National News

RBI tightens gold loans norms; proposes LTV ratio at 75% of pledged gold’s worth

RBI has proposed sweeping changes to how financial institutions lend against gold, tightening oversight in a bid to curb risks and bring greater transparency to a booming segment of the country’s credit market.

In draft guidelines released April 3, the Reserve Bank of India (RBI) proposed capping the loan-to-value (LTV) ratio for gold loans at 75% of the pledged gold’s worth. The move would standardize lending limits across banks and nonbank financial companies (NBFCs), ending a pandemic-era relaxation that had allowed NBFCs to lend up to 90% of the value of gold collateral for a year.

The new cap would apply uniformly, regardless of whether loans are intended for consumption, business, or other purposes—a significant shift that levels the regulatory playing field for NBFCs and banks alike.These proposals aim to harmonize regulations across entities while aligning them with risk-taking capabilities according to RBI Governor Sanjay Malhotra.

India is one of the world’s largest consumers of gold, and borrowing against jewelry and bullion is a common way for households and small businesses to access credit. The sector has grown rapidly, particularly through NBFCs that target less formal borrowers, raising concerns about inconsistent lending practices and over-leveraging.

In addition to the LTV cap, the RBI is pushing for enhanced internal controls and transparency. Lenders will be expected to establish their own LTV thresholds based on internal risk assessments. A standardized valuation framework will also be introduced to ensure consistency in assessing gold collateral across branches.

Under the new rules, banks and NBFCs must disclose the reference price of gold used for loan calculations and implement a uniform methodology to evaluate purity and measure gross and net weights. This information must be made publicly available on their websites.

The proposals are part of the RBI’s broader developmental and regulatory agenda. A public consultation process is now underway, and final guidelines are expected later this year.

The central bank’s move signals a growing focus on borrower protection and market discipline in India’s informal lending space, where gold loans remain a crucial—but sometimes opaque—source of credit.

JB Insights

Women’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

From milestone-driven collections to personalised styling and self-purchase narratives, jewellery brands across India are celebrating women’s independence, identity, and achievements this International Women’s Day.

International Women’s Day 2026 has prompted jewellery brands across India to launch campaigns that celebrate women’s empowerment, individuality, and personal achievements. Moving beyond traditional gifting narratives, many brands are positioning jewellery as a symbol of self-expression and personal milestones, reflecting the evolving role of women as independent buyers in the jewellery market.

