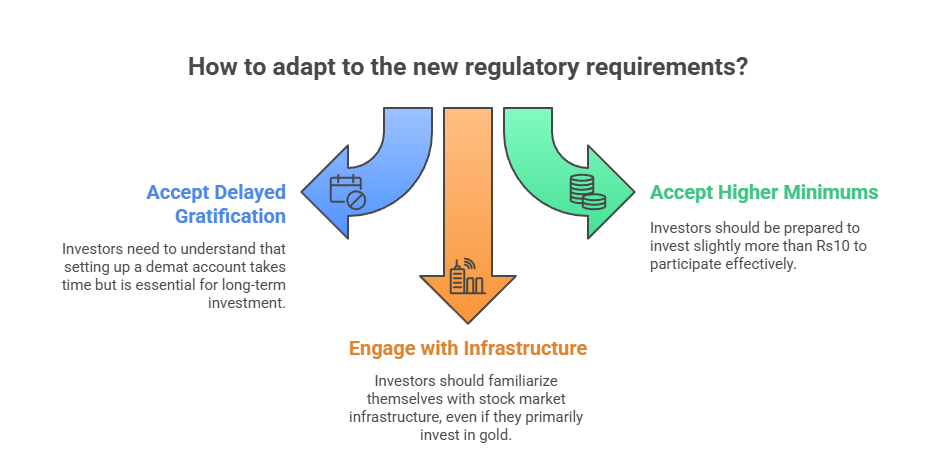

The regulator acknowledges the transition requires investors to:

- Move from instant gratification to slightly delayed gratification (demat setup)

- Accept minimum investment amounts slightly higher than Rs10

- Engage with stock market infrastructure (even if just as gold investors)

But SEBI’s message is clear: this small friction is the price of financial safety and regulatory protection—a trade-off mature investors should willingly make.

What Existing Digital Gold Investors Should Do

SEBI’s warning doesn’t mandate immediate exit but demands informed vigilance:

Immediate Due Diligence

- Verify vault partner credentials: Are they internationally certified (LBMA-approved) and India-registered?

- Check for third-party audits: Platforms like SafeGold and MMTC-PAMP publish Bureau Veritas audit reports

- Review terms of service: What happens in platform insolvency? Are you a secured creditor?

Risk Mitigation Strategies

- Diversify holdings: Don’t concentrate gold savings in one unregulated platform

- Consider gradual exit: If holding significant amounts, systematically shift to regulated alternatives

- Keep documentation: Maintain screenshots, receipts, and transaction records

Red Flags to Watch

- Platforms offering unusually high buyback premiums

- Lack of transparency about vault location or gold purity standards

- Absence of insurance coverage on stored gold

- Unclear fee structures or hidden charges

The Bottom Line

SEBI’s message is unambiguous: convenience doesn’t equal safety. While digital gold platforms offer accessibility and fractional ownership, they lack the regulatory architecture that protects investors in traditional financial products.

The push toward Gold ETFs represents SEBI’s vision of democratized yet protected gold investment—combining the transparency of regulated markets with increasingly accessible entry points. The regulator is betting that as investors become aware of the risks in unregulated platforms and the improving accessibility of ETFs, market forces will naturally drive capital toward safer alternatives.

For investors, the choice isn’t necessarily between digital gold and regulated alternatives, but rather understanding that with unregulated products, you are accepting risks that no authority will help mitigate. That’s not inherently wrong—it’s just a decision that should be made with eyes wide open.

The market will likely bifurcate: platforms that voluntarily adopt higher standards (third-party audits, insurance, transparent custody) may survive and thrive, while those operating opaquely face increasing investor skepticism and eventual regulatory pressure. Meanwhile, Gold ETFs are positioned to capture the quality-conscious segment of gold investors who value regulatory oversight over marginal convenience.

Key Takeaway: In India’s gold investment landscape, regulatory oversight isn’t just bureaucratic red tape—it’s the difference between an investment and a gamble on platform solvency. SEBI is making the case that Gold ETFs offer the best of both worlds—the convenience of modern financial infrastructure with the safety of regulatory supervision.

Gold and silver ended lower on the week despite sharp intraday rebounds, with price action reflecting continued volatility and fragile positioning rather than a sustained recovery. In the absence of a definitive macro catalyst, a broad-based decline across equities and cryptocurrencies prompted investors to raise liquidity, briefly dragging gold below the key $5,000 per ounce threshold. Non-yielding assets came under pressure as earlier stronger-than-expected US employment data pushed expectations for the first Federal Reserve rate cut further into midyear, reducing the appeal of bullion. Sentiment shifted, however, after inflation data showed annual CPI slowing to 2.4% and core inflation easing to 2.5%, reviving dovish expectations. The softer inflation print weighed on Treasury yields and pressured the dollar, allowing gold to recover toward the $4,990 region. Silver experienced similar turbulence, sliding sharply during the liquidation phase before rebounding above $76 per ounce, though it remained on track for another weekly decline.

