National News

RBI guidelines: Gold, silver allowed as collateral for micro, small enterprises

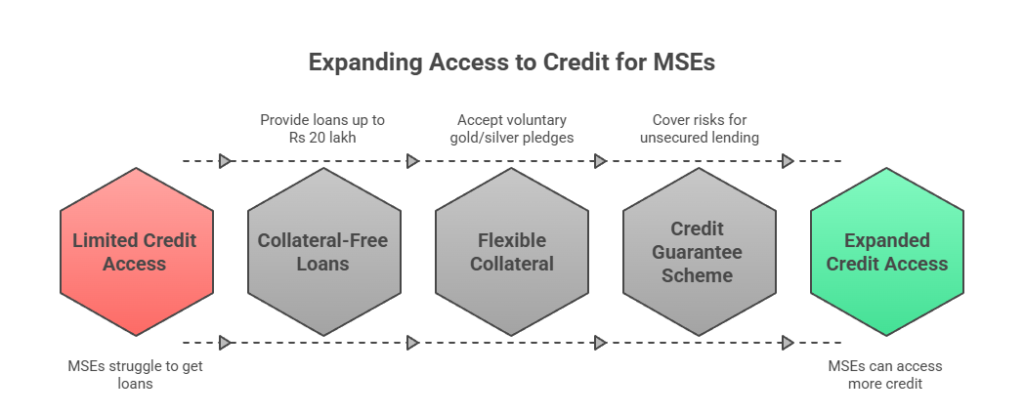

The Reserve Bank of India (RBI) has introduced revised guidelines to bolster credit access for micro and small enterprises (MSEs), allowing banks to accept voluntarily pledged gold and silver as collateral for loans up to the collateral-free threshold. This policy, effective for loans sanctioned or renewed from April 1, 2026, mirrors a provision extended to agricultural loans nearly a year ago and aims to support MSE growth without breaching collateral-free mandates.

Key Provisions of the Guidelines

- Collateral-Free Loans as Standard:

Banks must provide loans up to Rs 20 lakh without insisting on collateral security. This applies to all MSE units, including those under the Prime Minister Employment Generation Programme (PMEGP) run by the Khadi and Village Industries Commission (KVIC). - Flexible Gold and Silver Collateral:

Borrowers can voluntarily pledge gold or silver for these loans, and banks accepting such collateral will not face regulatory violations. Based on the borrower’s track record and financials, banks may extend collateral-free loans up to Rs 25 lakh under internal policies.

- Risk Mitigation Options:

Lenders can leverage the Credit Guarantee Scheme (CGS) to cover risks, enhancing confidence in unsecured lending. - The RBI’s clarification states:“Accepting gold and silver as collateral pledged voluntarily by borrowers for loans sanctioned by the banks up to the collateral-free limit will not be construed as a violation of the above mandate.”

Implications for MSEs and the Economy

This move addresses a key pain point for MSEs, which often struggle with collateral requirements despite strong growth. RBI data (end-December 2025) shows outstanding MSE credit exceeding Rs 10 lakh crore, with a robust 30% year-on-year increase.

Sectors like gems and jewellery—where gold and silver form core assets—stand to benefit significantly. Artisans and small manufacturers can now leverage household or business-held precious metals for quick funding, potentially spurring innovation, exports, and job creation under schemes like PMEGP.

For banks, the guidelines balance inclusivity with prudence, encouraging lending while offering CGS-backed safeguards. This could accelerate MSE credit expansion, aligning with India’s push for a $5 trillion economy through grassroots entrepreneurship.

National News

Indian jewellery stocks rise on US INDIA trade agreement

Indian jewellery stocks experienced a remarkable surge on the announcement of a bilateral trade agreement between the United States and India, which dramatically reduced tariffs on gems and diamonds exported from India—from 50% to 18%. This 64% tariff reduction represents a transformative shift for Indian jewellers who have long struggled with punitive export duties to one of the world’s largest luxury markets.