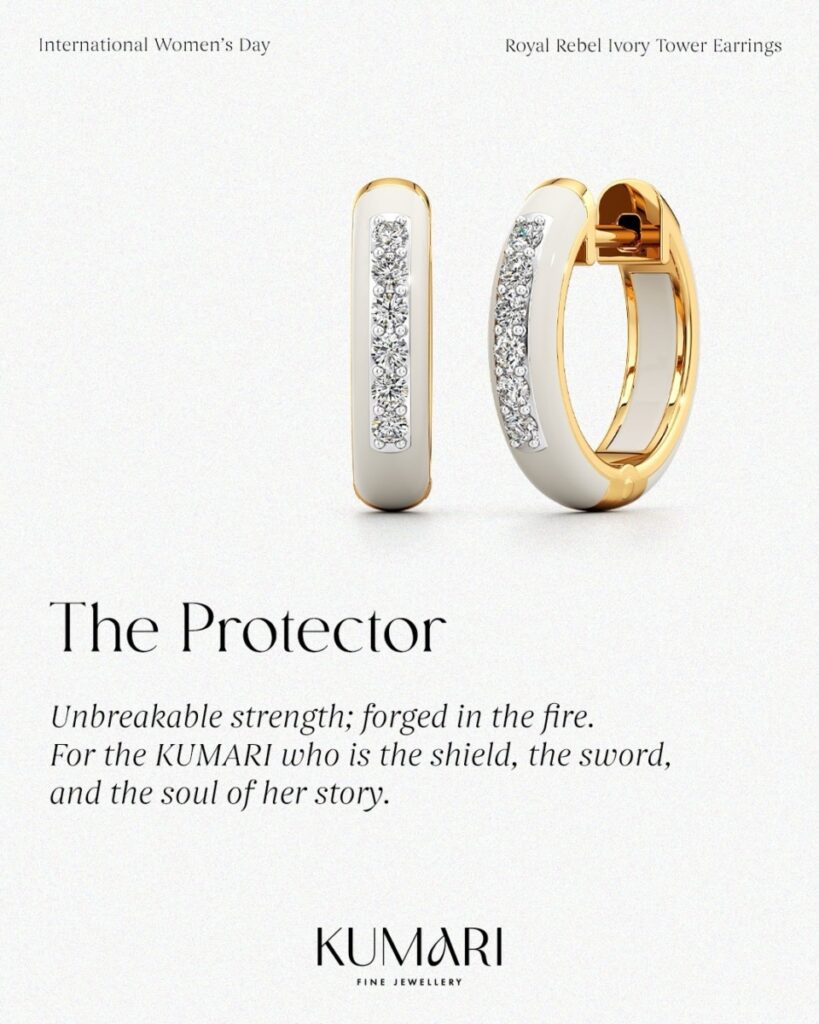

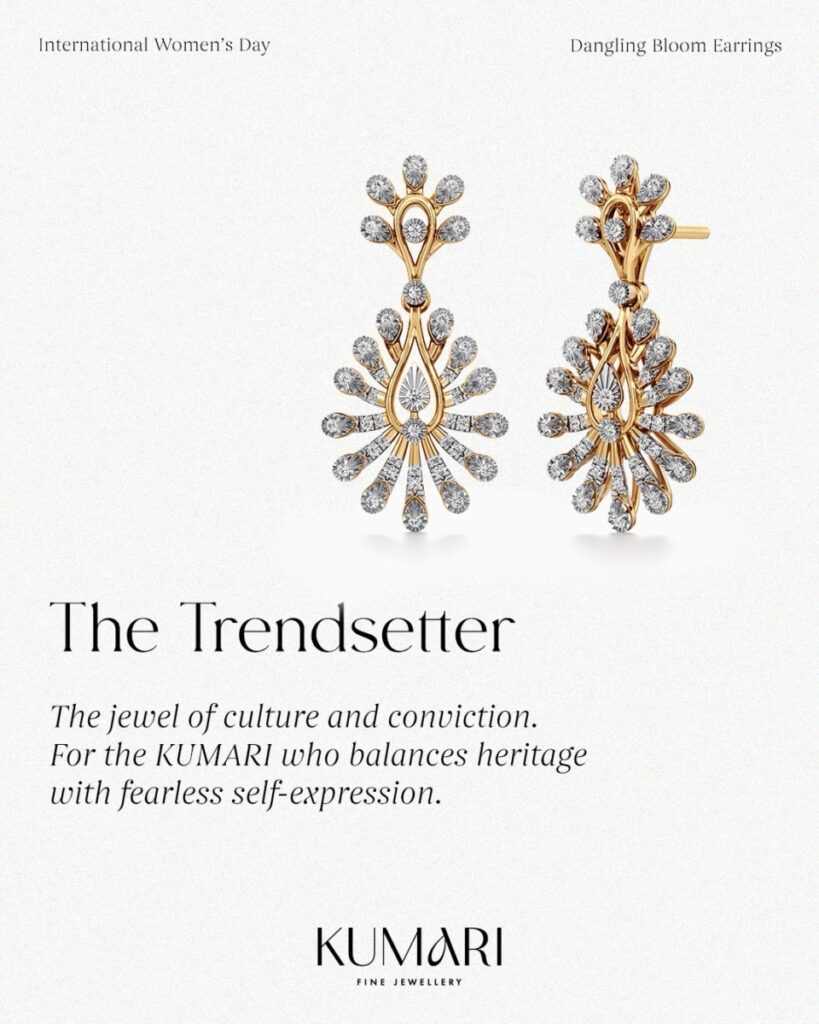

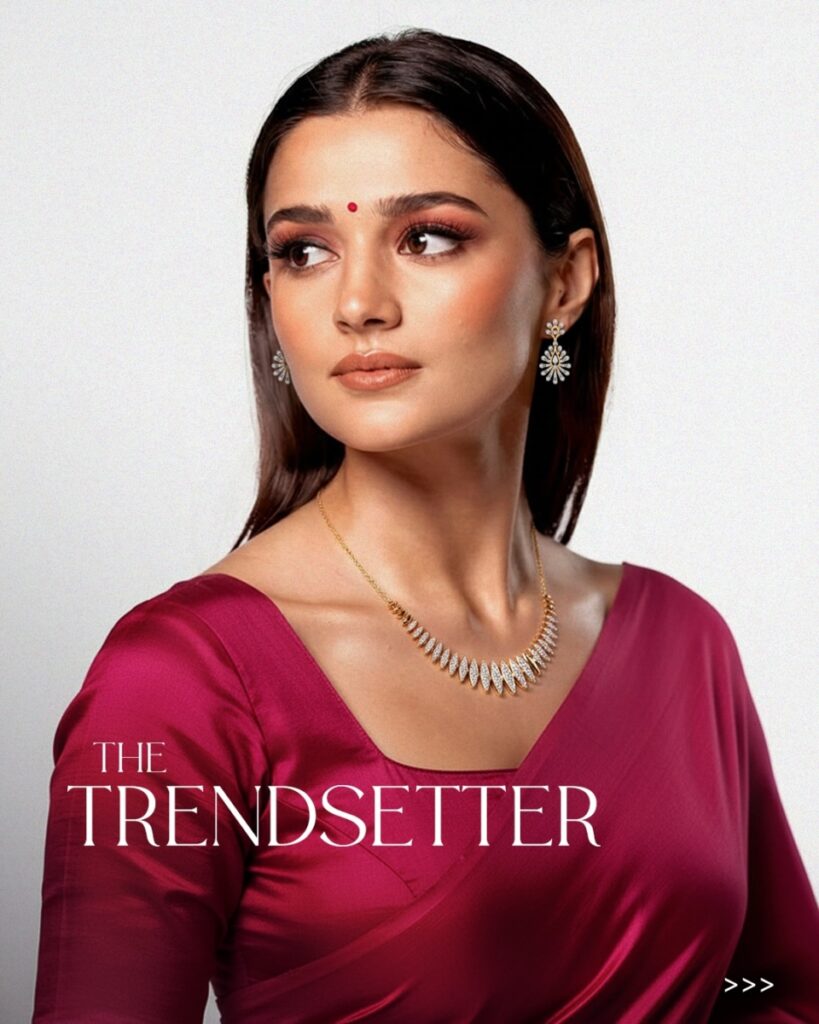

Kumari Fine Jewellery

Mumbai-based Kumari Fine Jewellery has introduced a Women’s Day showcase themed around the idea of the “Modern Indian Original.” The initiative focuses on financially independent women who mark their achievements with self-purchased jewellery. The showcase highlights lightweight gold pieces designed for everyday wear, reinforcing jewellery as both a style statement and a symbol of personal growth.