Gnanasekar Thiagarajan

Introduction:

Gold finished the period under pressure despite sharp rebounds, with price action dominated by cross-asset volatility and shifting rate expectations. After initially recovering more than 2% on softer-than-expected US inflation, bullion briefly pushed back toward the $5,000–$5,020 region as annual CPI slowed to 2.4% and core inflation eased to 2.5%, reinforcing expectations of multiple Federal Reserve rate cuts this year. Lower yields and a softer dollar provided near-term relief, reviving the structural appeal of non-yielding assets.

However, gains proved fragile as the dollar rebounded and gold slipped back below $5,020, underscoring hesitation around the psychological $5,000 threshold. Earlier strength in US labor data had already delayed expectations for the first rate cut toward midyear, capping upside momentum. Markets now await further guidance from FOMC minutes, GDP data and the core PCE print, while geopolitical developments — including renewed US-Iran nuclear talks and broader Middle East tensions — continue to shape safe-haven flows.

Silver tracked gold’s volatility but continued to underperform structurally, remaining in a corrective phase after January’s extreme surge. The metal rebounded nearly 3% on softer inflation data and firmer rate-cut expectations, briefly moving back above $76 per ounce, but gains faded as liquidity stayed thin amid China holidays and broader risk sentiment remained fragile. Heavy speculative positioning left silver exposed to sharp reversals, and prices are still far below late-January highs above $120 after the collapse toward the mid-$60s. While lower yields and debasement concerns offer underlying support, near-term trade points to consolidation rather than a swift return to the prior rally.

Gold and Silver:

Gold fell below $5,020 per ounce on Monday after rising more than 2% in the previous session, following weaker-than-expected US CPI data. The soft inflation print reinforced expectations for Federal Reserve rate cuts this year, with markets now pricing in slightly more than two reductions. Investors are awaiting the release of FOMC meeting minutes, the US GDP advance estimate, and PCE inflation data for further clues on the timing of the next rate cut. On the geopolitical front, traders are monitoring nuclear talks between the US and Iran, as well as US-led negotiations aimed at ending the war in Ukraine, both scheduled to resume on Tuesday. Developments in these areas could influence risk sentiment and safe-haven demand. Despite recent volatility, the precious metal remained supported by ongoing geopolitical uncertainty, strong central bank buying, and investor flight from sovereign bonds and currencies.

Silver March

Silver fell more than 1% toward $76 per ounce on Monday, reversing gains from the previous session, although trading volumes were subdued due to market holidays in the US, China and other countries. On Friday, the metal had jumped nearly 3% after soft US inflation data reinforced expectations that the Federal Reserve will cut interest rates later this year. Markets are currently pricing in a Fed rate cut in July, with a strong probability of a move in June. Investors now turn to the latest Fed minutes and the Fed-preferred core PCE price index report for further guidance on the US monetary outlook.

Meanwhile, mainland China’s markets are closed this week for the Lunar New Year holiday. Chinese traders had driven a speculative surge in precious metals in recent weeks, prompting authorities to curb market risks through various measures. Silver peaked above $120 an ounce in late January before falling to around $64 earlier this month as sentiment reversed.

Gold April

Technical View: $4996. Weekly chart shows a strong underlying uptrend with price holding well above the short-term moving averages and momentum expanding positively. The recent pullback appears corrective, with support seen near $4886/4878; holding above this zone keeps the broader structure intact for a move towards $5460. A decisive break below $4765 will be the first sign of deeper corrective pressure.

-

ShowBuzz4 hours ago

ShowBuzz4 hours agoIndia International Bullion Summit 2026: A Defining Platform Shaping India’s Bullion & Jewellery Ecosystem

-

National News4 days ago

National News4 days agoIIBS-11: Navigating the ‘New Gold Rush’ in a fragmenting global economy

-

International News4 days ago

International News4 days agoOroarezzo 2026, with Italian Exhibition Group, Manufacturing Explores New Markets

-

GlamBuzz10 hours ago

GlamBuzz10 hours ago#ViRosh Ki Shaadi: Rashmika Mandanna & Vijay Deverakonda Celebrate Love with Temple Gold & Timeless Tradition