International News

Precious Metals hit fresh record highs as geopolitical risks and Fed concerns intensify

Partnership to blend jewellery, confidence and contemporary style as RCB Women gear up for Women’s T20 League 2026

- Gold and silver surged to new all-time highs, with gold crossing $4,600 and silver moving past $86, as investors rushed toward safe-haven assets. The rally was driven by rising concerns over the independence of the U.S. Federal Reserve, escalating geopolitical tensions, and renewed trade-related uncertainty.

- Market sentiment was rattled after U.S. federal prosecutors reportedly threatened action against Fed Chair Jerome Powell over comments made to Congress regarding a building renovation project. Powell has described the move as a “pretext” aimed at pressuring the central bank to cut interest rates, raising serious concerns about policy independence.

- Geopolitical risks continue to mount, with the U.S. stepping up its involvement in Venezuela, President Donald Trump warning of possible military action amid unrest in Iran, ongoing conflict in Ukraine, tensions between China and Japan, and renewed insistence by the White House on acquiring Greenland. Adding to the uncertainty, Trump warned that any country doing business with Iran could face a 25% tariff on all U.S. trade.

- U.S. officials also confirmed that President Trump will be briefed on Tuesday on potential responses to Iran, including sanctions, cyber measures, and military options—keeping global risk sentiment fragile and supportive for precious metals.

Technical Triggers

- Gold has decisively broken above its earlier resistance at $4,570, opening the door to higher levels. The next key targets are $4,745–4,750 (78.6% Fibonacci extension, ~Rs. 1,46,000) and $4,966–4,970 (100% Fibonacci extension, ~Rs.1,52,500).

- Silver’s rally also looks set to extend further. Fibonacci projections point toward $88 (~Rs.2,78,000) and $93 (~Rs.2,93,000) in the coming weeks, while $70 remains a strong support zone.

Support and Resistance

| Metal | Market | Support Level | Resistance Level |

|---|---|---|---|

| Gold | International | $4,300 / oz | $4,750 / oz |

| Gold | Indian | ₹1,34,000 / 10 gm | ₹1,46,000 / 10 gm |

| Silver | International | $70 / oz | $88 / oz |

| Silver | Indian | ₹2,25,000 / kg | ₹2,78,000 / kg |

Source:Augmont Bullion Report

DiamondBuzz

Botswana Diamonds rebrands as Botswana Minerals PLC

Signals a definitive shift toward copper exploration as the diamond market faces a stiff cyclical downturn.

Botswana Diamonds PLC, a long-time explorer of the world’s most famous gemstones, has officially rebranded as Botswana Minerals PLC, signaling a definitive shift toward copper exploration as the diamond market faces a stiff cyclical downturn. The name change, which took effect Feb. 27, follows a strategic review that leveraged artificial intelligence to scan the company’s massive 95,000-square-kilometer geological database. While the AI was originally designed to hunt for kimberlite pipes—the volcanic rock that hosts diamonds—it instead unearthed “outstanding” evidence of copper deposits.

A High-Tech Pivot

The company, listed on London’s AIM and the Botswana Stock Exchange, has identified 11 copper targets across the country and has already secured eight prospecting licenses. The move reflects a broader trend among junior miners seeking to capitalize on the “green metal” boom driven by electric vehicles, renewable energy, and AI data centers.

The Diamond Dilemma

The rebranding comes as the natural diamond sector grapples with two simultaneous concerns:

- Technological Disruption: Lab-grown diamonds continue to cannibalize the lower end of the market, offering consumers a cheaper alternative that is chemically identical to mined stones.

- Cyclical Downturn: Sluggish global demand and high inventory levels have dampened investor enthusiasm for natural stones.

Despite the pivot, the company is not abandoning its roots entirely. It remains one of the largest holders of exploration data in Botswana and intends to maintain its diamond acreage, betting that high-quality natural stones will eventually regain their luster.

By shifting focus to copper, Botswana Minerals (trading under the new ticker BMIN) joins a growing list of players in the Kalahari Copper Belt, a region increasingly viewed as a world-class mining frontier.

-

DiamondBuzz2 hours ago

DiamondBuzz2 hours agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz3 hours ago

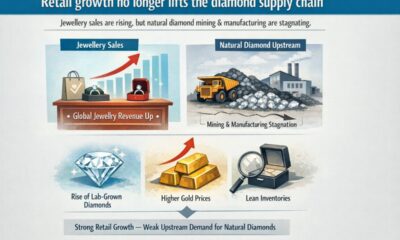

DiamondBuzz3 hours agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News5 hours ago

International News5 hours agoIndia Pavilion at HK twin shows showcases exceptional craftsmanship

-

International News5 hours ago

International News5 hours agoGold continues to get strength on the Middle East conflict