Dhirsons Jewellers

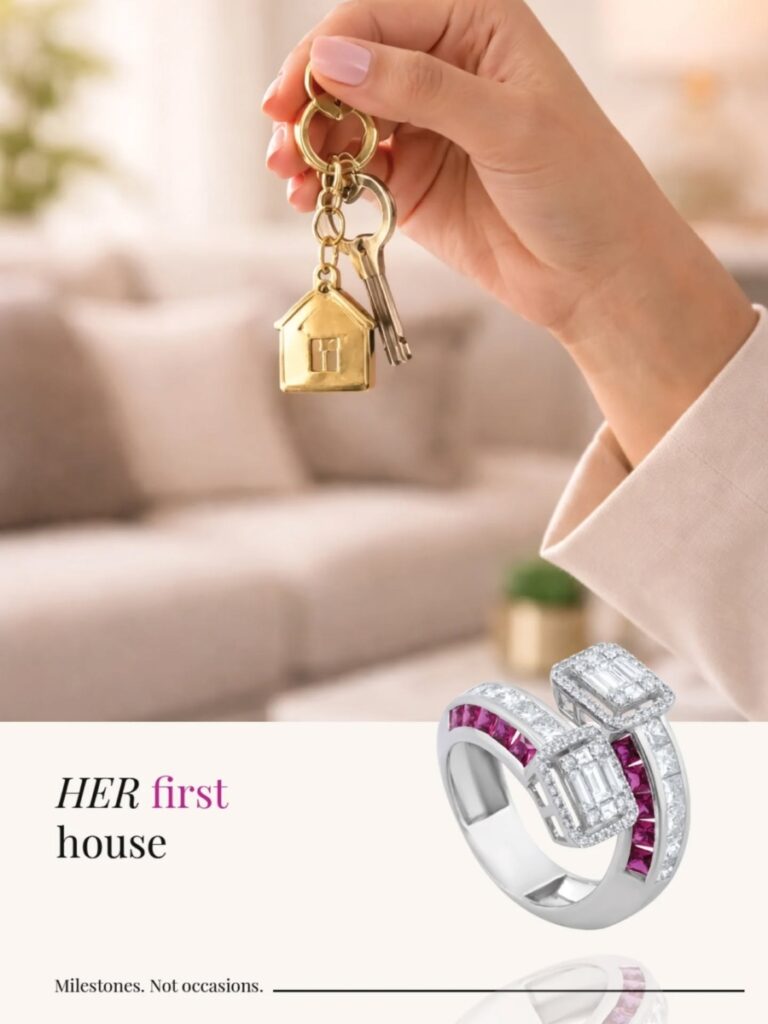

Delhi’s Dhirsons Jewellers has launched a campaign centred on celebrating milestones in a woman’s journey rather than traditional occasions. The initiative encourages women to recognise defining moments in their lives, positioning jewellery as a reflection of resilience, confidence, and self-belief.