India’s listed jewellery retailers are witnessing a strong earnings-driven rally, underpinned by robust quarterly performances. Kalyan Jewellers reported a 60% surge in consolidated net profit for the October–December quarter, fueled by healthy same-store sales and expansion-led growth. P N Gadgil Jewellers outperformed further with a 115.5% jump in profit, reflecting successful brand positioning and market expansion, while Sky Gold’s solid third-quarter numbers added to sector-wide optimism. Importantly, gains were supported by improved operational efficiencies, tighter inventory control, and stronger margins, signaling quality earnings growth.

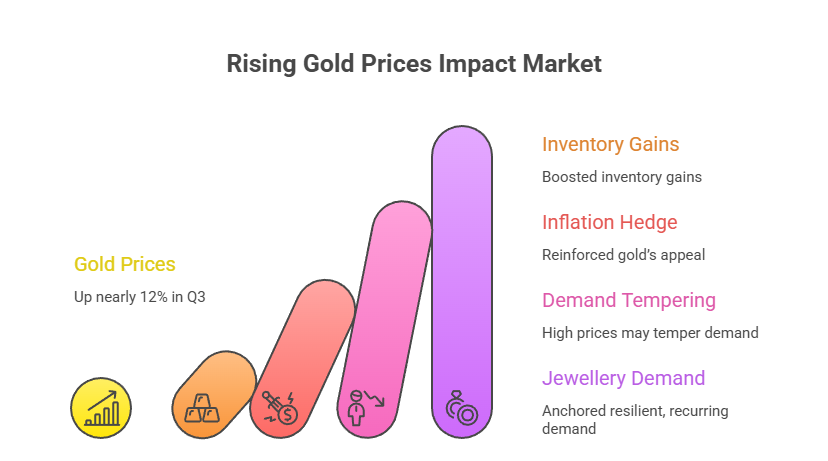

Rising gold prices—up nearly 12% in Q3 and over 16% in 2026 so far—have boosted inventory gains and reinforced gold’s appeal as an inflation hedge, though high prices may temper demand. Meanwhile, India’s $50 billion wedding economy continues to anchor resilient, recurring jewellery demand, sustaining momentum.

Perhaps the most important long-term driver is the ongoing structural shift from unorganized to organized jewellery retail. This secular trend, accelerated by regulatory changes like GST implementation and increasing consumer preference for trusted brands, continues to reshape the competitive landscape.

The recent rally in jewellery stocks reflects more than just short-term trading momentum. It represents the market’s recognition of a sector undergoing fundamental transformation, supported by favorable policy developments, strong operational execution, and enduring structural tailwinds. While near-term volatility is inevitable—particularly given sensitivity to gold prices and broader market movements—the long-term outlook for quality organized jewellery retailers remains bright.

For investors, the strategy should focus on companies demonstrating consistent execution, prudent capital allocation, and the ability to navigate the delicate balance between growth and profitability. The suggestion to “accumulate shares of leading companies in the segment on dips” appears sound, provided investors maintain appropriate position sizing and recognize that in this sector, quality and brand strength often matter more than valuation multiples.

As India’s consumer economy continues its upward trajectory and organized retail penetration deepens, the jewellery sector stands out as one where cultural affinity, economic progress, and corporate execution align to create sustained value creation opportunities.

-

JB Insights2 weeks ago

JB Insights2 weeks ago2026 THE ROAD AHEAD: Tradition Meets Technology, Sustainability, Personalization

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoAWDC Hails EU-India Trade Pact, Sees Strong Export Boost for Antwerp-Polished Diamonds in India

-

JB Insights2 weeks ago

JB Insights2 weeks agoGold is Talking, Silver is Screaming – A Case for Prudent Repositioning

-

DiamondBuzz2 weeks ago

DiamondBuzz2 weeks agoJapan, US Weigh Synthetic Diamond Facility to Strengthen Strategic Supply Chains