DiamondBuzz

Rio Tinto’s Diamond Division Posts $79 Million EBITDA Loss in 2025

Higher output from Canada’s Diavik Diamond Mine offsets revenue decline, but end-of-life pressures continue to weigh on performance.

Rio Tinto reported a challenging year for its diamond business in 2025, posting an underlying EBITDA loss of $79 million despite improved revenues. While the loss narrowed compared to the $115 million deficit recorded in 2024, the division remained under pressure amid a global diamond market slowdown and the nearing closure of its last active mine.

Annual revenue rose 19% to $332 million, supported by stronger production at the Diavik mine in Canada, Rio Tinto’s only remaining diamond operation. Output climbed 61% to 4.4 million carats, driven by the ramp-up of mining activities in the underground section of the A21 deposit, which began scaling up in late 2024.

However, the A21 underground ore body is expected to be depleted by the end of the first quarter of 2026, marking the end of Diavik’s operational life. The company plans to spend approximately $1 billion this year on closure activities related to Diavik, as well as rehabilitation work at the former Argyle Diamond Mine, which ceased production in 2020, and other non-diamond projects.

DiamondBuzz

LGDs dominate engagement ring segment, 239% increase since 2020: The Knot

Price stability may unlock deferred demand, while investment demand persists and wedding-related purchases support jewellery sales.

The traditional diamond industry just got a serious wake-up call. According to the latest data from The Knot, 2025 marked the official “takeover” of lab-grown diamonds in the engagement ring market. Couples are ditching the natural pipeline in favor of LGD stones that offer more sparkle for fewer dollars.

Here is the breakdown of how the engagement ring landscape shifted over the last year.

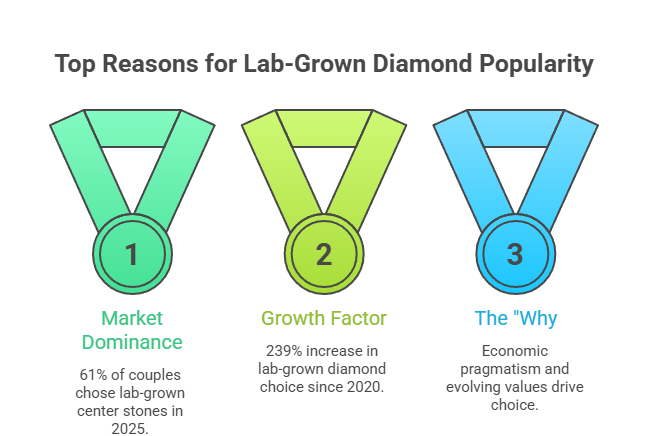

The Lab-Grown Revolution

The numbers don’t lie: synthetic stones are no longer a “budget alternative”—they are the primary choice.

- Market Dominance: 61% of couples chose a lab-grown center stone in 2025.

- The Growth Factor: That’s a staggering 239% increase since 2020.

- The “Why”: It’s a mix of economic pragmatism and evolving values. In fact, 40% of buyers specifically sought out lab-grown stones for ethical or personal reasons.

Spending vs. Size: The Great Trade-Off

While couples are spending less on average, they are walking away with much bigger rocks.

| Feature | Lab-Grown (Avg) | Natural Diamond (Avg) |

| Average Cost | $4,300 | $7,000 |

| Carat Size | 2.0 cts | 1.6 cts |

| Top Shape | Oval | Round |

Bottom Line: The average total spend on rings dropped from $5,200 in 2024 to $4,600 in 2025, yet the average stone size grew from 1.7 to 1.9 carats. Essentially, couples are getting “more for less.”

Style Trends: Yellow Gold is Back

It’s not just about the stone; the “look” of the ring is evolving too.

- Metal Magic: Yellow gold is the undisputed champion at 39% demand (a 140% jump over five years), while white gold continues to lose its luster.

- The Silhouette: Solitaire settings remain the top pick (38%), emphasizing the “big stone” aesthetic.

- Shape Shifters: While Round is still the #1 shape overall (26%), Ovals are hot on its heels at 25%. Emerald, princess, pear, and marquise shapes follow behind at 8% each.

- The Personal Touch: 90% of couples opted for custom designs or edits—the “cookie-cutter” ring is officially out.

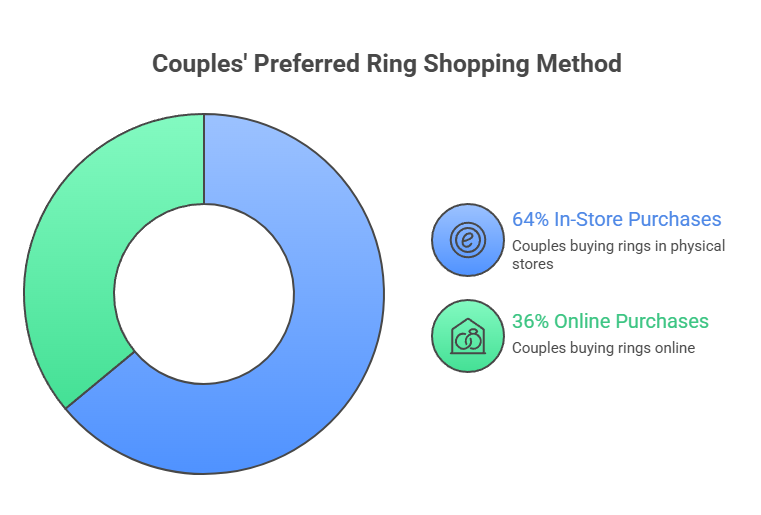

The Shopping Experience: High-Tech Stones, Old-School Service

Despite the rise of lab-grown tech, couples still want a “main street” experience.

- In-Person Preference: Over 50% of couples say shopping in person is a must.

- The Hunt: On average, proposers visit two retailers and look at 10 different rings before pulling the trigger.

- Final Click vs. Handshake: 64% of purchases were made in-store, with only one-third of couples buying online.

-

National News51 minutes ago

National News51 minutes agoGJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

-

National News2 hours ago

National News2 hours agoWGC India gold market update: Price strength fuels demand Looking ahead

-

National News3 hours ago

National News3 hours agoIndia’s polished diamond exports dip by 3.6 per cent yoy in January 2026

-

International News50 minutes ago

International News50 minutes agoUS Supreme Court ruling reshapes trade landscape for Indian GJ exports