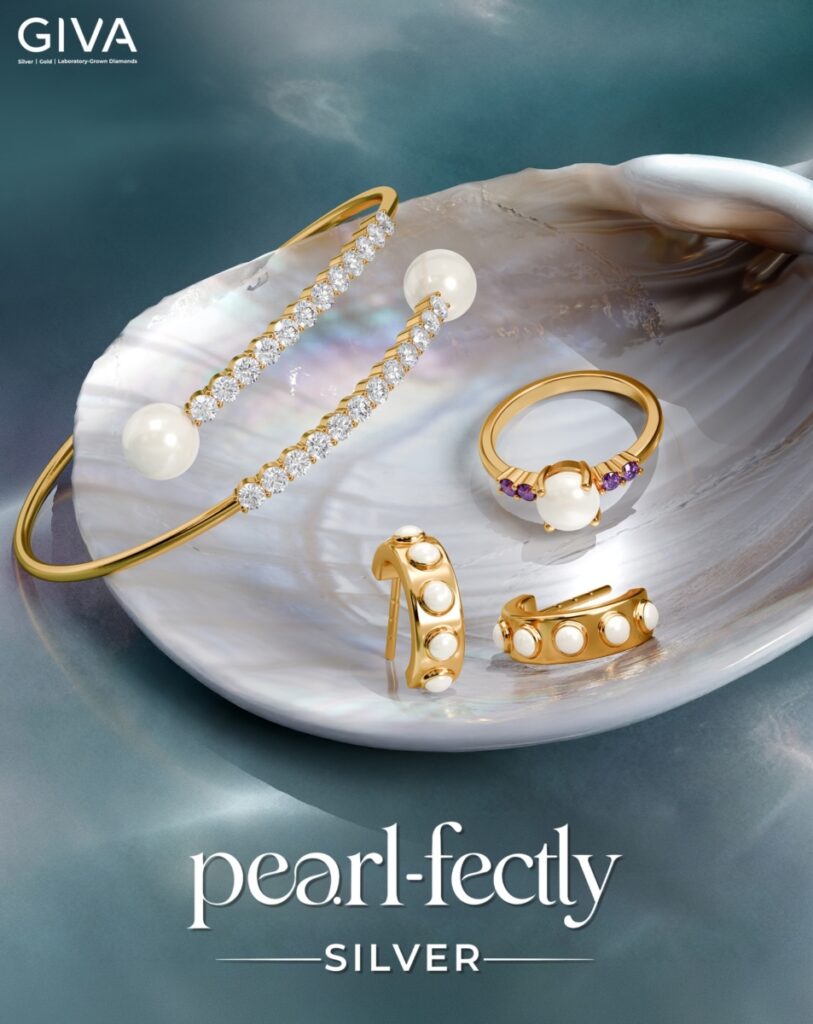

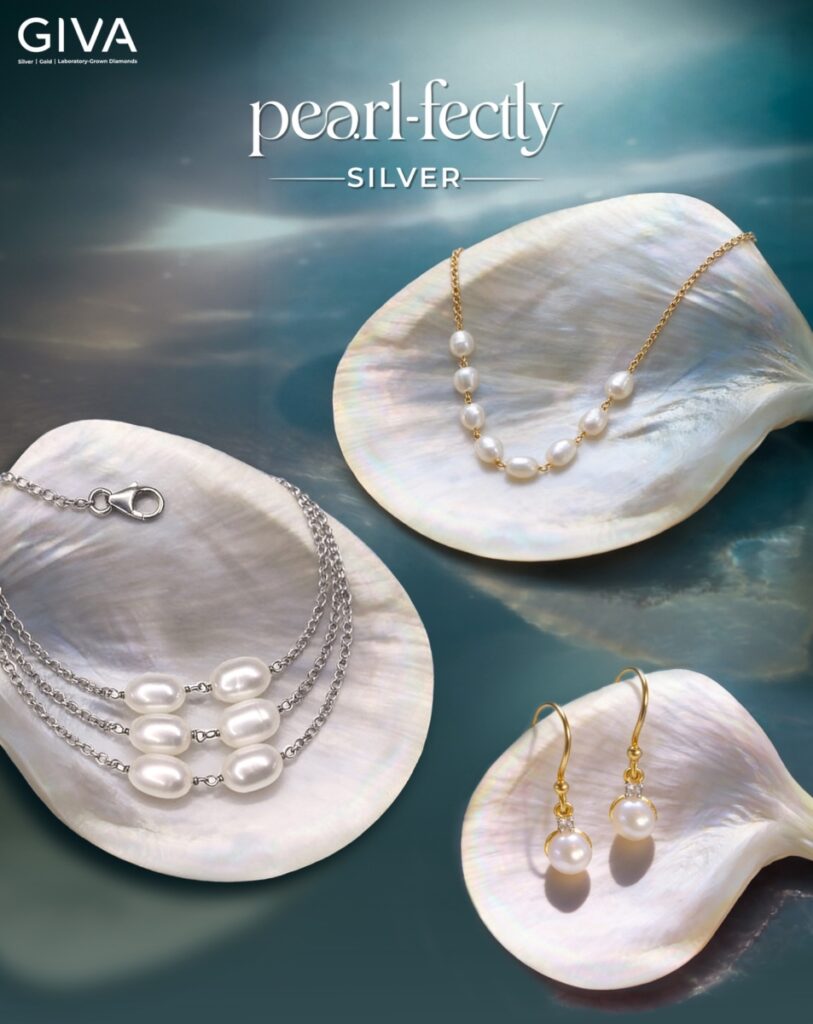

GIVA

Digital-first jewellery brand GIVA has unveiled a Women’s Day concept titled The Pearl Edit, focusing on timeless pearl jewellery that celebrates women who are building, leading, and redefining their paths. The campaign emphasises understated elegance while encouraging women to celebrate themselves through meaningful jewellery.

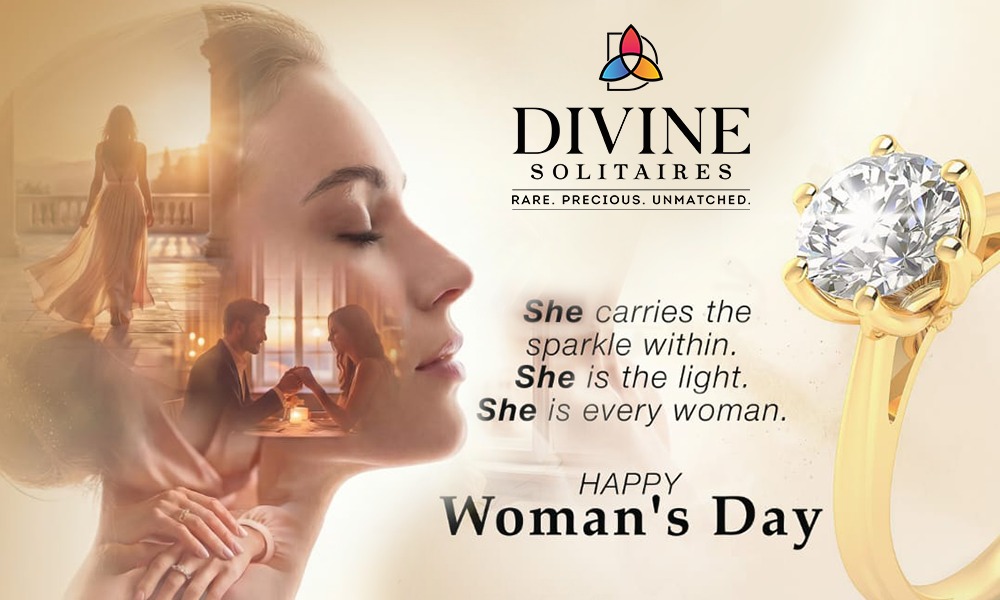

Divine Solitaires

Diamond jewellery brand Divine Solitaires has also introduced a Women’s Day campaign highlighting the emotional value of solitaire diamonds as symbols of personal milestones. The initiative focuses on recognising the journeys of women across roles—from professionals and entrepreneurs to mothers and mentors—while encouraging self-appreciation through jewellery.

Senco Gold & Diamonds

Technology-driven campaigns have also gained traction this year. Senco Gold & Diamonds has launched an initiative that integrates artificial intelligence into jewellery styling, enabling customers to discover pieces that match their personality and features. The concept highlights individuality while bringing digital innovation into the jewellery retail experience.

Tanishq

Large national brands are also participating in the Women’s Day narrative. Tanishq has continued its focus on celebrating modern womanhood through curated collections and storytelling campaigns that reflect the changing aspirations of contemporary women. The brand’s initiatives frequently highlight independence, confidence, and self-expression.

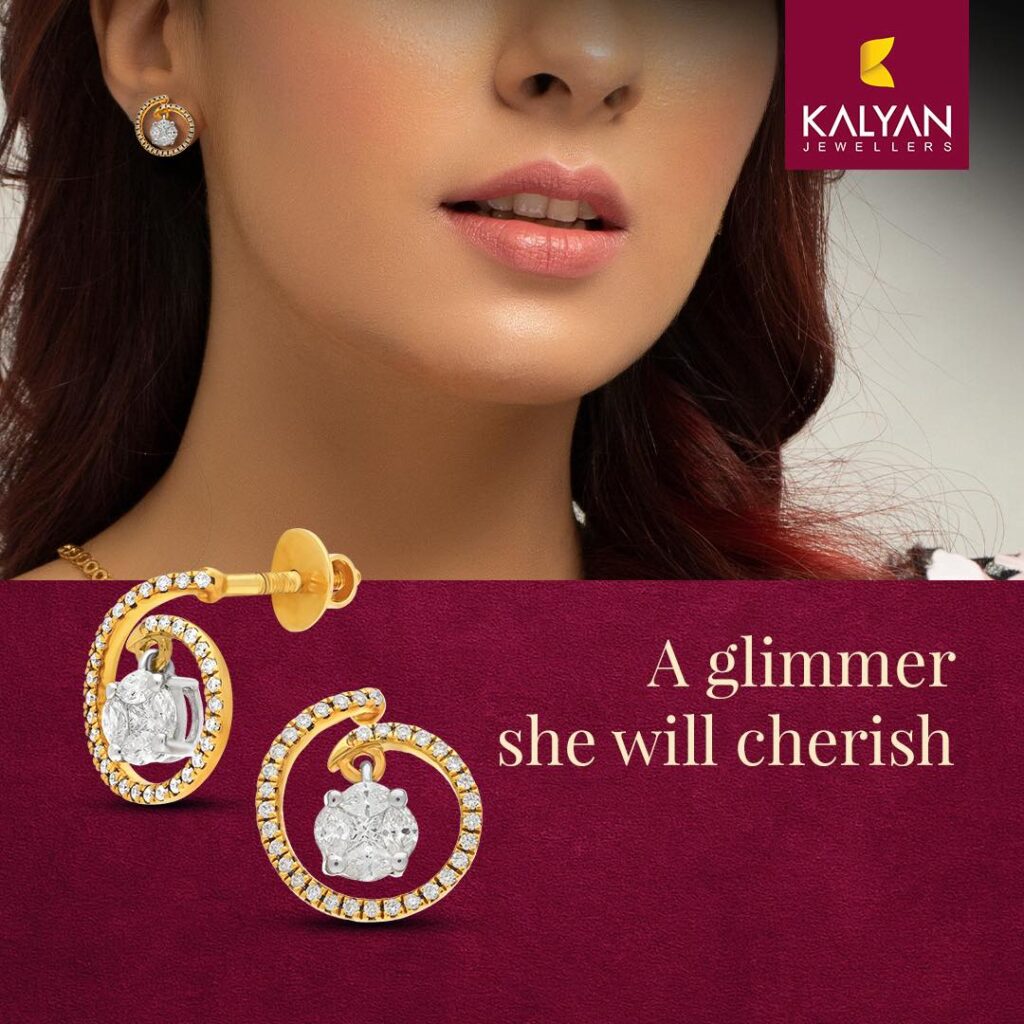

Kalyan Jewellers

Similarly, Kalyan Jewellers has aligned its messaging with women’s empowerment by supporting women-centric initiatives and partnerships, reinforcing the importance of recognising women’s achievements across different fields.

CaraLane

Other jewellery brands are also marking the occasion through special launches and themed collections. CaratLane has promoted contemporary diamond and gold jewellery collections designed for self-purchase and everyday styling, encouraging women to celebrate their personal milestones.

ORRA Fine Jewellery

Luxury diamond brand ORRA Fine Jewellery has highlighted modern diamond jewellery that symbolises confidence and individuality, targeting young professionals who view jewellery as a statement of identity.

Malabar Gold & Diamonds

Meanwhile, Malabar Gold & Diamonds has focused on campaigns that recognise women’s contributions to families, workplaces, and society, positioning jewellery as a tribute to their strength and achievements.

Across the industry, the Women’s Day celebration by many brands reflect a broader shift in consumer behaviour. Women are increasingly viewing jewellery not only as a traditional gift but also as a meaningful purchase that celebrates personal success, independence, and self-expression.

As jewellery brands continue to adapt to these changing aspirations, Women’s Day has become an important platform for storytelling, allowing brands to connect with modern consumers through themes of empowerment, individuality, and celebration of life’s defining milestones.

-

JB Insights14 hours ago

JB Insights14 hours agoWomen’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

-

National News18 hours ago

National News18 hours agoGold Rebounds in India After Five-Day Slide; Dollar Strength Keeps Pressure Intact

-

National News19 hours ago

National News19 hours agoKumari Fine Jewellery Celebrates the “Modern Indian Original” with Exclusive Women’s Day Showcase

-

National News23 hours ago

National News23 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey